Bilt made a big splash when it launched a couple of years ago and it hasn’t yet seem content to rest with the satisfaction of a big splash. Instead, they keep working on something bigger — to the point where two guys who didn’t think we wanted this card are actually considering it. This week, we discuss all the reasons Bilt is all that — and all the ways you can make it work for you, whether or not you rent or have the card.

Bilt made a big splash when it launched a couple of years ago and it hasn’t yet seem content to rest with the satisfaction of a big splash. Instead, they keep working on something bigger — to the point where two guys who didn’t think we wanted this card are actually considering it. This week, we discuss all the reasons Bilt is all that — and all the ways you can make it work for you, whether or not you rent or have the card.

Elsewhere on the blog this week, learn a great trick for using your Hyatt free night certificates, get the full rundown of Hyatt’s European all-inclusives, hear about a potential pitfall with Avianca LifeMiles and a lot more. Watch, listen, or read on for more from this week at Frequent Miler.

00:00 Intro

01:04 Oops!

01:06 Oops: You need 40K AA for Gold

02:05 Ooops: AA charity donation may have been AOK

03:46 Ooops: Can’t book JetBlue transatlantic with AA miles

04:52 Ooops: How did we forgret the Ink Business Preferred?

06:27 Giant Mailbag: That Sapphire Preferred 3x online grocery is better than we said 09:46 Award Talk

09:47 Seats.Aero adds support for Aeroplan and Emirates

10:21 Greg books his annual stay at the Inn at Bay Harbor

15:05 FM Party of Five Team Challenge Update

19:32 Mattress Running the Numbers

19:51 Marriott will offer 40K points for a Homes & Villas booking of 4 nights or longer

25:13 Bilt Rewards will offer a 100% transfer bonus to Air France Flying Blue on May 1st only

35:28 Card Talk: Bilt Card

43:48 Main Event: Bilt IS all that

44:20 Earn points paying rent

47:44 Bilt Transfer par

55:09 Pay for travel at 1.25cpp

57:32 Earn points on things other than rent

57:57 Rent Day Quiz / Promos

58:36 Points for referring friends

58:54 Link other credit cards to to Bilt Dining (without the Bilt Mastercard)

59:29 Link Lyft account to Bilt Rewards account for extra points

1:00:00 Is Bilt a no-brainer for renters?

1:05:00 Other things you can pay with Bilt (besides rent)

1:07:24 Is the Bilt card worth a 5/24 slot?

1:12:40 Who is the Bilt Mastercard definitely a bad fit for?

1:13:00 If you could only have one credit card, which one would it be?

1:17:04 Question of the Week: Avianca award taxes were wrong. What gives?

Subscribe to our podcast

Note that due to a technical difficulty, this week’s podcast episode will be several hours later than normal, but keep an eye on your favorite podcast platforms to see it released later on 4/29/23.

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Amassing Bilt Rewards

When Bilt Rewards launched, I was impressed with the set of transfer partners they had signed up as a brand new transferable currency, but at the time I still said that the program would primarily be interesting to those who pay rent. That assessment just isn’t true today: I don’t pay rent and I actively want Bilt Rewards points. The exciting thing is that you don’t even need the Bilt Mastercard to earn a decent chunk of Bilt points — though those who have the card and can maximize Rent Day are certainly at an advantage.

Bilt Rewards: Get 100% Transfer Bonus To Flying Blue (May 1 Only) + New Promo Rewards

The reason you may be suddenly very interested in amassing Bilt Rewards thanks to the latest Rent Day promotion. If you have Bilt points, this is certainly one to consider: On Monday, 5/1/23 only, Bilt will offer a 100% transfer bonus to Air France / KLM Flying Blue. If you’ve been amassing Bilt points on your rent or by using your Bilt Mastercard on rent day, this is a promotion to strongly consider. We usually advise strongly against speculatively transferring points, but this is an exceptional situation where you might actually want to consider transferring even without an immediate use in mind. Locking in what is essentially half-priced Air France awards probably makes sense for anyone who likes to travel to Europe now and then.

Incredible Marriott promo: Earn 40,000 bonus points on a 4+ night stay

The latest Marriott Homes & Villas promotion is out and in any week where Bilt hadn’t announced a 100% transfer bonus to Flying Blue, this would have been a top story. If you would consider buying Marriott points at 0.75c per point, you could look at the 40,000 points as a $300 rebate. That’s really solid — and particularly so if you need a rental in a particularly inexpensive market. But you’ll have to make your reservation in the first couple of days of May to qualify.

