| Card Details and Application Link |

|---|

Chase Sapphire Preferred® Card  ⓘ $985 1st Yr Value Estimate$50 prepaid hotel credit valued at $35 Click to learn about first year value estimates 75K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 75,000 bonus points after spending $5,000 within the first three months from account opening.$95 Annual Fee Click here to learn how to apply This is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Recent better offer: Expired 5/14/25: 100K after $5K spend FM Mini Review: Great welcome offer. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with no annual fee Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 5X Lyft through 9/30/27 ✦3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 10% annual point bonus Base: 1X (1.5%) Travel: 2X (3%) Flights: 2X (3%) Portal Flights: 5X (7.5%) Hotels: 2X (3%) Portal Hotels: 5X (7.5%) Dine: 3X (4.5%) Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Primary auto rental collision damage waiver ✦ Free DoorDash DashPass (min. one year, must activate by 12/31/27)✦ $10 off each month on one non-restaurant orders from DoorDash ✦ Transfer points to airline & hotel partners ✦ $50 back for hotel stays booked through Chase per cardmember year in the form of a statement credit ✦ Each account anniversary earn bonus points equal to 10% of total purchases made the previous year. |

Chase Sapphire Preferred Overview

The Sapphire Preferred card has long been a favorite for points collectors. It earns valuable Ultimate Rewards points, has no foreign transaction fees, and offers primary rental car coverage for $95 per year. Until the summer of 2021, the Chase Sapphire Preferred Card’s perks were straightforward: 2 points per dollar for all travel & dining purchases, no foreign transaction fees, and primary rental car coverage for $95 per year. As of August 16, 2021, though, Chase updated the earning structure and added new features:

- Earn 3x on Dining, Streaming Services, and Online Grocery (excluding Target, Walmart, and Wholesale Clubs).

- Earn 2x to 5x on travel

- Earn 5x on Travel Booked through Chase’s Travel Portal

- Earn 5x on Lyft (through September 2027)

- Earn 2x on all other travel

- Earn 1x on all other purchases

- 10% Anniversary point bonus: Each account anniversary, “earn bonus points that equal 10% of your total spend in points” based on spend in your cardmember year.

Note: This adds an extra 0.1x to all of your spend. If you spend $25,000 during the year, you’ll get 25,000 x .1 = 2,500 bonus points. You do not get extra points based on bonus categories. e.g. dining purchases, which earn 3x, effectively earn 3.1x not 3.3x thanks to this bonus. - $50 Hotel Credit: Each cardmember year, earn $50 back on hotels booked through Chase Travel. The portion of this spend that is rebated will not earn Ultimate Rewards.

In my opinion, The Sapphire Preferred card’s earning structure is good, but not exceptional. However, the card is a great choice for its welcome bonus and to unlock the ability to transfer Ultimate Rewards points to travel partners. You can do well by using this card plus various fee-free Ultimate Rewards cards to earn 3X to 5X in various categories of spend and then move those points to the Sapphire Preferred so that you can then transfer the points to airline and hotel programs.

Chase Sapphire Preferred Application Tips

- 5/24 Rule: You most likely will not get approved for a new card if you have opened 5 or more cards (with any bank) within the past 24 months. Most business cards do not count towards that five card total. Business cards that DO count include: TD Bank, Discover and the Capital One Spark Cash Select, Spark Miles and Spark Miles Select.

- 24 Month Rule: If you’ve previously had a card before, you can only get a welcome offer on that card again if you no longer have the card AND if it has been more than 24 months since you last received a welcome offer for that card. This rule does not apply to the Sapphire Preferred and Reserve cards (see below). There can be exceptions with some business cards.

- Sapphire cards: The Sapphire Preferred or Sapphire Reserve cards no longer have a family rule that prevents you from getting one if you currently have the other. However, both now have significant limitations that may prevent you from being eligible for a welcome offer if you've previously had the same card. In that event, you'll get a pop-up window that tells you that you're not eligible before you get a credit check and will ask whether or not you want to proceed with the application without the welcome offer attached.

- Southwest "Family" Rules: Chase applies additional "family" rules to the Southwest cards. You're not eligible for the welcome offer on a personal Southwest card if you currently have one, or if you've received a welcome offer on any personal Southwest card within the last 24 months. This doesn't apply to business cards. You also can't be approved for the Southwest consumer card if you already have one open.

