I love having a big stash of points in a wide array of loyalty programs. That way, when opportunity strikes, I can pounce on it. For example, when United briefly opened up business class award space to the far flung reaches of the world for only 60K miles each way, I booked my wife and I to New Zealand. And when ANA briefly opened the floodgates on first class awards, I was ready with my Virgin Atlantic miles and booked the entire Frequent Miler team. And when I found excellent award availability at Marriott’s luxury safari camp, JW Marriott Masai Mara Lodge, I had my Marriott points ready. And when Etihad opened up award space for their First Class Apartments, I jumped on that with my AA miles. I could go on and on.

The problem is that I’ve been quickly depleting my points with lots of deal pouncing lately. And I used my own points to fund the entire Party of 5 adventure to Asia and back, and then to South America and back. This has left my tank nearly dry in a few key programs…

Transferable Points

Transferable points are, of course, the best points to accumulate. Since they each transfer to multiple airline and hotel programs, having lots of transferable points can make it easy to be ready to jump on deals when they appear. Last year I found that I was getting low on Chase Ultimate Rewards points (which I use to fuel my Hyatt award stay addiction) and so I had my family of three apply for new Ink cards…. multiple times (see this post and this one). I feel comfortable now with our Chase point fortune.

I’m even more flush with Amex points. My family jumped on quite a few of the repeating 150K or bigger Business Platinum offers last year, plus we earned a lot of points through referrals and other deals. We’ll continue to go for the low hanging fruit, but adding to our Amex balances isn’t a priority.

I also feel good about my Citi ThankYou Rewards balance. At around 600K, that balance isn’t as high as our Chase and Amex balances, but I don’t find myself using my Citi points very quickly and so building this up further also isn’t a priority.

Now, our Capital One Miles balance is low. My wife has the Venture X card and about 13,000 points “Miles”. That’s enough for a couple of baseball tickets, but not much else. And I’m OK with that. I reviewed the Transfer Partner Master List and found that Capital One only has two transfer partners that I can’t get from other programs (TAP Air Portugal and Finnair Plus+) and I’ve never had a need for points in either of these programs.

Bilt Rewards is the one transferable points program where I am eager to build my balance. Until recently, I had slightly over 100,000 Bilt points (before Frequent Miler had an affiliate relationship with Bilt, I earned Bilt points through referrals), but I transferred all of those points to Air France/KLM Flying Blue when Bilt offered a 100% transfer bonus for one day. Now I’m wondering what other amazing deals we’ll see with Bilt in the future and I’d love to be ready with points just in case. And since Bilt transfers 1 to 1 to great programs like Hyatt and AA, there’s no downside to accumulating these points.

Airline Miles

During the Party of 5 Challenge, I spent a huge number of AA miles, a good number of Alaska miles, and some BA Avios. While I am now low on Avios, I’m not concerned about that since I can transfer to Avios from any major transferable points program and there are often transfer bonuses available. In fact, as I write this, and good through August 31 2023, there is a 30% bonus for transferring from Amex. Since I’m flush with Amex points, I’ll probably go ahead and transfer some points prospectively. I’m sure I’ll use those points eventually.

American Airlines and Alaska miles are a different story. Neither is available as a transfer partner from any major transferable points program. Yes, you can transfer to AA from Bilt, but as I wrote above, I’m Bilt-point-poor.

My highest priority is to rebuild my AA mile fortune. In the post “Why AAdvantage is my new favorite mileage program,” I explained why AA has become my favorite mileage program (not my favorite points program — I still prefer transferable points). It really comes down to this: I’ve found time and time again in the past year that AA miles have offered the best deal for the flights I’ve wanted to book. That’s both the reason why I’m now relatively low on AA miles and why I most want to rebuild my AA fortune.

I use Alaska miles less often, but they can be great at times. Like AA, Alaska doesn’t charge to cancel or change award tickets. And, unlike AA, Alaska offers free stop-overs on one-way awards. We used that to great effect for our Party of 5 flight to South America (45K business class to South America: LATAM sweet spot via Alaska Mileage Plan). And, before that but also this year, I got great value flying with my wife to Seattle, stopping over to see family, and then onward to California.

