NOTICE: This post references card features that have changed, expired, or are not currently available

As we reported last week, starting yesterday and running through 8/4/19, Simon Malls are offering $1,000 Visa Gift Cards with an activation fee of $3.95 to those folks engaging in Manufactured Spending. This is of course awesome because it means we can knock out a big chunk of spend with fewer gift cards and because it enhances the ease of liquidation since a single swipe has increased purchasing power. Furthermore, it reduces MS cost to a small fraction of a cent per point, making it easy to come out ahead using almost any rewards credit card. So what’s the catch? There really isn’t one — but here are some mistakes to avoid if you’re going to the mall to get in on the deal.

1) Being sheepish about the fact that you’re MSing

At this point, #1 should be obvious, but it’s worth repeating here: Simon is welcoming MSers. They have made it clear that they are aware of Manufactured Spending and that they welcome those buying Visa Gift Cards to be up front about the purpose and mark “Manufactured Spending” as the reason for purchase on their order forms.

Speaking of paperwork, in an effort to keep personal information more secure, Simon has implemented a new procedure for those customers who buy more than $10K in gift cards at a time. You’ll have to provide your SSN, date of birth, and email address initially, but your information will be entered into a computer database (before shredding the paperwork) and this will streamline the process with a simplified order form on future visits. Those customers who purchase less than $10K at once will continue with the same order forms currently in use.

The short story here is that Simon continues to welcome those who MS. If you have established a pattern of large purchases so that you can exceed the $10K speed limit, the process is going to get even easier. Even if you’re only intending to purchase a few thousand in gift cards, it’s nice knowing that you can be up front about what you’re doing and Simon is going to make the process simple and straightforward.

2) Suddenly spending $10K per day on a card you’ve never done that with

Of course, you don’t want to get carried away and put the pedal to the medal on $10K or larger purchases. Just like going from 0 to 60 in 1.9 seconds on your local town road could lead to disaster, so too could a sudden spike in spending that is far outside of your normal use patterns. Best practice in manufactured spending is to ramp up slowly. You’re better off splitting that big transaction over a couple of cards / banks if large purchases like this haven’t been your routine. Keep in mind that you can split tender at Simon.

3) Buying without a backup plan….or three

One of the Manufactured Spending tips I share with those new to the game is to be sure not to bite off more than they can chew. Things change unexpectedly. Perhaps you have a liquidation plan in mind for your cards, but maybe that outlet dries up next week. If you’re stuck with a couple thousand dollars in cards that you suddenly can’t liquidate, maybe you can simply hold them and use them for your regular purchases for the next month or two. If you’re stuck with twenty or thirty thousand dollars in cards that you suddenly can’t liquidate, it could give you a heart attack (maybe the hospital will accept Visa Gift Cards for payment?). Even if you have one more preferred method of liquidation, I recommend having at least 3 or 4 options in mind and maintaining a backup plan if things go south. For most of us, that backup plan should include the intention to avoid the temptation to get in over our heads in the first place. With this promotion set to last for almost 2.5 weeks, there’s time to go back for seconds once you’ve finished Round 1.

4) Using the wrong credit card

First up, do not use American Express. Amex has been paying out zero points on Simon Mall gift card purchases. So don’t use Amex at your Simon Mall.

Secondly, you should consider your return on spend.

For the sake of (relatively) easy math, let’s say that your cost to liquidate a single $1,000 Visa Gift card is $1. Between the $3.95 activation fee and that dollar liquidation cost, your cost will be $4.95 for each $1003.95 in spend.

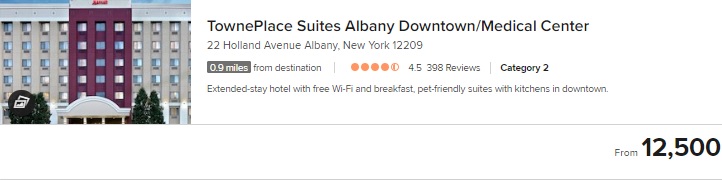

Let’s then imagine that you are spending with a specific goal in mind: to spend Saturday, August 10th at the TownePlace Suites Albany Medical Center in Albany, NY. Hey, maybe you’re attending a wedding downtown or something. The TownePlace Suites looks like a relative value if you don’t need a fancy schmancy hotel since it is a Category 2 Marriott property, which only costs 12,500 points for a free night.