- IHG "Family" Rules: You're not eligible for the welcome offer if you've received a welcome offer on any personal IHG card within the last 24 months. You also can't be approved for another IHG consumer card if you already have one open. You can have both an IHG personal and an IHG business card.

- 2 per month Rule: Most applicants are limited to 2 new cards per 30 days. Business cards are usually limited to one per 30 days.

- Marriott cards: Approval for any Marriott card is governed by a labyrinthine set of unintuitive rules. You can see the full eligibility chart here.

- Card Limits: Chase doesn't have a strict limit on the number of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. Because of this, reconsideration can sometimes be successful by moving credit from one existing card to the new card that you want.

- Application Status: Call (888) 338-2586 to check your application status.

- Reconsideration: If denied, call (888) 270-2127 for personal cards, or (800) 453-9719 for business cards, and ask for your application to be reconsidered.

Should you apply?

The Sapphire Preferred card usually has a terrific welcome bonus. Interestingly, the Sapphire Preferred bonus is usually better than the bonus for the Sapphire Reserve. For that reason, it can make sense to sign up for the Sapphire Preferred card even if you really want the Sapphire Reserve. You should be able to upgrade to the Sapphire Reserve after year simply by calling Chase to request the product change.

If you are eligible (see next section), the welcome bonus on this card makes it a great choice.

Are you eligible?

To get this card you must be under 5/24, you must not be a current Sapphire Preferred or Sapphire Reserve cardholder, and at least 48 months must have passed since you last received a new cardmember bonus for the Sapphire Preferred or Sapphire Reserve card.

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

How to apply

You can find the current best welcome offer at the top of this post.

Application status

After you apply, call (888) 338-2586 to check your application status.

Reconsideration

If your application is denied, I recommend calling for reconsideration (1-888-270-2127). It’s surprising how often denials can be changed to approvals just by asking.

Chase Sapphire Preferred Perks

Premium Ultimate Rewards

Since this is a premium Ultimate Rewards card, the following rewards are available:- Redeem points for more value through Chase Travel℠:

- 1.25 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.25x through Chase Travel℠ until October 26, 2027.

- Up to 1.75 cents per point: Cardmembers are eligible for Points Boost offers of up to 1.75x for premium cabin flights and up to 1.5x for other travel booked through Chase Travel℠.

- Transfer Points to Partners: Points can be transferred one to one to a number of airline and hotel loyalty programs.

- 10% annual point bonus: 10% bonus on total account year spend based on a rate of 1 point for each $1 spent (so, if you spend $30K during your account year, you'd get a 3K anniversary bonus).

Travel Benefits

- No foreign transaction fees

- $50 Hotel Credit: Each cardmember year, earn $50 back on hotels booked through Chase Travel℠. The portion of this spend that is rebated will not earn Ultimate Rewards. Those who have the card open before August 15, 2021, will have to wait until their next account anniversary after that date to begin earning this credit.

Travel Protections

- Auto Rental Coverage: Chase offers primary auto rental CDW (collision damage waiver). Here's the description directly from Chase: "Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $60,000 for theft and collision damage for most rental vehicles with an MSRP of $125,000 or less."

- Trip Cancellation / Interruption Insurance: "If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels."

- Trip Delay Reimbursement: "If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket."

- Lost Luggage: Reimburses for costs incurred to repair or replace checked or carry-on bags and property within if loss or damage occurs during a covered trip. Coverage is up to $3,000 per person per trip (or up to $500 for jewelry, watches, cameras, video recorders, and other electronic equipment).

- Baggage Delay Insurance: "Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days.

- Travel Accident Insurance: When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $500,000

Purchase Protection

- Extended Warranty: "Extends the time period of U.S. manufacturer's warranty by an additional year, on eligible warranties of three years or less."

- Damage and Theft Protection: "Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account."

Food Delivery Benefits

- DoorDash: Free DashPass through 2027.

- DoorDash: $10 off each month on one non-restaurant orders.

Lyft Rideshare Benefits

- 5X Rewards: Use your Sapphire Preferred card with Lyft in order to earn 5 points per dollar through 9/30/2027. That's 3X points in addition to the 2X points you already earn on travel.

