Chase Ultimate Rewards is a transferable points program available through a number of Chase credit cards. Ultimate Rewards offers a great combination of easy-to-earn points and both easy and valuable point redemptions. Those who are primarily interested in luxury international award flights will likely do even better with Amex Membership Rewards, but if you’re interested in hotel awards, domestic flights, or easy travel awards, Chase is a great pick.

Ultimate Rewards points can be earned via welcome offers, referral bonuses, bank account bonuses and credit card spend. As long as you have at least one Ultimate Rewards card with an annual fee, those points can then be transferred to airline or hotel partners or used to pay for travel at better than 1 cent per point value. There’s a lot of opportunity to be had.

Here’s everything you need to know about Chase Ultimate Rewards.

How To Earn Chase Ultimate Rewards Points

Earn Points with Credit Cards

All of the cards listed below earn Ultimate Rewards that can be transferred to travel partners provided you have at least one Ultimate Rewards-earning card that has an annual fee: Chase Sapphire Preferred, Chase Sapphire Reserve or Chase Ink Business Preferred.

| Card Offer and Details |

|---|

ⓘ $2185 1st Yr Value Estimate$300 travel credit valued at $285, $500 Chase The Edit credit ($250 Jan-Jun and again Jul-Dec) valued at $125, $100 GiftCards.com credit ($50 Jan-Jun and again Jul-Dec for cards purchased from https://reservebusiness.giftcards.com/) valued at $50 Click to learn about first year value estimates 200K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 200K points after $30K spend in first 6 months.$795 Annual Fee FM Mini Review: Could be very appealing for a business that books a lot of travel, as it earns 8x through Chase Travel or 4x when booking direct through airline and hotels. It has decent perks, best-in-class travel protections, and earns valuable Chase Ultimate Rewards points. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X social media and search engine advertising ✦ 5X Lyft (through September 2027) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $120,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $500 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Up to $500 The Edit credit ($250 January to June and again July to December) ✦ Up to $400 ZipRecruiter credit ($200 January to June and again July to December) ✦ $200 Google Workspace credit ✦ $100 Giftcards.com ($50 January to June and again July to December for purchases at giftcards.com/reservebusiness) ✦ Points worth 2 cents each towards qualified bookings through Chase Travel(SM) ✦ Transfer points to airline & hotel partners ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1074 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750 (*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: Great welcome offer for a no annual fee card. Good option for earning 1.5X everywhere. Good companion card to Ink Business Preferred, Sapphire Reserve or Sapphire Preferred. Click here for our complete card review Earning rate: 1.5X on all business purchases ✦ 5X Lyft through September 2027 Base: 1.5X (2.25%) Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1277 1st Yr Value EstimateClick to learn about first year value estimates 100K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 100K after $8K spend in the first 3 months$95 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 120K after $8K spend (expired 9/4/24) FM Mini Review: Great card for welcome offer and 3X categories. Also consider the Ink Business Cash for its 5X categories, and the Ink Business Unlimited to earn 1.5X everywhere. Earning rate: 3X travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year) ✦ 5X Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Points worth up to 75% more when redeemed for travel with Points Boosts ✦ Transfer points to airline & hotel partners ✦ Cell phone protection against theft or damage See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1029 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750(*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: This one should be in everyone's wallet. Incredible welcome offer for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5x Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1544 1st Yr Value Estimate$300 travel credit valued at $285, $300 StubHub credit ($150 Jan-Jun and again Jul-Dec) valued at $75, $500 Chase The Edit credit ($250 Jan-Jun and again Jul-Dec) valued at $125, $300 Chase Dining credit for dining at Sapphire Reserve Tables restaurants ($150 Jan-Jun and again Jul-Dec) valued at $75 Click to learn about first year value estimates 125K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 125K after $6K spend in the first 3 months. $795 Annual Fee FM Mini Review: Good all-around card for frequent traveler. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards. Click here for our complete card review Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X Dining ✦ 5X Lyft (through September 2027) Base: 1X (1.5%) Flights: 4X (6%) Portal Flights: 8X (12%) Hotels: 4X (6%) Portal Hotels: 8X (12%) Dine: 3X (4.5%) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $75,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $250 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Transfer points to airline & hotel partners ✦ Up to $500 The Edit credit annually ($250 January to June and again July to December. Note: In 2026, this changes to two times per year) ✦ Up to $300 Dining credit through Sapphire Reserve Exclusive Tables ($150 January to June and again July to December) ✦ Complimentary AppleTV+ and Apple Music through 6/22/27 ✦ Up to $300 in StubHub credits ($150 January to June and again July to December) ✦ Points worth up to 2 cents each towards qualified bookings through Chase Travel ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

