I’m a huge nerd when it comes to credit cards. I collect them the way that others collect baseball cards or sneakers. To me, the ideal cards for my collection are those that offer perks that I value more than the card’s annual fee, or better yet, fee-free cards that offer perks simply by keeping the account open. If the card also offers great rewards for spend — so much the better. Best of all is when such a card is no longer available to new applicants… but I still have it. A great example is the IHG Select card. You can’t get the card anymore, but those who have it get a 40K free night cert each year, which more than makes up for the card’s $49 annual fee. Plus, you get 10% back on award redemptions, and Platinum Elite status. It’s a true collector’s item.

Under 5/24

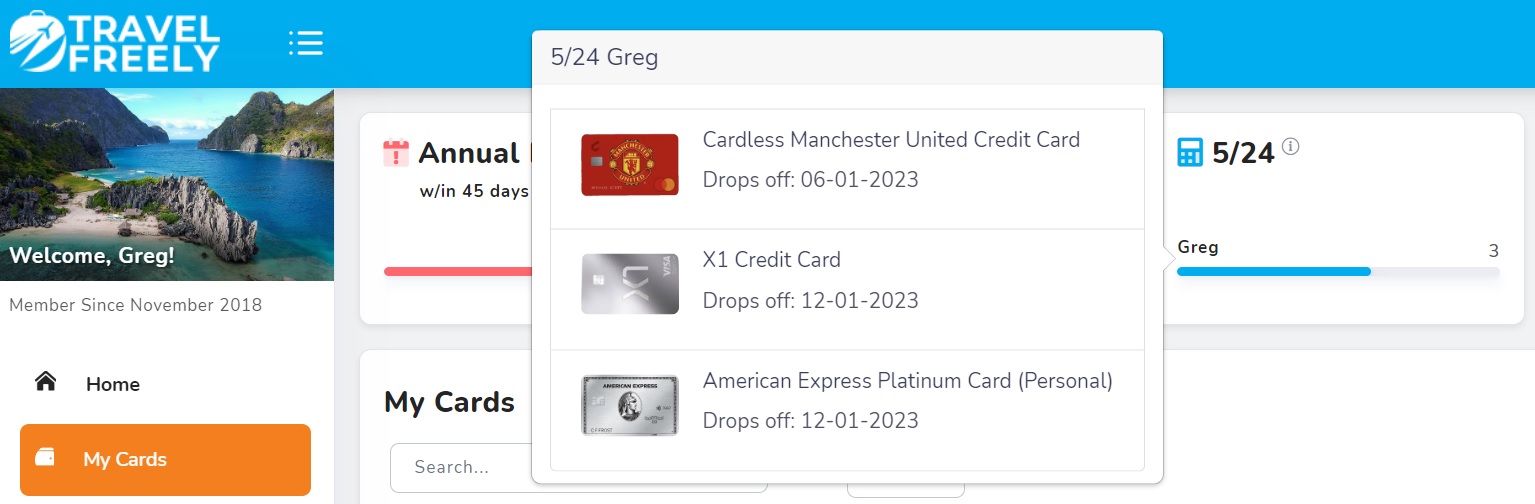

I’ve been on an unintentional Chase credit card diet for the past couple of years due to Chase’s 5/24 Rule, but I’ve finally dipped under. My Travel Freely account shows that I’m currently at 3/24 and will drop to 2/24 in June. I can finally apply for Chase cards again!

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

Chase Collectibles

My favorite Chase cards aren’t really collectibles. Instead, they’re cards that earn Ultimate Rewards points in multiples ranging from 1.5x to 5x for various categories of spend. And I already have them all: Chase Sapphire Reserve, Chase Ink Business Cash, Chase Ink Business Plus, Chase Freedom Flex, Chase Freedom Unlimited, etc.

I also already have lots of “collectibles” issued by Chase…

Rare collectibles (no longer available new)

The cards in this section are ones I have, but which are no longer available new. With the first two, as far as I know, there’s no way to get them now if you don’t already have them. The Ritz card, though, is still available through product changes.

