NOTICE: This post references card features that have changed, expired, or are not currently available

The Curve card could be an absolute game-changer both for Player 2’s wallet and even (as we say on the show) our own wallets. But can it deliver what it promises? Why do we love the concept so much and how can it help you max out your point earnings? This week on Frequent Miler on the Air, we talk about why we think this card is so awesome, even for folks like us who have a pretty strong handle on which credit card to use, and where it could fall short. We also talk strategy for dumping a Sapphire Reserve and why we haven’t talked much about Wyndham.

The Curve card could be an absolute game-changer both for Player 2’s wallet and even (as we say on the show) our own wallets. But can it deliver what it promises? Why do we love the concept so much and how can it help you max out your point earnings? This week on Frequent Miler on the Air, we talk about why we think this card is so awesome, even for folks like us who have a pretty strong handle on which credit card to use, and where it could fall short. We also talk strategy for dumping a Sapphire Reserve and why we haven’t talked much about Wyndham.

This week on the blog, read on for more about how Greg thinks he might break his Capital One hex with the Venture X, why Tim keeps the Sapphire Reserve for a single benefit that’s worth its weight in annual fee, how a little pain can help you gain uncapped 5% back at grocery stores, whether you should manufacture spend toward American Airlines elite status and more.

1:07 Giant Mailbag: What about Wyndham?

5:52 Mattress running the numbers: Wyndham promotion for up to 5x points

9:30 What crazy thing double header! What crazy thing . . . did Greg do this week?

14:44 What crazy thing . . . did American Express do this week?

26:32 The Main Event: The Curve Card promises, but can it deliver?

55:00 Post Roast: Why didn’t Nick tip Greg off to his strategy for the Curve card?

1:00:22 Post unroasted

1:01:02 Question of the Week: Is this a good strategy to replace the Sapphire Reserve?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week at Frequent Miler

Curve is here and it’s real. It won’t rule them all, but it’ll rule Player 2’s wallet.

While this may not quite be “one card to rule them all”, the Curve card is one cool tool to rule Player 2’s wallet at the very least. I love the ability to not only switch up which underlying card gets charged but the chance to go back in time and switch to a better card after the fact. Never again settle for 1x and gain the chance to meet the welcome bonus spend on a new card by switching charges you had previously placed on other cards. I only briefly touched on the ability to set rules, but as I play with this card more I just love it more and more. The chance to earn additional cash back on top of credit card rewards is just icing on the cake. I hope they do get Visa support, but even if not I think this may be one of the best things to happen in this space in a long time.

Approved for Venture X. Am I nuts? [On my mind]

Yup, I can confirm it: Greg is nuts. Last time around, they closed his account, redeemed his miles at half a cent each, and completely stonewalled him as to an explanation. What kind of glutton for punishment tries to drink from that trough again? Proving that his “no pain no gain” philosophy extends beyond the Paceline card, Greg has this time encouraged his wife to sign up and hope that she isn’t deemed guilty by association. I bet that she’ll be fine until about 3 days after she adds Greg as an authorized user. All I can say is that I hope she uses or transfers out the points before she gets Greg an authorized user card and they associate her with the riff-raff.

Chase Sapphire Reserve: Why .25 cents is worth $250 (for me)

Tim published this post after we had already recorded Frequent Miler on the Air, but it is entirely relevant to this week’s question of the week and adds some points to a part of the discussion that we didn’t have — should Vince have dumped the CSR at all? Personally, I find the Venture X to be an easy keeper based on the annual travel credit and points alone and that is a bit of a game changer in that it means I can’t really value overlapping benefits on my Ritz or Sapphire Reserve cards, but I also don’t really count the Venture X’s annual fee as a liability since the card is a net win annually. I don’t earn as many Ultimate Rewards each year as Tim and I’m not particularly enamored with the options for using them at 1.5c per point in value. I don’t value them at a full 1.5cpp when used through Chase Travel℠ because I don’t book many independent hotels and booking through Ultimate Rewards often costs more than your best alternative, which makes 1.5cpp really worth something less. I’ve said it before and I still feel this way: I keep it because it isn’t that expensive after I use the travel credit and I write about credit cards for a living. It’s convenient for me to have many of the cards we write about to be able to explain things, answer questions, and test ideas — but if I weren’t writing about credit cards, I’d have dumped the CSR a while back.

Manufacturing American Airlines elite status through credit card spend

Is it worth MSing for the purpose of earning American Airlines elite status? The idea initially seemed kind of preposterous to me given the easy opportunities we’ve seen to pick up Loyalty Points through the AAdvantage shopping portal and SimplyMiles, but as I thought more about it I realized that it may not be so crazy for someone looking for an easy and still not terribly expensive way to reach high-level American Airlines elite status — particularly if you’re already earning some Loyalty Points from flying.