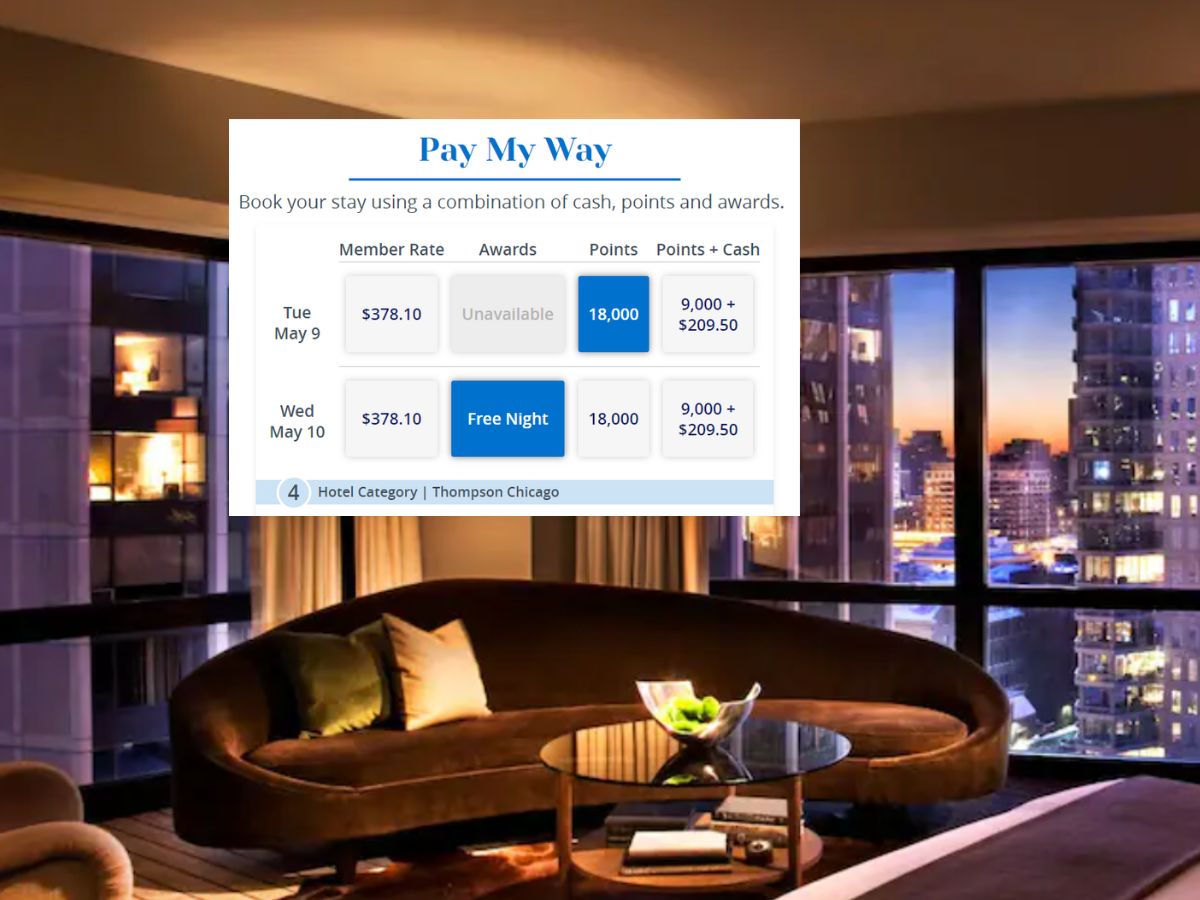

How to use Hyatt free night certs on a multi-night stay

Hyatt has long offered “pay my way” as a way to customize how you pay for your stay. You could use points on some nights and cash on others — or even free night certificates on some. This is not at all intuitive, so this post will help you figure out how to make it happen.

World of Hyatt: Complete list of all-inclusive properties in Europe (with map)

My wife and I have floated the idea of the Canary Islands a few times with no clear plan in mind as to where, why, or what to do there. The presence of a decently-regarded family-friendly all-inclusive resort may up the odds of us making that trip happen in the next couple of years. My initial reaction to Hyatt adding these European all-inclusives was that it seemed strange to me to travel all the way to Europe for an all-inclusive resort when the same experience is widely available with much shorter flights to the Caribbean, but with the recent devaluations to Hyatt’s all-inclusives there, I am starting to see the appeal of some of these at least for a few days of true “vacation” mixed in with more sightseeing.

