NOTICE: This post references card features that have changed, expired, or are not currently available

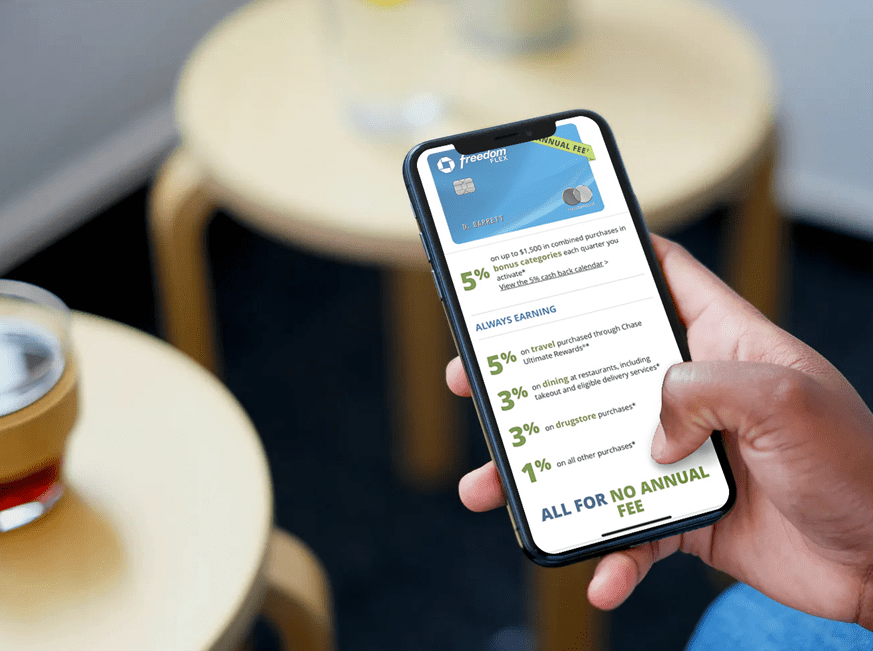

The all-new Chase Freedom Flex Mastercard is now live. Within Chase’s family of Ultimate Rewards cards, this one replaces the Freedom Visa. The Freedom Visa was a good card thanks to its rotating 5X categories, but the Freedom Flex is better. Much better. In addition to offering 5X categories that change each quarter, the Freedom Flex offers 5X for travel booked through Chase, 5X for Lyft, 3X for dining, and 3X at drugstores. That’s a powerful combination.

Chase is currently offering best-ever welcome bonuses for their Freedom card lineup. Both the Freedom Flex and the similar Freedom Unlimited offer three components to their offer: 1) 20,000 points after $500 spend; 2) 5X earnings at grocery stores for the first 12 months (on up to $12K of spend); and 3) 0% APR for 15 months. With either offer, if you spend the full $12K at grocery stores, you’ll end up with at least 80,000 points. It’s convenient too that the Freedom cards are great companions to the Sapphire Preferred, which is currently sporting a 80,000 point offer. See: Chase Sapphire Preferred 80K Offer – Should you go for it?

To get the most value from your points, you’ll want to have a premium Ultimate Rewards card in your household. With the Sapphire Preferred, or Ink Business Preferred you’ll be able to use points to purchase travel at a value of 1.25 cents per point. With the Sapphire Reserve you’ll be able to purchase travel at a value of 1.5 cents per point. With the Sapphire Preferred or Sapphire Reserve you can use Chase’s Pay Yourself Back feature to essentially cash out points for 1.25 cents per point (Preferred) or 1.5 cents per point (Reserve). With any of these premium cards, you’ll gain the ability to transfer points to airline and hotel partners.

The Freedom Flex card does charge foreign transaction fees, so leave it at home when traveling internationally. But within the US, the Freedom Card is a great choice for earning 3X to 5X rewards in selected categories.

Chase Freedom Flex Application Tips

Chase Application Tips

Call (888) 338-2586 to check your application status |

Should you apply?

