In December 2021, American Airlines ran an incredible promotion with SimplyMiles where you could earn 240 miles per dollar donating to Conservation International. That was equivalent to buying AAdvantage miles for less than half a cent each. Incredible. I bought 1.2 million AA miles through that deal and now wish I had bought ten times as many. I’ve already used most of those purchased miles! Unfortunately, we haven’t seen any deals anywhere near that good since then and probably never will. At the time I wasn’t too excited about AA miles (which is why I hadn’t bought more), but I’ve become a convert since then…

Big Picture

AAdvantage is my new favorite mileage program. It is not my favorite points program. If I had to pick, I’d still far prefer to have transferable points like Amex Membership Rewards, Chase Ultimate Rewards, Citi ThankYou Rewards, Capital One Miles, or Bilt Rewards. Each of these allow transferring to many different airline and hotel programs so that you can use the miles that best fit any given situation. However, of all airline mileage programs, AA is currently my darling. And, yes, that could change any time. In fact, comparing features side-by-side, Air Canada Aeroplan ought to have that mantle (thanks to having many more partners and offering stopovers for only 5K more miles), but I’ve been finding time and again that I’ve been booking awards through AA and rarely through Aeroplan.

American Airlines followed Delta’s lead in dynamically pricing awards. But, unlike Delta, AA has kept their partner award charts. And, unlike United Airlines, AA has kept their excellent partner business class award pricing unchanged. In short, AA dynamically prices it’s own flights, but keeps fixed pricing for flying partners. That has proven to be a winning combination. Before offering dynamic pricing on their own flights, it was rare to find saver availability. Now, I find that it’s common to find good award pricing (your mileage may vary), especially if you check back often.

Overall, here are the things I’ve been loving about AAdvantage miles:

- Free cancellations on all awards

- Free changes to partner awards

- AA Roulette: AA often randomly offers excellent award pricing on AA-flown awards. Keep checking!

- Partner award pricing: Great award pricing on partner awards, especially for flying business class

- Most partner awards are bookable online

- Low fuel surcharges with most partners: AA usually doesn’t impose fuel surcharges on award flights (with the notable exception of awards flown by British Airways).

- Domestic partners: When flying within the U.S., it’s possible to use miles to fly not just AA itself, but also Alaska Airlines, JetBlue (if AA is successful in fighting the break-up ruling), and Hawaiian airlines on certain routes.

- Loyalty Points: When earning AAdvantage miles, you usually earn Loyalty Points as well. This means that if you earn enough AAdvantage miles (even through shopping or credit card spend), you can earn elite status.

- Award Hold: AA lets you put awards on hold for up to 5 days.

But there are things I dislike:

- Cancelled award miles don’t always auto-redeposit: When cancelling award flights, miles don’t always automatically get returned and so you must track that and call AA to have the miles restored when this happens.

- Awards primarily flying American Airlines are not changeable: You can cancel these awards for free, but you can’t make changes. This is a problem when you’ve locked in a great award prices but want to make a small change. Fortunately, awards primarily flying partners can be changed via phone agents (hang up and call again if you get an agent that says it’s not allowed).

- Can’t transfer miles from major transferable points programs: Only Bilt offers 1 to 1 transfers to American Airlines. Even Citibank, which has close ties to AAdvantage, does not offer transfers from Citi ThankYou Rewards. Yes, Citi did offer this capability for a short period during the pandemic, but there are no signs of this returning unfortunately.

- No stop-overs: AA doesn’t allow stop-overs on award bookings. If you want to stay somewhere for more than 24 hours, you’ll have to book separate awards.

- British Airways fuel surcharges: British Airways imposes huge fuel surcharges on their own flights and AA passes these along to their customers. To be fair, this is true with all British Airways partners, but it’s a huge issue in the U.S. because if you fly east across the Atlantic, you are very likely to find British Airways award availability (along with very high surcharges).

