NOTICE: This post references card features that have changed, expired, or are not currently available

Credit card rewards have helped take me to more than 60 countries around the world. They completely powered the flights for a 4-month, 18-country honeymoon when I got married and have brought me to corners of the world I wouldn’t have otherwise found. However, over the past year, debit cards have been heating up. No, I haven’t gone all Dave Ramsey on you, but as my strategy begins to incorporate more and more cash back, it is seeming like a big mistake to be ignoring debit.

For the past two years, I’ve mostly been in “collect” mode, picking up points wherever possible and squirreling them away for a rainy day. Amex has made it almost effortless, with my wife and I picking up a seven-figure sum of points in the last six months alone. We also hopped on the chance to get more than 1.5 million American Airlines miles late last year. Heck, I even have more JetBlue miles than I’ll need anytime soon thanks to a couple of Lowe’s deals. I now find myself beginning to reach that point that many rewards enthusiasts have reached during these pandemic years: we have “enough” points to cover our needs for a while and we are now starting to migrate toward more cash back. As that migration progresses, I find myself realizing that the best rewards card strategy for cash back might not be credit cards at all but rather the right debit cards.

Key point: You’ll earn more from welcome bonuses

Whether you want travel rewards or cash back, the ticket to amassing as much as possible is clear: credit card welcome bonuses. Many cash back credit cards come with welcome bonuses that represent a 10% return or better on money spent.

Just as is the case with credit cards, the “best” cards to use won’t matter much to those willing to open many new cards. In other words, if you were to open a new card that offers a bonus of $500 after $5,000 spent in the first few months, using that card everywhere yields an effective 10% cash back, which beats what you can earn by maximizing the right card to use for the right type of purchase. Depending on your spending habits, you may be able to open a couple of new cards each year and earn an effective 10% back or more on all of your spend.

While some people will continue to open a new card each time they meet the spending threshold on the previous card, many will instead prefer a strategy of having a “right” card or two or three in order to maximize return on daily spend.

To that end (having the “right” card for a particular category), debit cards are becoming a more significant part of my cash back strategy.

Caution: Debit cards don’t have matching protections

It is definitely worth noting here that using a debit card for regular spend is a potentially risky endeavor. Credit cards come with consumer protections like extended warranty and return protection (details will vary by card and issuer) that debit cards may not offer. More importantly, in cases of fraud (stolen card numbers), liabilities can be significantly different.

In this post, I will consider the merits of the right debit-based wallet based on return for spend, but keep in mind that there are additional factors to consider regarding which card to use. I don’t feel like a debit-only wallet is a practical decision, but debit is taking on a more significant chunk of my spend than in the past.

Debit cards that are on the rise in my wallet

Nearside: 2.2% everywhere

The Nearside business debit card is really the one that brought this topic to front of mind. Tim recently turned me on to this card when he wrote about it. For 2022, this debit card is offering unlimited 2.2% cash back everywhere. That beats out the benchmark that most people set for credit cards.

Those who have the investments and/or cash to meet Bank of America’s Premium Rewards Platinum Honors status will surely prefer using the Bank of America Unlimited Cash Rewards card or Premium Rewards card, which each effectively offer 2.625% cash back everywhere for those with top-tier Bank of America status. However, for those who can’t meet the investment/deposit requirements for Platinum Honors status, this Nearisde debit card may be a next-best-thing.

And in fact in situations where using a debit card may be cheaper than a credit card (I’m looking at you, tax bill), this could be a nice win over a credit card.

The caveat of course is that this 2.2% cash back rate is just for 2022. I can’t imagine it will be sustainable long-term, but as I’ve said many times before when it comes to these FinTech companies with venture capital to burn, long-term sustainability isn’t very important to me. You’ve got to strike while the iron is hot.

It is also worth noting that there are a couple of other options for exceeding 2.2% cash back “everywhere else”. The Alliant Cashback Visa offers up to 2.5% cash back everywhere, but with some amount of hoops to jump through, and the Discover IT Miles card effectively earns 3% back for the first year. The US Bank Altitude Reserve is an under-appreciated card, with a 3x earning rate anywhere you can use mobile wallet to pay (Apple Pay / Google Pay). Those US Bank points can then be used via Real Time Mobile Rewards at a value of 1.5c per point. There are certainly options that beat the Nearside business debit card, but Nearside is looking quite good against a lot of the competition (particularly for a card with no annual fee and no hoops to jump through at the moment).

