Delta doesn’t want your undying devotion, they just want your dollars. Or perhaps it would be more accurate to say that Delta has redesigned its program to focus on rewarding those who spend the most with Delta — whether that’s entirely from one trip or from a combination of booking flights, vacations, hotels and rental cars. If you’re a bit spender, the changes are great since they will greatly reduce competition for things like upgrades, but for almost everyone else these changes hurt.

The good news is that the loyalty world this week also provided us with more positive news like fast tracks to status with World of Hyatt and American Airlines, the re-launch of the Turkish Star Alliance booking tool, and more. Watch or listen to the podcast or scroll on to read more from this week at Frequent Miler.

Podcast

00:00 Intro

01:24 Giant Mailbag

04:26 What crazy thing . . .did Citi do this week?

06:10 Mattress running the numbers

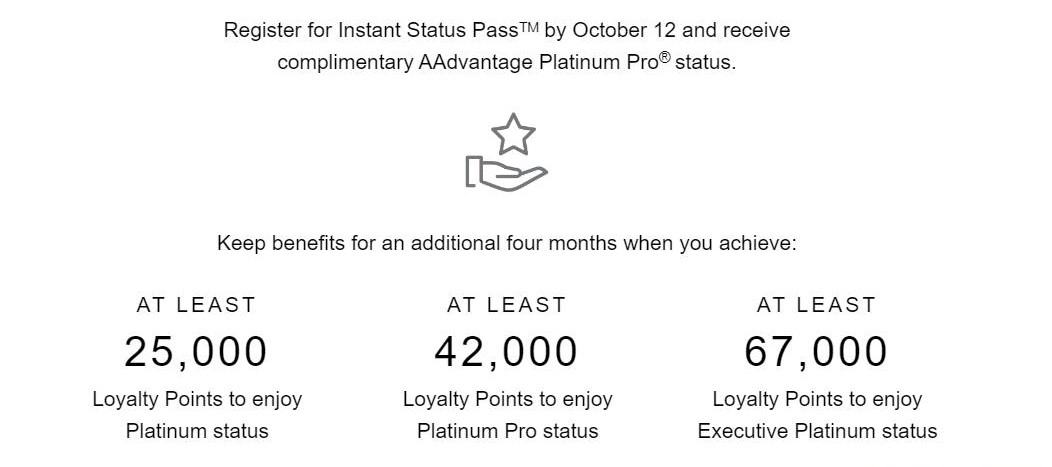

06:23 American Airlines elite status fast track for some Hyatt elites

10:25 Hyatt Globalist fast track for AA Platinum Pro & Executive Platinum members

