NOTICE: This post references card features that have changed, expired, or are not currently available

Amex’s “3 for All” referral offer is a crazy valuable deal for big spenders. If you’re lucky enough to be targeted, you can refer a friend to another Amex card (it doesn’t have to be the same one) and if your friend is approved you’ll earn both a big points bonus and an additional 3 points per dollar on all spend for three months. The potential is huge. For details about the offer, see: Wow! Earn an extra 3X for 3 months with Amex Refer A Friend Three For All.

The Amex Big Spend Problem

Often people increase credit card spend by buying and liquidating gift cards, or doing other things that Amex considers “gaming.” Amex doesn’t like that and they’ve done a number of things in their “war on gaming” to stop it. For example:

- Gift card purchases at Simon Mall do not earn points or spend bonuses

- Amex often holds back or claws back bonus points when they suspect people have bought gift cards. A recent example is where Amex offered big grocery store bonuses on a number of cards, but clawed back those bonuses. See: Amex Going Clawback-Happy For Grocery Store Spend.

- Amex shut down accounts of many people who referred themselves in order to get both new welcome bonuses and referral bonuses. See: Amex ratchets up their war on gaming with wave of shutdowns.

The only way to safely “go big” with this 3 for All deal, in my opinion, is if you have big real spend coming up over the next three months, or can prepay for big purchases. For example, it’s always possible to prepay taxes by credit card for a reasonable fee. Also, it’s common to encounter situations where a vendor or contractor allows credit card payments but only if you’re willing to pay an additional fee. When earning an additional 3 points per dollar on a card where points are worth more than a penny each, it’s well worth paying even 3% more for the benefit of using your card to pay.

My Opportunities

Through regular bills, tax payments, my son’s tuition, car payments, and rent, I can generate quite a bit of spend that should be Amex-safe. As a result, I’m very interested in making the most of this opportunity.

My wife and I found the 3 for All referral offer on five of our Amex cards: my Everyday Preferred, my Delta Platinum, her Amex Gold, her Delta Reserve, and her Bonvoy Brilliant. Within the family, we can refer each other or our son to new Amex cards in order to trigger the bonus. Which of our eligible cards should we go for?

None of my big spend opportunities are likely to trigger any of the category bonuses from my eligible cards, so I can look at each card’s “everywhere else” earning power to see how valuable it would be to have the 3 for All offer:

| Card | Base Earning Rate | + 3 Earning Rate | Reasonable Redemption Value | % Rebate on Spend |

|---|---|---|---|---|

| Everyday Preferred | 1.5X* | 4.5X | 1.55 | 6.97% |

| Amex Gold | 1X | 4X | 1.55 | 6.2% |

| Delta Platinum | 1X | 4X | 1.3 | 5.2% |

| Delta Reserve | 1X | 4X | 1.3 | 5.2% |

| Bonvoy Brilliant | 2X | 5X | 0.72 | 3.6% |

* 1.5X requires 30 purchases per billing cycle, otherwise 1X

If there were no other considerations, the Everyday Preferred would clearly be my best bet. There are other considerations though. For one, my wife’s Gold card has already triggered the offer through a referral. So, even though the Everyday Preferred would be better, it would only be a half point per dollar better than our bird-in-hand.

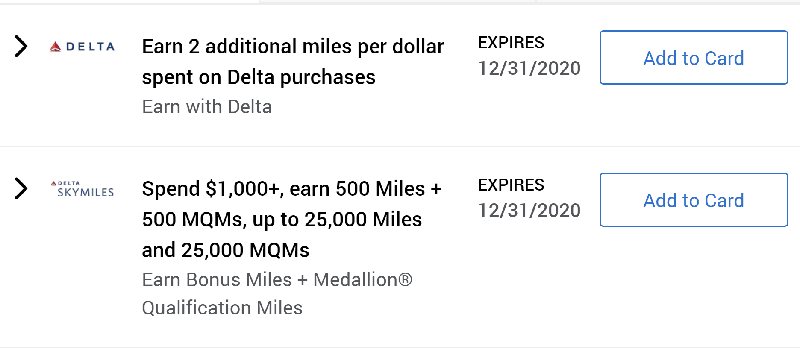

Another consideration is that my wife’s Delta Reserve card still has valuable offers loaded to it which would overlap with this one:

The offer to get 2 additional miles per dollar on Delta spend isn’t relevant since we don’t expect to spend much on Delta in the near future. However, the offer to get an additional 500 miles plus 500 MQMs per $1,000 is relevant. If we trigger the +3 offer on this card, the next $25K spend would earn 112,500 miles plus 12,500 MQMs towards elite status. Even if I valued MQMs at only 1.3 cents each (like the miles), this would amount to a 6.5% rebate on spend ($1,625 value from $25K spend). Plus, of course, the Delta Reserve card earns additional MQMs with each $30K of spend. Due to spend to-date, my wife would trigger the next 15K MQM boost after only $10K more spend this year and then another 15K MQMs with each $30K spend after that (up to the max 60K MQMs per year via status boosts).