- IHG Select: This $49 per year card offers an annual 40K free night e-certificate (but without the ability to top-off with points for higher-level stays). It also gives the cardholder a 10% rebate on award stays, and Platinum elite status.

- Marriott Bonvoy Premier Plus Business Card: This Marriott card offers a 35K free night certificate each year to more than make up for its $99 annual fee (Marriott 35K certs can often be redeemed for more than $200 value).

- Ritz-Carlton: The $450 Ritz card offers an annual free night certificate worth up to 85,000 points; $300 in annual airline incidental fee credits; Priority Pass with unlimited guests; and Free authorized users (each of which can get their own Priority Pass). Marriott 85K certs can often be redeemed for over $500 in value and so the free night alone can justify the card’s annual fee, but I also get excellent value from the annual $300 airline credits and the best version of Priority Pass currently available. While you can’t sign up new for this card, you can still upgrade from a Chase Bonvoy consumer card.

Available collectibles

The following are cards I currently have which are still available to sign up new. Each of these offer perks that I value more than the card’s annual fee. To make this determination, I look only at perks offered automatically, not those that require spend. For example, the Bonvoy Bountiful wouldn’t make the cut because it requires $15K spend for its 50K cert (and that’s why I don’t have or want that card!).

- Bonvoy Boundless: This $95 Marriott card offers a 35K free night certificate each year to more than make up for its annual fee (Marriott 35K certs can often be redeemed for well over $200 in value). Additionally, the Boundless card offers the ability to earn elite nights with spend: For each $5K of spend, you get an elite night that will help you earn elite status. While I don’t usually make use of this feature, it came in very handy late last year. See: Marriott Titanium achieved. Here’s how I sprinted to the finish.

- World of Hyatt: This card offers an annual category 1-4 free night certificate that more than makes up for its $95 annual fee (Hyatt Cat 1-4 certs can easily offset a stay costing $250 or more). Get another certificate after $15K annual spend. Plus, earn 2 elite nights with each $5K spend. This one would be a keeper even without its spend bonuses, but I do love the fact that the card can be used to earn high level Hyatt elite status with enough spend.

- IHG Premier: This one offers an annual 40K free night e-certificate (with the ability to top-off with points for higher-level stays) which more than makes up for its $99 annual fee. It also gives the cardholder fourth night free award stays; Platinum elite status (or Diamond status with $40K annual spend); and up to $25 in United TravelBank cash every six months.

- United Gateway Card: Like all United branded cards, the fee-free Gateway card unlocks improved economy saver award availability. 25% back on in-flight food, beverage, and wifi purchases; and 25% back on premium drinks in United clubs.

Which Chase cards should I collect next?

Now that I’m under 5/24, I can finally add to my Chase credit card collection. Here are the contenders where the card’s automatic benefits (which don’t require spend) arguably offset the card’s annual fee:

IHG® Rewards Premier Business Credit Card

| Card Offer and Details |

|---|

140K points ⓘ Affiliate Earn 140K points after $4K spend within the first 3 months$99 Annual Fee This card is expected to be subject to Chase's 5/24 rule (click here for details). Recent better offer: Up to 175K points: Earn 140K points after $4K spend within the first 3 months and an additional 35K points after a total of $7K spend with in the first 6 months [Expired 5/16/24] Earning rate: 10X IHG ✦ 5X travel, gas stations, restaurants and dining, social media and search engine advertising, office supply stores ✦ 3X on all other purchases Card Info: Mastercard World Elite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: 10K bonus points + $100 statement credit after you spend $20K in a cardmember year + make one additional purchase. ✦ Diamond status after $40K in purchases + one additional purchase in a calendar year ✦ Free night certificate (up to 40K points) after $60K in purchases + one additional purchase in a calendar year Noteworthy perks: Anniversary free night e-certificate good at IHG properties up to 40K points per night ✦ Ability to add an unlimited number of points to a free night certificate to book a higher-level hotel ✦ Fourth night free on award stays ✦ 20% discount on points purchases ✦ Platinum elite status ✦ Up to $50 in United TravelBank cash per year (must register your card with your United account) |