PointCard Debit Card: Frequent 5x Amazon / Costco / Whole Foods and lots of other increased payouts

Speaking of sustainability, I can’t imagine that the PointCard Debit Card will be sustainable forever, but for the time being it is my go-to card for rewards at Amazon, Costco, and more.

That’s because of ongoing offers to earn 5x points (which is 5% back given that points are worth $0.01 each) at a useful array of merchants. The returns here are not unlimited and are “officially” limited-time. However, Point has continued to renew these offers every month or two and is currently effectively offering 5% back on up to $1,000 in purchases at Amazon, Costco, and Whole Foods through 3/27/22. Similar 5% returns are currently available at Best Buy, Etsy, Trader Joe’s coffee shops, and more (with end dates and caps that can vary). They are also offering 5% back at Walmart now.

It’s worth noting that a number of Chase cards are currently offering 5x spending bonuses at Amazon this quarter. In my household, we only got targeted for that on a Southwest Airlines credit card. We’ve got a pretty healthy stock of Southwest points, so I’m happier to earn 5% cash back at the moment (and since this PointCard offer has been renewed repeatedly, it has been easy to “set it and forget it”).

While PointCard points are currently only redeemable for cash back (at $0.01 per point), I have some amount of hope for the future. The Titan credit card that they have announced will supposedly be able to transfer points to numerous airline partner programs. I have no indication that will happen with the debit card also, but I can hope.

I’m also a fan of the rideshare protection and missed event ticket protection that Point added. For a debit card, it has a pretty interesting set of benefits.

The major downside of the Point card is that it isn’t cheap thanks to an annual fee of $99. Still, given the returns, it has been well worth the cost to me. Point has run a number of deals to get $30 back on a cumulative $200 spend by using your card 5 days in a row and I have been able to take advantage of that enough times to cover the annual fee (though we haven’t seen a streak return in a while now). And given the new referral offer that only requires $50 spend, it’s easy to mitigate the fee for at least the first year.

Cash app: Frequent 5% off at Sam’s Club, sometimes good restaurant return, etc

A couple of years ago, I wrote about how you should stop sleeping on the Cash app. I have to admit, I’ve snoozed on this card more lately, but I shouldn’t. Between offers like the current one to get 5% off at Sam’s club (once a day up to $20 for a limited time) and periodic offers like 10% back (or 10% off) at restaurants and other popular stores, I should probably be using this card more often. My main hang-up here has been the same problem I long had with Freedom cards: you can usually only earn a pretty limited return and it takes some effort to keep up with the latest offers. However, I could probably beat the return I’m getting in a number of categories with just a little effort here.

The Sam’s Club offer in particular has probably been a boon for gift card resellers given the ability to get an additional 5% off of already-discounted gift cards at Sam’s Club. I’ve mostly missed the boat on that deal. I did successfully take advantage of 10% back in bitcoin on restaurant bills a few times — and thanks to the run bitcoin made last year, for a while that was worth a lot more than 10% of the bills on which I had earned it.

Debit cards that are a key part of a cash-heavier strategy

While the cards above are likely to get a lot of my debit card spend, there are a couple of additional debit cards that I think are absolutely worth having as part of a strategy that is weighted a bit more toward cash.

Schwab investor checking: For cashing out Membership Rewards points

While this card doesn’t earn any cash back on its own, I think it is well worth it for most people in this game to consider having a Schwab checking account and its associated debit card. First of all, the card offers ATM fee reimbursements worldwide, so it is an excellent debit card to have for travel.

More importantly for those playing the points and miles game, having a relationship with Schwab will be necessary if you ever want to open the Schwab Platinum card to redeem American Express Membership Rewards points for deposits to a Schwab account (at a rate of 1.1c per point currently). While you could certainly open this account whenever that day comes, there is no harm in having it and holding it in the interim.

My wife was recently targeted for both the Business Platinum and Business Gold card offers that we posted about over the past few days. My initial reaction to those offers was a mix of feeling like we need to give Amex a breather / cool-down period and that we don’t really need a new boost of Membership Rewards points right now. However, when I consider the fact that those bonuses could become cash at a value of 1.1c per point, I am more seriously considering them. While I wouldn’t generally recommend that most people trade the potentially outsized value and flexibility of Membership Rewards points for just 1.1c per point, those who are sitting on mountains of points should probably at least consider it since those points are unlikely to increase in value while cash can. Having a Schwab checking account is a first step.

