NOTICE: This post references card features that have changed, expired, or are not currently available

Many credit cards compete for your wallet share with great rewards for spend. There are cards that offer great rewards for all spend; and other cards that offer great rewards within categories such as grocery, dining, gas, travel, etc. This post is not about those cards. This post is about the cards that are worth keeping even if you never spend a cent on them…

Best Sock Drawer Cards

IHG Rewards Club Select ($49 per year)

This great sock drawer card is no longer available to new applicants, but if you’re lucky enough to still have the card you would do well to resist frequent upgrade offers. Simply by having this card, you get IHG Platinum elite status, a free night up to 40K points each year, and 10% back on any points-award redemption. For example, if you book a three night stay for 120,000 points, you’ll get back 12,000 points. This even works when using points to pay for Intercontinental Ambassador status (details here). And if you have both this card and the IHG Traveler card (or IHG Premier card) you will get both 4th Night Free awards and 10% back! This sock drawer card used to be really amazing when annual free nights were uncapped, but today it is still one of my top sock drawer picks. See also: Best uses for IHG 40K free night certificates.

IHG Rewards Club Premier Card ($89)

Those who don’t have the old $49 IHG Select card may do well with the $89 IHG Rewards Club Premier Card instead. Like the Select card, the Premier offers Platinum elite status and a 40K free night each year. Instead of the Select card’s 10% award rebate, this card offers 4th Night Free award stays (same as the IHG Traveler Card below). It also offers 10x earnings at IHG properties on top of the regular point earnings earned on paid stays.

Tip: If you and your significant other sign up at the same time, then the annual free nights will have the same expiration dates and will be easier to use to book a weekend getaway each year for only $89 x 2.

IHG Rewards Club Traveler Card (Fee Free)

If you’d rather not pay an annual fee, the Traveler card is a great option. It makes your IHG points more valuable thanks to it’s best perk: Fourth night free on award stays. On four-night stays, this can be even better than 25% off when the fourth night is particularly expensive. See: New IHG Sweet Spot: Dynamic Pricing + 4th Night Free For Huge Savings. The card also offers a 20% discount on full-priced points purchases.

Note: This card is not currently available to sign up new, but you can sign up for the IHG Premier card and downgrade a year later.

Tip: Earn a big welcome bonus by signing up for the IHG Premier card then downgrade to the fee-free Traveler card a year later when the annual fee comes due.

Radisson Rewards Premier Visa Card ($75)

This is a great sock drawer card because it includes automatic Gold elite status plus 40,000 bonus points each year when you renew. When I last looked, Radisson points were worth about a third of a cent each (0.34 cents per point). So, each year you get 40,000 x $0.0034 = $136 worth of points for $75. Of course, it’s possible to get much more than 0.34 cents per point value if you cherry-pick the best award stays. For example, at the most expensive Radisson hotels worldwide, standard rooms cost 75,000 points per night. Every two years of holding this card will give you more than enough points for a night that could have otherwise cost over $500 per night.

Wyndham Rewards Earner Business ($95 per year)

This Wyndham business card is a great sock-drawer choice because it gives you bonus points each year that are worth more than the annual fee. This card offers Wyndham Diamond status (which matches to Caesars Rewards Diamond status), a 10% discount on free night awards, and 15,000 points each anniversary year. When I last looked, the median value of Wyndham points was 0.82 cents per point. That estimate, though, doesn’t account for the 10% discount on free night awards that this card offers, nor does it account for high value awards such as with Vacasa Vacation Rentals. It also doesn’t account for the fact that “Go Fast” awards (points + cash awards) offer better value. If we conservatively assume that you’ll get 1 cent per point value, then the annual 15K points are worth $150. Those who cherry-pick the best awards will do much better.

Note that while this is a great sock-drawer card, it’s also a great card for spend at gas stations (8x rewards), Wyndham properties (8x), and select utilities (5x).

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

JetBlue Plus Mastercard or JetBlue Business Card ($99)

These cards offer a 10% rebate on points awards plus 5,000 bonus points every year. The points alone are almost worth the card’s annual fee. With the 10% award rebate, either one of these cards is a keeper for anyone who flies JetBlue at least once a year.