In my opinion, the Freedom Flex is an excellent choice in many cases, but it’s especially good if you or a household member has (or plans to get) the Sapphire Reserve card. Use the Freedom Flex to earn 5X for travel booked through Chase, 5X in rotating categories, and 3X for drugstores and dining. Move your Freedom Flex points to the Sapphire Reserve account to get at least 1.5 cents per point value from all points. When you earn 3X to 5X with the Freedom Flex and redeem at 1.5 cents value with the Sapphire Reserve, you get a 4.5% to 7.5% return on your spend.

Are you eligible?

To apply for the Freedom Flex card, you must not currently have the same card (it’s okay to have a different Freedom card), and you must not have received a welcome bonus for the Freedom Flex in the past 24 months. Of course, since the card is new, this shouldn’t be a problem for anyone yet!

More critically, to get this card you must be under 5/24.

| Chase's 5/24 Rule: With most Chase credit cards, Chase will not approve your application if you have opened 5 or more cards with any bank in the past 24 months. To determine your 5/24 status, see: 3 Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely. |

Application status

After you apply, call (888) 338-2586 to check your application status.

Reconsideration

If your application is denied, I recommend calling for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Chase Freedom Flex Perks

Travel Protection

- Auto Rental Coverage: Chase offers secondary auto rental CDW (collision damage waiver) when renting within your country of residence (presumably it is primary for rentals in other countries).

- Trip Cancellation / Interruption Insurance: If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.

Purchase Protection

- Extended Warranty: “Extends the time period of U.S. manufacturer’s warranty by an additional year, on eligible warranties of three years or less.”

- Damage and Theft Protection: “Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.”

- Cell Phone Protection: Up to $800 per claim and $1K per year against theft or damage with a $50 deductible when you pay your monthly bill with the card (max of 2 claims per year)

Other Perks

- DoorDash DashPass: Complimentary DashPass subscription for 3 months on DoorDash and Caviar. After that, you are automatically enrolled in DashPass at 50% off for the next 9 months – activate by 12/31/2021.

- Lyft credits: Get a $10 credit for every 5 Lyft rides you take in a calendar month.

- Boxed Rewards: Earn 5% back in Boxed rewards for future purchases.

- Free Shoprunner Shipping

- Fandango points: Double VIP+ points for movie tickets purchased via the Fandango app or at Fandango.com.

Chase Freedom Flex Earn Points

Welcome Bonus

The welcome bonus for this card is advertised as cash back, but the rewards are actually delivered as Ultimate Rewards points. Here’s the current offer:

| Card Offer |

|---|

ⓘ $292 1st Yr Value EstimateClick to learn about first year value estimates $200 cash back* ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Earn $200 (*awarded as 20,000 points) after spending $500 in the first 3 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great for 5X and 3x categories and World Mastercard benefits. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. |

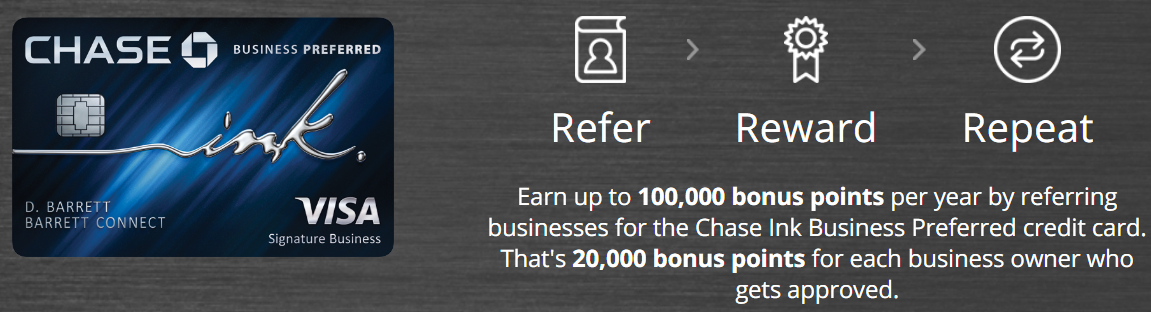

Refer Friends

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Bonus Spend

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 5x travel booked through Chase Travel℠ ✦ 5x Lyft through September 2027 ✦ 3x dining ✦ 3x drugstores ✦ 5x in rotating categories on up to $1,500 spend per quarter |

This is the most interest aspect of the card. 5X bonus categories change every 3 months. 5X rewards are capped at $1500 in spend per 3 months. It’s often possible to maximize your 5X earnings by buying gift cards. For example, during a quarter in which the card offers 5X at grocery stores, you can buy $1,500 in gift cards at grocery stores and then spend those gift cards at your leisure.