Since you cannot use an Amex card at Simon Malls, your logical choices for earning Marriott points are the Marriott Bonvoy Boundless card (old Marriott Rewards Premier Plus — the Chase card with the $95 annual fee) or the Chase Ritz-Carlton credit card. Either card earns 2 Marriott points per dollar on unbonused spend. You’d therefore earn just over two thousand Marriott points on each $1K Visa Gift Card

Buy a $1,000 Visa Gift Card + $3.95 activation = $1003.95 spent x 2 Marriott points per dollar = 2007.90 Marriott Bonvoy points earned

Since your total cost is pretty low ($3.95 activation fee + $1 liquidation fee = $4.95), your cost per point is also quite favorable.

$4.95 ÷ 2,007.90 = $0.0025 per point (in other words, 0.25 cents per point)

A quarter of a cent per point sounds like a great price for Marriott Bonvoy points. According to our Reasonable Redemption Values, you can generally expect to get around 0.72 cents per point, so you’re likely to come out a winner when purchasing points this cheaply.

And indeed with the TownePlace Suites, you’d come out looking pretty good here. The cash rate on August 10th is as low as $105. With tax, that comes out to $119.70.

This means you’re getting 0.96 cents per point in value from the 12,500 points used for the night. That seems like a great deal considering your cost per point. After all, 12,500 points at 0.25c per point will cost you about $31.25 between activation fees and liquidation.

$6,225 in spend x 2 points per dollar = 12,500 points

12,500 points * 0.25c per point = $31.25 in MS cost

You’d have to buy about $6,225 worth of cards to generate 12,500 Marriott Bonvoy points. Assuming you purchase in increments of $1,000, your total MS cost is just $31.25 for your points. Compared to the $119.70 cost of the room, you’re essentially getting about 74% off the cost of your hotel room. That’s amazing value, right?

Let’s consider an alternative scenario. There are several cards on the market that earn 2% cash back with no annual fee. Let’s imagine that you did the same $6,225 in spend on a card that earns 2% cash back.

$6,225 at 2% cash back = $124.50

As you can see, a two percent cash back card would yield $124.50. As you’ll remember, the hotel room in our example came to $119.70 with tax. If you opted to earn cash back instead of Marriott Bonvoy points for your Simon Mall purchases, you’d be almost four bucks ahead with cash back. The same amount of spend could get you the same “free” Marriott night, but with the added flexibility of cash (which is not tied to Marriott and does not depend on award availability).

Of course, you’ll also earn Marriott points if you’re using cash. Since TownePlace Suites is an extended stay brand, I’d only earn half the usual number of Marriott points for a paid stay (5 points per dollar). With my Platinum Elite status, I’d get a 50% bonus (7.5 points per dollar total). Based on a paid rate of $105 before taxes, that’s 787.5 Marriott points.

$105 x 7.5 Marriott Bonvoy points per dollar = 787.5 Marriott Bonvoy points.

In my case, I would additionally qualify for a targeted promotion on my account to earn 1500 points after my first paid stay, which means I would earn a total of 2,287.5 Marriott points on the stay if it were my first (plus 500 points as a welcome gift, though I’m not counting those since I would also get those for an award stay). I’ve actually already had one paid stay under that promo, so if this scenario were real I’d have the opportunity to earn 3K bonus points on this paid stay at the TownePlace Suites. If this were a Marriott stay at a non-extended stay brand (where I’d earn 15 Marriott points per dollar based on my Platinum status rather than 7.5), I’d be earning north of 3,000 points assuming the 1500 bonus points from the targeted promo or more than 4,500 points assuming it is my second paid stay.

In other words, the same $6,225 in spend would get me the same “free” Marriott night, but I’d come out four bucks and a few thousand points richer. The difference could certainly be starker if scaled for a more expensive property and/or more nights.

Are there even better options?

Consider an option like the Chase Freedom Unlimited or Chase Ink Business Unlimited. Either card earns 1.5 Chase Ultimate Rewards points per dollar spent on unbonused spend. The same $6,225 spent on one of those cards earns more than nine thousand UR points.