Hotel Points

World of Hyatt points are my favorite hotel points, but they’re easy to get since I can transfer 1 to 1 from Chase. So I’m good there (I could also transfer from Bilt Rewards once I get more Bilt points). Both Hilton and IHG points can be frequently bought for half a cent each during point sales and so I’m not worried about my point totals in those programs. Then there’s Marriott…

On average, Marriott points tend to be worth about 0.8 cents each towards award nights, but sometimes they can be worth much more. Here’s the dilemma: Sometimes Marriott sells their points for around 0.9 cents each. That’s not low enough for me to feel good about prospectively buying points, but it’s low enough to make me feel that transferring points 1 to 1 from Chase or Amex is a really bad deal. Even when there’s a 50% transfer bonus I don’t feel great about those transfers (but if Amex ever does a 50% transfer bonus again, I might do it since I’m so flush with Amex points).

I recently indirectly bought over 120,000 Marriott points for around $600 (~half a cent per point) thanks to an amazing short-lived promo where they offered 40,000 bonus points for each 4 night Homes & Villas stay. During the promo, I found properties in Africa that cost around $200 for four nights and I booked three separate stays. When the property owners reached out to me for details about my arrival time I let them know not to expect me but to “check me in” as if I was there. They were very happy to do so (they didn’t have to pay for cleaning!). Each time, it took over a month for my points to post (and they always posted on a Friday), but all three bonuses did eventually post (I also earned elite nights by the way). That was awesome and I now wish I had booked many more stays! Those points didn’t last long. My balance now is already down to 60K.

My Point Goals (Summary)

As described above, here are the programs where I’m looking to build up my point fortune:

- Bilt Rewards

- American Airlines

- Alaska Airlines

- Marriott Bonvoy

In priority order, it goes like this:

- American Airlines

- Marriott Bonvoy

- Alaska Airlines

- Bilt Rewards

My Point Plans…

American Airlines AAdvantage Miles

The fastest way to earn AA miles is through credit card welcome bonuses. Last month I picked up the Citibusiness AAdvantage card when the welcome offer was for 65,000 points after $4K spend. Going forward, I could earn significant numbers of points from Barclays’ Aviator Red card, Barclays’ Aviator Business card, the Citi AAdvantage Platinum Select card, and the AAdvantage Executive World Elite card. As I write this, there in an excellent 70K offer for the Barclays business card, but only 50K offers for Aviator Red and the Citi AAdvantage Platinum Select card. The Executive card offer is expected to jump up to 100K in the next day or so, along with its new bigger annual fee (see: AA “enhances” the Citi Executive card and encourages spend elsewhere).

Beyond the welcome bonuses, several AA cards offer companion certificates with $20K or $30K spend (see our AA card comparison here). So, simply spending a lot on AA cards can result in both miles earned and additional perks.

In addition to earning AA miles from new credit card offers and from spend, I can shop through the AAdvantage eShopping portal and maybe even book some hotels through AAdvantage Hotels if I can find any good deals there.

Marriott Bonvoy

Rebuilding my Marriott point fortune is going to be tough. My wife and I have almost every variation of Marriott card already and so we’re not even close to being eligible for a new card bonus. Our son might be able to pick up a card or two, but even that will require deep study to figure out which Marriott cards he is eligible for.

I could earn points through Marriott credit card spend, but Marriott cards aren’t very rewarding for spend. The base earn rate is only 2 points per dollar. Compared to spending on a 2% cash back card, that’s like buying Marriott points for a penny each. Considering that Marriott occasionally puts their points on sale for around 0.9 cents each, that’s not a good deal. I could also use one of my business Marriott cards to earn 4x at gas stations, but I hate doing that when I know that I could instead earn 8x with my Wyndham Earner Business card. If I could easily generate $60K of base spend on the Bonvoy Brilliant card, the 85K free night certificate that’s available as an annual choice award could make that spend worthwhile. But that’s a huge amount of spend!