In addition to the rotating 5X categories, this card offers 3X to 5X earnings, uncapped, in the following categories of spend:

- 5X Travel Booked through Chase Ultimate Rewards

- 5X Lyft (through 3/31/22)

- 3X Dining (restaurants and food delivery)

- 3X Drugstore

Chase Freedom Flex Redeem Points

Cash Back

Cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer.

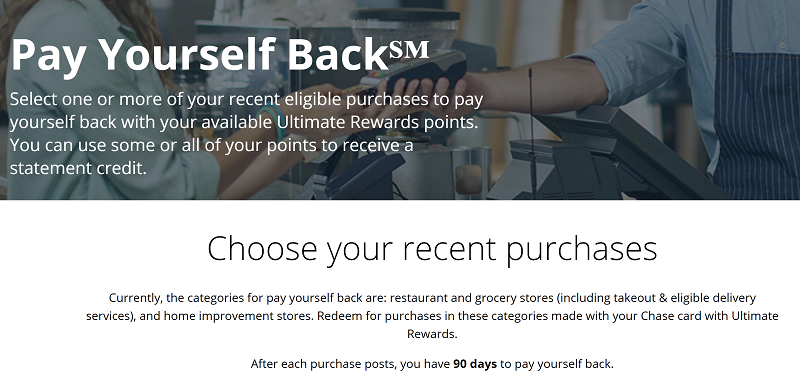

Pay Yourself Back

If someone in your household has the Sapphire Preferred or Sapphire Reserve card, then you can take advantage of the Pay Yourself Back feature by moving your Freedom points to the Sapphire card. The basic idea is that Sapphire Preferred and Reserve cardholders can exchange Chase Ultimate Rewards points for statement credits against certain categories of purchases. For example, at the time of this writing, you can redeem points, at full travel value, to offset restaurant, grocery, food delivery, home improvement store, and select charity purchases. With the Sapphire Preferred card, points are worth 1.25 cents each. With the Sapphire Reserve card, points are worth 1.5 cents each.

Travel

Redeem points for travel: Up to 2 cents per point through Chase Travel℠

This option requires that someone in your household has the ultra-premium Chase Sapphire Reserve card. First move (combine) points from your no-fee card to the Sapphire Reserve account. Next, log into Chase under the Sapphire Reserve account, and go to the Chase portal to book through Chase Travel℠. Depending on when your Sapphire Reserve card was obtained, the value of your points may differ:- 1.5 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.5x through Chase Travel℠ until October 26, 2027.

- Up to 2 cents per point: Cardmembers are eligible for Points Boost offers of up to 2x for travel booked through Chase Travel℠. All hotel bookings with The Edit by Chase Travel℠ should qualify for 2x (details here).

Redeem points for travel: Up to 1.75 cents per point through Chase Travel℠

This option requires that someone in your household has a premium card that earns Chase points: Chase Sapphire Preferred or Chase Ink Business Preferred. First move (combine) points from your no-fee card to one of these premium cards. Next, log into Chase under the account that now has the points, and go to the Chase portal to book through Chase Travel℠. Depending on when your card was obtained, the value of your points may differ:- 1.25 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.25x through Chase Travel℠ until October 26, 2027.

- Up to 1.75 cents per point: Cardmembers are eligible for Points Boost offers of up to 1.75x for premium cabin flights and up to 1.5x for other travel booked through Chase Travel℠.