AA Roulette

When booking flights on American Airlines itself, prices are dynamic. Yes, other airlines like Delta offer dynamic pricing as well, but this is different. When Delta dynamically prices an award, the award price usually stays unchanged as long as the cash price remains stable. With AA, meanwhile, I’ve seen award prices jump up and down multiple times a day. Running award searches feels like playing a roulette wheel except that you don’t need to spend any chips to play.

Here are some tips to winning the AA Roulette game:

- Repeat your search regularly

- Alternate between trying round-trip awards and one-way

- Try different destinations if you have some flexibility. For example, at one point in time, I found that it was much cheaper to fly from São Paulo to Detroit with a stop in Miami than to fly São Paulo to Miami. Later, the nonstop to Miami was cheaper. You never know with this roulette game.

- Be prepared to book the award as soon as you see the price drop to a low level. Remember that all awards are fully refundable, so there’s not much risk in booking.

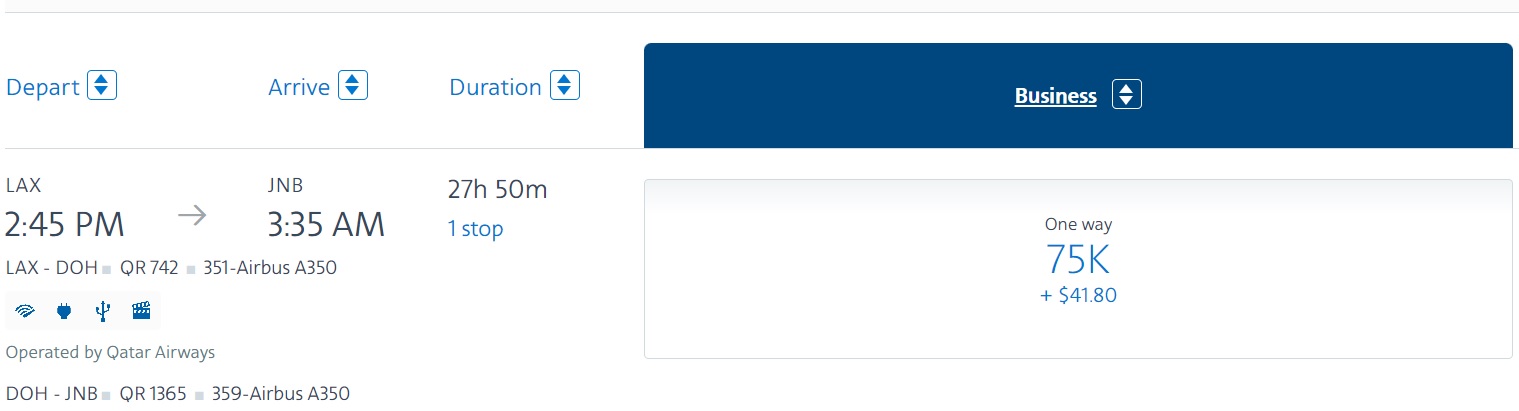

Partner Award Pricing

AA offers excellent partner award pricing, especially in business class. Here are some business class examples for flights from the continental United States:

- To/From Africa: 75K one-way

- To/From Asia (other than Japan or Korea): 70K one-way

- To/From Asia (Japan or Korea): 60K one-way

- To/From Europe: 57.5K one-way

- To/From India: 70K one-way

- To/From Middle East: 70K one-way

- To/From South Pacific (including Australia, New Zealand, etc.): 80K one-way

- To/From Southern South America: 57.5K one-way

- To/From Northern South America: 30K one-way

Depleting my miles

Here are some examples of how I’ve spent down my AA miles in recent months (this is not a complete list):

- 300K miles (60K per person) to fly 5 people JAL business class from San Francisco to Tokyo

- 112.5K miles (22.5K per person) to fly 5 people Cathay business class from Manilla to Hong Kong

- 150K miles (30K per person) to fly 5 people JAL business class from Hong Kong to Tokyo

- 55K miles to fly myself AA business class from São Paulo to Miami

- 55K miles to fly Carrie AA business class from São Paulo to Charlottesville

Not yet flown:

- 125K miles (62.5K per person) to fly 2 people Etihad First Apartments from London to Abu Dhabi

- 140K miles (70K per person) to fly 2 people primarily in Qatar QSuites from Detroit to the Maldives

- 140K miles (70K per person) to fly 2 people primarily in Qatar QSuites from the Maldives to Detroit

Rebuilding my fortune

My wife still has nearly half a million AA miles from deals we took advantage of long ago, but I’d still like to regrow my own balance. There are two primary ways I’m looking to do that: credit card bonuses and playing the Loyalty Point game.

Credit card bonuses

Both Citi and Barclays offer business and consumer American Airlines credit cards and I haven’t had either for a number of years. I’m ready to go for them.

A couple of days ago I signed up for the CitiBusiness card and was instantly approved. At 65K after $4K spend, it’s not the highest bonus ever for this card, but it has been a long time since Citi has increased the offer. I didn’t want to wait because Citi has a 48 month rule against applying again. You can get the same card again if it has been more than 48 months since receiving a welcome bonus. I decided that the sooner I get that clock started the better. Plus, since it’s a business card, it doesn’t contribute to my 5/24 count. I could have also gone for Barclays’ Aviator Business Card, but I’m going to wait on that one for an 80K or better offer to return (hopefully). With the personal cards, I need to do a bit more planning: am I enough under 5/24 to afford to pick up a consumer AA card or two? That’s a question I need to noodle some more.

The following are current bonus offers, card benefits, and earning structures. Keep in mind that bonuses do not count as Loyalty Points. Base earnings (1 mile per $1 spent) do count as Loyalty Points.

Consumer

| Card Offer and Details |

|---|

15K miles ⓘ Non-Affiliate Earn 10K AA miles after $500 spend in 3 monthsNo Annual Fee FM Mini Review: Not bad for grocery spend if you highly value AA miles Earning rate: 2X grocery ✦ 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Save 25% on inflight food and beverage purchases |

| Card Offer and Details |

|---|

50K Miles ⓘ Non-Affiliate 50K miles after $2,500 spend in first 3 months $0 introductory annual fee for the first year, then $99 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Excellent choice for a great intro bonus. Plus it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) Earning rate: 2X restaurants ✦ 2X gas ✦ 2X AA Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: $125 AA Flight Discount with $20K membership year spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight food and beverage purchases |

| Card Offer and Details |

|---|

100K miles ⓘ Non-Affiliate 100K miles after $10,000 spend in first 3 months$595 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Good choice for those who need Admirals Club® access and those who value the Loyalty Points boosts at 50K and 90K Loyalty Points earned. Plus, it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) and some handy credits for Avis or Budget rentals and GrubHub. Earning rate: 4X AA ✦ 10X hotels booked through AA.com/Hotels ✦ 10X car rentals booked through AA.com/Cars ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: ✦ First Checked Bag Free ✦ Admirals Club® access for both primary and authorized users ✦ Up to $120 in statement credits per calendar year for car rentals booked directly with Avis or Budget ✦ Up to $120 per 12 monthly billing cycles for GrubHub purchases (up to $10 per monthly billing cycle) ✦ $10 monthly Lyft credit after you take 3 Lyft rides that calendar month ✦ 10K bonus Loyaty Points after earning 50K Loyalty points through all channels and another 10K bonus Loyalty Points after earning 90K Loyalty Points through all channels ✦ 25% savings on eligible in-flight purchases on American Airlines flights ✦ Up to $100 Global Entry or TSA PreCheck application fee credit every 4 years |

| Card Offer and Details |

|---|

70K Miles ⓘ Non-Affiliate 70K miles after 1st purchase and paying the annual fee within 90 days $99 Annual Fee Recent better offer: Up to 75K: 60K miles after first purchase and 15K after adding an authorized user and making one purchase on that card [Expired 2/24/24] Earning rate: 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate with $20K membership year spend. Noteworthy perks: First checked bag free ✦ Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation ✦ 25% off in-flight purchases ✦ $25 wifi credit per membership year ✦ Flight cents: round up purchases to earn more miles |