An Avianca LifeMiles pitfall: the website displays inaccurate taxes & fees in search results (sometimes)

Avianca LifeMiles is one of my favorite award programs for the many award chart sweet spots, but when it comes to quirks, there are a plenty. Unfortunately, one of those quirks is that the website just doesn’t always display the taxes & fees correctly when searching for awards. While you shouldn’t pay more in taxes with Avianca than with other programs (note that you will pay a $25 per passenger booking fee, but otherwise just mandatory taxes), the full taxes & fees can be a lot higher than you’d expect at first glance.

Making lemon water out of lemons (ruined plans saved by award travel flexibility)

Unfortunately, I had to cancel a big trip we had planned to Fiji last week. While it hurt to miss out on what was slated to be an incredible trip, it worked out for the best as both of my kids ended up being sick. Thankfully, this bucket-list-type-trip that would have cost tens of thousands of dollars to book at (likely nonrefundable) cash rates mostly just took a few clicks to fix (and by “fix” I mean cancel and get most of my points and money back). While this definitely wasn’t the outcome I wanted, it was far better than what it could have been.

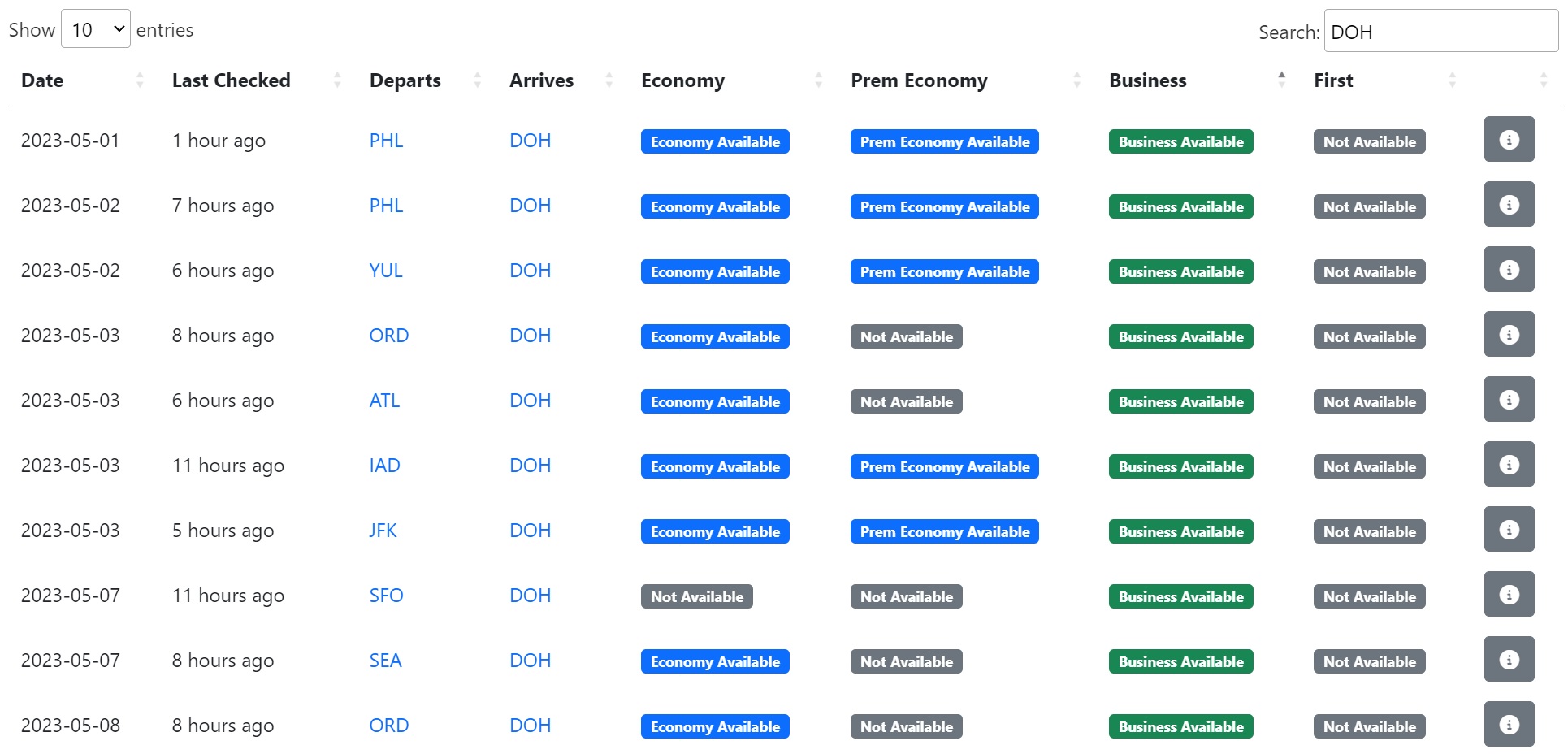

Seats.aero: a wonderfully nerdy tool for finding Unicorn flight awards [New: Aeroplan & Emirates]

Seats.Aero has now added support for both Aeroplan and Emirates. It’s great to see this funky little tool continue to expand and become more and more useful with each new addition.