Details about booking travel through Chase

You can use the Chase portal to book airfare, hotels, cruises, activities, and car rentals. Airfare purchased through the portal still earns airline miles and elite qualifying miles. Hotels booked this way do not earn hotel rewards unless the portal specifically notes otherwise. Worse, hotels booked through the portal often won't offer you elite benefits even if you have status.Travel protections apply

When you pay with points for travel, Chase's automatic travel protections do apply. So, you can be covered for things like car rentals, trip delays, trip cancellation & interruption, lost luggage, etc. The coverage you receive will be based on which card's rewards were used to book the trip. For example, if you have both a Chase Sapphire Preferred and a Sapphire Reserve, you would want to move your points from the Preferred to the Reserve and then use the Reserve points to book your trip. You will get both better value and better travel protections. See: Sapphire Reserve Travel Insurance.Transfer points

Move points to premium or ultra-premium card first

You cannot transfer points directly from a no-annual-fee Chase card to airline or hotel partners, but you can move points first to a premium card (Sapphire Preferred or Ink Business Preferred, for example) or ultra-premium card (Sapphire Reserve) and then transfer the points to airline or hotel partners. Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. Points can also be transferred to the loyalty account of a joint business owner, but they do need to be an authorized user on the associated business account.Transfer Partners

| Rewards Program | Best Uses |

|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

| Wyndham | Wyndham often allows booking multi-room suites for the same price as a standard room. It's sometimes possible to get great value from points in that way. Bonus: award nights are not subject to resort fees. Wyndham Earner cards offer automatic 10% discount on award stays. |

Other ways to redeem points

You can also use points to pay some merchants directly (Amazon.com, for example or via Chase Pay). Don't do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your points - causing you a headache in getting your points reinstated).

Chase Freedom Flex Manage Points

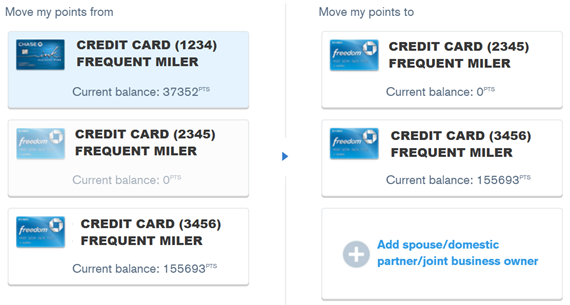

Combine Points Across Cards

If you intend to cancel a card that earns Chase points, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account. A product change should not affect your balance, but some people prefer moving points before a product change as well, just to be safe.

Share Points Across Cardholders

Why this is valuable:

Why this is valuable:

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

How to Keep Points Alive

Chase Freedom Flex Lifecycle

How to meet minimum spend requirements

Keep, cancel, or product change?

Is this card worth keeping in the long run? Yes! It has no annual fee and it offers great 3X and 5X reward categories. If you decide to cancel anyway, make sure to first redeem any remaining points or move them to another Ultimate Rewards card.

Related Cards

Ultimate Rewards Consumer Cards

| Card Offer and Details |

|---|

ⓘ $292 1st Yr Value EstimateClick to learn about first year value estimates $200 cash back* ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Earn $200 (*awarded as 20,000 points) after spending $500 in the first 3 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great for 5X and 3x categories and World Mastercard benefits. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Earning rate: 5x travel booked through Chase Travel℠ ✦ 5x Lyft through September 2027 ✦ 3x dining ✦ 3x drugstores ✦ 5x in rotating categories on up to $1,500 spend per quarter Card Info: Mastercard World issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ Cell phone protection ✦ Lyft credits ✦ $10 quarterly credit for non-restaurant DoorDash orders See also: Chase Ultimate Rewards Complete Guide |

ⓘ $296 1st Yr Value EstimateClick to learn about first year value estimates $200 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn $200 (*awarded as 20,000 points) after spending $500 in the first 3 monthsNo Annual Fee This card is likely subject to Chase's 5/24 rule (click here for details). Recent better offer: Unlimited Double Cash Back for 12 month (expired 1/11/24) FM Mini Review: Great for 3x categories and 1.5X everywhere else. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5x travel booked through Chase Travel℠ ✦ 3x dining ✦ 3x drugstores ✦ 2% cash back total on qualifying Lyft products and services purchased through the Lyft mobile application through 09/30/2027 ✦ 1.5X everywhere else Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ $10 quarterly credit for non-restaurant DoorDash orders See also: Chase Ultimate Rewards Complete Guide |