ⓘ $985 1st Yr Value Estimate$50 prepaid hotel credit valued at $35 Click to learn about first year value estimates 75K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 75,000 bonus points after spending $5,000 within the first three months from account opening.$95 Annual Fee Recent better offer: Expired 5/14/25: 100K after $5K spend FM Mini Review: Great welcome offer. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with no annual fee Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 5X Lyft through 9/30/27 ✦3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 10% annual point bonus Base: 1X (1.5%) Travel: 2X (3%) Flights: 2X (3%) Portal Flights: 5X (7.5%) Hotels: 2X (3%) Portal Hotels: 5X (7.5%) Dine: 3X (4.5%) Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Primary auto rental collision damage waiver ✦ Free DoorDash DashPass (min. one year, must activate by 12/31/27)✦ $10 off each month on one non-restaurant orders from DoorDash ✦ Transfer points to airline & hotel partners ✦ $50 back for hotel stays booked through Chase per cardmember year in the form of a statement credit ✦ Each account anniversary earn bonus points equal to 10% of total purchases made the previous year. |

ⓘ $446 1st Yr Value EstimateClick to learn about first year value estimates $300 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn $300 (*awarded as 30,000 points) after spending $500 in the first 3 months (Offer Expires 1/15/2026)No Annual Fee Alternate Offer: Rakuten is offering bonus cashback or bonus points for this card This card is likely subject to Chase's 5/24 rule (click here for details). Recent better offer: Unlimited Double Cash Back for 12 month (expired 1/11/24) FM Mini Review: Great for 3x categories and 1.5X everywhere else. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5x travel booked through Chase Travel℠ ✦ 3x dining ✦ 3x drugstores ✦ 2% cash back total on qualifying Lyft products and services purchased through the Lyft mobile application through 09/30/2027 ✦ 1.5X everywhere else Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ $10 quarterly credit for non-restaurant DoorDash orders See also: Chase Ultimate Rewards Complete Guide |

ⓘ $292 1st Yr Value EstimateClick to learn about first year value estimates $200 cash back* ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Earn $200 (*awarded as 20,000 points) after spending $500 in the first 3 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great for 5X and 3x categories and World Mastercard benefits. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Earning rate: 5x travel booked through Chase Travel℠ ✦ 5X Lyft through September 2027 ✦ 3x dining ✦ 3x drugstores ✦ 5X in rotating categories on up to $1,500 spend per quarter (Q2 2025: Amazon, Streaming Services) Card Info: Mastercard World issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ Cell phone protection ✦ Lyft credits ✦ $10 quarterly credit for non-restaurant DoorDash orders See also: Chase Ultimate Rewards Complete Guide |

There is one, extremely confusing exception that exists in the Ultimate Rewards portfolio of cards. The Chase Ink Business Premier earns Ultimate Rewards and has an annual fee. However, the Ultimate Rewards earned on this particular card (a charge card rather than a credit card) aren’t transferable – they can only be redeemed for cash or other redemption options.

