Which loyalty programs are on the upswing and which are on a downward trend? At any given time, the answer to that question could be influenced by award chart changes, availability trends, new program features, elite status benefits, and so on. This week, Greg and Nick discuss their totally subjective feelings about each of the major hotel and airline programs and examine which are on the rise in their eyes.

Which loyalty programs are on the upswing and which are on a downward trend? At any given time, the answer to that question could be influenced by award chart changes, availability trends, new program features, elite status benefits, and so on. This week, Greg and Nick discuss their totally subjective feelings about each of the major hotel and airline programs and examine which are on the rise in their eyes.

Elsewhere on the blog this week, we discuss how to find the best award flights, what you can do to get your passport application reviewed in a hurry, IHG’s new program in the real world, and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

01:05 Giant Mailbag

06:50 Card Talk: Chase Sapphire Preferred

19:17 What crazy thing….double header

19:32 What crazy thing….did Hyatt do this week?

22:30 What crazy thing….did Aeroplan do this week?

27:24 Award Talk: British Airways Business Class with AA miles

29:40 Free MSC Cruise

34:35 Seats.Aero adds Emirates

36:08 Main Event: Loyalty program changing fortunes

36:31 American Airlines

40:26 Delta

41:46 Southwest

43:13 United

46:37 Virgin Atlantic

48:27 Alaska

50:50 IHG

54:57 Hyatt

56:06 Marriott

59:20 Hilton

1:00:25 Wyndham

1:02:34 Choice

1:02:58 Radisson Americas

1:04:46 Question of the Week: What’s your strategy regarding speculative bookings?

Subscribe to our podcast

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Is IHG Diamond Status Elite? My Experience Over 10 Stays At 5 Brands

The new IHG One Rewards program looks pretty good on paper, but I was skeptical from the beginning as to whether or not IHG would successfully get its many different owners to play ball. In this post, Tim outlines his experiences with IHG One Rewards over multiple stays and brands. Surprisingly, I think there is a lot that IHG is getting right here. While the results weren’t all rainbows and sunshine, I find it impressive that IHG has done as well as they have in creating consistency — and as I say on this week’s podcast, the cheap price at which they perpetually sell points combined with the revamped loyalty program have me buying IHG points and moving them up in my mental lineup when searching for award stays.

How to find and book the world’s best first class award flights

If a luxury lineup is up your alley, you will no doubt know many of the airline products included in this post. The luxury that is within reach with miles and points is truly mind-boggling. I often find myself unable to adequately describe it to someone who hasn’t experienced international business and first class. Perhaps the most amazing thing about the world’s best first class flights is that many of these ultra-luxe experiences can be booked with miles and points, giving us all a chance at a glimpse into an entirely different world….perhaps for 8 or 10 or 15 hours at a time. This post will help get you there in style and comfort.

Follow along as Greg helps Maisie book her first business class reward redemption.

Speaking of getting there in style and comfort, Greg recently helped friend-of-the-blog-and-culinary-concierge Maisie complete her first-but-surely-not-last business class redemption. Whether you are new to award travel or someone for whom this world is old hat, there is something very enjoyable about watching Maisie learn and ask the questions that all of us had at one point in this game. I know I wasn’t the only person rooting her on as I watched and this was a great reminder of just how much of a game-changer our game can be.

Success expediting a passport application

For at least a little while this week, I thought that I was going to have to settle for living vicariously through Maisie’s travels as I wasn’t sure that my son’s passport was going to arrive in time for a big international trip that we have on the horizon. Luckily, I got some game-changing advice from Frequent Miler Insiders: to call a congressperson. We went from scrambling to plan a last-minute trip to El Paso for an in-person appointment to having a new passport in-hand in two days thanks to help from a politician. Now if only they could make everything move so quickly in Washington . . . .

(Update) Hyatt No Longer Shady With Terms Of Latest Promotion

In loyalty program craziness this week, Hyatt appeared to have changed the rules of the game in the middle of its recent promotion that awards 3K points for every 2 nights. Thankfully, we got an update this week that they are fixing this and will be making sure that everyone who was affected by the switcheroo in terms will be made whole by mid-June. That’s a bit slower than I’d like, but it sounds like many people have already received corresponding adjustments, so perhaps the June deadline is more of a worst-case scenario.