Some of this card’s perks are useless to me since I also have the consumer version of this card. For example, I already get the fourth night free on award stays, a 20% discount on points purchases, Platinum elite status, and $25 in United TravelBank cash every six months (These don’t stack: I won’t get $50 every six months for having both cards). All of that said, I know I can use the 40K free night cert for more than $99 value every year and so this card fits nicely as a collectible. For me, it’s not a must-have, but it’s a nice-to-have.

United℠ Business Card

| Card Offer and Details |

|---|

75K Miles ⓘ Affiliate 75K miles after $5K spend in first 3 months.$0 introductory annual fee for the first year, then $99 After clicking through, be sure to click the link at the top that says, "Are you a small business owner?" to see the business card offers that include this card. You are not eligible for the bonus if you have received the bonus on this card within the past 24 months. Please note that the United EXPLORER Business card (no longer available) is a different product and does not affect your ability to get the bonus on this card. FM Mini Review: Decent perks such as enhanced access to United saver level economy awards makes this a keeper for some. Earning rate: 2X at restaurants including eligible delivery services , gas stations, and office supply stores ✦ 2X United ✦ 2X on local transit and commuting, including taxicabs, mass transit, tolls, and ride share services Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: $100 annual United travel credit after 7 United flight purchases greater than $100 ✦ Earn up to 1,000 PQPs per year: 25 PQPs per $500 spend Noteworthy perks: ✦ Improved economy saver award availability ✦ Unlocks complimentary elite upgrades on award tickets ✦ Free first checked bag ✦ Priority boarding ✦ No foreign exchange fees ✦ 2 United Club passes per year at anniversary ✦ Free DashPass for one year (must activate by 12/31/24) ✦ Primary auto rental collision damage waiver ✦ 5,000 bonus miles at anniversary when you have this card and also a personal Chase United credit card. ✦ 25% back as a statement credit on United in-flight and Club Premium drink purchases |

This card gives me two things every account anniversary to help offset the annual fee: 5,000 bonus miles (I qualify for this because I also have the United Gateway card), and 2 United Club passes. I would also qualify for perks when flying United such as free first checked bag and priority boarding, but I already get those things from having United Premier Silver elite status, which I get from having Marriott Titanium elite status. Going forward, if I ever fail to qualify for Marriott Titanium status or if the United/Marriott partnership ends or changes, then those perks may become meaningful to me. Meanwhile, the question is whether I’m willing to pay $99 per year for 5,000 United miles plus two club passes. I’d be willing to pay as much as $75 per year for the annual 5K bonus, but would I pay $24 per year for United Club passes? I’m not so sure (I can’t even remember the last time I’ve been at an airport with a United Club and where I haven’t either had free United Club access due to flying international business class or had free access to other clubs thanks to Priority Pass or my Amex Platinum card). The good news is that I don’t have to decide right away. With the current offer, the first year annual fee is waived.

Cards that didn’t make the collectible cut

I considered a few other Chase cards, but they didn’t meet my definition of “collectible” cards:

- The Aeroplan® Card: This card’s discounted award pricing on Air Canada flights alone could make it worth the $95 annual fee, so I’m on the fence with this one as to whether or not it qualifies as a collectible for me. The problem is that I don’t often book awards flying Air Canada and it’s impossible to know how much of a discount I’m likely to get when I do. If I was interested in earning Air Canada elite status, I’d be more excited about the card since it offers 25K status w/ $15K annual spend and a status boost to the next higher level of status with $50K spend.

- United Quest Card: For frequent United flyers, this card’s perks can easily make up for the $250 annual fee: Up to $125 in statement credits for United purchases each cardmember year; first and second checked bag free; two 5K award flight rebates per cardmember year. In my case, I don’t fly United often enough to be likely to use these benefits every year.