17:51 Wyndham Shopping Portal Promo

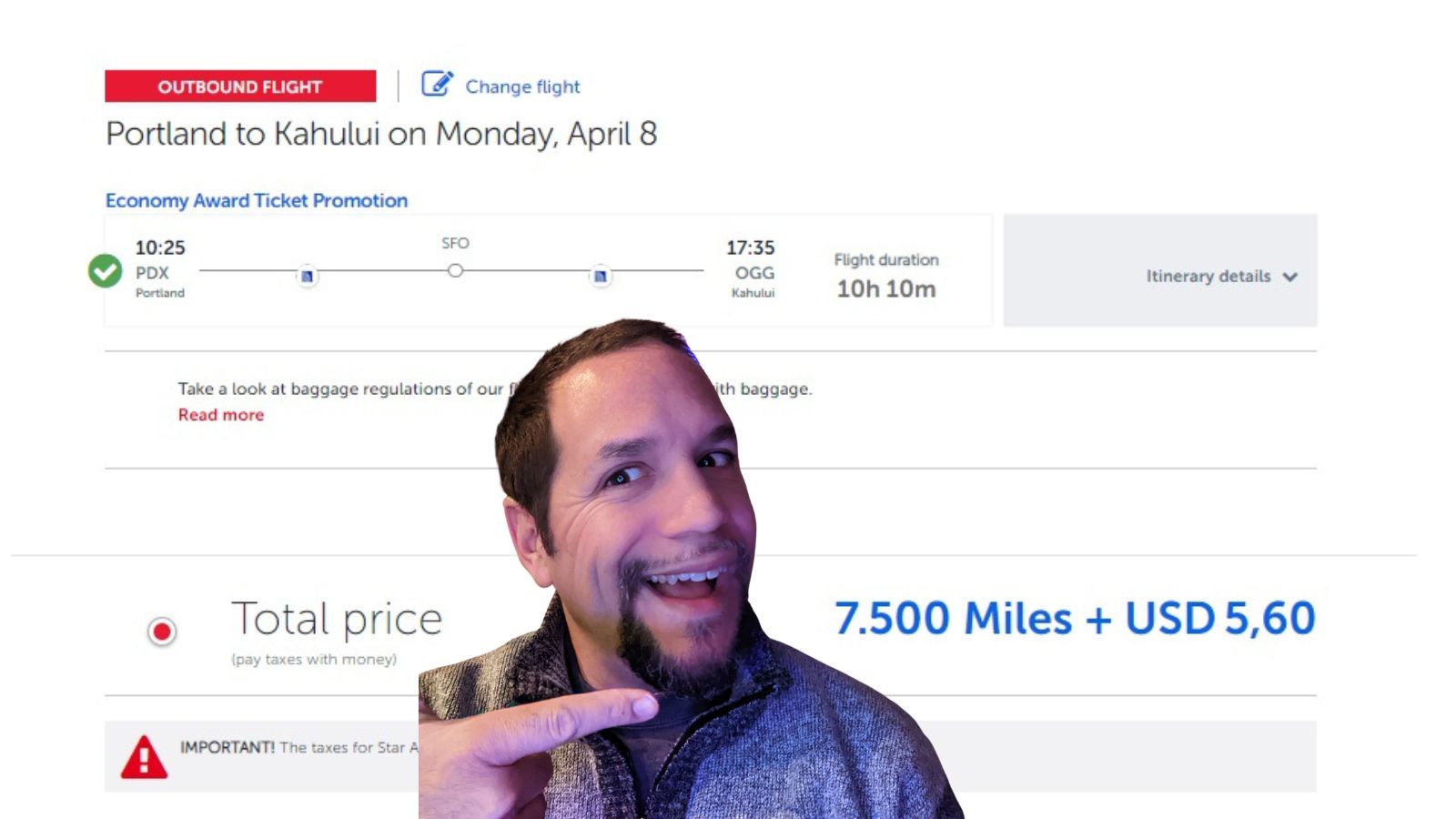

19:54 Award Talk: Now book Star Alliance awards on Turkish Airlines website again

26:23 Main Event: Delta breaks up with its loyal customers (It’s not you, it’s Delta!)

31:01 How do you earn MQDs in the newly-announced program?

36:00 No more rollovers

37:45 January 1, 2024 Delta Sky Club® access changes for cardholders

40:08 Feb 1, 2025 Sky Club access changes

44:12 Who is the winner here?

46:11 What will be the best ways to get Sky Club access moving forward?

48:06 How did Greg do on his predictions?

57:51 What will Greg do about Delta elite status now?

1:06:16 If you’re close to Million Miler status . . .

1:07:45 Question of the Week: Better rewards or more peace of mind?

We publish Frequent Miler on the Air each week in both video form (above) and as an audio podcast. People love listening to the podcast while driving, working-out, etc. Please check it out and subscribe. Our podcast is available on all popular podcast platforms, including Apple Podcasts, Spotify, and many more.

Alternatively, you can listen to the podcast online here.

This week on the Frequent Miler blog…

Delta’s 2024 elite program: it ain’t pretty

Delta has revamped its elite status program for 2024 and the message is clear: Delta wants your dollars. If you previously eked your way into elite status, you’re likely to balk at the new spending requirement to achieve that same level of status. In short, it’s time to say “so long” to Delta elite status unless you want to get really spendy.

Delta announces big Sky Club access changes for 2024 and beyond

Not only is the elite status program taking a sizable hit, but the Sky Club access policy is getting completely revamped. Starting in 2024, Delta Platinum cardholders will lose the ability to buy access and those flying in basic economy will not get lounge access regardless of entry method. Beginning in 2025, access even for Reserve and American Express Platinum Card® cardholders will only be available for a limited number of visits per year. These are some major changes that you’ll want to understand if you’re used to using the Sky Club when you fly Delta domestically.

Delta got you down? Don’t sleep on American’s easy elite status

There’s no doubt that the Delta changes have been brutal. If you’re looking for a silver lining, you’ll have to head over to the red, white, and blue. With just a few hundred bucks and the patience to participate in four different shopping portal offers, you could have easy American Airlines Gold status, which is roughly comparable to Delta Silver (except that it will require far less time and money to achieve). If you’re able to hop on the fast track from Hyatt, things get even better.