United Gateway Card (Fee Free)

This card has two unadvertised perks that make it a great sock-drawer keeper:

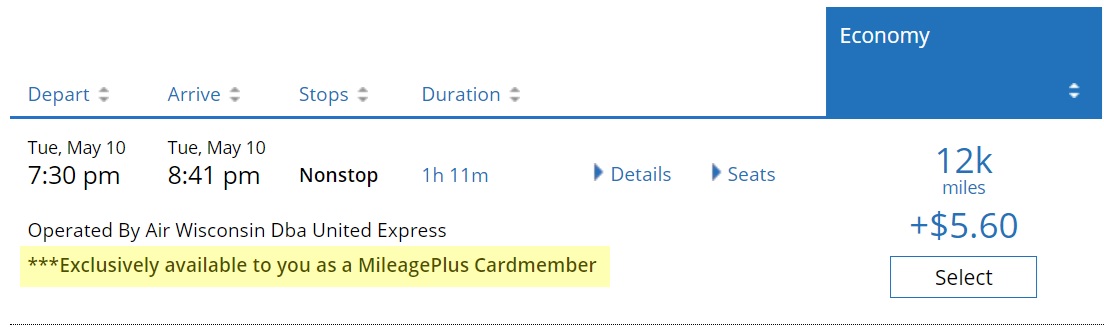

- Cheaper economy awards. As shown above, when searching for United awards, having this card is enough to unlock economy awards at lower award prices than for those who do not have a Chase United card or United Premier elite status. For example, the same award shown above for 12,000 miles costs 15,000 miles to anyone without the card and without elite status.

- MileagePlus X App 25% Bonus. The MileagePlus X App basically gives you United miles for buying gift cards through the app. By being the primary cardholder of any Chase United card, you get a 25% bonus.

Citi Rewards+ (Fee Free)

If you collect Citi ThankYou points through high point-earning cards such as the Premier Card, Double Cash, or Custom Cash card, then this fee-free card is a great addition to your sock drawer. By simply having this card and combining your ThankYou accounts, you’ll get a 10% point rebate when you redeem your ThankYou points. This benefit is limited to 10K back per year. Unfortunately, combining multiple Rewards+ cards into the same ThankYou pool does not expand the limit (I tried).

Alaska Airlines Visa Signature or Alaska Airlines Business ($75)

Alaska Airlines credit cards come with a $121 companion pass every year plus free checked bags. For those who fly Alaska Airlines at least once a year with a companion, the companion pass can be worth far more than the card’s $75 annual fee. For details, see: Alaska Airlines Companion Fare Complete Guide.

Honorable Mentions

- United Business Card ($99): For those who fly United often, the United Business Card can be a great companion to the fee-free United Gateway Card. This is primarily because of one unusual perk: 5,000 bonus miles at anniversary when you have this card and also a personal Chase United credit card. Those miles go a long way towards rebating the card’s $99 annual fee. The United Business Card also throws in other airline card perks like first checked bag, priority boarding, 2 United Club passes per year, etc. Note that to get free checked bags, you’re supposed to pay for the flight with your United Business card so including this perk here slightly bends the whole sock-drawer premise (i.e. I’ve mostly only listed benefits that you get without using the card for spend).

- Wyndham Rewards Earner Card (fee free): If you’re not interested in paying $95 per year for the Wyndham Rewards Earner Business card, you can still get a 10% discount on free night awards with the fee-free Wyndham Rewards Earner card.

- Amtrak Guest Rewards Platinum Mastercard (fee free): This fee free card offers a 5% point rebate on Amtrak Guest Rewards redemptions and it prevents points from expiring.

- Free Spirit Travel Mastercard (fee free): This card offers points pooling, no points expiration, and Zone 2 priority boarding.

- Southwest Airlines Rapid Rewards Priority Credit Card ($149): Get 7,500 anniversary points each year, a $75 Southwest annual travel credit, and four A1-15 boardings every year.