Business

| Card Offer and Details |

|---|

65K miles ⓘ Non-Affiliate 65K miles after $4K spend in first 4 months$0 introductory annual fee for the first year, then $99 Alternate Offer: There is an alternative offer of 30K + $400 credit that can be found when doing a dummy booking on aa.com. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card usually has a great welcome bonus, but if you're looking for a card to keep long term, you'll find better options. Earning rate: ✦ 2X AA ✦ 2X certain telecommunications merchants ✦ 2X car rental merchants ✦ 2X gas Card Info: Mastercard World issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 plus taxes domestic companion certificate after $30K spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight purchases |

| Card Offer and Details |

|---|

Not currently available It appears that this card is not available at this time.$95 Annual Fee Recent better offer: Expired 2/6/23: 80K miles + a $95 statement credit after $2K spend in first 90 days. Earning rate: ✦ 2X AA, office supply, telecommunications services, and at car rental agencies ✦ 1X everywhere else Card Info: Mastercard issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: $99 companion certificate with $30K account year spend Noteworthy perks: ✦ First checked bag free ✦ Preferred boarding ✦ 5% bonus on miles earned the previous year after AF is paid ✦ 25% statement credit on in-flight purchases |

AA Loyalty Point Game

We coined the term AA Loyalty Point Game to describe the ways in which you can earn AA elite status without flying. The trick is to find portal deals, SimplyMiles deals, hotel offers, and more to earn outsized numbers of AA miles and Loyalty Points. Last year I earned over 75,000 miles and Loyalty Points by stacking deals.

So far this year we haven’t seen many big deals, but my renewed interest in earning AA miles, aside from Loyalty Points, has me more interested than ever in finding new deals. If you see any great ones, please let us know!

What about Bilt?

The Bilt card is a great way to earn transferable points from spend, especially if you pay rent (I do not). Plus, Bilt offers great transfer partners including AA. I will consider signing up for a Bilt card at some point in the future, but right now there is lower hanging fruit with AA card welcome bonuses.

Greg- any idea if I can link a MC in my name to my wife’s simplymiles account? Since you can never change an enrolled card to another AA account, I don’t want to make a mistake. Thanks for all you guys do for us!

Sorry no I don’t know

as soon as I added the CC to simplymiles, it put it into AA dining- and as you probably know, each CC can only be in one dining program at a time. So it took that card out of the p[program where I previously had it.

Still not sure if the name on the CC matters or not, but I suspect not.

I’ve been using credit cards in both my and my wife’s names on the same AAdvantage dining account for the last few months (mine) and no issues with both cards earning the points – I assume since AAdvantage Dining and Simplymiles seem to be sharing stored card lists / interwoven, it should work for Simplymiles too…

I had a surprise win on AA metal – award flights to Japan in J or F are sparse this summer and I had pretty much given up, then yesterday AA dropped a bunch for 60k on their own metal! Not as nice as the JAL F experience was dreaming of but an incredible price to get there in Flagship Business from the northeast. The prices fluctuated so rapidly, I’m glad I booked quickly. In 30 min the price more than doubled!

[…] ever since I gave up on elite status and became a free agent. So, when posts like that show up Why AAdvantage is my new favorite mileage program you just need to realize that blogs in this space are big businesses and it is in their best […]

Will I get loyalty points if I get a hotel on bookaahotels.com with my Amex Platinum card?

Yes

Definitely the best point redemption value, BUT, huge con is the fuel surcharge with British Airlines. East Coast (PIT) to Europe is difficult on AA.

It seems to me that AA became impossible for a while, and now it’s not. For the past 15ish years we’ve frequently booked tix to South America, AA was clearly the best for maybe the first 7 years, then it got harder and harder to use them – meanwhile UA became awesome for those redemptions, esp given their strong partners there. So I could never have enough UA miles… for instance, when I did my travel package with Marriott, I went for 152k on UA.