- World of Hyatt Business Credit Card: In exchange for the card’s $199 annual fee, you get up to $100 each cardmember year in Hyatt statement credits (get a $50 statement credit up to two times per year). Additionally, the card offers these spend bonuses: Get 5 elite qualifying night credits every time you spend $10,000 in purchases; after $50K spend in a calendar year, get 10% back on redeemed points for the rest of that calendar year (Up to 20K points back per year). To me, this is the most interesting of the cards that didn’t make the initial cut. I stay at Hyatt hotels often enough to easily earn back $100 each year in statement credits. Additionally, I usually put huge spend on my consumer World of Hyatt card in order to ensure earning Globalist elite status each year. As I’ve shown in the past (see this post for details), the best strategy is to have both cards and to spend just $15K each year on the consumer card and then put big spend on the business card. If I could put $50K spend on the business card early enough in the year, I shouldn’t have any problem with earning 20K points back (worth much more than the card’s annual fee).

- Southwest Cards: Chase offers quite a few Southwest Airlines credit cards. Most come with annual point bonuses and perks when flying Southwest. For those who fly Southwest often, some of these cards would be great to have and to hold. I never fly Southwest and so, I’m not interested.

First Up: United and IHG

| Card Offer |

|---|

75K Miles ⓘ Affiliate 75K miles after $5K spend in first 3 months.$0 introductory annual fee for the first year, then $99 After clicking through, be sure to click the link at the top that says, "Are you a small business owner?" to see the business card offers that include this card. You are not eligible for the bonus if you have received the bonus on this card within the past 24 months. Please note that the United EXPLORER Business card (no longer available) is a different product and does not affect your ability to get the bonus on this card. |

140K points ⓘ Affiliate Earn 140K points after $4K spend within the first 3 months$99 Annual Fee This card is expected to be subject to Chase's 5/24 rule (click here for details). Recent better offer: Up to 175K points: Earn 140K points after $4K spend within the first 3 months and an additional 35K points after a total of $7K spend with in the first 6 months [Expired 5/16/24] |

Last week I decided to get started on my next collectibles by applying for both the United Business card and the IHG Business card. Both have very strong welcome offers at the time of writing and since both are business cards, they won’t add to my 5/24 count.

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

I applied for both cards on the same day. That way, the hard credit inquiries get combined into one. In general I don’t believe that credit inquiries are much of a problem, but when I can avoid one easily I might as well do so.

