Does Citi have the ultimate credit card combination for an everyday spender? This week on Frequent Miler on the Air, we tune in to Citi’s quintessential credit card quartet and wonder whether this is really the ultimate rewards card combo.

Elsewhere on the blog this week, Greg ponders his application strategy, Tim takes us to what many consider to be the best Hilton property in North America, and JetBlue makes its new program official. Watch, listen, or read on for all that and more.

00:00 Intro

00:49 Giant Mailbag: Citi updates application rules

04:18 What crazy thing . . . did Hilton do this week?

08:52 Mattress running the numbers: IHG Timeshare offer for 3 nights + 50K points for $199 / $249

13:20 Award Talk: Booking Aer Lingus with Alaska Mileage Plan

20:42 Greg books British Airways via Asia Miles

24:25 Party of 5 Team Challenge

27:57 Main Event: Citi’s quintessential credit card quartet

30:30 Card Talk: Citi Premier card

38:35 Card Talk: Citi Double Cash card

44:00 Card Talk: Citi Custom Cash

49:50 Card Talk: Citi Rewards+

57:00 Downsides of the Citi quartet

1:00:53 Curve card to rule them all

1:10:26 Are people missing the boat on the Citi Quintessential Quartet?

1:15:36 Question of the Week: Is it OK to buy store gift cards with an Amex card?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Under 5/24. Which cards should I collect next?

Finally under 5/24, Greg contemplates his next collector’s items. To be clear, Greg’s strategy here isn’t just to get the best welcome bonuses, but rather to collect a couple of cards to have and to hold long-term. I have to admit that I always forget about the IHG business card and it would probably make sense for me to get it to be able to take advantage of both the 4th night free and the 10% rebate from my old (and no-longer-available) Select card. I appreciate Greg’s reminder!

(Ending Soon) Chase Sapphire Preferred: Earn 80k Ultimate Rewards

Speaking of chasing Chase cards and reminders, I wanted to include this quick deal post since those looking to collect transferable points (rather than collector’s cards) are probably more interested in this 80K offer — but it will end soon.

Curve card review: Awesome, but limited

When the Curve card officially came out of Beta, none of us on the Frequent Miler team thought it was ready for the limelight. However, after some additional time to work out the kinks, Greg has been finding the card very useful and far less glitchy than it had previously been. That’s great news because it would pair really nicely with the Citi quartet we discussed on this week’s podcast — particularly when it comes to automating multiple Custom Cash cards without needing to carry them all and keep them straight. This card may now be worth a look, particularly as the ultimate “Player 2” solution.