| Card Offer and Details |

|---|

ⓘ $695 1st Yr Value EstimateClick to learn about first year value estimates $1,000 Cash Back ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer $1K after $10K Spend in the first 3 Months$195 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This is an almost 1 to 1 copy of Capital One's Spark Cash Plus card, but the Chase card throws in 2.5% earnings on very large purchases. Unfortunately, the Chase card also has a slightly higher annual fee. The biggest disappointment about this card is that, unlike other Chase Ink cards, the rewards cannot be moved to other Chase cards to improve their value. Even though this card technically earns Ultimate Rewards points, it's best to think of it as a straight up cash back card. Click here for our complete card review Earning rate: 2.5% cash back on purchases of $5,000 or more ✦ 5% back on travel purchased through Chase Travel(SM) ✦ 2% cash back on all other spend ✦ 5x Lyft through September 2027 Base: 2% Portal Flights: 5% Portal Hotels: 5% Card Info: Visa Signature Business Charge Card issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Purchase protections ✦ Cell phone protection (up to $1K per claim) ✦ Travel protections |

Ultimate Rewards-earning cards that are no longer available to new applicants

| Card Name w Details & Review (no offer) |

|---|

$0 introductory annual fee for the first year, then $95 Earning rate: ✦ 5X office supplies, 5X cellular/landline/cable ✦ 2X gas and hotels ✦ 5X Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Points worth 25% more when redeemed for travel ✦ Transfer points to airline & hotel partners See also: Chase Ultimate Rewards Complete Guide |

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: Great for 5X categories. Good companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. No Annual Fee Earning rate: 5X Lyft through September 2027; 5X in rotating categories on up to $1,500 spend per quarter (Q2 2025: Amazon, Streaming Services) Base: 1X (1.5%) Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ $10 quarterly Instacart credit ✦ 3 months free Instacart+ See also: Chase Ultimate Rewards Complete Guide |

Earn Points with Bank Products

Some Chase banking products also earn Ultimate Rewards points for new accounts. If you can find a good offer (like this expired one), you can earn as many as 60,000 points. Similar offers occasionally surface for things like new mortgage accounts, though you’ll want to be sure you’re getting the best rate along with your points.

Keep in mind that points earned through banking are generally taxable. However, Chase Ultimate Rewards points earned from bank account bonuses can be transferred to airline partners or combined with another member of your household.

Earn Points by Referring Friends

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

How to Redeem Ultimate Rewards Points

Ultimate Rewards points are worth 1 cent each when redeemed for cash. That said, there are a few ways in which it is possible to get more value:

- “Pay Yourself Back”: Up to 1.5 cents per point value.

- Redeem points for travel: Up to 2 cents per point value with Points Boosts.

- Transfer points to airline and hotel partners: Value depends on how your airline or hotel points are used.

- Redeem points for gift cards: A selection of brands goes on sale for 10% off each month, although in many cases you’d be better off redeeming points for cash and buying the gift cards for more than 10% off elsewhere.

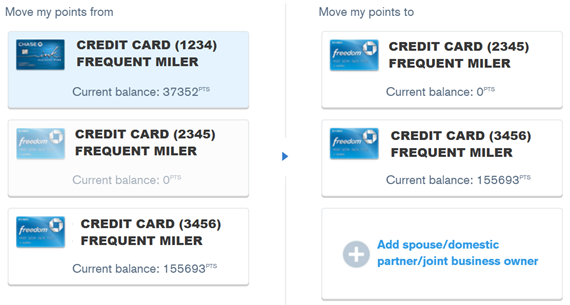

Points earned on fee-free Ultimate Rewards cards are not directly eligible for any of the above better-than-one-cent-per-point redemptions, but you can move points first to a premium card (Chase Sapphire Preferred or Chase Ink Business Preferred) or ultra-premium card (Chase Sapphire Reserve) in order to get the best value from your points. In fact, you only need one premium or ultra-premium card per household since points can be freely moved from one card to another within a single household.

A family working together could have a single Sapphire Reserve card and use that one card as the vehicle for redeeming points. All points earned on the family’s other Ultimate Rewards cards (Freedom, Ink, etc.) would be moved to the Sapphire Reserve account for that purpose.