Now the pendulum has swung back to AA. P2 flew J on AA just last week for 30k where UA wanted 40k+ for economy.

But it’s really random. It’s to a place where you really need 200k in each major airline, or accessible to move there (MR, UR). And that’s the problem with AA.

Thank you! I have been thinking about the same thing even though I fly out of SFO and much more on United than AA domestically. I would like to apply for the Bilt and CitiBusiness card, and may be one more AA personal or business card later. Does it matter the order between Bilt and CitiBusiness?

I don’t think the order is likely to matter but I’d sign up first for whichever one you want more just in case.

Another to add to the “con” list is the difficulty and expense of adding infants to award tickets with AA

My wife and I scored on the SimplyMiles deal buying over 7 million AA miles but also had a child around the same time. Since then we have been focusing on programs such as aeroplan and avios since infant ticketing is super cheap and easy and haven’t spent any of our SimplyMiles fortune yet.

Now the kid is approaching two years old so we are gonna spend the next few years burn long through that fortune and have a ton of fun doing it 🙂

interesting. What was the cost of accumulating 7 million AA miles and how and how long did it take. Trying to understand time, effort, value

It was around $25k and it took me as long as it took to put in my card info and press submit. The opportunity was once in a lifetime and will probably never be back so that’s why we went big. We were thinking of the long game and glad we pulled the trigger

Ooh good point.

Have been watching comments all day so thought I’d quickly contribute. I am Lifetime Platinum on AA and pre-pandemic had been using AA miles extremely successfully, including Qatar in Q-Suites to the Maldives and Delhi, Cathay Pacific trans-Pacific in J twice, JAL to Tokyo, Qantas from Sydney to Perth, AA metal in J to Venice and Rome, AA in the back to Sydney (it can be done), etc. I also had Etihad booked in J roundtrip to the Seychelles using AA miles but lost that due to the pandemic. I have been having huge difficulties finding anything good using Aadvantage miles recently. I refuse to pay an upcharge of $1600 per ticket to get to Europe on BA, and AA metal is dynamically priced now so the number of miles required for J is crazy. Can never find anything going through Helsinki in J using miles, so trying to use AA to Europe is a bit of a mess. I have read elsewhere that finding Cathay in J anymore is nearly impossible from the USA. I found great flights on Etihad to the Seychelles buy they are all (tried multiple times) phantom. I’ve seen roundtrip flights on AA in J to Seoul price at 770,000 miles 11 months out.

Bizarrely, my most hated program is now my most successful. I still had many, many miles accumulated on Delta from my years with Delta status living in Atlanta, and could never find any use for them that made sense. Of my next nine booked trips, two are using AA miles, one is using UA miles, one is using Emirates miles and five are using Delta miles. Yes, all of the Delta flights are in coach, but in each case, the cost in miles (with the 15% credit card discount) has been much cheaper than AA and UA. I’ve only flown Delta once during the last 10 years (but thanks to the pandemic I’ve been Delta Gold for the past two years), so kind of surprised about this fairly recent development. I don’t think Delta has gotten that much better–just that the other programs have gotten that much worse.

Agreed. I don’t know why FM is saying we can find all of these partner awards at standard prices. Standard biz pricing on Cathay or JAL does NOT exist anymore. I’m very surprised that FM would publish a click-bait article.

Click bait?! I wrote about my real world experiences. I have no interest in or reason to lie about this stuff. Additionally, keep in mind that award space changes all the time. Yes it is very hard to find award space to Asia right now (but not impossible) but that could change any day.

i cry for you, Greg. 🙂

I tried to take advantage of the SimplyMiles thing…but had some log-in problem I couldn’t get around, and still can’t – last I tried.

Wahh….cry for me! Anyone!