Our experience booking a “free” MSC Cruise

Speaking of worst-case scenarios, I made my first MSC cruise line booking this week despite having read numerous negative reviews about their customer service and the quality of their offerings. Frankly, I just don’t care about MSC’s potential short-comings when the worst-case scenario is that we don’t enjoy the ship but my family of four still spends 10 nights visiting some of the most beautiful ports on the Mediterranean with lodging, transportation, some meals, and entertainment included for $518 all-in after service charges. That’s a worst-case-scenario with which I’ll gladly live — and if it’s anything like our experience on Carnival in Europe last fall, it may just manage to exceed expectations.

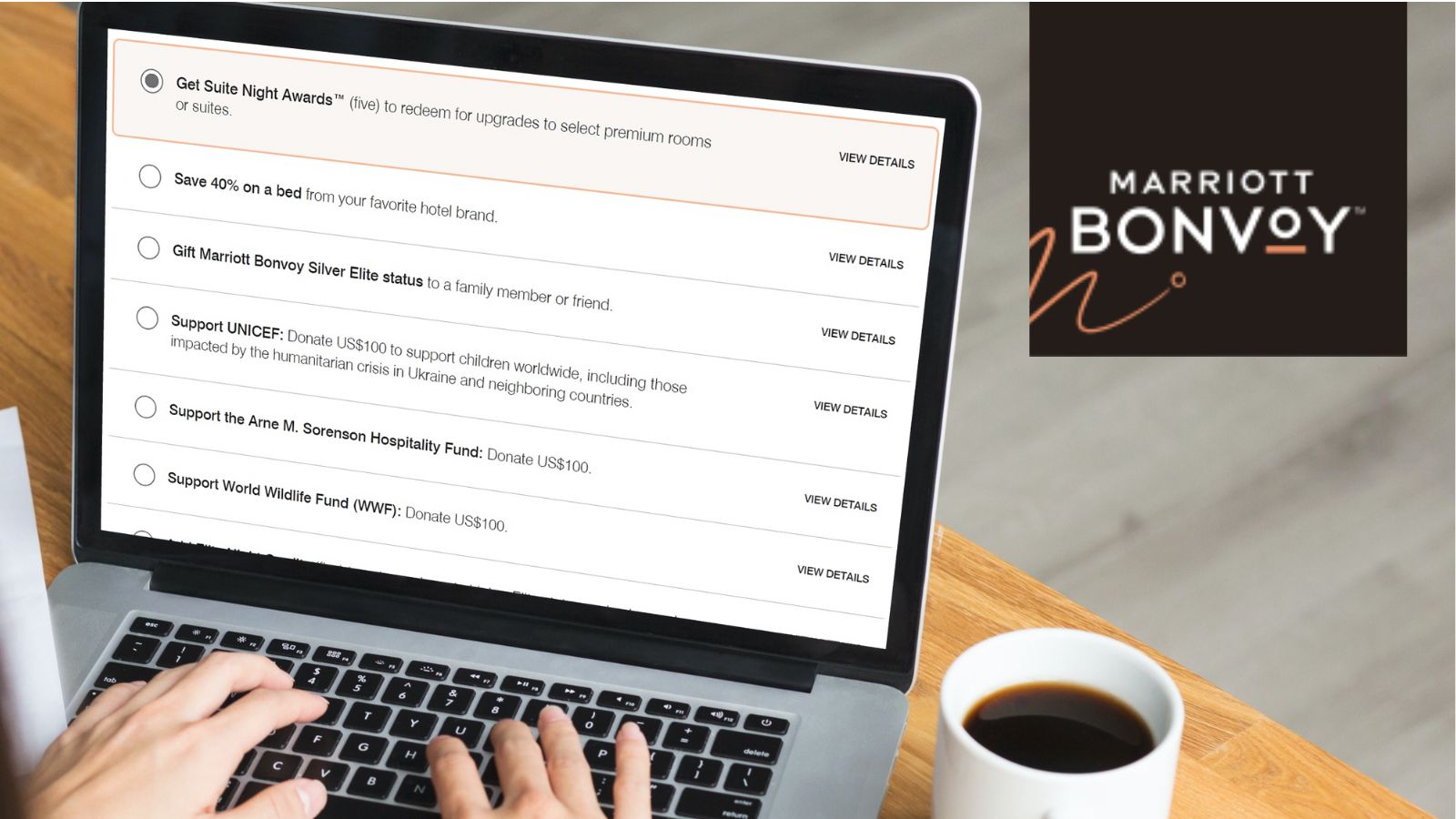

Marriott Bonvoy Choice Benefits. Which to pick? (2023 Benefits Now Live)

If beggars can be choosers, I’d beg you not to choose poorly with your 2023 Marriott choice benefits. If you have completed 50 nights this year (remembering that you could get either 30 or 40 just from holding the right combination of credit cards), the choices really come down to 5 suite night awards or 5 nights of elite credit. If you’re planning to take the elite night credits, I would hold off as long as possible on making the selection so that you can be sure that you actually need those 5 nights to reach Titanium and that you will indeed reach Titanium with them, otherwise you would be far better off with the upgrades even if they don’t clear most of the time.

Bilt Rewards Complete Guide (New 100K Max on Yearly Rent Payments for Cardholders)

Speaking of upgrades, Bilt Rewards has upped the ante in terms of the maximum number of points one can earn per year on paying rent. While the idea of paying enough in rent to earn 100K points per year seems outlandish to me, I know that rent in some large cities is high enough to have exceeded the old cap. I think the vast majority of people should now be able to earn points on the full rent every year. If you weren’t previously earning points on rent, this is like getting a low-effort welcome bonus year after year.

Chase Sapphire Preferred Complete Guide

Of course, if you’re after a great welcome bonus, you might need to pop in to a Chase branch for the in-branch offer that’s alive for this card at the time of writing. If you’re curious as to whether or not the Sapphire Preferred is a good fit for your wallet (and you weren’t completely convinced by this week’s Card Talk Segment), then check out this complete guide which should answer the vast majority of questions you’re likely to have about what is widely considered to be the best beginner miles and points card.