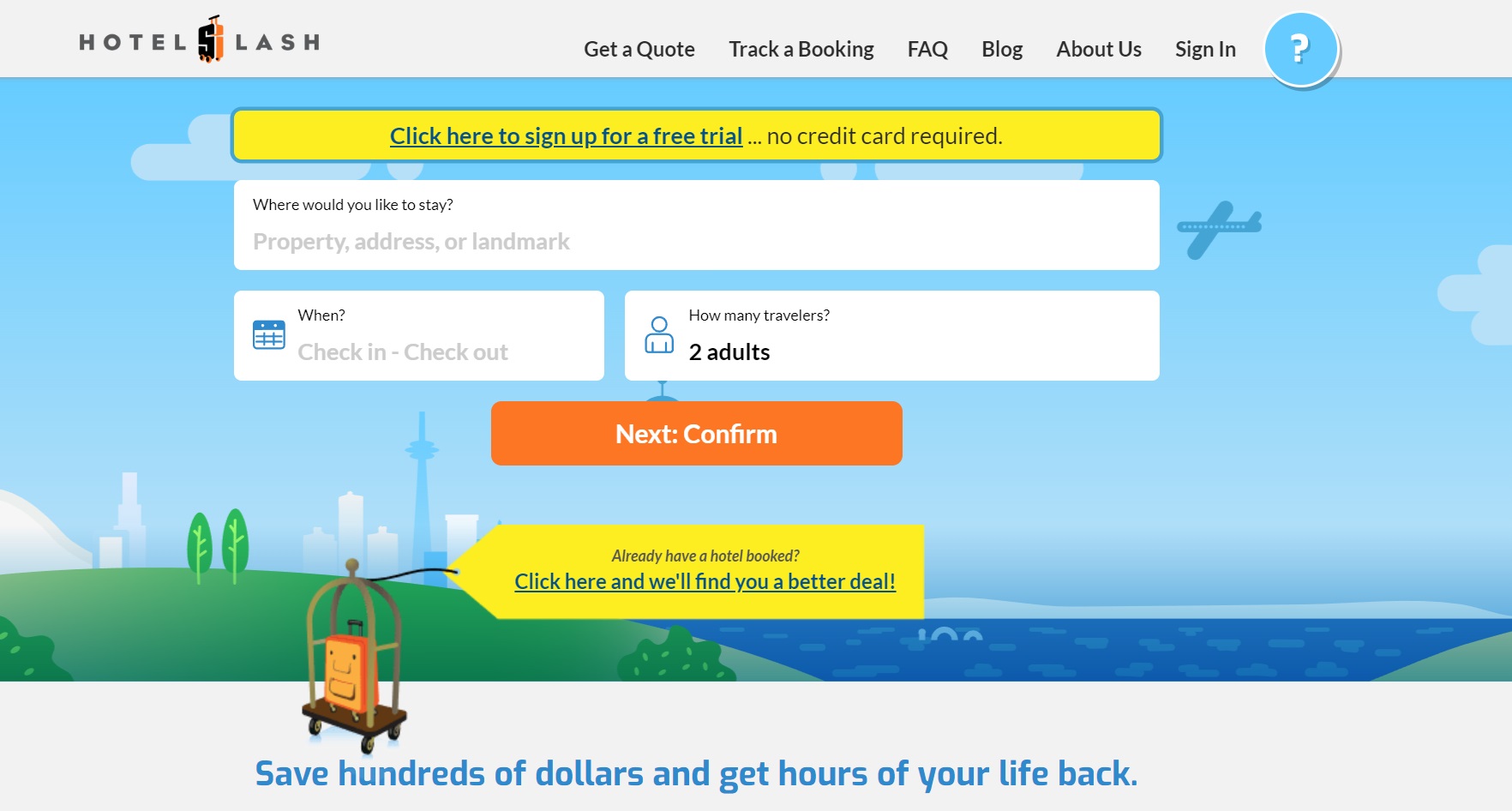

AutoSlash launches HotelSlash: Here’s the pros, cons and a free 6 month membership

I love Autoslash and have used it frequently to price rental cars (and I often recommend it to others). It is awesome knowing that I’ve got the best rate for my rental (and being able to track the rates easily). Like Tim, I am lukewarm on the hotel version of this though simply because I don’t want to give up elite credit and elite benefits. If I were booking more non-chain hotels or if I were a regular 3rd party hotel booker, I would probably jump on this. Of course, the real question is how much will I lose (in the form of savings that I could have had through HotelSlash) in the pursuit of loyalty games?

How to earn American Airlines Loyalty Points without flying (Cheat Sheet to play the elite status game)

Speaking of Loyalty games, it had been a long time since we had last updated our American Airlines Loyalty Points cheat sheet. The game has changed when it comes to earning easy American Airlines miles for status. There are fewer standout opportunities than there once were through the AAdvantage eShopping portal, but if you value some of the services and wait for payouts to increase, you can still easily supplement your existing efforts to get or keep American Airlines elite status without flying.

New JetBlue TrueBlue Complete Guide (new program launches today)

While not quite as easy to “game” as American Airlines elite status, JetBlue finally launched its own new elite program this week and it has some intrigue. That’s because there will be perks along the way even for those who don’t reach Mosaic status and there is finally a mechanism to earn confirmed upgrades to Mint class. Now with the chance to combine JetBlue spend, credit card spend, and spend on a wide range of travel-related purchases via Paisly, JetBlue perks will probably be easy to obtain for a wider ranging audience.

Waldorf Astoria Los Cabos Pedregal: Bottom Line Review

I highly anticipated Tim’s review of the Waldorf Astoria Los Cabos Pedregal if only because I have seen a number of positive mentions through social media and other blogs. Despite the overall positive tone of this bottom line review, I walked away from Tim’s review with less desire to put this property on top of my bucket list and more of a sense that it might be good to keep in mind if I decide to visit Los Cabos in the future and I want to burn a free night certificate or two.