Chase 5/24 Rule: How to Count Your Status – 3 Easy Ways (Chase approving some above 5/24)

The Chase 5/24 rule continues to seem a bit more flexible than it once was. That is certainly an exciting development and we can hope that the belt continues to loosen on this. We often say that there is more value in a positive data point than a negative one and I think that has to hold true here. While approvals over 5/24 are still more the exception than the rule, I totally agree with the assessment that these recent reports mean that it is worth throwing in an application now and then when an offer is attractive — even if you’re over 5/24.

That’s it for this week at Frequent Miler. Keep your eye out for this week’s month-ending last chance deals.

![Cutting our collections, comparing free night certificates, and expediting new cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/07/Nick-Platinum-cancel-218x150.jpg)

![Re-Bilt already, Fixing Marriott, the best Hyatts for Free Night Certificates and more [Week in Review]](https://frequentmiler.com/wp-content/uploads/2026/01/wp-1768653765552601913603261308925-218x150.jpg)

[…] Brian is still active in monetizing the world of points and miles, first as an investor in Bilt and now in claiming a stake of the oxymoronically-named credit card company, Cardless (yes, they do […]

I certainly find Bilt to be valuable, though I feel lucky that I was able to get in with the Evolve Bank card instead of the Wells Fargo card (not sure if I’ll be able to fully avoid Wells Fargo, but I’d prefer to when I can.)

As for what card I’d choose if I had to pick one, though, it’d have the be the Venture X. Yes, that’s giving up roughly 15,000 points off of rent, but I’d probably make most of that up through 2x on all spend (my expenses are spread throughout the month and couldn’t be reliably front-loaded on the double points days, and I have a decent amount of travel spend on trains, third-party bookings, shuttle buses, etc. that don’t fit Bilt’s narrow travel definition.) That card also gives lounge access and somewhat more robust travel and purchase protections, and I’m still irrationally annoyed that the physical Bilt card doesn’t have contactless. Yes, I wouldn’t have Hyatt as a transfer partner, but I’m still in the economy-levels of travel, which generally means Hyatt is a good-but-not-amazing redemption option; I’d simply pay for most of my stays at other, more budget chains instead. I also find Capital One’s support to be better – Bilt is particularly weak in this category in my experience.

Congratulations on 200 episodes! Thank you for working so hard and consistently to put the show out – we appreciate it.

Oops…regarding prior highest airline transfer bonuses, 40% was quoted as the previous high— but Bilt had 100% to Hawaiian a couple of months ago.

You guys hit it – missed that somehow on the first stream attempt that got interrupted. Bygones

In the article on the Bilt Rewards May Rent Day 100% transfer bonus to Flying Blue there’s a little bit mentioned about KLM. In the most recent FMotA podcast, there’s virtually no discussion of KLM. Am I missing something or are redemptions of points transferred only going to be allowed on Air France, but not KLM?

I have a friend who lives in New York City. He has all of the chase cards he wants, Amex platinum, Business, platinum, etc. Owns a successful business, etc. Pays thousands of dollars a month in rent to a landlord that only takes ACH. Of course he has the Bilt card. Why wouldn’t he? He’s earning tens of thousands of points each year he wouldn’t otherwise and already has all of the Chase cards he wants.

I have another friend who got divorced during the pandemic and is renting for the first time in years. Never had any interest in points and miles because, frankly, it wasn’t necessary in order to travel previously. She’s not going to learn how to juggle three different cards and really just wants to fly a few states away to visit family now and then. Bilt is a great fit because it offers points on an expense she never previously had and she can use those points for the flights she needs a couple of times each year.