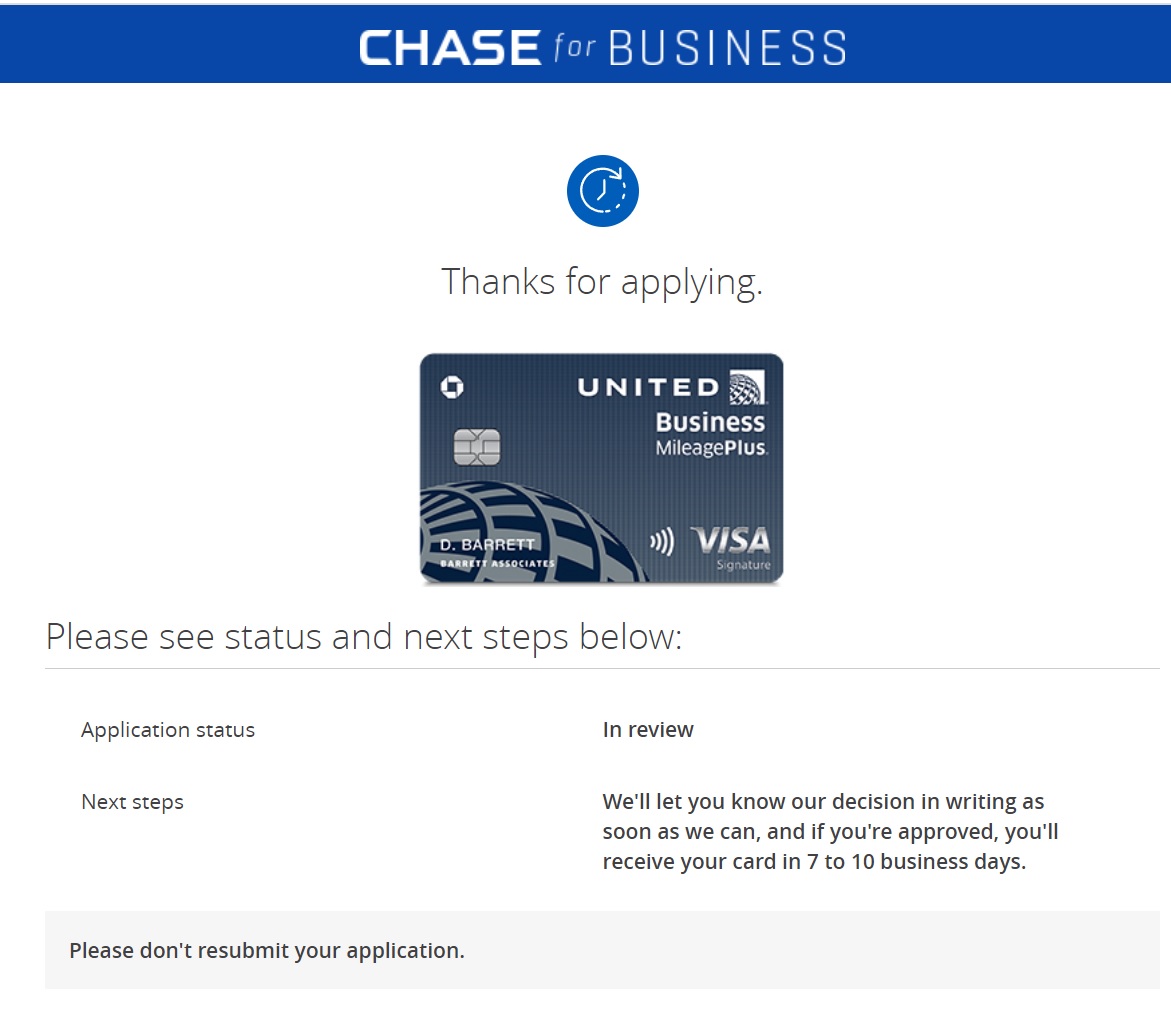

In both cases, it looked like my application wasn’t automatically approved:

However, the United application was actually automatically approved. Within seconds of applying, I got this email:

Subject: Greg, Your new Chase credit card is approved

Congratulations! Your new credit card is approved

Your new United Business Card and welcome kit are on the way and should arrive in 3 to 5 business days.