American Airlines back with instant status pass for Hyatt Elite Members (targeted)

Timing is everything and marketing folks from Hyatt and American Airlines had to be high-fiving uncontrollably when Delta’s elite status details got released. Not only does American look like a far more attractive program for low or medium spenders, but its gamified combination of ways to earn Loyalty Points just makes it fun. If you’re eligible for this fast track offer, it probably makes sense to dive in.

New American Airlines / Hyatt status match & challenge; get Globalist with 20 nights

Above I recommended that anyone eligible for the American Airlines fast track should probably register. By contrast, the match from American Airlines status to Hyatt is awesome only for Platinum Pro and Executive Platinum members, who can get a Globalist fast track challenge. Otherwise, this challenge is borderline useless for most other folks given the thin set of benefits you’d get with Hyatt Explorist status.

Marriott Bonvoy to offer soft landings for elites

Marriott Bonvoy members who fail to requalify for their current level of status don’t necessarily need to worry about losing all benefits since it has been announced that Marriott will once again offer “soft landings”. That is to say that, for example, if a member currently has Titanium status and they fail to reach 75 nights this year, they will only move down one elite level (to Platinum status) next year even if they didn’t earn any elite night credits at all this year.

Turkish Star Alliance awards online once again! Book United to Hawaii for 7500 miles one way.

For months, the Turkish Miles & Smiles online booking tool has showed no award results at all. Now, Star alliance bookings are once again available at the Turkish Airlines website. Don’t be surprised if your searches still turn up no award availability, but at least now there is a chance that you’ll find something and be able to book it. Also nice: you an use the “Award ticket” button on the home page to get to the Star Alliance search tool now.

Bilt outsmarts Curve’s “Everyday is Rent Day” trick

In credit card news, Greg discovered that Bilt transactions put through the Curve card were no longer earning any points at all. This is a bummer since it had seemed like an easy way to “go back in time” with a purchase to put it on Rent Day (for double points). Alas, Bilt either realized that was happening or saw it coming and blocked these transactions from earning any rewards.

Greg’s point earning strategy

Luckily, Greg has a lot of methods in mind to earn outsized rewards — and using the Curve card is a very small part of that strategy. In this post, Greg lays out how he earns the bulk of his points and also his strategy for day-to-day spend. It is surprising to see how much of Greg’s day-to-day spending goes to Citi cards.

Farewell gaming. $300 Venture X travel credit now applied as discount when booking

This small change to how the Capital One Venture X Rewards Credit Card annual travel credit functions will not make a difference for most people. However, in a situation where you use the credit on a future booking before it expires and you later (after it expires) need to cancel that booking for a refund, you’ll now forfeit the credit instead of getting a statement credit.

Capital One Venture X Business Card now available for online applications

I’m including this small piece of news in this week in review post just because of the fact that this card had previously required applying through a Business Relationship Manager but it is now available online, making it available to a much wider audience than it previously was.

Capital One Venture X Rewards Credit Card Review (2023)

The consumer version of the Venture X can be an easy keeper card given the combination of the annual travel credit and the anniversary miles. Depending on how much you value the miles, the card could be a break-even with the annual fee or perhaps even an annual win before even considering benefits like Hertz President’s Circle status and Priority Pass. This review has all of the key details on the Venture X card.