Ultimately I think I’ll simply watch for easy wins. When Marriott offers good new promotions I’ll try to take advantage of them. When Chase or Amex offers bonus points for spend on the Marriott cards, I’ll try to do that too. And if Amex ever brings back a 50% transfer bonus to Marriott, maybe I’ll do that as well.

Alaska Airlines

Bank of America offers both consumer and business Alaska MileagePlan cards. While the offers for those cards aren’t great at the time of this writing, I’ll jump on either or both next time the offers are in the 70K range.

Additionally, crediting paid flights to Alaska can be a great way to earn Alaska miles. Unlike most other carriers, Alaska still awards miles based on the distance flown and they add a multiplier for premium cabin flights. The details vary by partner flown, but with British Airways flights, for example, it’s possible to earn up to 5 times the distance flown and that’s before even considering elite status bonuses.

Bilt Rewards

With Bilt, it’s possible to earn some points through Bilt Dining, Lyft rides, and probably a few other things that aren’t popping to mind. Ultimately, though, the best way to earn Bilt points is with spend on the Bilt credit card (which I don’t yet have). The card offers 3x for dining, 2x for travel, and 1x everywhere else. Plus it offers 1x for rent payments. I don’t pay rent, so I’m really looking at the earnings for spend. And where those earnings really shine is on the first of each month when Bilt doubles the earning rate for Rent Day (capped at 10,000 bonus points). That’s when it becomes possible to earn 6x for dining, 4x for travel, and 2x everywhere else. That’s a fantastic earn rate. With some careful planning, I may be able to spend heavily in those categories at the start of each month.

My Card Application Plans (and 5/24)

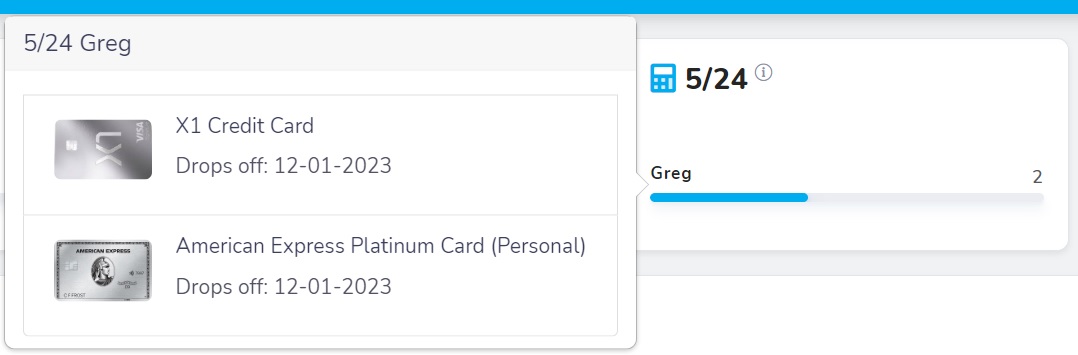

In the paragraphs above, I indicated a desire to apply for multiple AA cards, multiple Alaska cards, and the Bilt card. That’s a lot of new cards, and a lot of potential to go way over 5/24. That’s not a huge problem since I have most of the Chase cards that I want, but I have been enjoying being under 5/24 in recent months and having at least the option to pick up new Chase cards when I want to.

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

Currently, Travel Freely shows that I’m at 2/24 and will be at 0/24 by December 1st if I don’t apply for any new consumer cards between now and then:

This means that I can add up to 4 new consumer cards to my arsenal this year and I’ll still be under 5/24 by the end of the year. The business AA card and business Alaska card won’t add to my 5/24 count, so those represent an easy win. For the rest, I could imagine applying for each of the following:

- Barclays Aviator Red

- Citi AAdvantage Platinum Select

- AAdvantage Executive World Elite

- Alaska MileagePlan

- Bilt

The problem with the above card collection is that I’d prefer not to reach 5/24 if I can help it. As new cards and new welcome offers hit the market, I want the freedom to apply for them if I’m interested, and the moment I reach 5/24 I’ll be locked out of any new and interesting offers from Chase.