A final consideration is that my wife and I spend big on our Delta cards each year to earn top tier Delta Diamond status (see this post for details). Thanks to Delta rolling over status and MQMs to next year, we haven’t had to do that spend in 2020, but we’ll probably want to do so in 2021. The 3 for All offer is available until October 28th and will kick off 3 months of +3 earnings. This means that we’d be able to get in some of our 2021 spend in early January while still getting +3 miles per dollar. That’s a sweet carrot.

Given the considerations listed above (including the fact that our Gold card already has the offer triggered), my priorities for getting in on this deal are as follows:

- My wife’s Delta Reserve card. I’d love to max out the offers she has on this account while also earning +3 miles per dollar. Additionally, it will be great to have the +3 offer on her card when we start 2021 spending in January.

- My Delta Platinum card. I wouldn’t spend anything on this card this year, but would be very happy to earn +3 miles per dollar in early January to get a start on my spending towards Diamonds status.

- Everyday Preferred. This would have been first on the list if we didn’t already have the offer triggered on my wife’s Gold card. I love the idea of getting 4.5X everywhere for 3 months, but it’s only a half point per dollar win over what we already have with the Gold card.

I have no interest in triggering the offer on the Bonvoy Brilliant card since Marriott Bonvoy points aren’t nearly as valuable as Membership Rewards points or Delta miles.

My Next Steps

My top priority is for either me or my son to use my wife’s Delta Reserve referral link to sign up for a new card. The problem is that Delta cards can only refer other Delta cards, and Delta cards are credit cards (see this post for more about Amex card limits). I have more than the max 4 Amex credit cards, so it’s unlikely I’d qualify. Our son already has the Delta Gold and Delta Platinum business cards (he picked up both less than a year ago) and the current offer for the business Reserve card isn’t that great. So, he’ll most likely use my wife’s referral to sign up for the Delta Gold consumer card. Here’s the current offer:

| Card Offer |

|---|

ⓘ $988 1st Yr Value Estimate$100 Delta Stays credit valued at $50 Click to learn about first year value estimates Up to 90K miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Limited Time Offer: Earn 70,000 Bonus Miles after you spend $3,000 in purchases with your new Card, and an additional 20,000 bonus miles after you make an additional $2,000 in purchases on the Card, both within your first 6 months. Terms apply. Rates & Fees (Offer Expires 4/1/2026)$0 introductory annual fee for the first year, then $150 Alternate Offer: Dummy booking offer of 50K + $500 credit. See this for more details. FM Mini Review: Priority boarding, and free checked bag make this a reasonably good option for Delta flyers who do not have elite status. However, those who can make use of an annual companion certificate would do better with the Delta Platinum card. |

I’d love to also trigger the offer on my Delta Platinum card, but we don’t have any more Amex credit card slots in the immediate family to make that happen. If you’re interested in signing up for a Delta card before 10/28/20, you are of course welcome to use my referral link with my thanks (found here), but I recommend instead finding a family member or close friend who would appreciate you using their referral link.

Greg

I did the referral (2 of them ) from my Gold card on 10/19. The 50K bonus posted on 10/20. However the transactions I have made since then do not have the extra 3X (I have the offer on my Amex Gold Card) . My statement closed on 10/23 and so far I have not received the extra 3X for transaction from 10/20 to 10/23. I reached out to Amex reps and they have not been very helpful (8 to 12 weeks they asked me to check back)

Any DP on this

Thanks

Raghu

You should get an email soon about qualifying for the +3 referral. My guess is that it took about 2 weeks before my email arrived. Once you get the email, you’ll start earning the extra points.

Thanks!

[…] My Amex +3X strategy (on my mind) […]

Greg, I used my Delta Platinum card referral to refer my spouse. She already has a Delta Platinum card in the past so will not qualify for bonus. Therefore, I tried to open the Delta Blue card for her instead. It gave me the message that you are not eligible for bonus. Your post says that you used a Delta Reserve referral to open a Delta Gold consumer card. Am I missing something here or doing something wrong? Thanks…

It doesn’t sound like you did anything wrong. It’s unclear when/why Amex pops up those messages when it seems like people should be eligible as in this case.

Thanks Greg. Even if the welcome offer is not available, if the card is approved, it should still trigger the referral bonus, correct? Thanks….

Yep

Greg

Great article. I currently have the spend $1000 get 1k bonus points on my Hilton card. If I refer does that mean I’m getting 7x on all spend? The 1k promo ends 12-18. Thanks.

Yes-ish. The spend $1K get 1K promo only gives you a full extra 1X if you spend in exactly $1K increments, but yes you’re essentially correct.