$6,225 x 1.5 points per dollar = 9,337.50 Ultimate Rewards points

That is not enough points to transfer to Marriott for a free night in this case. However, if you also have the Chase Sapphire Reserve card, you could combine your points and use those points through Chase Travel℠ at a value of 1.5c per point.

9,337.50 Ultimate Rewards points x 1.5c per point = $140.06 in travel

Assuming the TownePlace suites were available for the same $120 total through Chase Travel, you could theoretically book it for just 8,000 Ultimate Rewards points — leaving you with a surplus of 1,337.50 Ultimate Rewards points (worth $20 in travel booked through Chase).

It would only be more glaring if you were using a card that earns 3% back in the first year (see the Discover IT Miles card or Alliant cashback card), in which case you’d be able to cover your room and maybe dinner somewhere local, too.

$6,225 at 3% back = $186.75

It is therefore worth running the numbers to decide whether or not you’re getting reasonable bang for for your buck in terms of whatever reward you’re receiving for your spend. Am I saying that you should only use a single cash back card and forgo miles and points completely? Absolutely not. In fact, if you try that move with the Alliant card, you might get a warning letter (or worse, you never know when they might give you a nasty surprise). But I do think it’s worth some forethought in terms of which card(s) you use.

5) Failing to diversify

Speaking of a card or cards, it’s always worth diversifying. I intend to make a couple of trips during this promotion and I will be using several cards from several different issuers.

One reason for that is to diversity my holdings: while some subscribe to the earn & burn mentality, I agree with Greg’s post: The earn and burn fallacy: Shall we give hoarding and cherry picking a try instead?. In short, I want a variety of points in my pocket so I’m prepared to strike while the iron is hot on the right opportunity (like, I don’t know, flights to Hawaii for 7500 points each way in economy or 12500 each way in business class). I won’t put all my eggs in one basket.

By the same token, it’s important to keep in mind that the landscape can change quickly. Who is the next Amex? Is it possible that another issuer could refuse to post rewards for Simon Mall purchases? I certainly hope not, but it’s a scenario for which I’d rather be prepared than stuck with a lot of money in activation and liquidation fees to pay and no points to show for it.

6) Getting too wrapped up in the moment

I definitely think that thousand dollar gift cards are big. We’ve never seen gift cards in a denomination so large readily available on the mass market before, and having these cards available at a merchant that is so welcoming of the MS community is exciting.

On the other hand, this isn’t the best deal in MS. Staples occasionally runs promotions that make gift cards fee-free (in fact, they happen to be offering such a promotion starting on 7/21/19, and Staples of course happens to fit into a good category bonus). Apps like Dosh or certain Chase Offers or Amex Offers may present the opportunity to buy cards at a slight profit, and portal shopping brings activation fees for some online purchases down to quite favorable levels as well. On a cost-per-point basis, the Simon cards make for an excellent MS opportunity, but not an unprecedented one.

Where the $1K cards at Simon really shine is in enabling volume / scale. With liquidation being the barrier that most people face, or at least the most time-consuming part of the equation, the $1,000 cards are a welcome sight. These should speed up liquidation and reduce or eliminate the need to split tender on money order purchases. I know in my case I am looking forward to this part. The request to split tender on the money order purchase is often the part of the MS process that draws the most skepticism and this will ease the difficulty there. For that reason, I do intend to make a trip to Simon Malls while these cards are available. But if you’re just looking to pick up a few free points here and there, you can leverage those Staples or supermarket promos to potentially be a better deal. Most importantly, don’t convince yourself to buy here instead of those more profitable deals. Buy at Simon if you just can’t get enough in those deals to satiate your appetite for MS.

7) Being reckless

The final key mistake to avoid is in being reckless. As the saying goes, failing to prepare is preparing to fail. If you’re going to purchase VGCs in volume, you have to stay organized and keep track of what you’ve purchased, what you’ve liquidated, and where everything is. It’s easy to get lazy / complacent, but one small mistake here (think a misplaced card or MO) can wipe out the value of a large quantity of rewards.