Another option is for me to spread out applications over time. If I pick up a couple of consumer cards now and wait a year to pick up more, then even if I reach 5/24, I’ll never be more than a year away from going under the threshold. From that point of view it makes sense for me to grab a couple of consumer cards ASAP. The sooner those new accounts hit my credit report, the sooner they’ll drop off as being more than 24 months old. So, maybe I’ll apply for consumer cards as follows:

- July 2023: AAdvantage Executive World Elite + Bilt

- Mid 2024: Barclays Aviator Red + Citi AAdvantage Platinum Select

- Mid 2025: Alaska Airlines Visa Signature

And, for completeness, I can pick up these business cards whenever the offers are good and I have the capacity to meet minimum spend requirements:

What do you think?

Did I miss any great ways to accumulate points in the programs discussed above? Did I leave out an important program? Please comment below.

AA’s recent Zimbabwe-dollar like award pricing makes Skypesos seem almost reasonable. It’s only a matter of time before partners jack up Aadvantage award prices.

Consider yourself lucky that you have depleted your stash of AA points. I’m sitting on 600K and am faced with choosing between random domestic destinations in basic economy, blowing almost all of it on ~300K lie-flat transoceanic redemptions, or doling out additional zillions for BA’s (formerly “fuel”) surcharges.

If you bloggers want to remain honest, you should stop mentioning AA at all.

OK, I’ll get together with all of the other dishonest bloggers (we check with each other before posting anything) to discuss becoming honest by no longer mentioning AA.

What should I do then, though, when I find great deals via AA like I’ve found repeatedly lately?

Oops, looks like I touched a nerve. Sorry.

If you can objectively say that AA provides fair value, more power to you.

I should add that one of the reasons this is my favorite travel blog is that you are NOT the PointsPimp and I hope you can keep it that way.

I’ll add my two cents here. I flew AA First Class Transcon NYC-SFO-NYC in November for an unprecedented 46,000 miles each way (for flights, that yes, can run into the 200,000-300,000 miles range). So deals are possible and you just need to be patient — and have the ability to plan ahead. That being said, I usually fly transcon on AA with one-stop service in first class — the beds are clearly not flat in those circumstances — but they are comfortable seats.

Just got back yesterday from Boston on a trip from the Bay Area. AA first transcon with a connection in PHX for 28K miles each way, so yes it is possible.

The return was a JetBlue nonstop in Mint for 38K miles (5AM departure meant getting up at 1AM as our hotel was 100 miles away). But worth it – Mint wins hands down. I have a trip planned for May and the lowest I can see is 68K. I might break down and splurge with Amex MR.

This is extremely useful, and so relevant to the question you guys so helpfully answered on air – how do you guys generate so many points? And first and foremost it appears the most important strategy is business cards, business cards, business cards. My problem is that my wife used to run a clothing sales business and I used to do more software consulting, and we also had a rental property which had business expenses – but right now, for time and other reasons we don’t really have much of any business expenses, so we’re stuck with personal cards for the time being.

Which is fine, these generate enough points for our economy flying travel lifestyle: we sleep well on planes so economy is sufficient. However, when we do restart our businesses I think we will lean heavily into business cards for our travel hobby. It’s great to see concrete examples of points amassing strategies to get a sense for what is possible.

You don’t need business expenses to get business cards… use them for everyday spend just like personal cards no one cares.

In the I prefer to have at least SOME sort of business of some kind before applying for a business card. As for what expenses go on the card I’m willing to be generous in my interpretation, but I still want to wait until we have at least SOME kind of business going. We have plenty of points for our current needs so we are fine with waiting till we have a business opportunity.

Barclay’s are a bit picky about people who have many CC. So, sometimes hard to get.

Alaska Charges $12.50 when cancelling partner awards

Well, it’s not that the charge $12.50 to cancel, it’s that there is a nonrefundable $12.50 partner booking fee when you book it. I know that may not feel like a functional difference, but I wanted to be clear that it isn’t a penalty fee that they add on at the end — it’s a fee you pay at the time of booking and you’re out that $12.50 whether you fly or not. So yes, you’re out $12.50 if you cancel — but you’re also out $12.50 if you don’t cancel.

True, I could have worded it better.I just treat it as essentially the same in my book.