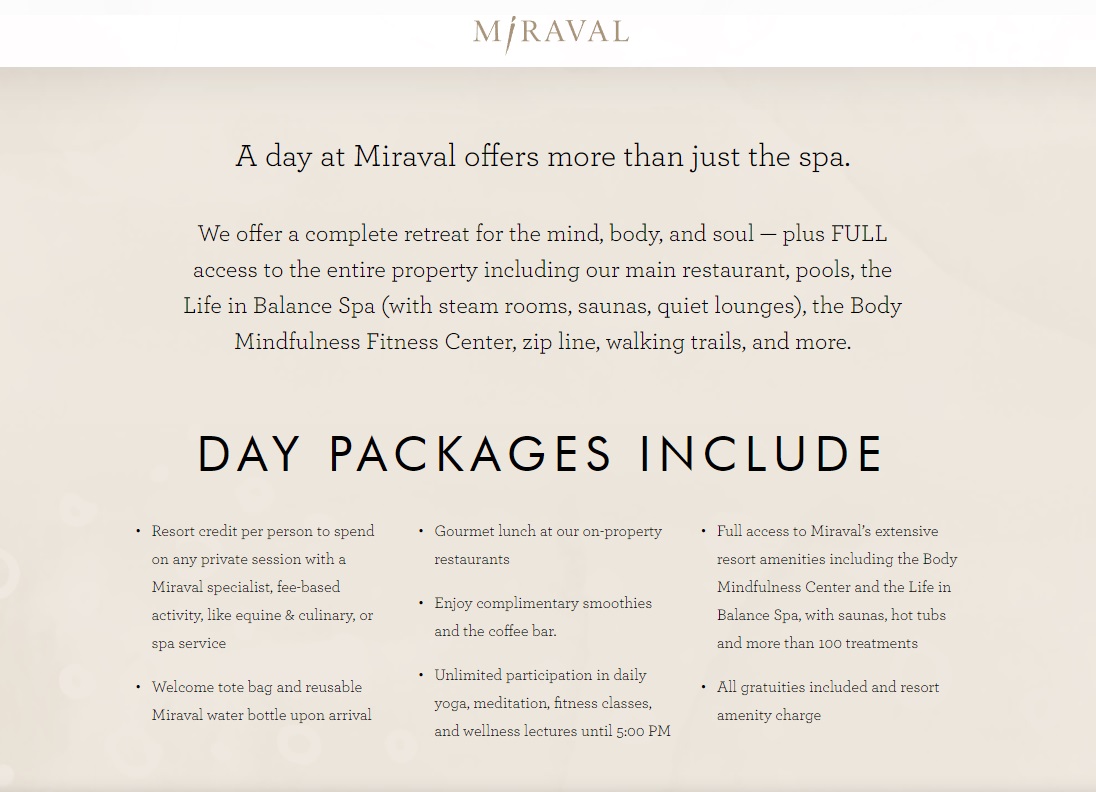

A “cheap” day at Miraval with Day Spa Packages

Hyatt’s Miraval properties are very expensive whether booking with World of Hyatt points or cash, but Day Spa Packages can be surprisingly reasonable, particularly if you stack with a discounted spa finder gift card. My wife really enjoyed a day at the spa and while still a sort of spendy day, it was a more reasonable splurge than one might expect.

Why does Greg hate flying Southwest? | Ask Us Anything Ep 59

Spoiler alert: Greg doesn’t really hate flying Southwest (or at least not a lot), but on this month’s Ask Us Anything we ponder Greg’s feelings on Southwest among many other topics. If you missed us live, you can catch this replay — and then don’t forget to mark your calendar for the first Wednesday of the month at 9pm.

A new Marriott sweet spot: Danang Marriott Resort & Spa, Non Nuoc Beach Villas

Stephen found a great-looking brand new Marriott property in Danang, Vietnam where a 35K free night certificate could potentially be used to book into a 2-bedroom villa. This looks like it would be a great spot for a family trip given how much space there is in the 2bdrm units. I wish I could make this work, but for now it’ll have to wait as we don’t have a good spot to fit this one on the calendar.

Don’t forget to keep an eye on last chance deals to make sure that you don’t miss any of those scheduled to end this week

![Mileage running 2026-style, playing the AA transition, a coming points conference and more [Week in Review] a group of toy airplanes on a game board](https://frequentmiler.com/wp-content/uploads/2022/01/American-Airlines-Game-218x150.png)

Thinks of a customer that

Lives near a Delta hub

Enjoys flying Delta

Prefers perks and the “joy of free” over cash

Has unlimited spend capacity for an Amex Delta reserve

Loves loyalty programs.

That customer is Greg the frequent miler. If even Greg is out on Delta elite status and prefers a boring old cashback card, then this is truly a paradigm shift in Delta’s loyalty program.

What if you get your tickets bought on Concur through your company but attached to the SkyMiles number? Will that count towards MQDs if the credit card used to pay is not the one in the name of the traveler?

I don’t know for sure. Hopefully someone else can answer.

Yes that will count

It makes complete sense for a company to reward customers based on revenue. Isn’t that what AA has essentially done? And, that’s what Delta has done. In doing so, Delta has eliminated non-revenue ways to game tier status. I might not like the specifics but I’m not going to vilify Delta over its choice.

Read Nick’s story about AA LPs vs the new DL program and you’ll see the difference. DL not allowing MQD earning on lower fee cards, shopping portal, etc. makes it uncompetitive with AA (for now).

Absolutely, there are differences. Delta has chosen to dial up the selectivity of customer it wishes to reward. That’s Delta’s prerogative. Other loyalty programs have made changes. With any change, some people win and some people lose. That’s the way it goes. So, no pissing and moaning. Just improvise, adapt, and overcome. Don’t go away made, just go away. Get tough or die.