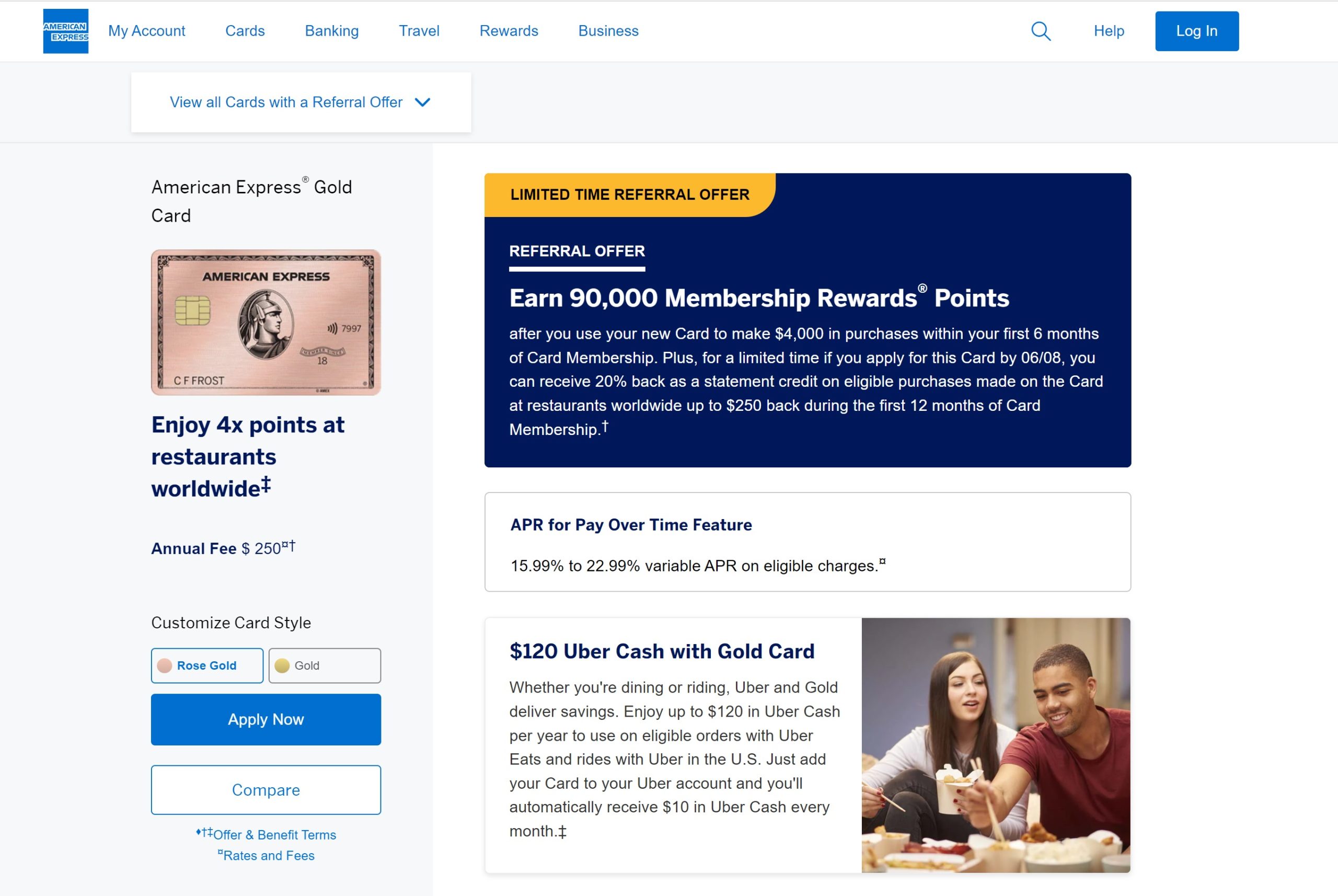

Huge Gold card offer: Earn 90K points and up to $250 in statement credits with qualifying activity

The points parade marches on: Amex continues to surprise and delight with huge welcome offers, the latest of which is a 90K offer on the Gold card that also comes with up to $250 in statement credits at restaurants. Open this card and then refer someone (perhaps your Player 2?) for a new card under the latest referral offer and you might be able to earn an additional 5 points per dollar (that’s 9 total!) on restaurants for the first few months. There is just no reason not to be flush with Membership Rewards points these days. This one is only available via referral and only some cardholders can generate a link, but we’ve got reader links going on our Best Offers page if you need one.

(Update: New link adds 10x at Restaurants) 150K Platinum card offer via referral

As if the Gold card offer above wasn’t enough, there is now a referral offer on the Platinum card that pairs a 150K welcome bonus and 10x at restaurants. This could be a fantastic opportunity for someone planning a wedding where the caterer will code as a restaurant, but it’s also a fantastic offer even for those who don’t max out every penny of spend.