I like their flexible calendar view by month. You can even select to only show nonstop options, which is what I prefer with kids over anything else. We are in PHL, AA hub, and fly regularly to Europe for 30k (economy for now, since we can’t accrue fast enough, haha). Last summer we found awesome nonstop Venice flights and it was not 11 months out or last minute – only found those easily because of the monthly calendar view.

Oh great point. Yes their monthly calendar view is very helpful!

Hi! Just a question about the Barclay’s red AA card. Do you know if you can get the red card (and the bonus) if you had it years ago and then product changed to the AA silver card over 4 years ago?

I believe so, yes

Yes, I literally just did that and got approved for the Red again (well, now I hope I get the bonus too, it didn’t say otherwise.). I still have my silver that I downgraded a few years ago from Red.

awesome! Thanks for the data point!

100% disagree with FM. He may have been lucky in finding those partner awards, but the average person will not find anything in biz class for flights from west coast NA to Europe or east coast NA to Asia on partner airlines at those standard prices, even one year out.

I’m an average person and I booked two business class seats to India from the east coast, although I had to book a year out.

With AA you can book 11 months out max.

Well then, whenever the max is. That’s when I booked. In my world, 11 months rounds up to a year.

How many miles did it cost you? 200K each? I just checked Washingto DC to Tokyo. They are priced at 150K one way with three segments that takes 24 hours. Laughable.

80,000 per person on Etihad.

Lucky…you won the lottery.

I just got two business class seats on BA for 57.5K plus fees from DEN to GLA. The BA site wanted 90K plus even higher fees. They are out there…You may need to fly to a different city to pre-position if needed.

For finding partner awards I think it is very important to use tools like Seats.Aero. You’re right that the average person won’t usually find these on their own, but with certain tools it’s not so hard.

See this post for details about different tool options: https://frequentmiler.com/which-award-search-tool-is-best/

Thank you, FM. But how is seats aero going to find awards that don’t exist? I just checked DFO, LAX, IAD, ORD, BOS, and JFK to Tokyo on AA’s website. There is absolutely nothing at standard pricing (60K miles) one year out. I think you’re being a bit optimistic about JAL awards. You got really lucky finding those 5 seats before Japan opened up. Those days are over.

Why would someone thumbs down this? Teri is vicious lol. Fwiw I thumbs upped so now it’s neutral again.

I think the key here is “average person.” While that may be true, if you’re flexible with dates and willing to hunt and use all the tools available you can find availability. Especially if you’re ok with taking a positioning flight and flying in shoulder season for the desired destination (which I tend to often prefer anyways to minimize crowds).

Edit: I guess figuring in positioning flights strays from your point. I agree E Coast to Asia and W Coast to Europe is quite limited.

Being flexible with dates is irrelevant when there are no dates available. Not a single one. Can you find them?

LAX to CDG on 6/29, 7/3, 7/5, 7/7, 7/14, 7/16, 7/23. But I know that’s last minute and not what you’re thinking. Honestly I’ve been looking for flights to the ME which are easier to come by. Been doing a lot of searching and forgot that most all of the Europe availability I was looking at was with Star Alliance. Other than last minute, yeah the flights are pretty slim.

Another example, since now I see you’re looking at W Coast to Asia as well is 12/27 currently there are 2 seats on JAL business for 60k each, SFO to HND.

Oh. Good find.

Is that just one seat?

Greg, I had a longer comment that got stuck in the moderation que for some reason…?

Anyway, I’m posting again because while people are still reading your piece, you might want to include under “pros” AA’s ability to “hold” award flights for up to five days without any payment is a big plus–especially given the ability to play Roulette with pricing.

Thanks for the tip! For holding awards, can it be done online or have to call?

Online–very easy. Just pick “hold” at checkout. More details on this in my comment below (which just got approved).

I found it in spam and approved it. No idea why it was there.

Thanks! Now if we could just edit comments–I’m chagrined at how many typos I had in there! 🙂

Hi, I am surprised you haven’t posted about Loyalty Points Hunter yet which is a resource for current AA deals and potential stacking opportunity.

I’ve never heard of it before