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer availableNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great for 5X categories. Good companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Earning rate: 5X Lyft through September 2027; 5X in rotating categories on up to $1,500 spend per quarter Base: 1X (1.5%) Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ $10 quarterly Instacart credit ✦ 3 months free Instacart+ See also: Chase Ultimate Rewards Complete Guide |

ⓘ $985 1st Yr Value Estimate$50 prepaid hotel credit valued at $35 Click to learn about first year value estimates 75K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 75,000 bonus points after spending $5,000 within the first three months from account opening.$95 Annual Fee Recent better offer: Expired 5/14/25: 100K after $5K spend FM Mini Review: Great welcome offer. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with no annual fee Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 5X Lyft through 9/30/27 ✦3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 10% annual point bonus Base: 1X (1.5%) Travel: 2X (3%) Flights: 2X (3%) Portal Flights: 5X (7.5%) Hotels: 2X (3%) Portal Hotels: 5X (7.5%) Dine: 3X (4.5%) Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Primary auto rental collision damage waiver ✦ Free DoorDash DashPass (min. one year, must activate by 12/31/27)✦ $10 off each month on one non-restaurant orders from DoorDash ✦ Transfer points to airline & hotel partners ✦ $50 back for hotel stays booked through Chase per cardmember year in the form of a statement credit ✦ Each account anniversary earn bonus points equal to 10% of total purchases made the previous year. |

ⓘ $1544 1st Yr Value Estimate$300 travel credit valued at $285, $300 StubHub credit ($150 Jan-Jun and again Jul-Dec) valued at $75, $500 Chase The Edit credit (2x per calendar year) valued at $125, $300 Chase Dining credit for dining at Sapphire Reserve Tables restaurants ($150 Jan-Jun and again Jul-Dec) valued at $75 Click to learn about first year value estimates 125K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 125K after $6K spend in the first 3 months. $795 Annual Fee FM Mini Review: Good all-around card for frequent traveler. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards. Click here for our complete card review Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X Dining ✦ 5X Lyft (through September 2027) Base: 1X (1.5%) Flights: 4X (6%) Portal Flights: 8X (12%) Hotels: 4X (6%) Portal Hotels: 8X (12%) Dine: 3X (4.5%) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $75,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $250 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Transfer points to airline & hotel partners ✦ Up to $500 The Edit credit annually ($250 twice per calendar year) ✦ Up to $300 Dining credit through Sapphire Reserve Exclusive Tables ($150 January to June and again July to December) ✦ Complimentary AppleTV+ and Apple Music through 6/22/27 ✦ Up to $300 in StubHub credits ($150 January to June and again July to December) ✦ Points worth up to 2 cents each towards qualified bookings through Chase Travel ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