I’ve tried referrals to 3 family members, who aren’t big flippers of credit cards. Unfortunately, all 3 got the “You don’t qualify for this bonus” message.

Greg, thanks for covering this incredible offer.

I referred a friend, and now have the +3 on my AMX Gold card from 10/5/20 through 1/5/2021.

I am making all of my 2020 charitable donations on my Gold card, and I will make all my 2021 charitable donations in the first 5 days of 2021. I am over-paying taxes through pay1040. I pre-paid my estimated 2021 charges at my two favorite restaurants (earning 7X) and I am in the process of figuring out my non perishable grocery spend, earning 7X on as many groceries as possible

Oh, also, I earned 4000 points yesterday by making a tiny donation to the Biden campaign!!

Did they give the 3X referral offer on the Blue Business Plus ? I recently referred my wife and I got the 15K referral bonus but I forgot to check if the 3X offer was also available. I called Amex customer service after the 15K points posted, and they said that I did not have the 3x earning offer active on my account for spend..

Jerry, the 3X offer only applies to personal cards

Do you think using Paypal Key combined with the +3 offer for organic spend at places that don’t accept AMEX would be safe? Thinking about doing this on my Hilton Surpass card. Also, what about in January when restarting the 15k spend for FN (already met it this year)?

Any reports of this?

@Greg The Frequent Miler is it confirmed that EDP *won’t* earn the 50% bonus on the +3x points, since we know it earns the 50% bonus on grocery spend?

Sadly yet helpfully, the terms are explicit about that:

I published the full terms in this post: https://frequentmiler.com/amex-refer-a-friend-three-for-all/

Got it, thank you..And yes that is sad!

Greg, still puzzled at how you manage to give 1.55 value to MR points. I understand that there are some redemption paths through airline transfer points to make a great value out of MR, but only for specific flights zones, class, etc. If I happen to live in an unfavorable area to major hubs, or my interests don’t include flying to most destinations abroad in first class, etc., are there any OTHER redemption paths that give MR great value besides the airline transfer paths? Thank you.

You’re right, the valuation is entirely based on flight opportunities. You can easily do much better than 1.55 when booking international business class awards (during normal times). And you can get about 1.55 when paying with points for airfare with the business Platinum card.

Unfortunately, the only good standard redemption that I’m aware of outside of airfare is to get 1.25 cents per point cashing out if you have the Schwab Platinum card.

Sometimes Amex offers a 1 to 3 transfer (via a transfer bonus) to Hilton. In that case, if you value Hilton points at a half cent each, it’s like a 1.5 cent per point redemption.

I haven’t got the 3x yet, but I do have a Delta offer on one card for $120 back on $300 spend. I was thinking of just buying a GC on the desktop site. Would that trigger it? I assume so. In any case, I’ll wait until closer to the 12/31 exp date so I don’t have to float the money as long and in case I might get the 3x.

Stephen had luck doing that: https://gcgalore.com/delta-amex-offer-spend-300-get-120-back-buying-gift-card-should-work/

Using Plastiq should work for putting spend on the Amex after you qualify right? I’ve never used Amex on Plastiq before and just wanna make sure there’s not expected to be any problems before I switch my rent over.

Yes, that will definitely qualify

“So, even though the Everyday Preferred would be better, it would only be a half point per dollar better than our bird-in-hand.”

I’m exactly sure what you mean here. A half a point per dollar can still make a difference if you’re planning to spend big.

I referred the Amex Gold to my wife and she was approved. She was instantly approved and I was instantly given the 25k referral bonus points. Like you, I have a lot of big spending coming up including estimated income taxes, property tax payments, holiday spending, and our typical food expenses.

I wasn’t very clear. My first priority was to get +3 on the Everyday Preferred until I (accidentally) had it triggered first on the Gold card. So, now that I have +3 on an MR card, the Delta option becomes my next priority over trying to get an extra half point per dollar with MR. I’d certainly still love to have that extra half point but the need for it shifted down after the offer triggered on the Gold card.

I think Greg is trying to make up for not getting roasted on FM on the air this past week.

With respect your suggesting earning 4 DL skypesos insted of 4 MR points, and to add insult to injury you want to sign up for a sub par card with a sub par sign up offer that you can only get once for life.

Now I understand that you have a very special place in you heart for Delta’s loyalty program ( whatever…) , And that your planning on doing the spend anyways, but to me it sounds like a twisting oneself in a pretzel without a justifiable reason.

Unless of course this is based on already having a MR card with the 3 for all promo, but reading the article that’s not the message I get.

P.s. I don’t mean to be rude or offensive G-d forbid and I hope it dosent come across that way it’s just … On my mind.

My first priority was to get +3 MR, but that happened before I wrote the post, so my next priority was to get +3 on a Delta card that I was planning to spend big on anyway.

got it now that makes more sense