For AA – Citi/AA recently offered 60k sub for a checking account. Had to have a couple of direct deposits (paychecks, dividend checks, pension, etc) + use the debit card for 1k withdrawals – pretty easy to do. I think I got the offer in the mail around April or May. Perhaps you’ll luck on something like that.

Yep, that would be great

AA points are great, in the past I would strategically purchase them when a good promotion would surface. Haven’t seen one in the past couple years. Now I accumulate them with the frequent and lucrative credit card sign up bonuses – as well as spend to emerald status. The latter does have opportunity cost, but I irrationally love my emerald status. Fortunately I can do this with business spend.

Greg – you forgot about Bask Banks AAdvantage Savings account. You can earn up to 500k in AA points after one year of depositing $200k

I am considering that, but you’re right I should have listed it in the post!

That is a massive cash deposit to have just sitting there! I suppose rich people may have $200k just lying around as a rainy day fund.

I would assume that Greg could get more than 2 cents per AA mile (I don’t value them nearly this high), but with current interest rates on high yield savings accounts, you would make over $10k in interest per year by having $200k tied up in a bank account. Assuming 5% interest rate (of course these can change, higher OR lower), that is $10k in interest missed out on. If you can get 2c+ per mile on 500k AA miles, you come out ahead. Anything less than that would likely be a loss and you are now beholden to AA miles rather than cash. I don’t know about Bask Bank AA account, but I’m assuming it doesn’t earn any interest on top of the AA miles.

I know this might make sense for a small handful of people (you have to be wealthy enough to just have $200k cash that needs something to do), but I equate this to spending $10k in cash to buy 500k AA miles – a definite losing proposition in my book.

I love this post and I agree with your strategy, just a few questions,

Are you doubling these apps with your wife and kids? Or spreading them out amongst yourselves (that would avoid your 5/24 concerns)?

How did you amass all those TYP? The only big SUB is the Premier and it’s once per 24(48?) months.

Although you can buy IHG and Hilton points for cheap, that still isn’t free. Wouldn’t you want to go for some big SUB so you don’t pay at all?

I wrote the post from the point of view of just my own point balances, but yes my wife and son can (and will) also sign up for some of these cards as well.

TYP: Most of the points were earned years ago when it was much easier to earn from welcome bonuses, but a lot were also earned from retention offers, spend bonuses, and simply from earning 5x for dining (Prestige), 5x grocery (multiple custom cash cards), 3x everywhere else (Double cash), 10% rebate (Rewards+)

To me, I always try to be at least at 3/24 or 4/24 (unless there’s a reason I want to pause apps). Any new card starts the 2 year clock and means it’ll fall off your 5/24 count earlier.

Ex: If you go to 5/24 in a short span now, the clock starts now and you won’t be back under 5/24 until 8/2025. If you instead had been adding cards every 4-6 months, you would know that if you’re not under 5/24 already, you’ll constantly be dropping back down sometime soon.

That’s next level optimization! I think it’s a great point, with the exception of if you’re wanting to do a CSP/CSR MDD…but personally I generally stay away from Chase personal cards, since it slows down my Chase biz card velocity.

Same here! Keep it under 5/24 always and you always get the Chase slow burn over time.

I think DOC has a link for 70k on the Aviator Red

Nope. That offer has ended.

https://cards.barclaycardus.com/banking/credit-card/american-airlines/mastercard-mastercard-business/inflight/9f53f207-c09f-4079-8334-7c916d08b7b9/

Don’t forget that we always show the best public offer that we’re aware of, so once a 70K offer resurfaces, you should be able to find it here:

In the meantime, the Aviator Business card is at 70K here:

Thanks for all the ideas. When you sort it out, could you guys do an updated post on the Bask Bank current offer, consider the tax issue that was raised. I would love to learn more. Also, if your son is living at home, maybe it is time for him to start paying rent? 🙂

I think Marriott points are the hardest hotel currency to accumulate at a modest price. As you point out (after exhausting cc SUBs), good strategies are reduced to either buying points at a not-so-favorable rate or actual spend on the cards which isn’t very attractive outside AMEX/Chase Offers or spend promos.