Furthermore, don’t be reckless about your deposits. Some banks are notoriously uncomfortable with money order deposits and may close your accounts. Further, structuring is a crime you’ll want to avoid. The key tip here is to keep MS banking activity separate from the banks where you maintain credit card relationships and to make sure you aren’t structuring your deposits. MSing isn’t a crime, but trying to hide your money can be. This goes back to the advice not to get in over your head – see our Complete Guide to Manufactured Spending and read up a bit before diving in.

Bottom line

I can’t lie, I’m excited about the $1K Visa Gift Cards at Simon Malls. It’s pretty awesome to be able to buy such large-denomination Visa Gift Cards and it only gets better when you consider how much volume you can do thanks to Simon’s MS-friendly attitude. Being able to call ahead to get the order set up before you even arrive makes this an awfully convenient way to MS. But before we rush off without a plan of attack, it’s important to consider how you’re going to handle these gift cards — from which cards you’ll use to purchase to how you’ll liquidate when your preferred method shuts down. Keep these tips in mind that this can be a very good and scalable deal indeed.

What’s the deal with different card designs and issuing bank (Meta/Blackhawk)? My first batch of $1k cards were easily liquidated at safeway via MOs, but the second batch (different design + personalized with my name) are being automatically hard-coded denied. The rear legal jargon is slightly different from card-to-card but both are Metabank.

Same store, different cards, I purchased MOS with ease just one month ago (Sept 2021). Now this new batch is being rejected automatically.

Just had all my cards at Chase closed by them, unannounced. Any thoughts on how to get them to reopen. Been with them for 20 yrs with all my banking

[…] live near a mall, this process is a super easy way to spend from the couch. Just keep in mind the Mistakes to avoid on $1K Simon Visa Gift Cards. If you haven’t read that post, I highly recommend reading it before getting into […]

[…] To that end, I recommend reading a post I wrote last year when Simon debuted the $1K Visa Gift Cards at their malls: Mistakes to avoid on $1K Simon Visa Gift Cards. […]

“The key tip here is to keep MS banking activity separate from the banks where you maintain credit card relationships and to make sure you aren’t structuring your deposits.” To me this seems paradoxical because structuring in itself is knowingly avoiding BSA/CTR reports. Using different banks is borderline structuring because it involves partitioning money to avoid raising red flags. What’s your take on this? Also, another option would be to purchase cryptocurrencies with a debit card since it does not involve the banks. The only reason to do this would be to hit the min spend because crypto transaction fees eat up the profit.

You’re misunderstanding me. I’m definitely not suggesting you split deposits to stay under reporting thresholds . I’m suggesting you don’t deposit your money orders in a bank where you have credit cards or do other business since those banks may shut down your accounts due to discomfort with MO deposits. I’d rather be shut down by a bank I don’t need than a bank that issues 5 credit cards that I want.

Just be aware that the banks can and DO SHUT down cards. Looking back I don’t think it was worth it. I had a ton of Chase cards and one day they stopped working. Chase shut down ALL my credit cards and even my checking and savings accounts with them. I’ve been a long time loyal customer but they deemed these purchases as too risky for them. I got a letter saying that ALL my credit cards were shut down. Then a few weeks later they shut down my checking and savings and told me to withdraw the funds.

Just last week Citibank shut down ALL my credit cards as well for the same reason. I used a few of their cards to buy massive amounts of cards at Simon Malls. So be forewarned about this.

May I ask what do you mean by “massive amounts”? Is it $10K per month, $100K, or $800K? TIA.

Well I started out small a few months ago when there were just the $500 cards I was using 4 and getting $2,000 Money orders at Walmart. Then when they came out with the $1,000 cards I was doing $4,000 at a time. I’d do maybe $8,000 per week or around $35,000 per month. Some months I’d go harder and do over $50,000.

The the Walmarts near me banned any use of gift cards and it was getting harder anyway but it was too late. This Chase and Citibank shutdown clearly show that they can easily just figure out who is buying these VGC’s from Simon Mall. You might not think you are on their radar but you are.

It’s not worth it to get totally shut down from Chase or Citibank. I’m the type that had six figures organic spend on the card each year so it was a major bummer to get shut down on both of these cards where I had a lot of great cards.

I’m really surprised to hear you got shut down with that little volume, exponentially so if you had six figures of organic spend on your cards. Were you doing bill pay to pay the cards? Were you cycling your CLs often? Were you depositing MOs at Chase? There had to be some extenuating circumstances.