I don’t think I was moaning, just pointing out they have zoomed past AA in terms of limiting what counts for revenue-based programs. I’m a DL hub-captive like Greg (ATL not DTW) and I also don’t like Southwest who’s schedule is terrible here. We’ll survive, but flying will become more of a chore like before I had status.

I’m not specifically referring to you regarding the “moaning” comment. More to the comments to all the various blog articles. Delta is not going to lose a dime on the people who are gaming the system or who are coupon-clipping a credit card. These people are not a meaningful source of revenue for Delta. Delta doesn’t care about these people. And, when these people say they’ll cancel their Reserve Card and that’ll show Delta, they vastly overestimate their value as a consumer.

These people sound like spoiled brats who want . . . who expect . . . everything for free. I will never forget one reader who commented on an article unrelated to this topic: “It’s unfair that the people in first class get champagne and the people in economy don’t.”

Now, I will be the first to say that Delta has a blind spot with respect to the exclusion of its shopping portal. It is a revenue source for Delta. And, yes, it does make AA more attractive. But, perhaps when Delta looked at its metrics, including its shopping portal didn’t move the needle enough. Or, perhaps it will be added in v2.0 in the inevitable tweak after year one. Or, perhaps Delta’s high-revenue customers don’t use the shopping portal much but tier status gamers do. Whatever the reason, the decision-makers made a conscious choice not to include the shopping portal.

Good loyalty programs are suppose to spark some kind of emotional connection with their customers. It’s why those customers do irrational things to maintain their status. It’s why customers tend to like or dislike companies when those companies aren’t real people. Delta has now changed to a more transactional approach. Give us cash and will give you perks. Delta shouldn’t be surprised when those same customers have an emotional response. Will this new program work? Maybe. Delta has been profitable being an early adopter of dynamic pricing , basic economy etc. Only time will tell if this new approach is succeeds or not.

Consider this: The tier status herd will be thinned. The tier status herd will be populated, as designed, by high-revenue customers and not my low-revenue/coupon-clipping tier status gamers. Those who survive . . . these valuable high-revenue customers . . . will actually get upgrades, etc. It seems to me that Delta is creating a very friendly environment for its valuable customers. It seems to me that Delta is telling low value/low-revenue/coupon-clipping tier status games to go suck wind.

Certainly, there are moderate value customers who will be collateral damage with these changes. And, some of those customers will decide to jump ship. But, then, there are just as many disaffected customers at AA and UA and SW and wherever who will jump ship and move to Delta. It’s the same thing with the hotel loyalty programs. People complain about Marriott and they move to Hilton or Hyatt or IHG. Other people complain about Hilton and they move to Marriott. Etc. Etc. It’s a numbers game.

As you state, time will tell.

This concept you have of “low-revenue/coupon-clipping tier status gamers” seems like an odd way to characterize someone spending $250K per year for a Diamond MQM waiver and/or someone spending either $25K on a card and still flying Delta enough to earn the necessary MQMs or someone spending $120K+ on Delta credit cards to earn the necessary MQDs for meaningful status. What percentage of elite members do you think were “gaming” the system at those much-higher-than-the-average-American levels of credit card spend?

I don’t disagree that Delta has every right to change their program as they see fit, and you are clearly right that they have decided what they want to reward, and I have to imagine that they know their own metrics well enough to know that they have enough people at or near the $35K level (and all of the other levels) to reach their goals for the program. I just think this concept of “tier status gamers” isn’t really all that applicable to Delta (I’d understand your “tier status gamer” label if we were talking about AA, but considering Delta’s requirements it doesn’t seem all that applicable here). I think characterizing people who were jumping through the necessary hoops to meet Delta’s previous requirements is someone who is “looking to get everything for free”. I think people are upset about this because they were already sacrificing better rewards on other cards to the tune of large spend and were likely choosing to fly Delta even when Delta was more expensive, etc. Again, I would find your comments more applicable to AA shopping portal elites like me.

Is the $250k from MS? If yes, then the cost of tier status is low. And, then the argument is disingenuous. I would think the percentage of individuals achieving $250k via organic spending is low. I can’t help but think Delta and Amex saw too many trips to the grocery store or office supply store across four cards and made a command decision. I’m not judging. I’m not trying to rain on anyone’s parade. I’m just trying get into the minds of Delta and Amex as to why they made these specific choices, which have drawn inordinate ire from the hobby community. To me, they had hobbyists in their crosshairs. Just look at the new Amex Platinum family language. The new Delta card family language.