What percent of our hotel stays are paid vs award bookings? | Ask Us Anything Live, Ep 54

Speaking of questions, the entire Frequent Miler team fields questions from readers on the first Wednesday of each month. If you missed our April 2023 Ask Us Anything, here is where you can find the rerun and run through this month’s questions.

[Public] Five 50K free night certificates with new Bonvoy Boundless offer

In other big credit card news this week, there is a new public offer out on the Marriott Bonvoy Boundless card that matches the best we’ve ever seen — this time with arguably much better timing than the last time we saw this offer (given that travel has made quite a comeback since that time). I don’t always include new credit card bonuses in our week in review post, but this offer seemed too strong to ignore.

That’s it for this week at Frequent Miler. Keep an eye out on this week’s last chance deals to make sure that you get them before they are gone.

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

hahah! Greg! Now that is a funny pic! Good one

Insightful podcast. When you book a positioning fight to Europe, do you need to allow time to go through customs? For example, if you book a non-stop on BA to London. Then a different airline to your final city?

It takes no time at all to go through customs (it’s the “Nothing to declare” sign you pass under after collecting your bags. Immigration can take some time.

Whether you have to go through immigration depends on whether you have to enter the country or not. If you don’t have checked bags (which would have to be picked up and rechecked on the other side of immigration) and you are able to check in remotely (and not use a desk in the departures hall) and if the airport has airside transfers between your arriving gate and your departing gate, you probably wont need to cross the border and enter the country. If any of those things is not true, you will.

If the country you enter in and the country you’re continuing to are both Schengen countries, then you will “enter” and pass immigration at your first port of arrival and then continue on without further passport control.

Also note that LHR, in particular, has additional security screening for airside terminal transfers which can take some time. If your route is Europe->Europe->United States then you will always find secondary screening at the second European airport — it’s not immigration per se but rather an extra effort to make sure no one ineligible boards a flight to the US. And there is random secondary baggage screening at these points as well.