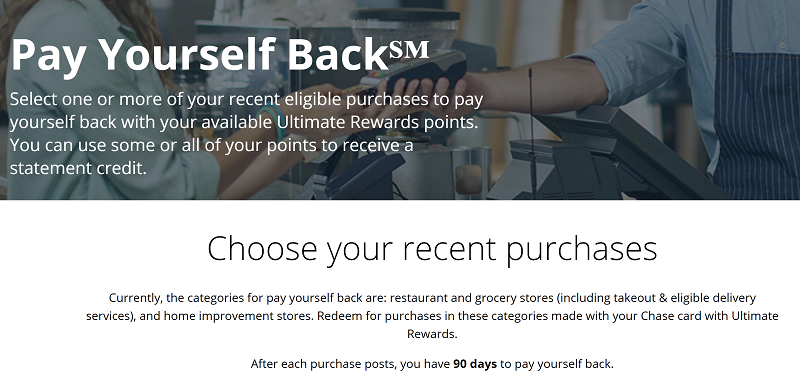

Pay Yourself Back

Chase allows most Sapphire, Freedom, and Ink cardholders to “Pay Yourself Back”. The basic idea is that you can exchange your points for statement credits against certain categories of purchases. Here’s the link to use this feature yourself.

Chase allows most Sapphire, Freedom, and Ink cardholders to “Pay Yourself Back”. The basic idea is that you can exchange your points for statement credits against certain categories of purchases. Here’s the link to use this feature yourself.

Chase changes or renews the eligible categories every few months. When using this feature, Sapphire Reserve cardholders get 1.25 cents per point value for most categories, and all other eligible cardholders get 1 cent per point value. Chase used to offer 1.5 cents per point value for Sapphire Reserve cardholders and 1.25 cents per point value for Sapphire Preferred cardholders. That was a decent deal, but with the lower redemption values in play today, we no longer recommend this option.

Travel

- Chase Sapphire Preferred or Ink Business Preferred:

- 1.25 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.25x through Chase Travel℠ until October 26, 2027.

- Up to 1.75 cents per point: Cardmembers are eligible for Points Boost offers of up to 1.75x for premium cabin flights and up to 1.5x for other travel booked through Chase Travel℠.

- Chase Sapphire Reserve:

- 1.5 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.5x through Chase Travel℠ until October 26, 2027.

- Up to 2 cents per point: Cardmembers are eligible for Points Boost offers of up to 2x for travel booked through Chase Travel℠. All hotel bookings with The Edit by Chase Travel℠ should qualify for 2x (details here).

How to redeem points for travel through Chase Travel℠

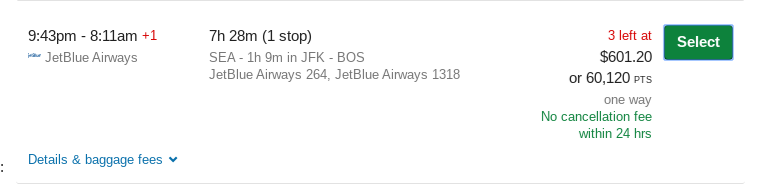

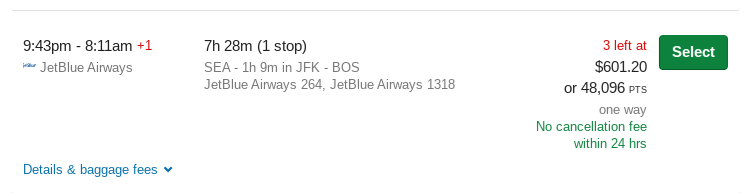

With many no-annual-fee Chase credit cards, you can redeem points for travel booked via Chase Travel at a rate of just 1 cent per point (or you could alternatively book travel anywhere and cash out your points for a statement credit at a value of $0.01 each). As an example, if you have a card like the Chase Freedom Unlimited card, a $600 flight would cost you about 60,000 points. See this example of a flight that costs $601.20 or 60,120 points. However, with the Chase Sapphire Preferred or Chase Ink Business Preferred card, you may get more value. The same example flight would cost just 48,096 points when booked through the Chase Travel when a 1.25x Points Boost is available.