Chase Sapphire Preferred Earn Points

Welcome Bonus

This card earns super-valuable Ultimate Rewards points. Here’s the current best public welcome offer (but note that at the time of writing the alternate offer, in-branch only 90K, is the one to go for if you can):

| Card Details and Application Link |

|---|

Chase Sapphire Preferred® Card  ⓘ $985 1st Yr Value Estimate$50 prepaid hotel credit valued at $35 Click to learn about first year value estimates 75K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 75,000 bonus points after spending $5,000 within the first three months from account opening.$95 Annual Fee Click here to learn how to apply This is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Recent better offer: Expired 5/14/25: 100K after $5K spend FM Mini Review: Great welcome offer. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with no annual fee Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 5X Lyft through 9/30/27 ✦3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 10% annual point bonus Base: 1X (1.5%) Travel: 2X (3%) Flights: 2X (3%) Portal Flights: 5X (7.5%) Hotels: 2X (3%) Portal Hotels: 5X (7.5%) Dine: 3X (4.5%) Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Primary auto rental collision damage waiver ✦ Free DoorDash DashPass (min. one year, must activate by 12/31/27)✦ $10 off each month on one non-restaurant orders from DoorDash ✦ Transfer points to airline & hotel partners ✦ $50 back for hotel stays booked through Chase per cardmember year in the form of a statement credit ✦ Each account anniversary earn bonus points equal to 10% of total purchases made the previous year. |

Refer Friends

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Referring friends is often a good way to earn extra points with Chase products, but referral offers come and go over time. When referral offers are available, Chase sends emails to eligible cardholders with the offer details. Cardholders can also look for Chase friend referral offers here.

Bonus Spend

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 5X Lyft through 9/30/27 ✦3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 10% annual point bonus |

Chase Sapphire Preferred Redeem Points

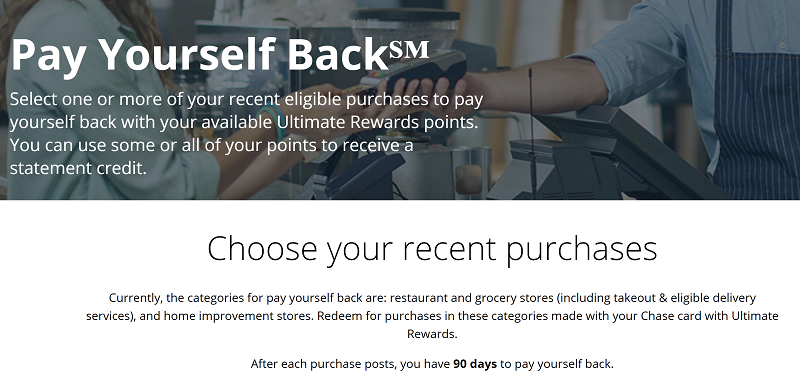

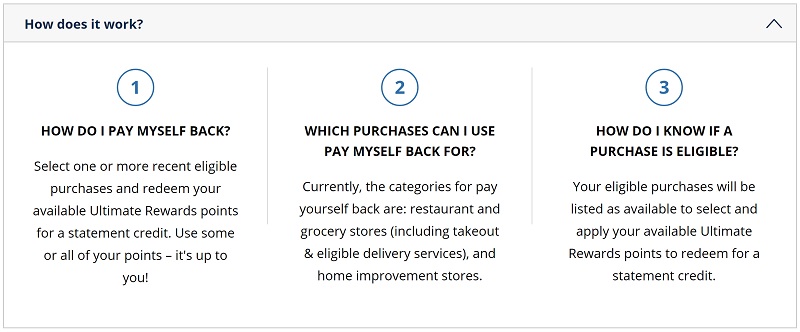

Pay Yourself Back

Chase allows most Sapphire, Freedom, and Ink cardholders to “Pay Yourself Back”. The basic idea is that you can exchange your points for statement credits against certain categories of purchases. Here’s the link to use this feature yourself.

Chase allows most Sapphire, Freedom, and Ink cardholders to “Pay Yourself Back”. The basic idea is that you can exchange your points for statement credits against certain categories of purchases. Here’s the link to use this feature yourself.

Chase changes or renews the eligible categories every few months. When using this feature, Sapphire Reserve cardholders get 1.25 cents per point value for most categories, and all other eligible cardholders get 1 cent per point value. Chase used to offer 1.5 cents per point value for Sapphire Reserve cardholders and 1.25 cents per point value for Sapphire Preferred cardholders. That was a decent deal, but with the lower redemption values in play today, we no longer recommend this option.