Spend is spend from a banks perspective. I don’t have insight into how cobrand partners are paid but I’m guessing it’s related to spend all well. Seems like you are here just to swing on deltas marbles

Is it though? To play devil’s advocate here – interchange fees can vary based on MCC, and for large enough customers there is the potential for a better negotiated rate due to the large volume of transactions they process. Large national grocery and office supply stores like Kroger and Office Depot certainly seem like they’d have the customer revenue to ask for a better rate.

I’m not in the payment processing industry to know the numbers so I’ll use some plausible hypotheticals. A 0.4% difference in average interchange fee (1.6% vs 2.0%) comes out to $1,000 less in revenue for AMEX on $250K spend. A customer only spending on MS at a grocery store could bring in 20% less revenue than one using that spend more organically across dining, shopping (especially at luxury retailers), etc. Some of those merchants have a higher risk of charge backs and payment default so this doesn’t directly translate to profit but undoubtedly they can make more off these transactions. Add in that customers generating spend through MS are more likely to have lower breakage on card benefits and max them out…

Is it still a revenue loss for AMEX & Delta if that customer closes their card or shifts spend outside of AMEX? Yes. Maybe they’re fine with that because they want to consolidate only into higher margin customers. Maybe they’re betting this will allow them to draw in or keep customers who put say $1MM a year on their Delta cards and are mad they have to stand in line at Sky Clubs with everyone else or don’t get upgraded that often.

I have no inside knowledge, but what Lee is describing seems possible.

Bingo.

Andrew is offering a reasonable explanation of why Delta and Amex have done what they’ve done. Andrew is not advocating what they’ve done. Andrew is not saying that any of us have to like what they’ve done. So, don’t throw any darts at him.

But, whatever the reason, it is what it is. Some people get hosed but others will actually benefit from the changes. If a person is in the hosed group. don’t gripe, don’t expend mental energy, just move on. You’ll be better off . . . happier.

Nick, if you were Delta and you needed to thin the herd, how would you have restructured SkyMiles? Keep in mind, your most valuable revenue customers are becoming dissatisfied. What are you going to do? Serious question honestly asked.

DL thinks their excrement doesn’t stink. They really believe that they are the best thing going among US airlines (and maybe beyond) and by such a wide margin that they can do whatever they want, and people will still be falling over themselves to fly them.

Their mindset is not without some basis. They’ve consistently gotten away with having the some of the most worthless redeemable miles out there. They do tend to be slightly more reliable operationally than most competitors. But the bottom line is they think they are heads and shoulders above the rest, and in reality they may just have a few inches on ‘em.

If there was a fundamental disconnect between the comprehensive package that Delta delivers and the price Delta charges, we’d see Delta customers walk. But, the fact is that they’re not. If you’re unhappy with Delta, don’t go away mad, just go away.

For me (and most DL Diamonds that I know), the most valuable benefit of Diamond is the GUC. By putting Diamond out of reach, they are removing the biggest carrot that incentivizes me to make sure I meet the requirements to make Diamond year after year.

Moreover, many folks that are reaching $35K in spend on flights (only) are likely buying first/business class tickets. For this category of traveler, GUCs aren’t all that valuable. I have an industry friend exactly like this; he doesn’t use his upgrade vouchers at all because he’s already up front.

I have already reached Diamond requirements for 2024, but sadly, I likely will not use it much. I’m now planning my strategy with AA next year. I’m hopeful they will open a status match opportunity. If they do, my loyalty will shift to them sooner than later.

This whole thing is disheartening, but the only way Delta will listen is if we vote with our wallets.

I actually thought about exactly what you are saying here — that the type of customer spending $35K likely doesn’t need the GUC. I feel like they are going to have to really enhance the value of Diamond status to make it interesting to the type of customer they are seeking.

Agree, and I’m not sure what other incentives they can offer. Maybe a more secluded Skyclub? Aside from that, there’s not much I can think of. These are the folks that have millions of Skymiles and redeem them for a new Tumi suitcase.

It’s not you, it’s Tom Brady

The Delta Air Lines’ corporate Kool-Aid has long been very customer-unfriendly — going back at least 20+ years — with regard to the frequent flyer program. And DL’s customer-unfriendly corporate culture with regard to the frequent flyer program has never been exorcised from the DL corporate culture and instead has been repeatedly rewarded by the DL shareholders, board of directors and the senior-most executive team throughout the decades. It’s not the customers, it’s in Delta’s corporate culture/DNA to do this and to try to discipline the market to follow and do as DL wants.