A “5/24 slot” is not only not precious to her, it’s meaningless. Like the vast majority of Americans, she never has been and never will be anywhere near 5/24. She hasn’t opened a new credit card in years. She’s just not going to open even one new card every year, but one card one time could continue to give her enough points to fly to visit family once or twice a year. I’m sure you would argue that she could get a Venture card bonus one time and cover those flights for the next couple of years, but I know that she wouldn’t want to continue paying a $95 annual fee every year and without the points earned from rent, she wouldn’t earn enough on a continuing basis for it to be meaningful. Obviously, if I were in her situation, I would do things differently and open three new cards a year. But she and I are not the same person. I can imagine something fitting her even if it’s not a fit for me.

I think you’re missing the fact that those for whom 5/24 is any consideration at all is also an extremely niche category of people (and while you may assume it is to the majority of people who read this blog, I imagine there are enough people getting approved through our Chase affiliate links to quickly prove that notion incorrect, though I don’t have access to that data).

If you don’t personally know someone for whom this card is a great fit nor can you even imagine someone for whom it is and you read this site regularly and know that we don’t use our affiliate links for cards where we know there’s a better offer (and so we let readers earn millions of referral points – an amount that far far far far far far far eclipses whatever minor impact the Bilt card has) and read the volume of content we write about things that earn no affiliate commission at all, and so on, and rather than recognize all of that you choose to think that we’re recommending a card to harm readers, it feels like you’re just ignoring all logic.

Obviously everyone’s situation is different. Some want premium cabins (in which case, forget Chase bonuses entirely as they flat out stink for that purpose IMO – you want Amex and Capital One points!), some care about luxury hotels (in which case, while a new card bonus is nice, what you really want is a couple of Ink Cash cards to have and hold forever), some just want to be able to book a flight to Florida now and then (and don’t care at all about premium cabins or fancy hotels. never mind carrying about them several times a year) and would be well served with 20-30K points per year picked up from paying the rent that could be transferred to AA, UA, or TK. And some like me would be happy to get 6x dining and 4x travel on the first of the month and hold out for the possibility of a 100% transfer bonus at some point.

Yes, applying for lots of cards is the fastest way to accumulate lots of miles and points. We’ve always recognized that. But we’ve also always recognized that people are different – and most won’t open new cards all the time, so their strategy is going to differ from yours or mine or someone else’s. My way to play or your way to play isn’t the “right” way. There are a lot of ways. It’s easy to get caught in an echo chamber and assume that there’s only one right way to do things and one set of end goals to want, but that’s just not the reality of things.

I presume you’re replying to my comment, even though it isn’t visible. I assume caught in your spam filter even though it contained no links or spam.

Unsurprisingly, I disagree with your assessment. For every person you know who says Bilt makes sense for them, I know as many people in real life, and can point to 10x as many people online (on Reddit, OMAAT, FlyerTalk, Facebook, etc), who regret getting cards marketed to them by bloggers early in their points career that turn out to be subpar cards & lock them out of other cards due to 5/24 or related considerations, such as Citi’s 1/6 limit or Barclay’s 6/24 limit.

You are also making points accumulation sound far more idiosyncratic than it, in fact, is. For example, you say Amex and Capital One are better than Chase for premium cabins. That is flat out wrong. You cannot acquire anywhere near as many Capital One points as Chase — you basically hit the Venture sign-up bonuses once and that’s it. And it is far cheaper and easier to acquire UR than MR. To take a simple example, for $15K spend, you can earn 150K MR (with a Biz Plat) or over 230K UR (with two Inks and referrals). With Amex, once you’ve done the once-in-a-lifetime personal cards, you are paying $295 for 90K with the Biz Gold and $695 for 150K MR with the Biz Plat. By comparison, you have $0 AF and way more predictability in acquiring URs (no pop-ups to contend with, scurrying for NLLs).

Similarly, your comment about holding Ink Cash cards for luxury hotels is flat out wrong. Even with 5x on office gift cards, you will earn points at a far faster rate through sign-up bonuses. A Chase Ink sign-up bonus is 12.5x on spend, 20x with a referral from P2.

As a result of these errors, you vastly underestimate the importance of 5/24 slots and remaining capable of accessing new Chase cards.

The fact that you have plenty of people use your Chase referral links proves my point. One of the key demographics for your blog are people getting started on their points accumulation journey. The people who are not yet aware that Bilt is a suboptimal way of accumulating points and that are not yet aware how precious 5/24 slots can be.

If people make a conscious decision to get Bilt in spite of its issues, so be it. That’s up to them. Not everyone has to maximize their points accumulation journey. That’s completely fine. But you have presented a very one-sided view of Bilt. Highlighting other aspects of your business model (eg giving readers the opportunity to use their referrals for the your personal Amex cards) doesn’t negate my point. If I’m ethical in one part of my life, I can’t use that fact to say I should be free of criticism in other areas where I’m not ethical.