That’s it for this week at Frequent Miler. Keep your eyes out for this week’s last chance deals.

![Viral marketing proves infectious for two more airlines, a new card lands with a thud and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/06/viral-airline-marketing-218x150.jpg)

Regarding the IHG Timeshare 50k deal; I attended one of these (for more points) 2 years ago. There was no option to stay at one of the HI Resorts; only the “partner hotel.” It wasn’t even an IHG property, just a generic no-chain local hotel! Crazy that IHG doesn’t want to show off it’s own properties during a timeshare deal by having you stay at one of their own properties. Beware the “partner hotel”…

As someone with the Citi Quartet (or Quartet+++, with Citi Premier x2, Rewards+, Double Cash, Custom Cash x2, and AT&T Access), a couple notes:

The number one reason I remain engaged in this program are retention offers. Citi is awesome with this. Currently I have an extra 2 points per $ (up to $17500 spent) on both my Double Cash and one of my Custom Cash cards. I recently had to pay an $11k property tax bill. Getting 44k TYP on it was awesome! And on my original Premier, I have received “spend $95, get $95” offers the past 4 years. Basically this makes it a no annual fee quartet.

They do not offer purchase protection, but the Premier and Rewards+ offer 2 years extended warranty protection, longer than most other programs. I use my Citi cards for items I want extended protection on.

When you were talking about having multiple Citi Rewards+ cards, and how you do not get more than 10k points back, it reminded me of your old post about this. Did we ever find out if creating separate pools (combining 1 Rewards+ with a Prestige and another Rewards+ with a Prestige, for example) will allow for 10k points back on each?

Great point about retention bonuses. I love how Citi will offer these even for fee-free cards.

And thanks for the reminder about the Premier and Rewards+ extended warranty coverage.

Re: separate pools for Rewards+. I’d guess that it would work, but I’m not at all sure that it would be worth the effort. If your goal is to transfer to partners, you would need a premium card in each of the pools. That extra $95 would negate most of the up to 10K rebate per year benefit.

Nick said he has premier and might convert an AT&T More to Double Cash. Convert it to Rewards+ instead. I’m sure he has a 2x card already and R+ gets you a zero-effort rebate on TK, Wyndham and other transfers. If it’s because there’s no welcome bonus citi doesn’t preclude you from getting it later with a new app.

I buy small appliances and electronics with R+ for the warranty. With a $0 fee I know I’ll still have it when I might make a warranty claim.

Also I highly doubt AA will allow Citi TYP transfers as a regular feature. It would undercut their own card, and Barclays might have a clause to block this too. Similarly I thought I read that UA is unhappy about UR transfers.

I don’t have Wyndham Business Earner yet, but if you hold that and Citi Rewards+ I think you earn a double rebate when redeeming TYP for Wyndham awards. 10% from each. Is that right?

Sort of. Rewards+ gives you the rebate when transferring to Wyndham. Having the Wyndham Earner card doesn’t give you a rebate but a discount. So four nights in a one bedroom Vacasa unit would cost 13,500 points per night = 54k total (vs 60k if you didn’t have the Earner card). If you transfer 54k from Citi you get 5.4K back thanks to Rewards+. So total cost for four nights would be less than 50k Citi points

Where does the Strata Elite fit in the Citi ecosystem?

Wherever your imagination would like to see it.

BA metal crazy surcharges…missin?!? Just booked three seats direct OW LHR to BOS econ for 25k Avios +$100 each…where’s the crazy fees??? UK long haul London departures taxes is ~$100/ea alone. One of our three is age <16 and exempt, but still….

The crazy fees are on business and first class awards.

Nick, I agree. Basically $100pp for econ, $200pp above departure tax.

But as you both mentioned on podcast, BA charges well beyond that. Yet, my award res has virtually no extra charges, maybe ~$33 each. That’s not the BA I know.

https://onemileatatime.com/guides/uk-air-passenger-duty/

Thanks for the Alaska tip regarding Aer Lingus. Not for lack of trying, I’ve never been successful finding business class award availability on Avios.com.

I had found biz class last winter for to DUB to this summer. But my plans changed and recently tried to cancel my Aer Lingus avois award tickets with Aer Lingus. They replied that I need to cancel with original booking company!?!

Wasn’t mentioned during podcast; AIG BA owns Aer Lingus 100%