However, with the Chase Sapphire Preferred or Chase Ink Business Preferred card, you may get more value. The same example flight would cost just 48,096 points when booked through the Chase Travel when a 1.25x Points Boost is available.

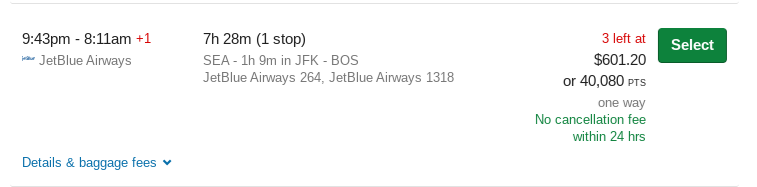

It's possible to get the most value with the Chase Sapphire Reserve card. The same example flight would cost just 40,080 points with the Sapphire Reserve when booked through the Chase Travel when a 1.5x Points Boost is available.

It's possible to get the most value with the Chase Sapphire Reserve card. The same example flight would cost just 40,080 points with the Sapphire Reserve when booked through the Chase Travel when a 1.5x Points Boost is available.

Using Ultimate Rewards, cardholders can directly book airfare, hotels, cruises, and car rentals. Airfare purchased via Chase Travel still earns airline miles and elite qualifying miles. Hotels booked through Chase Travel do not earn hotel rewards except where specifically noted otherwise. Worse, hotels booked via Chase Travel often will not offer you elite benefits even if you have status.

Using Ultimate Rewards, cardholders can directly book airfare, hotels, cruises, and car rentals. Airfare purchased via Chase Travel still earns airline miles and elite qualifying miles. Hotels booked through Chase Travel do not earn hotel rewards except where specifically noted otherwise. Worse, hotels booked via Chase Travel often will not offer you elite benefits even if you have status.

Fortunately, when you pay with points for travel, Chase's automatic travel protections do apply. So, you can be covered for things like trip delays, trip cancellation & interruption, lost luggage, etc. The coverage you receive will be based on which card's rewards were used to book the trip. For example, if you have both a Chase Sapphire Preferred and a Sapphire Reserve, you would want to move your points from the Preferred to the Reserve and then use the Reserve points to book your trip. You will get both better value (1.5 cents per point) and better travel protections.

The following chart summarizes travel insurance provided automatically by each related card. Cells in green indicate best in class coverage, yellow indicates good coverage, red indicates worse than peers' coverage. "Pay partial" means that you can get full coverage even if you pay only part of your transportation costs with this card. For example, you could pay just the taxes and fees for an award flight. Or, you could pay part of a cruise with gift cards and the rest with the credit card. In 2024, Chase changed the terms and conditions on its trip cancellation and interruption insurance to limit the amount covered to only what was charged on the card or paid for with rewards. All other insurance categories are unaffected (so far). Special note for New York residents: Chase seems to have a bone to pick with you. Car rental collision damage waiver (CDW) is secondary if you already have your own auto policy, as opposed to the primary coverage given to cardholders in the other 49 states.

| Sapphire Reserve | Sapphire Preferred | Ink Business Preferred | Ink Cash, Ink Business Unlimited | Freedom, Freedom Flex, Freedom Unlimited | |

|---|---|---|---|---|---|

| Auto Rental Collision Damage Waiver | Primary | Primary | Primary for Business* | Primary for Business* | Secondary* |

| Roadside Assistance | 4X per year limit | Pay per use | Pay per use | Pay per use | Pay per use |

| Trip Cancellation and Interruption | Limited to amount charged | Limited to amount charged | Limited to amount charged | N/A | Limited to amount charged |

| Trip Delay | 6 hour delay Pay partial | 12 hour delay Pay partial | 12 hour delay Pay partial | N/A | N/A |

| Lost Luggage | Pay partial | Pay partial | Pay partial | N/A | N/A |

| Baggage Delay | 6 hour delay Pay partial | 6 hour delay Pay partial | 6 hour delay Pay partial | 6 hour delay Pay partial | N/A |

| Travel Accident Insurance | Pay partial | Pay partial | Pay partial | Pay partial | N/A |

| Emergency Evacuation and Transportation | $100K limit Pay partial | N/A | N/A | N/A | N/A |

| Emergency Medical and Dental | $2,500 limit Pay partial | N/A | N/A | N/A | N/A |