Hyatt protects their program by keeping Globalist status difficult (even the “challenges” aren’t easy) yet keeping point redemptions attractive. Marriott has made acquiring status easy thru credit cards but gonna cost you to use those points on a room to actually use your status.

This year I stayed 10 Marriott nights to hit 50 & the resulting SNAs (along with the 25 + 15 nights from Biz & Brilliant) but have now shelved the program for the year. Same with Hyatt. I am focused on Preferred Hotel bookings using Choice (& ultimately Citi TYP). You have enough TYP for 11 nights at their top properties. You could focus on using your TYP while rebuilding other hotel/airline caches.

I am booking a leaf peeping trip this fall. Preferred Hotels is well represented via extremely charming inns & lodges in NE states (where luxury chain redemptions are already more difficult). Most nights would cost $600-700/nt whereas using 55k Choice points (transferred 1:2 from Citi) is excellent value. And many good rooms are only 25k – 35k points.

I’m only re-sharing the same TYP/Choice/PH strategy you brought to light when Citi began 1:2 transfers…& I thank you again! To take it a little further, however, join PH & email them your Globalist info to upgrade your PH status to Elite. Add your iPrefer number to your Choice/PH booking for room upgrades & goodies on a $500+ room booked with about $165 of TYP.

Does PH Elite only status match with Hyatt or will it also match with Hilton Diamond? Also have you had any issue with Preferred Hotel Bookings and reservations? I’ve read about paying points for the rooms but when arriving there is a reservation but it has not been paid for yet.

PH doesn’t tell you what criteria they use to status match, so I always use the most valuable status I have at the time of my request. I have held Globalist since I started matching so haven’t needed to try Diamond, Titanium, etc. The match isn’t permanent (and must be requested annually) but at least there is no cap as to frequency like some other programs. At a minimum I feel PH would at least match you to their mid-level status which offers benefits as well. And as Greg always says…better to have some status on a booking than none.

I have read (probably the same comments as yourself) about rooms not posting, but those issues seemed to be happening early on in the Choice/PH partnership. After the runaround Greg went thru with early bookings I sat out awhile until better procedures were in place.

I have booked and stayed at around 10 different properties using this strategy now with no issues. Choice and PH remain on different systems, however, so I always call the property after booking with Choice to make sure they have my res and to add my iPrefer number to the res. The property has always had my res on file and I have another 10 or so reservations booked (but not yet stayed) where that is the case as well. Choice doesn’t reward points for spend at a PH property so no issues with trying to receive any Choice points for incidental spend (while on a different system) thank goodness, like SLH with Hyatt for ex.

This is a great suggestion Pam. What is the email address for status matching?

Hi Greg – either register/log in to the iPrefer website & request from there or email: members@iprefer.com and attach proof of your Globalist status with Hyatt.

PH used to also offer 1k iPrefer points for every referral, up to 10, who signed up for membership (incl your own) so don’t miss out on that if still offered. Points are best used at their (at least) semi-annual auctions. I have bid on, & won, fantastic travel for peanuts. Just the 10k points earned from referrals can win you something!

A wonderful niche program privately run with tremendous value & outstanding properties. The holding co also manages Historic Hotels of America, a modest mbrship with them also offers a nice discount on PH property bookings. I know from your posts you also enjoy unique boutique experiences – I think the PH partnership with Choice is more significant than Tribute/Autograph/Curio/Tapestry.

That worked! I’m now elite! Thanks for the help

Wonderful, thanks for letting me know!

FYI – I don’t know when it became bookable with points (your early PH post indicated not), but the Chatham Bars Inn in Cape Cod was awarded their PH Best Hotel (World) of 2023 last month (55k points).Same points for the Hermitage Hotel in Nashville, awarded the 2023 Best Hotel (US/Canada). I have previously stayed there and it exceeds all the new kids on the block.

PH has 5 global “collections.” Both of the above are the top Legend Collection which are like Marriott Tribute props influenced by location. The next collection is LVX. Many of both are represented in the Choice/PH partnership.

I wouldn’t advertise what you told the African property owners. Sure people do this, but I believe it is specifically against program rules. Please consider deleting the sentence and this comment for your continued good standing in the program.