Cash Back

Cardholders can redeem points for 1 cent each either as statement credits or as cash back. Cash back can be taken as a statement credit or via check or ACH transfer.

Travel

Redeem points for travel: Up to 2 cents per point

This option requires that someone in your household has the ultra-premium Chase Sapphire Reserve card. First move (combine) points from your no-fee card to the Sapphire Reserve account. Next, log into Chase under the Sapphire Reserve account, and go to the Chase portal to book your travel. Depending on when your Sapphire Reserve card was obtained, the value of your points may differ:- 1.5 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.5x through Chase Travel℠ until October 26, 2027.

- Up to 2 cents per point: Cardmembers are eligible for Points Boost offers of up to 2x for travel booked through Chase Travel℠. All hotel bookings with The Edit by Chase Travel℠ should qualify for 2x (details here).

Redeem points for travel: Up to 1.75 cents per point

This option requires that someone in your household has a premium card that earns Chase points: Chase Sapphire Preferred or Chase Ink Business Preferred. First move (combine) points from your no-fee card to one of these premium cards. Next, log into Chase under the account that now has the points, and go to the Chase portal to book your travel. Depending on when your card was obtained, the value of your points may differ:- 1.25 cents per point: For cardmembers who applied or otherwise obtained their card prior to June 23, 2025, points earned prior to October 26, 2025 are eligible to be redeemed at 1.25x through Chase Travel℠ until October 26, 2027.

- Up to 1.75 cents per point: Cardmembers are eligible for Points Boost offers of up to 1.75x for premium cabin flights and up to 1.5x for other travel booked through Chase Travel℠.

Details about booking travel through Chase

You can use the Chase portal to book airfare, hotels, cruises, activities, and car rentals. Airfare purchased through the portal still earns airline miles and elite qualifying miles. Hotels booked this way do not earn hotel rewards unless the portal specifically notes otherwise. Worse, hotels booked through the portal often won't offer you elite benefits even if you have status.Travel protections apply

When you pay with points for travel, Chase's automatic travel protections do apply. So, you can be covered for things like car rentals, trip delays, trip cancellation & interruption, lost luggage, etc. The coverage you receive will be based on which card's rewards were used to book the trip. For example, if you have both a Chase Sapphire Preferred and a Sapphire Reserve, you would want to move your points from the Preferred to the Reserve and then use the Reserve points to book your trip. You will get both better value and better travel protections. See: Sapphire Reserve Travel Insurance.Transfer points

Move points to premium or ultra-premium card first

You cannot transfer points directly from a no-annual-fee Chase card to airline or hotel partners, but you can move points first to a premium card (Sapphire Preferred or Ink Business Preferred, for example) or ultra-premium card (Sapphire Reserve) and then transfer the points to airline or hotel partners. Points can be transferred to the loyalty accounts of the primary cardholder or any authorized user on the account. Points can also be transferred to the loyalty account of a joint business owner, but they do need to be an authorized user on the associated business account.Transfer Partners

| Rewards Program | Best Uses |

|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. |

| JetBlue | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Other ways to redeem points

You can also use points to pay some merchants directly (Amazon.com, for example or via Chase Pay). Don't do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your points - causing you a headache in getting your points reinstated).

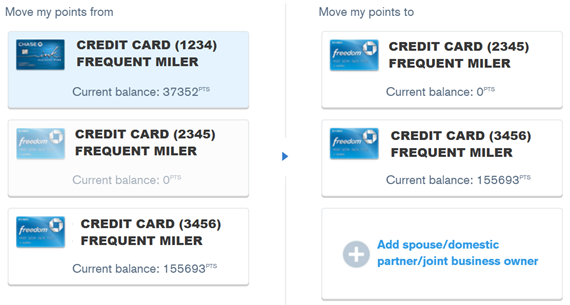

Chase Sapphire Preferred Manage Points

Combine Points Across Cards

If you intend to cancel a card that earns Chase points, you should first combine your points with a card you intend to keep active. Once you cancel, you will forfeit any unused points in that account. A product change should not affect your balance, but some people prefer moving points before a product change as well just to be safe.

Share Points Across Cardholders

Why this is valuable:

Why this is valuable:

- You earn points with the card offering the best return on purchases and then use points with the card offering the best redemption rate.

- Only one member of your household needs to maintain a premium card for transferring to partners or booking travel (though note that the primary cardholder can only transfer points to partner loyalty programs in the name of the primary cardholder or authorized users).