Bob, you write, “But you have presented a very one-sided view of Bilt.” What negative arguments against Bilt do you think Nick is not providing?

I don’t have a Bilt card. In addition to 5/24 considerations, I’m a bit wary of reports of shutdowns for high users, and of what happens when Richard Kerr’s team runs out of VC money.

That said, I don’t see FM or Nick having been one-sided in their coverage.

Thanks Dave, most happy to elaborate.

Here’s what a fair review of Bilt would have highlighted and that FrequentMiler failed to do so:

Jeb, each person needs to make their own assessment of the value of a 5/24 slot, but funnily enough just a few days ago Sebby from AskSebby in his video titled ‘Chase 5/24 Exceptions??’ calls Bilt a trap for new players precisely for the reason I explained. Yet there’s no explanation of that potential trap from FM.

Bob, thanks for taking the time to answer my question, I appreciate it.

FWIW I agree with much of your assessment. I’d further contend that generally speaking, Bilt isn’t a great solution for seasoned points optimizers, especially those who don’t pay rent–at least absent a method of gaming the card that the Bilt team has yet to suss out and eliminate, per Todd’s remark above.

As for your specific points:

Again, thanks for taking the time for penning this respectful reply!

Thanks Dave. All great points. On the plugging of the welcome bonus, I’m basing those comments on the article (linked above) on which the podcast is based.

Your examples of opening multiple Chase Ink cards and using it for office supply spend are ones that only make sense if you’re treating earning points as a hobby (or potentially a business.) That’s not reflective of most people, and offering advice for a general audience based on that niche case would be foolish. Someone could open up a new card every six months and never worry about hitting 5/24.

I think you’re vastly overstating the importance of 5/24 slots as well – at worst, a two-year waiting period will open that path up again, and in most instances it’d be a year or less (if someone opened a card every 3 months, for example, it’d take 9-12 months of no card openings to get under 5/24 again.) If someone isn’t worried about getting a Chase card now, there’s no reason to artificially limit yourself just out of concern that at some point that slot might be valuable.

Or, take someone like my kids, just starting out. If they had a Bilt card and paid $2,000 per month rent and took advantage of the 100% unique-to-Bilt transfer bonus and the Flying Blue specials, they could fly two people round trip to Europe in economy on only their rent spend.

Reading the comments, it appears Greg is genuinely confused as to why people are pushing back against their promotion of Bilt. In addition to its shady business practices mentioned by Bill, I think the reason is very simple. You are recommending something that could actively hurt the long-term interests of readers.

Unless you fit a niche category (eg a blogger earning thousands of points through affiliate links or have huge natural spend through a business), the only way to earn enough miles to engage in all the travel experiences you promote on this blog is to generate points through sign-up bonuses. You’re simply not going to be able to fly premium cabins and stay at nice hotels multiple times per year without them.

That means every personal card is worth hundreds of thousands of points. Not just the points you earn from the new card bonus, but also because every new personal card takes you one step closer to 5/24 & being locked out of Chase business cards for months if not years. And we all know Chase business card bonuses are some of the best out there.

That means it actively hurts your readers to recommend a personal card that doesn’t earn a sign up bonus worth at, a bare minimum, $800-1000.

You have to be paying a boatload of rent to make a Bilt card worthwhile, and you need to be paying that rent for multiple years. Even if you pay rent with Bilt today, if you decide to become a homeowner 12 months from now, you will not make back the points you could have earned from another card bonus and thus you will have wasted a precious 5/24 slot.

O hey. Look who is back. The Bilt shills.

Troll

I’ve had Bilt since last December. It’s definitely a solid card, especially for Hyatt and AA. I think y’all are right to call it out as a card worth having.

To all of you naysayers, I’ve often stumbled upon a new card strategy via a “hey, wait a second” moment. And, often individuals discount this card or that card until they’ve had that moment. So many times I see people comment “someone is a fool to pay the Amex Business Platinum’s annual fee.” Right? Those individuals haven’t had that moment with the Amex Business Platinum. It is absolutely the most valuable card in my wallet.

And, so many times I see people comment that the Bilt card simply isn’t worth it. There’s nothing sexy about it. I’ve had my “hey, wait a second” moment with the Bilt card. And, I will say that it is the second most valuable card in my wallet. You’ll forgive me if I don’t share my trade secrets. The potential is there but it’s up to each individual to figure things out. Respectfully, if you can’t figure it out, it’s not Bilt’s problem, it’s YOUR problem.