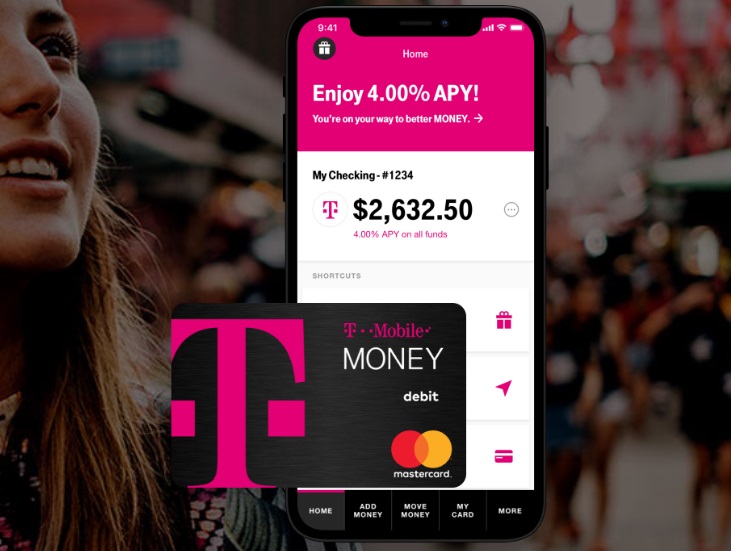

T-Mobile Money: For 4% APY on up to $3K per player

As a T-Mobile customer, having a T-Mobile Money account is a great benefit. This account offers a base rate of 1% APY (which is quite good in the current environment considering no minimum requirements). More importantly, it offers 4% APY on up to $3,000 (per account holder). Even if you have significantly more than $3,000 in the account, the mixed rate considering 4% on $3K and 1% on the rest is still probably better than most other places you’d hold cash.

Apart from needing to be a T-Mobile customer, the hoop you need to clear for 4% APY is that you’ll need 10 debit card transactions per month. I’ve actually found insurance bills quite easy for this: at the beginning of the month, I can schedule out 10 small payments toward insurance premiums and secure myself 4% APY. Now that New York has legalized online sportsbooks and I have become acutely interested, I’ll have to see whether this card works for deposits as that may make it easier to hit the 10 transaction requirement without automating so many payments to the same merchant (I haven’t yet tried my T-Mobile Money card for deposits). It may not be the best way to fund those accounts, but it would probably help with some diversification.

Honorable mentions

Crypto.com Visa Debit: Potentially great rewards

This card has been on my radar for quite some time and I think I’m ready to take a dip in this pool. The Crypto.com Visa Debit card sounds really interesting, with the ability to earn as much as 8% cash back everywhere. The catch? You need to “stake” some crypto and the cash back you earn depends on your stake. In other words, you need to lock up some money in a crypto currency that could crash and burn in order to get better-than-credit-card cash back.

The staking requirements for 5% or 8% back everywhere are just too rich for my blood (they used to be much less!), but the 3% tier isn’t out of the realm of possibility for me. While there is a “cost” to tying up the stake in the sense that it wouldn’t be earning 1% APY as it could in my T-Mobile Money account, the 3% back tier also comes with a 100% reimbursement for Spotify and Netflix subscriptions. While my Netflix subscription is (mostly) covered by T-Mobile, I do pay for Spotify. The $13.99 reimbursement each month would add up to well over what I could earn in interest otherwise on that $4K.

All that said, I haven’t opened this yet and this one seems risky to me as compared to all of the other options in this post given that you need to stake real dollars and cents in order to get the return. Still, I think I’ll give it a shot. I’m probably late to the party on this card, but maybe better late than never? I hope.

PayBal Business Debit: For promotions

The PayPal Business Debit card is one that I slept on for a long time and definitely shouldn’t have missed. This card has offered some terrific promotions over time that I completely ignored. While I can’t imagine they will offer promos quite as good moving forward, it is worth keeping an eye on this one and it may be worth opening and having for targeted promos. I have a PayPal business account thanks to that big Brex promo last year, so I should probably go ahead and request the business debit card already.