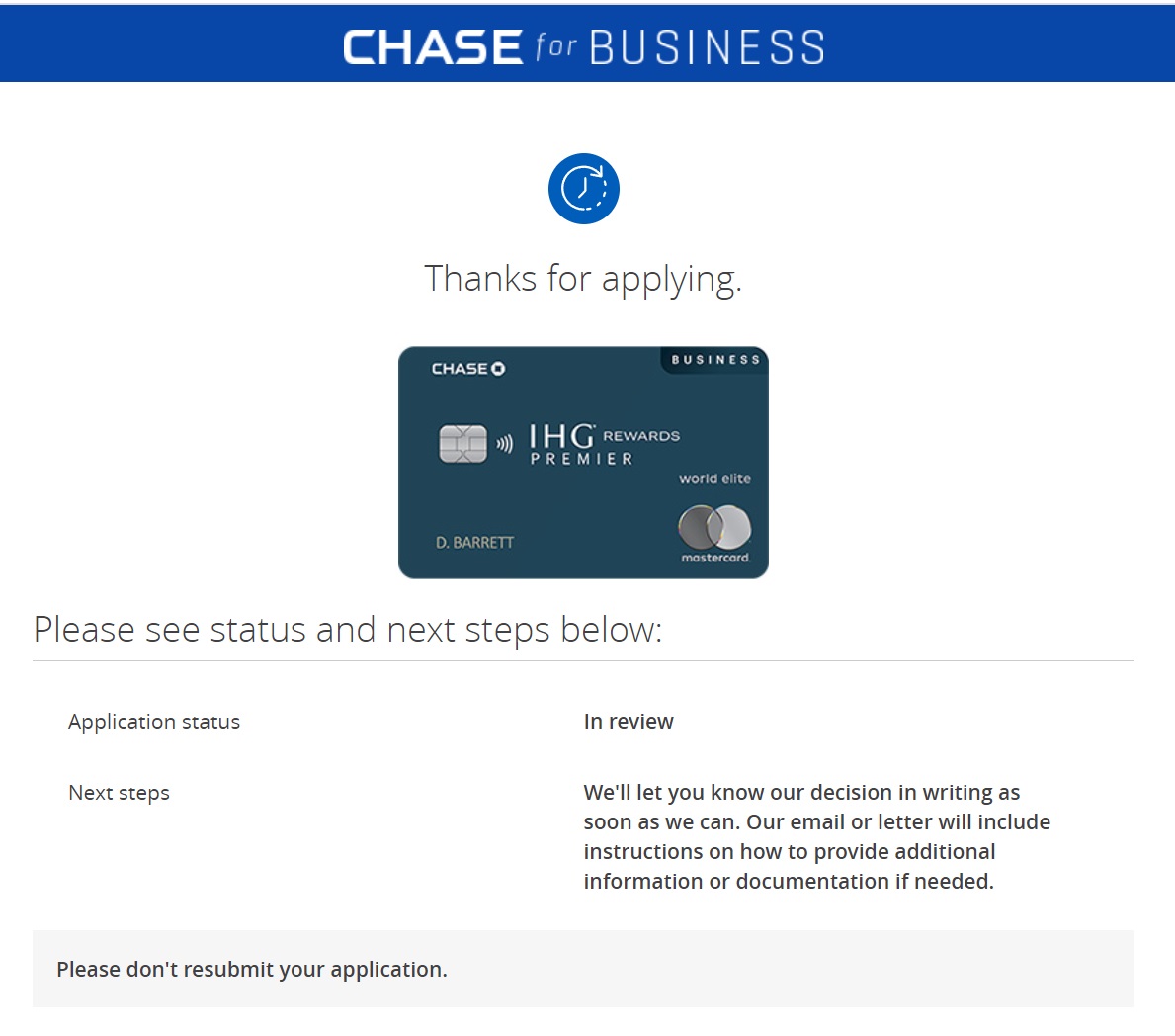

With the IHG card, the initial email showed that my application was pending review:

Subject: Greg, Thanks for applying for a Chase credit card

Thanks for requesting a new credit card!

We’ll review your IHG Rewards Premier Business Credit Card application and be in touch soon.

A day later, though, my application was approved!:

Subject: Greg, Your new Chase credit card is approved

Congratulations! Your new credit card is approved

Your new IHG Rewards Premier Business Credit Card and welcome kit are on the way and should arrive in 3 to 5 business days.

Next Up: Hyatt

| Card Offer and Details |

|---|

60K points ⓘ Affiliate 60K after $5,000 spend in 3 months$199 Annual Fee This card is subject to Chase's 5/24 rule. FM Mini Review: Great for its initial bonus and for Hyatt enthusiasts to spend toward status and rebate on award stays. Earning rate: ✦ 2X in the top 3 spend categories each calendar quarter through 12/31/24 (then the top 2 categories after that). Eligible categories include dining; airline tickets purchased directly with the airline; car rental agencies; local transit and commuting; gas stations; internet, cable and phone services; social media and search engine advertising; and shipping ✦ 4X Hyatt and Mr & Mrs Smith Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: Get 5 elite qualifying night credits every time you spend $10,000 in purchases. ✦ After $50K spend in a calendar year, get 10% back on redeemed points for the rest of that calendar year (Up to 20K points back per year). Noteworthy perks: Discoverist elite status ✦ Ability to gift Discoverist to up to 5 employees (they do not need to be cardholders) ✦ Up to $100 each cardmember year in Hyatt statement credits: Spend $50 or more at any Hyatt property and get a $50 statement credit up to two times per year. |