Give the FM team credit that they’ve had their “hey, wait a second” moment with the Bilt card. Don’t suggest or imply that they have hidden or not so hidden intentions. It’s quite offensive. Regular readers know that the FM team tries to help everyone to “move the ball forward.” They are stand-up guys (and gal) who are focused on the hobby. So, be respectful in your comments and give them the benefit of the doubt.

Intriguing. . .

Indeed.

Bilt is sensitive because it’s not a big deal and you are giving a lot of time to something few believe in. And now you just discovered that 10 things you said we could charge is incorrect, making the card even less rewarding.

The 10 incorrect things were things that Bilt ITSELF stated. Once Bilt recognized ITS error, the FM team corrected the article.

It is the single best non-fee miles-earning and redeeming card out there. No bonus, it’s true, and no “ecosystem”. I don’t have it myself, but I’d definitely recommend it to my kids if and when they start paying the rent (another housemate does the payments currently). Also, if I had a very high organic spend it would also be a no-brainer. Since I’m not able to spend millions a year I rely on bonuses to earn my miles. Bilt’s too smart to build a program that will attract me but that’s to their credit.

Hey Nick. Great post on BILT. Speaking of Hyatt, can you and Greg talk about Hyatt purchasing Mr. and Mrs. Smith properties. How Hyatt will incorporate and does this make Hyatt points more valuable?

We definitely will. We didn’t have that info at the time that we recorded this show.

I don’t really care what is posted but I would agree with Jim/Mike in the sense that is appears you are pumping the card even if you aren’t. As they say perception is reality whether it should be or not.

I appreciate that perspective. Can you help me understand why Bilt is such a sensitive topic? Last week we made a big deal about AA miles and AA cards, but no one seemed to think we were pumping AA cards (we weren’t). What’s the difference? Similarly, we often talk about how much we love Hyatt, but no one suggests that Hyatt paid us for that coverage (which, for the record, they didn’t and we wouldn’t accept if they tried)

Back in Jan this year Bilt was hacked and data were exposed releasing pertinent account information on users. This led to privacy concerns, and potential for account closures.

I don’t consider this pumping.

Bilt is a clear winner if you pay rent and can’t otherwise pay by CC. That’s an opportunity loss.

Since I don’t pay rent, I had to make a list of spending categories. Where is another no-fee card better? Where is a fee card better if I keep it for other reasons like travel insurance or FNA?

Paying rent on the 1st of the month (or other charges from landlord)

– If landlord does not take CC, Bilt wins

– If landord takes CC, then a 2x card is equal or better depending on your goal. Ink Cash is even better if your landlord easily allows multiple $200 online payments via gift card purchases from office stores. Depending on the person, this could be hassle or not

– If Ink Cash doesn’t work for you, and you like Hyatt, Bilt always wins

2x Travel

– Bilt wins against no-fee cards if you like Hyatt. Else a 2x card is just as good

– If you already have Sapphire Preferred for travel insurance, then it wins at 3.3x (due to 10% anniversary bonus)

– If you keep other fee cards for other reasons, then Altitude and Ink Preferred are also 3x. Maybe you already keep a hotel card for FNA, and that hotel card often wins. For airfare, maybe you get 5x from Amex Platinum

3x Lyft

– Bilt wins against no-fee cards

– For others, it’s the same as the 3x travel category, unless you have CSR at 10x

3x Dining

– Bilt wins since it’s no-fee and transferable points

– However Altitude Go is free and earns 4% cash

– Rotating category cards earn 5%, so Bilt could lose here

– If you already have Aspire for the FNA, it wins at 7x Hilton points

– If you’re already paying for Sapphire Preferred to get travel insurance, then it beats Bilt, at 3.3x dining

Dining Rewards

– Bilt card is not needed for this

– However Bilt wins against other programs

– Earns 5x and Hyatt doesn’t have their own program

– Other dining programs offer 3x – 5x miles, but 5x requires enough dines to reach VIP first

Earns 5x in the first 5 days:

– Bilt loses here

– Worth doing when you plan a large purchase or tax payment

– Other cards have better bonuses, e.g. $15k spent on Amex Business Platinum

Referral bonus

– Bilt is not the best at 2500 points, possibly 10k

– Chase, Amex, Discover and sometimes even Citi offer more

“Rewards beyond rent”

– Sounds like this is a no-go

– If it worked, Bilt sometimes wins, sometimes loses to Ink Cash. Some utilities also charge a flat fee or $0, not a percentage

– Bilt loses to Ink Cash in some categories that were named: internet, cable, cell

There’s also a Hyatt factor. If you like Hyatt and can pile everything up on the 1st of the month, you can do better in non-bonuses categories than other cards. (I’m rarely going to time my travel and dining purchases to the first of the month.)