Another thought on this. Greg, did you book the Africa property with no intention of staying? While I don’t have a problem with the advanced MS strategies that you tout on your site and podcast, selfishly blocking others from using properties like this, just so you can fatten your miles account is another thing. In my opinion you are becoming gluttonous in your quest to build your points balance. I truly enjoy your posts and podcast for all of the helpful information that you provide, but maybe step back and look at what you are becoming. It is not appealing to those of us who follow you for that reason. At least it is not appealing to me.

I do not understand how this is selfish. Greg paid for a product/service and chose not to make use of it. A commercial transaction took place and the purchaser of the product elected to use his purchase in a way that suited him. The preconceived intent for the usage (non-usage) of the product purchased in no way invalidates the commercial transaction that took place between a willing buyer and willing seller.

If I book a 2 queen bed hotel room because it’s cheaper than a room with a king bed, but only intend using the room for myself, does that make me selfish because I potentially blocked a family with young children booking at that hotel if that happened to be the last 2 queen bed room available? That reasoning is absurd.

This is the equivalent of getting upset with someone who buys a product on Amazon because of a great deal (eg a very limited item Black Friday killer deal that they were aware of because they were tracking all the Amazon deals) and then they never actually use the product, or uses it very infrequently. This happens all the time. Would their effort to acquire the knowledge and manner how to track and purchase the best deals on Amazon now be regarded as selfish because it prevented someone else from buying the product who would have made better use of it?

Furthermore by letting the property owners know he had no intention to make use of the rooms booked, he gave them the opportunity to release those rooms back into the market. Thereby giving them the opportunity to improve their profit margins and freeing up the room for others to use. But even if Greg didn’t tell them anything, he had a every right to make use, or non-use, of a product he bought through a perfectly legitimate commercial truncation.

Let’s put the “selfish” characterization to the side. Let’s only consider loyalty program credit. If you buy a plane ticket and don’t take the flight, do you earn points, qualifying dollars, or qualifying segments? No. It’s the same thing with hotels. Loyalty program terms and conditions state this. Why is this a question for anyone?

Greg also took the risk that points/EQNs would not post from his $ investment, so I consider whatever happens either way fair game.

I see both sides of this. One hand, if I were in the shoes of someone who couldn’t book a room thanks to someone else who booked without intending to stay there, I’d be miffed. Other hand, if the room would otherwise be empty then it wouldn’t matter. My guess is the promotion exists to generate bookings that would otherwise not have been made. So in that sense, there would be nothing selfish about letting the vacant room stay vacant.

We can’t predict other’s actions/reactions/motives, only our own, & to try otherwise generally leads to certain disappointment

Everyone has different views on what crosses the line and what doesn’t. That’s cool. There are probably things that you do which I wouldn’t feel right about doing myself. I’m 100% comfortable with booking lodging for the points even if I don’t plan to stay there. I could get into the reasons, but it doesn’t really matter. If you find it objectionable, great, don’t do it.

See also: https://frequentmiler.com/drawing-the-line/

Thank you for replying Greg. I get that it doesn’t bother you to do this. My point is that your behavior has an effect on others. Perhaps the deal gets killed because too many people violated the terms or the limited number of availability is gobbled up by individuals such as yourself. Sure, nobody “needs” to spend the night at these properties, but where do you draw the line? Is it a person’s right to overeat to the point of gross obesity, and then buy an economy airline ticket and spill over into another’s seat and just say “Deal with it! It’s my right!” It is what this world is coming to, but I guess I just expect better from you. Anyway, I know this will ignite a storm of comments against me, but it just struck nerve with me. I truly do love your posts and podcast and have benefited greatly by them. Thanks for giving me your ear.

Great post! I think in the same way. I like to have a nice stash in each currency to increase my options.

I saw on youtube combining the curve and bilt card. Charge all your dining on curve and on the 1st use the go back in time feature and move all the transactions over to BILT. The transactions move over as dining so 6x on your whole month of dining purchases as long as your statement and due dates lineup. I’ve done it the past 2 months.