While the World of Hyatt Business card fell short of my definition of a collectible card, I’m still mildly interested in getting the card. In this case, it’s the card’s benefits from spend that I value. After I earn the welcome bonuses for the IHG and United cards, I’ll probably try signing up for the Hyatt Business card.

Bad Advice

Please don’t mistake the above discussion for advice. It’s not meant to be advice for what you should do. Not at all. For most people, the best approach is to make sure you have a core set of Ultimate Rewards cards and then whenever you can, try signing up for additional Ink Business Unlimited and Ink Business Cash cards (see this post for considerations about getting the same card again). These business cards tend to have the best welcome offers and they earn super valuable Ultimate Rewards points which, when combined with a premium Ultimate Rewards card, can be transferred to airline and hotel partners.

How many current personal and business cards do you have @Greg? I have quite a few of each and am worried about how many is too many 🙂

Hey, just wanted to tell you about my odd experience applying for the CSP the other day. Relevant facts, I’m under 5/24 (3 new cards opened in the last 24 months actually, last one 4/4/23), I’ve never had a CS card before and my credit score is between 809-820. I had P2 sign up first and then used his referral link so we could both get the larger welcome bonus and the referral points. When I went to apply I was denied! Thanks to all the tricks you guys have taught me (I’m new to the game!) I called the reconsideration line. When I asked why I was denied they mentioned the 5/24 rule, but I explained that couldn’t be the case. They then transferred me to someone else, and after examining my report she said I had only opened 2 new cards (my new southwest and Amex gold showed up but not the Hilton aspire) and was an authorized user on 2. The AU on one was from years ago and honestly I don’t even know what the second one is. Regardless, I was approved in the end! Thanks for all you guys do!

Hi, did you apply for the united biz and ihg biz basically at the same time or how long did you wait between? I thought you can only get approve for 2 chase cards in 30 days, but only 1 biz card in 30 days.

Yes I applied within minutes of each other.

Hey Greg, are you aware that Aeroplan recently added a U.S. tax “recovery fee”? It’s approx. CAD $57.40 RT, but when added to the $39 partner award fee, it adds up.

That’s a bummer!

I’m curious how much discount the Air Canada card offers on award flights, from what you’ve heard and seen so far.

The United Biz card offered a 150K SUB recently (with higher minimum spend required). Why didn’t you get it then if you wanted it? Were you not under 5/24 yet?

I don’t have any good data on that (how much Aeroplan discounts award flights for cardholders). If anyone knows anything here, I’d be interested!

United Biz: I wasn’t yet under 5/24. Plus I’d rather keep my really big spend for big transferable points welcome offers.

why not apply for more ink cards instead?

Inks offer better SUB then United and Hyatt.

That was the point of the “bad advice” section of this post. Remember, I’m a nerdy card collector.

While you were in Chase jail which other cards did you get?

I picked up the Wyndham Biz, several Amex biz Plat cards, the Amex Plat, Chase Ink Cash (I wrote about how I got approved despite 5/24)

I love to read all your newsletters and posts so much to learn. What are the benefits of Wyndham biz? And can you write or find good read on hotels at the airports to stay for the night before or a long layover but budget friendly and point friendly too.International airports in Europe,Middle East. Thank you!

It gives 45,000 points SUB for spending $2,000 in 3 months The most interesting thing about the card is it gives 8 points per dollar spend on gas. On each anniversary year, you receive 15,000 points so you should be getting back more than your annual fee of $95 assuming Wyndham points are 1 cent each.