Good stuff. Just a quick correction: The CSP’s 10% annual bonus means that it earns 3.1x for dining not 3.3x. The 10% bonus isn’t based on points earned but rather on dollars spent. So if you spend $10 at a restaurant, you’ll earn 30 points initially and then 1 bonus point at the end of the year.

I think the issue with Bilt is they have some suspect business practices. For example I recently signed up for their Hyatt promotion. I noticed that I never received the second email explaining the promotion details so I reached out to their customer service to confirm I was registered. I explained to them I properly registered for their promotion and could provide screenshots of me doing so. They agreed I did everything correctly but for some reason they had no record of it. They stated there was nothing they could do for me and I was not registered. As a inconvenience they provided me with 500 Bilt points which is laughable. I think they should have to put a disclaimer for these rent day promotions that even if you properly register for the promotion, they may not honor it…

That is awful how they handled that. And, I’m not trying to make light of that situation (I would be seriously pissed if I were you) but here’s the thing: we’ve heard similarly bad (or worse) customer service stories about every card issuer, every loyalty program, every airline, every hotel chain, etc.

Greg,

To me, Bilt is a sensitive topic because their entry into the points and miles world for many blog readers was tied to that trip to Moskito island. That felt like such a blatant quid pro quo that is seemed….icky. It immediately made me distrustful of anything they were selling. I am not saying this is the objectively correct way to feel about this, but that will always be the first thing I think of when I see Bilt coverage here or on any of the other blogs.

Like many, I consider you & the FM team to be the straightest shooters in the points and miles world. Further, I am not so naive to think you are just providing all of the valuable information you do out of the goodness of your own heart – it’s a business, I got it. However, (again at least for me) Bilt will always have that shady stink around them that makes me question coverage of their products.

I am sure many feel differently and I not here trying to change anyone’s mind but rather just respond to the question posed about why Bilt seems to be a sensitive topic.

Keep up the good work.

Excellent, excellent response. I appreciate you explaining how it makes you feel while at the same time avoiding any negative name-calling.

I wouldn’t worry about it. It might be that some of us read other blogs and saw Bilt, Bilt, Bilt and then saw more here and just got tired of it. Not sure. I only glance at 4 blogs and am not really into collecting points big time since I don’t plan to do a lot of travel any more and I have a couple million points overall which for me is enough.

There has been a lot of coverage on Bilt across travel blogs recently, I think that’s largely a result of the unusually rewarding promotion they put out with the Flying Blue 100% transfer bonus. The Moskito Island trip for bloggers that Bill mentioned is certainly eyebrow raising for how much Bilt was willing to drop on promoting their platform but in the more recent coverage I think Bilt just came out with such a good promotion that it gathered wide publicity in the points world. It would seem odd to me if FM or any other big player in this space didn’t talk more about Bilt after such a promotion as it shows some major potential value that could be had from the program.

I agree with Bills point about their entry into the points and miles space. Another reason I am weary of them is they are not a bank so they do not have to follow bank regulations. If they think you have “gamed” their system they do not have to follow any of the rules that a regulated banks would have to follow. When more data points start rolling in I think that people will be surprised about how far they are willing to go compared to a bank.

Kerr must be paying big bucks to you guys for that Bilt card.

While we do earn a commission for the Bilt card, it is so small that it doesn’t factor into our company finances in any meaningful way at all. It is way less than any other card with which we earn a commission. And as regular readers know, we don’t cover cards differently depending on whether or how much we are paid. Take the Wyndham cards for example. We don’t earn a penny from them but we tell people over and over and over again what a great deal the Wyndham Business Earner card is.

This is the reason I follow you guys over others. With few exceptions content creators tend to push the same bevy of cards over and over and over and over that all have either an affiliate program or a referral program.

This is why I respect and trust Frequent Miler. You guys are the most honest in the business, imho. And I love that you share reader links when their offers are better than what you can offer. Nobody else does this. If I want to know the truth about a card’s worth, I check with FM first and trust what I read. Sorry you have to deal with the haters.

You are pushing BILT too hard now.

We aren’t pushing Bilt. We publish stuff that we’re excited about in this space and Bilt is more and more exciting