Ultimate Rewards Business Cards

| Card Offer and Details |

|---|

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available$0 introductory annual fee for the first year, then $95 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: ✦ 5X office supplies, 5X cellular/landline/cable ✦ 2X gas and hotels ✦ 5X Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Points worth 25% more when redeemed for travel ✦ Transfer points to airline & hotel partners See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1029 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750(*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: This one should be in everyone's wallet. Incredible welcome offer for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5x Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1277 1st Yr Value EstimateClick to learn about first year value estimates 100K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 100K after $8K spend in the first 3 months$95 Annual Fee Recent better offer: 120K after $8K spend (expired 9/4/24) FM Mini Review: Great card for welcome offer and 3X categories. Also consider the Ink Business Cash for its 5X categories, and the Ink Business Unlimited to earn 1.5X everywhere. Earning rate: 3X travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year) ✦ 5X Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Points worth up to 75% more when redeemed for travel with Points Boosts ✦ Transfer points to airline & hotel partners ✦ Cell phone protection against theft or damage See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1074 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750 (*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: Great welcome offer for a no annual fee card. Good option for earning 1.5X everywhere. Good companion card to Ink Business Preferred, Sapphire Reserve or Sapphire Preferred. Click here for our complete card review Earning rate: 1.5X on all business purchases ✦ 5X Lyft through September 2027 Base: 1.5X (2.25%) Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1595 1st Yr Value Estimate$300 travel credit valued at $285, $500 Chase The Edit credit (2x per calendar year) valued at $125, $100 GiftCards.com credit ($50 Jan-Jun and again Jul-Dec for cards purchased from https://reservebusiness.giftcards.com/) valued at $50 Click to learn about first year value estimates 150K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 150K points after $20K spend in first 3 months.$795 Annual Fee Recent better offer: 200K points after $30K spend in first 6 months. (Expired 1/22/26) FM Mini Review: Could be very appealing for a business that books a lot of travel, as it earns 8x through Chase Travel℠ or 4x when booking direct through airline and hotels. It has decent perks, best-in-class travel protections, and earns valuable Chase Ultimate Rewards points. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X social media and search engine advertising ✦ 5X Lyft (through September 2027) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $120,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $500 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Up to $500 The Edit credit ($250 twice per calendar year) ✦ Up to $400 ZipRecruiter credit ($200 January to June and again July to December) ✦ $200 Google Workspace credit ✦ $100 Giftcards.com ($50 January to June and again July to December for purchases at giftcards.com/reservebusiness) ✦ Points worth 2 cents each towards qualified bookings through Chase Travel(SM) ✦ Transfer points to airline & hotel partners ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

If I convert my Freedom Unlimited to a Flex, will it be possible for me to convert the Flex back to a UR-earning Visa in the future, or am I stuck with the Flex since it’s a Mastercard?

Good question. I’m not sure.

Has Chase stated how long the current offer (20K + Grocery) will be valid until?

Sorry, I missed this question. No, we haven’t heard anything from Chase about a deadline for the current Freedom offers.

if you convert over do you get the 12x at grocery is that only for new members

No. You have to sign up new to get that

I got the sapphire preferred card in the last 12months. Can I still get the flex card with its bonus?

Yep. No problem

[…] It is true that Chase will be phasing out the old and trusty Chase Freedom Card. And they have introduced the better Chase Freedom Flex card. This will be the new rotating 5x quarterly card going forward. But wait, this is not all on the earning side. You get 3x on Dining and Drugstores, 5x on Lyft through March 2022, 5x on booking travel on the Chase travel portal and of course 1x on everything else. But wait, there is more! Earn 5% cash back on grocery store purchases on up to $12,000 spent in the first year. Wait, there is more! 20,000 Chase Ultimate Rewards points for signup bonus and all Mastercard World Elite benefits (such as $800 cell phone insurance). This is pretty rich for a no annual fee card.Here is a Chase Freedom Flex Complete Guide. […]

My Flex application first went of a verification page and timed out after about 45 minutes of spinning. I assume Chase is deluged with applications.

Do I need to reapply? Will I have two credit pulls if I do?

Thanks for your interest in Chase credit cards. Your session timed out so we ended it for your protection.

Please visit chase.com/credit-cards to start again. If we can help you in any way, please contact us.

I’d recommend calling to check the status of your application. If it can’t be found then apply again. Call (888) 338-2586 to check your application status

So can you apply for the Flex if you already have the Freedom card? Or do you have to cancel the Freedom card first?

You can hold both cards

Yes, you can apply for the Freedom Flex while still holding onto the Freedom Visa and/or the Freedom Unlimited.

Can you please explain the “creating a loop” strategy to combine UR points? In your example, why transfer the points back to Joe’s Freedom Unlimited once they are successfully transferred to Suzy’s Sapphire Reserve? Isn’t the goal to get all points into one premium card and not vice versatility?

LOL, you’re right, there’s no real point to that last step. The idea was to show how you can easily move points from any card in the household to any other via a loop. So if Suzy wanted to move points to Joe for some reason, this is how she could do so.

In my mind I keep going back and forth, How is the first $12,000 spend calculated? If I spend $6,000 on non grocery purchases and $6,000 on grocery purchases am I done with the 5% sign up offer or do I still have $6,000 to spend on groceries (assuming this is all under 12 months)

The $12K limit on 5X earnings is specific to grocery spend. So, in your example you would have $6K left to spend on groceries