* Each of these cards offers primary coverage outside of your country of residence. Unfortunately, the Ink Cash, Ink Business Unlimited, Freedom, Freedom Flex, and Freedom Unlimited cards all incur foreign transaction fees internationally.

If you would like to use points earned on other cards with a card like the Sapphire Preferred or Sapphire Reserve, combine your points with other cards in your name or with one other member of your household or business partner.

The Edit Luxury Hotel Program

- Daily breakfast for 2

- $100 property credit per stay (such as dining or spa credits)

- Room upgrade at check-in (based on availability)

- Early check-in and late check-out (based on availability

- Complementary wifi

Transfer points

In terms of absolute value, the best use of Ultimate Rewards points is to transfer points to airline and hotel partners in order to book high value awards. Your best bet is usually to wait until you find a great flight or night award before transferring points. Points transfer at a ratio of 1:1 as shown in the list of transfer partners below. Keep in mind that while transfers are instantly posted to most loyalty programs, transfers to Singapore Krisflyer and Marriott Bonvoy are usually not.

Chase Ultimate Rewards Transfer Partners

| Rewards Program | Best Uses |

|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Current transfer bonuses

If there are any current transfer bonuses from Chase Ultimate Rewards to a travel partner, details will appear here:

| Transfer Bonus Details | Start Date | End Date |

|---|---|---|

| Up to 25% transfer bonus from Chase Ultimate Rewards to Air Canada Aeroplan | 11/24/25 | 01/05/26 |

| 70% transfer bonus from Chase Ultimate Rewards to IHG | 12/01/25 | 01/15/26 |

Cash back

Chase Ultimate Rewards cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer.

Other ways to redeem Ultimate Rewards points

You can also use points to pay some merchants directly (Amazon.com, for example or via Chase Pay). Don't do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your points - causing you a headache in getting your points reinstated).

Best Ultimate Rewards transfer partner awards

Our post, Chase Ultimate Rewards sweet spots, details the best uses of Chase Ultimate Rewards. Either click here or click below to jump to a section of the post:

- Hotels

- Domestic US flights

- Hawaii

- Europe

- Asia

- Caribbean / Latin America

- Africa

- Australia / New Zealand / Oceania

How to Manage Ultimate Points

Combining Points Across Cards

If you intend to cancel a card that earns Chase points, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account. A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Sharing Points Across Cardholders

Why this is valuable:

Why this is valuable:

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

[…] transferibles, p. ej. Persigue las mejores recompensas, Puntos de agradecimiento de la ciudad.y Recompensas de membresía de AMEX Es, con diferencia, la […]

Hey Nick,

I have the the CSP and tried to transfer points to my spouse’s Aeroplan Acct. Spouse is AU on my Chase freedom acct only. I called and was told it can’t be done and that spouse needs to be AU on my CSP account. Is that true?

Thanks!

Thanks Guys…..

Some argue that in the absence of Hyatt as a transfer partner, Chase would look rather anemic. Once Hyatt broadens dynamic pricing, eyes will drift and Chase will need to rethink its card lineup. Maybe that’s what Project Emerald is about.

—–

Consider the following:

Sapphire Reserve earns 3X on hotels and transfers 1:1 to Hyatt. If someone’s average Hyatt redemption is 1.7cpp (or less), the reward rate is roughly 5 percent (or less).

WF Autograph Journey earns 5X on hotels and redeems for `1cpp. The reward rate is 5 percent fixed. From the perspective of a 3X world, one might alternatively say 1.666cpp. But, with a charge offset, one’s choice of hotel extends beyond just Hyatt . . . and, one will earn points on the reward stay (further enhancing the effective reward rate) irrespective of which hotel loyalty program.