Yah I also saw that strategy…haven’t really seen many people talking about it, but it sounds epic! I posted about it on the FM Facebook group

Seems to work well so far!

Hi Richard, I am very interested in this strategy & tried locating the specific youtube/blog link discussing this in more detail to little avail. Can you please provide and also explain further: “as long as your statement and due dates lineup?” Thanks

Search the “god tier trifecta” on YouTube.

It’s May confusing at first. Essentially the Curve card is like an Apple wallet. There are no fees or subscription for the US. Load at least 2 Mastercards on the curve card with 1 of them being the BILT card. I am using the citi double cash. Every time I make a purchase with the curve card it goes on the double cash. On the 1st when BILT is 6x on dining i use the go back in time feature on the app and drag all dining transactions over to the BILT card. It will refund from citi and show up on the BILT and still render as dining. I changed my statement date with citi to match BILT. I didn’t want to have citi payments due before I can transfer them on the 1st. So my Citi statement date closes on the 1st and BILT closes on the 2nd. BILT requires 5 transactions a month. Hope it’s not to confusing.

Thanks for the addtl instruction, Richard!

Tried sharing the link in a previous post but needs approval. Until it’s approved try searching YouTube for the “God Tier Trifecta”. I explained how I do it in the previous post as well so hopefully it’s approved.

Yes thank you, watched Calby (creator) & Anthony with great interest. I think what’s important in moving ahead for me is to pick a MC to initially receive charges I don’t mind if shut down from too many credits/refunds (that is then charged to my Bilt on the first).

I have been manually moving hotel charges to the 1st as much as possible myself since getting the Bilt in January (restaurants won’t do this when you ask). But sometimes there is pushback from hotels & they won’t, either – this strategy does it for them & saves me time, love it!

I also really like there is now a mechanism (with Curve) for cutting off my Custom Cash cards exactly at $500 spend so I don’t waste any $ on 1x points.

Thanks again for your help, prior research, & application. I look forward to reading more of what you posted upon approval.

Please use caution. The reason I’ve never suggested this publicly is that the Bilt people are aware of this and will shut you down if you do too much of it.

That’s unfortunate – I haven’t heard of anyone being shutdown but I will keep that in mind.

Well that is clearly useful info, Greg! If this new Trifecta was out there & you were aware of it, why wouldn’t you have already done a post about it along with its pros & cons (shut down being one)? The extra point accumulation can be significant, I don’t understand why not at least some discussion about it?

Also, on the Bilt side all they see is the final charge on the 1st, right? I can see the bank on the refund side taking offense over too many of those (& I would post those initial charges to a garbage card & bank I wouldnt mind being cancelled) but do you know what Bilt sees that they know its not an initial charge?

The credit card bill shows each item with “CRV*” before it. Like “CRV*Starbucks” so it’s easy for them to know.

I didn’t report it before because I didn’t want to shine a big light on it. I think that if it becomes overly publicized, even with plenty of cautions, many people will do it and Bilt will then have to take action. It would cost them a fortune if lots of people did this.

You appear to have acted in good faith. I still think light SHOULD be shined on it, though, so somebody with some sense as yourself has a voice on the subject. Censorship rarely works out as intended.

So what I don’t understand is why a company like Bilt doesn’t add “No GBIT from Curve etc or you will be shut down” in their T&Cs if they even remotely see it making a dent to their bottom line? Other issuers have no problems black-&-white stating what they won’t condone (think Dosh & OD; AMEX & gift card spend on SUBs). And seems already built-in safeguards to me with Rent Day limited by account to 10k bonus points.

I know you are only reporting what you’ve been told, just gripes me these sorts of legitimate tools are legal & available without accompanying fine print of when a person could be crossing some invisible line.

Thanks for the addtl info.

Btw were you able to load both your cards & your wife’s to your Curve card?

I actually haven’t even tried. I have all of the best Mastercards in my own name.

Lol yeah me, too, was thinking of getting Curve for my husband but not a great play if I can’t load my MCs to it. Will you please ask Nick – I think an early post on Curve had him getting one for his wife? Thanks

A reader over on my Bilt post said that he has added his partner’s cards

Famtastic news, thanks!