Love reading your articles so much to learn for neebies

Thanks!

For the United Card (and all United cards), do you have to purchase the flight with that card to get the free checked bags? I used LifeMiles to book domestic United flight (paid taxes using VentureX), and wondering if getting the United card would help with checked bag cost after the fact.

Unfortunately, it has been my experience that you have to pay with a united card to get the bag benefit (if you don’t have at least silver status). And yes, just paying the award fees count.

Yes, you need to pay with the United card. It’s one of the few airline cards that require that. See: https://frequentmiler.com/free-checked-bags-via-credit-card-complete-guide/

Hey Greg, I have the same 3 Chase collectible cards as you, so I guess we don’t need to trade 🙂

Too late for this advice, but I was going to say if you wanted to double dip on the 2 x $25 UA credit with the IHG Business CC, you should have created a second IHG and UA account, then entered the second IHG account on your IHG Biz CC application.

I currently have the IHG Select, IHG Premier, and IHG Biz linked to the same IHG account, so I found out the hard way that the 2 x $25 UA credit do not stack if you have multiple qualifying IHG CCs.

There are downsides to having 2 IHG accounts, since you cannot combine points or get the 10% rebate from the IHG Select, so I’m not sure those downsides are worth the $50 UA credit.

I don’t think the Gateway card gets you increased award availability anymore. Can you confirm that?

It still does.

Has anyone written about how valuable the expanded award availability benefit is these days?

No. It doesn’t.

https://thepointsguy.com/guide/award-availability-united-credit-cards/

https://www.nerdwallet.com/article/travel/united-expanded-award-availability

That article is out of date.

The 2nd one is from December 2022. Not out of date.

It may not be out of date but it’s incorrect if it says that the Gateway card doesn’t give you extra saver award availability. Tim’s wife tested this recently and it definitely works.

Yeah, I think some bloggers (not FM), just update the date to make it look like it is recently updated – when in fact the only thing that changed is just the updated date of the article.

“A great example is the IHG Select card.” -FM

For anyone who churns (everybody here), I don’t think holding onto this card is a good idea because it prevents you from obtaining the Premier card and its SUB. Granted, the Select card provides a 10% discount for reward nights for half of the annual fee of the Premier, but how much are you really saving?

Simple math shows a savings of $50 and max 30,000 points per year, if you spend 300,000 points. So, that’s $100 and 60,000 points every two years. If you apply for the Premier, you’ll pay $100 extra and earn 140,000+ every other year. Net is 80,000 points earned for $100 (0.125 cent per point; best rate to purchase points from IHG is 0.5 cent) if you were to spend 300,000 points per year with the Select.

Also, the FNC for the Select can’t be topped off, so you’re limited to 40K properties.

The downside is that you have to waste a 5/24 slot every other year to churn the Premier.

The select card doesn’t stop you from getting the business premiere though, so you can still get the 4th night free benefit with that.

And the IHG Business is actually better to churn, especially if you have the Select (wish I did)

The idea is to churn both the business and personal cards.

I think most people would probably just prefer to churn the ink cards instead if you are looking for a straight churn.

Exactly this.

Can you hold multiple Ritz cards?

That’s what I’m trying to do. Get all the Amex Marriott bonuses first. Then get boundless and bountiful without the bonus just to upgrade to two ritz cards Later.

I assume so, but haven’t tried.

Do forget to use the United business card for United purchases (travel bank) of $100 or more for 7 times and get $100 credit back. More than cover the annual fee by itself.

How to find UA travel bank and what do you purchase?

https://www.united.com/en/us/fly/account/travelbank.html

You can pay United biz card annual fee with PYB at around 1.5 cpp. So if you use the 5000 miles you get each year to “erase” the annual fee. Effectively you’d only pay 1600 miles each year to keep the card. (6600-5000=1600UA)