FYI for anyone else reading this, cycling with Citi is a very common trigger for Citi shut down. Depositing MOs with a bank that issues the CCs is a common trigger for shut down also.

Definitely a bummer that you got shut down — I’m very sorry to hear it.

Hi Nick,

No, I wasn’t getting anywhere near my credit limits. My credit limits on Chase Sapphire Reserve, Freedom are all high. On CSR it was $50,000 and on Freedom it was about $47,000. On my Citibank Executive Card it was about $69,000.

No, I wasn’t depositing into Chase or Citibank. Just into my Wells Fargo to pay the bills. Mostly just getting money orders but yes I did do a few bill pays but nothing crazy.

I know people that have done far more MS’ing than I do. A few in my local FB group also got shut down on Citibank and Chase so I know it’s not just me. Just something to look out for as it’s not worth it to get totally shut down from Chase as they have a LOT of the good credit cards out there.

A friend mentioned the same thing happened to him and he just had to wait 2 years and then Chase let him open back up. But honestly I’m not sure how long I’ll have to wait.

Bummer.

Strange. Bill pays are a known trigger (some people find they work fine for years….until one day they don’t). It’s not that shut downs never happen — that is of course a risk here — but typically they involve things like suddenly ramping up spend way beyond your normal spending activity all at once, cycling CLs, depositing MOs where you shouldn’t, or anonymous bill pays. Obviously the numbers you’re quoting aren’t small, but on the other hand with Simon allowing up to $25K at a time there are people doing far more.

On the bright side, as you said, some folks do find a way back in and there are other cards on the market. That’s no consolation at all today and I understand the perspective of asking “was it worth it?”. Some will say no. Others will say that the rewards they reaped while they could far eclipsed what they could have gotten otherwise. It’s a debate with no single correct answer. Have you tried getting reinstated with Chase? I have no idea how feasible it is, but it might be worth trying to see if they’ll reconsider the decision. Citi is less likely to reconsider.

If you have a partner, hopefully they are not also shut out and hopefully you’ll then have some opportunity to get the rewards you want moving forward. Not to pile bad news on, but to make you aware of something to look out for, I have heard of Citi shutting down the accounts of AUs after shutting the accounts of the primary cardholder.

[…] come to the office and request the cards. New customers are welcome to buy, but see my post about Mistakes to avoid on $1K Simon Visa Gift Cards if you’re new to the field. I encourage those new to go slow and test what works before […]

Nick, I started MSing a week ago after doing a bit of reading/homework. Based on my “testing the water” experience it appears I might be residing in an MS friendly area. I have a question regarding your advice “ramp up slowly”. Is it relatively safe to MS $1k each on CSP, cap1, Citi, discover, Oldnavy? On each individual card/bank its just a 1K for a billing cycle but in total its $5k which would be a sudden 3X increase from my average monthly organic spend. Is this a “ramp up slowly” strategy or a potential red flag for banks? I guess the question I am asking is does a bank receive info from C bureaus as to how much a customer is spending on all of their CCs, i.e., CCs issued by other banks? Thanks for your help!

Yes, that’s definitely relatively safe and a good way to start.

As far as banks knowing how much you’re spending, other banks will only see what gets reported when your statement closes. If you pay the bill off before the statement date, your balance will be reported as $0 and that’s what other banks will see.

Thanks, Nick. So the idea is to pay off the entire balance before statement closes, is this a usual MS strategy? I generally like to take advantage of 0% APR promotions by putting all of my expenses on CC, pay minimum due each month, and put all of my money in a high yielding bank account ( I have never paid a penny in interest to CC issuers). But if paying in full before statement end is the norm in the MS world I would certainly like to follow.

Not necessarily just for MS but also for maintaining a good credit score. Utilization makes up 30% of your credit score — high utilization (overall or on a single card) hurts your score (and therefore makes it more likely for an account review that could draw eyes to your MS activities. My advice here is general — there are nuances (for example, US Bank reports your balance on the last day of the month rather than your statement cut date; Chase will report the new $0 balance if you pay in full mid-cycle, BOA sometimes reports mid-cycle if you have a huge spike in spending, etc). But generally speaking, you want to pay your balances in full before the statement cuts (to really hit the max for your score bucket, you actually want to let $1 or $2 report on the statement for exactly 1 credit card, but that’s more of a thing for credit score hobbyists than it is practical / necessary). Anyway, your question was whether or not other banks will see your MS activity — if you pay off your balances before the statements cut, the answer is generally no.