Paceline card: Uncapped 5% back for grocery, drugstore & more; 3% everywhere else. But you’ve gotta work out for it!

When I first heard about the chance to get uncapped 5% back on grocery and drugstore purchases, my interest was piqued. Then I read more and the way the welcome bonus gets dragged out over 24 months didn’t excite me, but Greg almost convinced me that it could still be worth it for the rewards. Then I got to the part where I found that I would need to get an iPhone and a fitbit and I decided that I need to use the exercise equipment I’ve already bought before I add any more. I’m out on Paceline for now, but in on more exercise (I hope).

Best uses for Marriott free night certificates (⏱Book these now!

If you have Marriott free night certificates, particularly if you have extended certificates that are scheduled to expire in June, now may be the time to get those attached to a stay — particularly if you had your eyes on one of the many places set to increase by up to 10K, 20K, or 30K points per night above the current peak pricing. Here are the properties you may want to consider while you can.

Possible negative change on the Caesars x Wyndham status match-go-round

The Caesars x Wyndham status-match-go-round has been very lucrative for those who have been able to take advantage of benefits like the Diamond celebration dinner. My wife and I each had $200 in Diamond celebration credit from the previous two years that we just didn’t get a chance to use before it expired on 2/1, but those who have been able to use it have made out well without gambling a dime. Now it seems that Caesars may be limiting both matches and benefits, though data points aren’t quite consistent. This much I know: if you haven’t yet matched from Wyndham to Caesars, go all in on that now and cross your fingers that you don’t crap out (dice reference for the non-gamblers among us!).

Waldorf Astoria Monarch Beach, California: Bottom Line Review

True confession: I’ve never stayed at a Waldorf Astoria property. It just hasn’t ever appealed to me. The pictures in Greg’s review actually made me think that we should consider this as an option for Hilton free night certificates that we have on hand, and I am less turned off by it being a large resort than Greg is, but the $60 daily parking fee always makes me feel like I should be staying at a Hyatt given that my Globalist status gives me free parking at Hyatt properties. Regardless, this place wouldn’t have been on my radar without Greg’s review and now I’ll try to keep it in mind for the day when I finally get some time in the California sun.

DoubleTree by Hilton Weerawila Rajawarna Resort for Yala Safari | Bottom Line Review

I’ll admit it: before Carrie started talking about a Yala Safari and doing a review of a hotel near the park, I hadn’t realized that you could go on a safari in Sri Lanka. In fact, I know embarrassingly little about Sri Lanka apart from its location on a map. This post convinces me that I should read up and consider Sri Lanka more carefully the next time I’m in the region.

That’s it for this week at Frequent Miler. Keep your eye on this week’s last chance deals to make sure you don’t miss them before they are gone.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

I’ve been 35,000+ for 2 months now. seems like no movement. anyone else get any traction on this?

Nick, Are you an office products or gift card reseller? I was curious about the comment that you max out ink 5x bonuses every year.

Gentlemen, in your “what crazy thing did Amex do” segment, you mentioned something to the effect that Amex had not offered the 90k + 20% credit on the Gold Card previously. Perhaps it was targeted but my wife received that exact offer in July 2021 . . . and took it.

Nice! I don’t ever remember seeing that before. Good offer to take!

Just a note that it was mentioned that capital one requires SSN for authorized users. That is not true. SSN is optional. Birthdate is a required field, but apparently doesn’t even have to be correct because I made a mistake on one of my authorized users birth date

That’s great to know. Thanks! Maybe it will take C1 a few extra weeks to figure out who my wife associates with

@Nick Reyes: in this episode, you and Greg seemed to allude to the possibility that we might at some point lose the ability to book Vacasa rentals with Wyndham points. Is that something that you’re really worried about happening? If so, what’s the basis for that worry? I ask because my wife and I use a Wyndham Rewards Earner Business Card for gas and utilities–I would switch that to another card if I thought the “booking Vacasa with Wyndham points” thing would go away before I’d be able to use those Wyndham points.

No specific reason for concern apart from the fact that they don’t own Vacasa. It’s a partnership, so you never know for sure when that could end on either side and the best deals just don’t last forever. My point was that I love Wyndham points right now, but that would change drastically if the partnership with Vacasa ended, so I don’t really view it as a program on the upswing since that single partnership makes up most of the value for me. I am certainly more excited about Wyndham than I was before that, but I’m not going to build an infinite stash of points if a partnership with an outside company is what I’m hanging all of my redemption hopes on. I’ve been glad to generate those points for the time being and I’ll probably use a bunch on a Vacasa rental next month and then go right back to earn mode until I have enough to comfortably cover my next anticipated need or two.

Understood. Thank you!

Can you set a Curve Mastercard up on SimplyMiles? Double dip over to Visa somehow?

Good question! Not sure, but I’ll give that a try.