Bottom line

While I love travel rewards and won’t stop collecting them entirely, cash back is becoming a bigger part of my regular spending strategy. We do have the Bank of America Premium Rewards card in my household, so that’s been a go-to for earning cash back. However, there are situations where each of the debit cards in this post will eclipse the return I could otherwise get with the Premium Rewards card. If I’m getting particularly spendy, I sometimes like to spread that spend around and so I could see the Nearside card getting some use despite a slightly lower return (and since it is a Mastercard, I’m hoping it will play well with SimplyMiles offers). While I currently have healthy stashes in several rewards programs, my Ultimate Rewards balance still isn’t what I’d like it to be, so I am far from being in all-cash-back mode. Cash isn’t quite king for me, but it is becoming a bigger part of my overall rewards strategy — and surprisingly, that cash back strategy is shifting to include a lot more debit cards than ever before. I doubt these debit card offers are sustainable long-term, but I do try to strike while the iron is hot and right now it is hotter than it has been in years for debit cards.

If you can hit the DD Porte is better than T-mobile IMO.

Cash app loads trigger debit spend for T-mobile so far, don’t think they’re supposed to though

I’m so thankful for you putting this together. I have plenty of family who would much prefer this over churning credit card SUBs, and during certain seasons like getting ready to buy/build a home you gotta cool your jets, so this is absolutely fantastic.

1) Amex MR can be cashed out at 1.1 cents if you have the Schwab platinum, and you can earn 5x on flights, 4x on dining and grocery, 3x on travel, etc with various cards

2) Citi TYP can now be pooled and cashed out at 1 cent per point. You earn 3x dining; grocery, etc with Citi Premker, 2x on all other spending with double cash

3) Chase UR can be cashed out at the cent per point at a minimum, more if you use the portal or PYB

4) Capital One can be redeemed at 1 cent per point for travel, and you can pool points earned on Savor/SavorOne (3x or 4x dining)

With basically all transferrable currencies now able to be redeemed at least 1 cent per point, and category spend bonuses for many, is there a need to add debit cards on an ongoing basis (provided the annual fees work for you)

+11% with rewards + for TYP, a lot of people would do better with multiple custom cash cards than double cash. 2.22% ain’t bad though

Nick, I think your cash back strategy is missing leveraging purchasing discounted gift cards. For example, many times I can find Walmart gift cards for 6% off face value and Target gift cards for 5-11% off face value. I then use my 2.5% alliant cashback card to purchase the gift cards and load to Target.com or use the Walmart gift cards on my Samsclub order. Depending on the merchant (e.g. Sam’s club), I can get additional cashback for using a cash back portal like Rakuten if I’m doing a pick up order.

Also, US Alliance Credit Union has a 3% flat cashback credit card for 2022. This was originally 3% in 2021 as well and was extended for 2022. I don’t know if they’ll make this permanent – which is the reason I’ve shied away from getting the card myself. The field of membership also looks fairly broad if you join the American Consumer Council (life time membership is $15) or live in the NE U.S. or work for the various companies that are part of the field of membership.

Lastly, while the Amex Schwab Platinum card works well for cashing out membership rewards point and someone invested heavily in the Amex points system, it also has a $695 annual fee which may negate much of its usefulness from a pure cashback strategy point of view. I do realize that each person will value the perks of the Amex Schwab card differently (as well as the value of Amex points), however, if you’re using it for a pure cash back standpoint, the $695 annual fee will be hard to over come in the long run.

Just curious as to where you’re getting the Walmart gift cards? Your Sam’s Club strategy is sound.

Great stuff Nick. On the crypto card, make sure you understand the tax record keeping burden. I dipped my toe in crypto last year and the whole taxes issue sucks, and the various crypto platforms stink with getting you records.

Every micro transaction from or to crypto to usd counts and you need to calculate basis on each. I think most people just say screw it. But the IRS might not. Maybe crypto.com gives you a nice clean 1099. Skeptical. Put some value on your time.

Hey Nick, great post. I just opened the Nearside Biz checking account so I’m excited to try out the 2.2% cash back. I feel like I always forget to look at cash app boosts and the offers on my point debit card.

Would you consider the Brex card a debit card? I haven’t used my Brex account in months after I cashed out all my points but I wondered if you are still using Brex card. Thank you.