Thank you. Very helpful.

Re: the CSP, Not that 3x grocery is super exciting and can’t be easily beat, but would have been worth it to mention it triggers with Kroger Pay in person, for whatever your local flavor of the Kroger family may be.

Guess the first time I edited the post it magically converted to spam… I recreated the general idea.

I feel that you guys dismissed the 3x spend bonus on online groceries with the CSP too quickly. I completely agree that spending on services like Instacart is overpriced and definitely not worth using these platforms to capture the 3x bonus. However, that doesn’t mean it is the only way to utilized this category bonus. In my area the two most prominent grocery stores are Publix and Kroger. With both of these stores you can order groceries ahead a pick them up, which triggers the 3x bonus. Furthermore, both these stores have mobile payment options (Publix Pay and Kroger Pay) that allow you to pay at the store and they also trigger the spend bonus (unless something has changed recently). This requires little effort (it’s not like having to liquidate gift cards) and I’m certain there are plenty of easy opportunities in other regions. Also when comparing 3x at groceries to other credit card it is very competitive. The only cards that beat this category bonus are the Amex Gold, Amex BCP and rotating 5x bonuses. This card also ties the Citi Premier. It is hard to justify the Gold’s annual fee for just an extra 1x given it’s painfully annoying coupons, especially if spend is getting diverted for some sign up bonuses throughout the year. The BCP doesn’t earn a transferable currency and the rotating categories are not predictable. Lastly, the Citi Premier ties in this category but is often praised for the 3x grocery bonus. Depending on valuation of the coupons for the Gold and CSP, it would take at least around $15,000 to break even at groceries (though I would argue it would be closer to $20,000). And while I understand that mathematically it does not make sense to preferred 3x UR vs 4x MR, I would rather earn the UR points. They have much better flexibility with easy cash out (not that I would but in an emergency there could be value there), 1.25 cpp in travel portal or pay your way, and Hyatt (let’s be honest… mostly Hyatt). I do understand it is easier to simply swipe and not have to worry but adding a card to a groceries mobile wallet is not that big of a hurdle. I may not be bold enough to claim the CSPs online grocery is amongst the best bonus for the grocery bonus but it is definitely up there – might just require an extra step.

Correct me if I am wrong, but I believe you both were too dismissive about the 3x spending category on online groceries. In my area the two most prominent grocery chains (and where I tend to get my groceries) are Publix and Kroger. Both of them allow groceries to be ordered online and picked up. They both also allow mobile payment through their apps (Publix Pay and Kroger Pay) that, unless something has changed and I am not aware, code as online groceries when using them to pay in-store. I’m sure there are many other possibilities in other part of the country and other vendors. I agree that Instacart or other similar platforms are generally a ripoff. However using mobile payment methods is a low effort way (compared to say liquidating cards) to get earn a bonus that is only beat by the AMEX Gold, Blue Cash Preferred (if you want cash), and rotating 5x when groceries are the bonus category. And it is tied with the Citi Premier. The AMEX Gold has an annual fee that is hard to justify for an extra 1x grocery and dining (unless you’re one of the people hitting the gift cards hard) given it has such painfully annoying coupons, which is made worse when spend might be getting diverted to other sign up bonuses throughout the year. The BCP is not useful if you are looking for transferrable currencies and 5x rotating is never guaranteed. As far as it comparing to the Premier, I would rather earn UR point due my Hyatt addiction (and credit card protections – which any card out there beats Citi…). I might be too bold in claiming that it is one of the best grocery bonus categories but if you are taking advantage of methods like mobile payments it is very compelling. I know it is not rational from a mathematical perspective but I would rather get 3 UR vs 4 MR. I can cash it out without effort (wouldn’t do it but if needed it is there), get up to 1.25 cpp with travel portal redemptions, and Hyatt (until they do something like retroactively “update” the category changes for 2023), to name a few advantages.

And to think you both turned down a gift of AA EP status.

Amazingly, I just did a Delta redemption at 2.4 cpp. I don’t expect a repeat.

Lee, where did they turn down EP?