Thanks a lot, Nick!!

Good one … laid out beautifully for a newbie

Hey Nick, I posted this in your other blog post but in case you didn’t see it….I went to the MIM, FL mall and I was told they only sell these to people with corporate accounts or businesses. The guy said he couldn’t sell to the general public. Is there a link to the simon mall offer somewhere I can show him? I would appreciate it. Thanks.

The first time I asked for the $1000 cards the person asked if I was on “the list”. I said no, and the person had to call her manager as she was not sure what to do. The manager was happy to give me a form to fill out and now I am “on the list”.

That was likely just a misunderstanding at the beginning when some reps didn’t yet understand how it should work. All reps should know at this point that you don’t need to be on any list to buy the $1K cards. You do need to build up a history (i.e. be on “the list” so to speak) to buy $25K at a time, but anyone can buy up to $10K (inclusive of fees). I followed up with corporate when JBCH reported the issue above you and they made sure that the mall was up to speed before JBCH went for a return trip.

Nick, from your experience, what is the history that I would need before I would be on “the list”? Is it 4 purchases of $2K, or more like 10 purchases of $10K? So far I have 3 visits of $1K, $2K, and $5K.

I’d just ask at your local mall. It varies a bit from mall to mall. If you tell them that you want to be approved to buy up to $25K at a time and ask them what you have to do in order to be able to do that, I’m sure they’ll tell you. Originally, I think we were told it was 10 transactions of $10K, but I’ve heard of people being approved for $25K with less than that, so I’d just ask.

Hi, can anyone please confirm that 1k cards works the same as $500 Simon visa cards (pin enabled and can be used to buy MO or load cards ) ?

Yes.

[…] current Simon Mall deal — $1,000 Visa gift Cards for a $3.95 activation fee — would be more attractive to be both on a cost and liquidation basis, though sites like […]

Although large scale acquisition just got easier, liquidation is still labor intensive. I wasn’t around for KATE, but I still miss KATE! I don’t want to be one of *those* people holding up the WMT money services line buying 10 @ $1K MOs. I still find it hard to justify 1.5x or 2x @$1k MS when there are still good opportunities for 5X @$200 at Staples/OD and 4X @$500 at Neighborhood WMT (which code as Groc Stores for AMEX).

So, does it have to be Walmart super store to code as groceries?

Walmart super stores don’t typically code as groceries for CC bonus categories if that’s what you’re asking. He’s saying Neighborhood Market.

@ReconScott: I certainly wouldn’t do MS at 1.5 or 2x if there was bandwidth left to be had in terms of 5x / 4x. The beauty of the Simon deal is that it adds what is for all intents and purposes nearly unlimited bandwidth beyond those things. By all means, cap out your 5x / 4x stuff. Don’t do this instead of that.

Are they selling them only at Simon Malls or also Premium Outlets?

Also at Premium Outlets.

Nick, thanks for this great article!

This may be a bit of a side bar.. but I have the A/E Blue Cash and must spend $6500 first to trigger the 5x categories.

I have purchased gift cards at Grocery stores in the past to accumulate that amount – but you mention A/E does not pay out on Gift Cards? Is this a fairly new policy? Or Is just for meeting the amount for a new card bonus?

Thanks.

I said they pay out 0 on Simon purchases. Grocery store spend has thus far been unaffected. Obvious GC purchases like Simon and GiftCards.com have failed to trigger welcome bonuses and spending bonuses like free night certs or AU bonuses. More recently, the Simon purchases specifically began earning 0.

Are there any datapoints on AMEX co-branded cards earning 0 points? I know the AMEX cards earning cashback and MR points earn 0 points, but what about the other AMEX cards like Marriott, Hilton???

Yes. See this post:

https://frequentmiler.com/did-amex-drop-the-bomb-on-simon-purchases/

Good job hitting on opportunity cost, which is huge.