- World of Hyatt Card ($95): Free category 1-4 night every year upon renewal; Discoverist elite status; and 5 elite qualifying nights per year (to get you closer to elite status)

- Chase Marriott Bonvoy Bold Card (Fee Free): Get 15 nights towards elite status each year. If you don’t have any other Marriott consumer card and if you’re interested in earning Marriott elite status, then this is a great card to keep in your sock drawer to help you get there.

- Chase Marriott Bonvoy Boundless or Marriott Bonvoy Amex ($95): Both cards offer an annual 35K free night certificate and 15 nights towards elite status each year. Holding multiple consumer Marriott cards will not give you more than 15 elite nights (but adding a business card will…)

- Marriott Bonvoy Business Amex ($125) or Chase Marriott Bonvoy Premier Plus ($99): Only the Amex version is available to new applicants. Both cards offer an annual 35K free night certificate and 15 nights towards elite status each year. Holding multiple business Marriott cards will not give you more than 15 elite nights, but if you have both a consumer and business Marriott card you’ll get a total of 30 elite nights each year which will put you well on your way to earning Platinum status (which requires 50 elite nights per year).

- Hilton Honors Surpass or Hilton Honors Business Card ($95): Both cards offer Hilton Gold elite status and 10 free Priority Pass lounge visits per calendar year. Hilton Gold elite status alone can be well worth paying $95 per year since it usually means getting free breakfast at any Hilton hotel worldwide (for the rest of 2021, Hilton hotels in the U.S. are offering food & beverage credits instead).

How often do you recommend using these “sock drawer” cards so that the issuer doesn’t close the account for non usage?

I don’t think it matters for cards with annual fees, but for fee-free cards, a charge once every 6 months should be enough

Another two card I’d add to the list:

Amex Everyday – keep MR points alive while you churn everything else, plus access to Amex Offers and recurring targeted bonuses to upgrade to Everyday Preferred

Any American Airlines co-branded card – free checked bags and priority boarding without needing to pay with the card (use Ritz or something for travel protections)

Great article!

Is the Jetblue 10% back thing new? I have both the personal and biz card and have never heard of this. Nor do I see it mentioned when I click through to the applications – I’d think it would be a top line thing to promote.

If it is indeed real, great – my business card annual fee just hit and I was about to cancel. I guess if there is no limit to the 10% then I only need one card.

It’s real. Once upon a time the 10% back from both the personal and business would stack until someone let the cat out of the bag…

Thanks! I went back and checked and indeed on my one reward redemption I saw the 10% credit. I learned something today!

Since I have both business and personal any recommendation which one I should close since the 10% doesn’t stack? Do you find retention offers to be better on one or the other? Are there any other significant factors I’m missing?

Consumer gets annual $100 credit on vacation packages

Yeah thanks, that is listed on the application page. Can’t imagine I’d ever use, much less twice. I’ll call to see if I get a retention offer on the biz one and if not will have to decide.

Great post (as usual). The problem is getting them to begin with. Which of these are worth wasting a 5/24 slot for?

Well, the Wyndham Earner Biz and JetBlue Biz don’t add to 5/24 so they’re definitely worth it. Others depend upon your own circumstances. With some, such as IHG and United, you’d definitely want to sign up for other similar cards that have big bonuses and later downgrade.

Hi Greg,

I agree with the IHG and Radisson cards. However, I just “status matched” my Americas to my new Radisson Hotels (international) acct. and Gold level was there but none of my 270,000 points. Any idea on this?

Thanks, Gary

I think you have to transfer your RRA points to your RR account. I’m not sure if this feature is available online but they should be able to do it for you on the phone.

My understanding is that you have to ask them to move your points over to Radisson Hotels in order to book a stay.

Just did this a few days ago, xfer is nearly instant (although matching accounts prior to doing this requires about a day and a screenshot of your Americas info):

For points transfers – login to americas account> redeem > Global points transfer (ENSURE BROWSER is set to ALLOW POPUPS!):

https://www.radissonhotels.com/en-us/rewards/redeem/globalpointstransfer

This has been a bizarre year for the Hobby. Many of my 25 different credit cards would definitely be considered worthy of the sock drawer, but I have received decent promotions (defined as better bonuses than my regular bonus cards) at some point in the year on 21 of the 25. Similarly, cards I would always use for certain categories have received little or no spend. For example, Citi Premier normally gets all my gas spend for the 3x category but this year I have virtually no spend on that card due to gas promotions that beat Citi Premier on other cards. AMEX Gold is awesome for 4x spend on groceries and restaurants, but this year it has received absolutely nothing on groceries and virtually nothing on restaurants due to other promotions that beat 4x in both categories. I have only signed up for two new cards this year, so my spending in general isn’t going to welcome bonuses–it is going to category bonuses on normally sleeper cards!