—–

Freedom Unlimited earns 1.5X on everything. At the same Hyatt redemption rate, the reward rate is 2.55 percent.

There are pure cash-back cards that offer better overall reward rates.

—–

And, if one is transferring points to an airline, higher earn multiples are even better. (WF will certainly expand its stable of transfer partners.)

==========

The CSR’s strong suit remains its travel protections. But, for some, the travel protections are not a priority or those offered by other issuers are adequate.

==========

Hope this helps some to broaden their considerations.

[…] Chase Ultimate Rewards points are earned through several Chase credit cards. These include the Chase Sapphire Preferred, Chase Sapphire Reserve, and others3. You can get them through welcome offers, referral bonuses, and spending on your card4. […]

Do you guys want the new 75k CSP/CSR referral links that Chase is emailing out as of June 14?

A couple questions on The Edit. 1. Is the pricing the same for a property as on Chase Travel? 2. Can you provide a sense of the hotels available? Total number? Geographic distribution?

Getting those elite benefits and 1.5 cents/point redemptions could be compelling. Unfortunately, non-Reserve holders aren’t able to check available hotels and pricing.

Also seeing this page corrupted with the same bug, where it lists all credit card blurbs and.

Fixed. Thank you

Thanks for the quick fix!

Is it possible to buy an United Air ticket on the CHASE Travel Portal using a combination of UR Points and a Chase United Quest Card to receive the 2 free checked baggage benefit?

It appears that when purchasing a ticket on Chase Portal with points and credit card, Chase then goes and buys the ticket at United using their own institutional credit card (i.e. ending in 8909) and the United reservation does not show the original United Quest card that was used to pay on the Chase Portal. Thus, baggage benefits are not recognized.

Any help/experience with this is appreciated…

I’m having trouble combining points with my wife. We’ve got..

Sapphire Reserve (me, no authorized users)

Sapphire Preferred (wife, no authorized users)

Freedom Unlimited (me, wife is authorized user).

I have no issue transferring between Freedom Unlimited to Sapphire Reserve, but I can’t get the points from Sapphire Preferred to transfer. The Freedom Unlimited doesn’t show up in her login. I tried through secure message requesting to combine and they told me I could and when I gave them the Reserve account number, they told me this:

the “move to” account is associated with another account.

Which of course it is, that’s why I’m trying to combine them. Any suggestions how I respond??

I had this same issue. In my instance, I added my spouse as AU on my CSR & then no issues online transferring his CSP URs to my/our CSR.

[…] Chase Ultimate Rewards 是 chase 信用卡的點數,可以轉成很多航空公司的哩程,也可以轉成旅館的點數。很有彈性,建議想要玩 travel hacking 的朋友,一定要入手。想要攻讀 Chase Ultimate Rewards 如何使用,請參考 frequent miler。 […]

Does anyone know when Chase will be dropping Expedia (with their acquisition of CX Loyalty)?

[…] Read all about Chase Ultimate Rewards points here: Chase Ultimate Rewards Complete Guide 2020. […]

[…] does charge foreign transaction fees so leave it at home when traveling internationally. See our Chase Ultimate Rewards Guide for more […]

[…] The Freedom Unlimited card is unique among Chase’s Ultimate Rewards cards in that you’ll earn a minimum of 1.5 points per dollar for all spend while also earning 3 to 5 points per dollar within specific bonus categories. Chase advertises the Freedom Unlimited as a cash back card, but it actually earns Ultimate Rewards points. When paired with a premium card, the points earned with the Freedom Unlimited card become more valuable. You can freely move your points to a premium card in order to get better than 1 cent per point value for travel. For example, if you move points to a household member’s Sapphire Reserve card, you can get 1.5 cents per point value. In that situation, the Freedom Unlimited earns between 2.25% (1.5 cents per point X 1.5 points per dollar) and 7.5% in rewards! See our Chase Ultimate Rewards Guide for details. […]