True!

how do you keep up with 25 cards? im having a toughtime balancing 6

Microsoft Excel is a wonderful thing!

I find Travel Freely indispensable for keeping track of cards, signup bonuses, annual fees, etc.

https://frequentmiler.com/take-the-stress-out-of-credit-card-bonus-hunting-travel-freely/

Greg, I just got off the phone with Chase and unfortunately the IHG Traveler credit card is no longer fee free. A real bummer

Call Chase again. At 1pm ET today, I called and downgraded my IHG Premier to IHG Traveler with no fee.

The Traveler card used to have a $29 fee until they dropped in to fee-free. It seems that a bunch of reps still believe it has a fee for some reason.

@Greg, did you get your IHG premier card before or after Chase dropped the Traveler card to fee free? I tried to downgrade my IHG premier to the traveler last summer and was advised by a couple different reps that since the traveler was $29 when I obtained the premier, that their system was only showing the $29 traveler card as a downgrade option.

After. Very interesting. It never occurred to me that older versions of the Premier might not qualify for the no-fee Traveler. Weird! (and unfortunate if true).

Greg, I believe the IHG Traveler card is not free and has an annual fee of $29.00. I would love it if I am wrong…

Great post!

While none of these cards probably should be in the front of someone’s wallet, you may not want to emphasize you never need to spend a cent on them. OMAAT has had a few posts this year about how Citi shut down his Rewards+ card because of a lack of activity.

Also, for the United Gateway card, one added perk are United Visa Rewards. While I guess you actually have to use the card to get these, I have earned way more miles this way than with the 25% MPX bonus. They have had bonuses in the past (earned 10K+ miles that way), and occasional great returns (current 37x miles/$ with Radisson).

Thanks for the reminder. Yes, I’ll update this post with a note about regularly putting some spend on fee free cards in order to avoid having them shut down

I don’t believe a credit card company will or should close a credit card with an annual fee. In their eyes, they want you to keep the card and keep paying the annual fee. With that said, it’s important to occasionally use no annual fee cards to prevent the cards from being closed due to lack of activity. I like to do $5 Amazon GC balance reloads on a few of my favorite no annual fee cards every month to keep activity on the cards.

Agreed, although every month is aggressive. I do 2x/year and haven’t had an issue yet.

Good post. JetBlue Business Plus card also has FREE luggage for you and three people on same reservation. This alone makes it even more worth keeping.

Yep. The only reason I didn’t include that perk in the write up is that you have to pay for the flight with your JetBlue card to get that perk (and so you need to take it out of the drawer, at least virtually). See: https://frequentmiler.com/free-checked-bags-via-credit-card-complete-guide/

Hey Greg, what are our options for getting the UA Gateway card if we’re over 5/24 and don’t have any other UA cards available for downgrade? Is it possible to product change from other Chase cards to the gateway card?

No, I don’t think you can product change from anything other than a personal (not business) United card. The only options are to either wait until you’re under 5/24 or wait for a situation where 5/24 doesn’t apply (such as green or black star offers). https://frequentmiler.com/new-offers-bypassing-5-24-black-star-just-for-you-offers/

Bummer. Wish I had known about this all those years ago when I cancelled my UA card outright (instead of downgrading).

Correct me if I’m wrong, but I believe you can utilize 2x rewards+ if you setup multiple points pools? Would take a while to get enough cards and probably not worth the effort though….

Yes, I’d expect that to work. I haven’t been in position to test it because all of my cards are in one pool and you can’t unpool, unfortunately.

Thanks Greg. Great Post

I believe you created the sock drawer phrase………………………………

Thanks!