How to Keep Points Alive

Chase Sapphire Preferred Lifecycle

How to meet minimum spend requirements

Keep, cancel, or product change?

Is this card worth keeping in the long run? The main reason to keep this card around long term is as a way to transfer points to airline and hotel programs. You can get that same capability from the Sapphire Reserve or Ink Business Preferred, so you may find that one of those cards fits your needs better.

Related Cards

Ultimate Rewards Business Cards

| Card Offer and Details |

|---|

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available$0 introductory annual fee for the first year, then $95 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Earning rate: ✦ 5X office supplies, 5X cellular/landline/cable ✦ 2X gas and hotels ✦ 5X Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Points worth 25% more when redeemed for travel ✦ Transfer points to airline & hotel partners See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1029 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750(*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: This one should be in everyone's wallet. Incredible welcome offer for a no-annual-fee card. Great card for 5X categories. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5x Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1277 1st Yr Value EstimateClick to learn about first year value estimates 100K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 100K after $8K spend in the first 3 months$95 Annual Fee Recent better offer: 120K after $8K spend (expired 9/4/24) FM Mini Review: Great card for welcome offer and 3X categories. Also consider the Ink Business Cash for its 5X categories, and the Ink Business Unlimited to earn 1.5X everywhere. Earning rate: 3X travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year) ✦ 5X Lyft through September 2027 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Points worth up to 75% more when redeemed for travel with Points Boosts ✦ Transfer points to airline & hotel partners ✦ Cell phone protection against theft or damage See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1074 1st Yr Value EstimateClick to learn about first year value estimates $750 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer $750 (*awarded as 75,000 points) after $6k spend in the first 3 months.No Annual Fee Recent better offer: $900 (*awarded as 90,000 points) after $6k spend in the first 3 months. (Expired 11/13/25) FM Mini Review: Great welcome offer for a no annual fee card. Good option for earning 1.5X everywhere. Good companion card to Ink Business Preferred, Sapphire Reserve or Sapphire Preferred. Click here for our complete card review Earning rate: 1.5X on all business purchases ✦ 5X Lyft through September 2027 Base: 1.5X (2.25%) Card Info: Visa Signature Business issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $20 monthly Instacart credit See also: Chase Ultimate Rewards Complete Guide |

ⓘ $1595 1st Yr Value Estimate$300 travel credit valued at $285, $500 Chase The Edit credit (2x per calendar year) valued at $125, $100 GiftCards.com credit ($50 Jan-Jun and again Jul-Dec for cards purchased from https://reservebusiness.giftcards.com/) valued at $50 Click to learn about first year value estimates 150K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 150K points after $20K spend in first 3 months.$795 Annual Fee Recent better offer: 200K points after $30K spend in first 6 months. (Expired 1/22/26) FM Mini Review: Could be very appealing for a business that books a lot of travel, as it earns 8x through Chase Travel℠ or 4x when booking direct through airline and hotels. It has decent perks, best-in-class travel protections, and earns valuable Chase Ultimate Rewards points. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X social media and search engine advertising ✦ 5X Lyft (through September 2027) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $120,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $500 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Up to $500 The Edit credit ($250 twice per calendar year) ✦ Up to $400 ZipRecruiter credit ($200 January to June and again July to December) ✦ $200 Google Workspace credit ✦ $100 Giftcards.com ($50 January to June and again July to December for purchases at giftcards.com/reservebusiness) ✦ Points worth 2 cents each towards qualified bookings through Chase Travel(SM) ✦ Transfer points to airline & hotel partners ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

Ultimate Rewards Consumer Cards

| Card Offer and Details |

|---|

ⓘ $292 1st Yr Value EstimateClick to learn about first year value estimates $200 cash back* ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer Earn $200 (*awarded as 20,000 points) after spending $500 in the first 3 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great for 5X and 3x categories and World Mastercard benefits. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Earning rate: 5x travel booked through Chase Travel℠ ✦ 5X Lyft through September 2027 ✦ 3x dining ✦ 3x drugstores ✦ 5X in rotating categories on up to $1,500 spend per quarter Card Info: Mastercard World issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ Cell phone protection ✦ Lyft credits ✦ $10 quarterly credit for non-restaurant DoorDash orders See also: Chase Ultimate Rewards Complete Guide |

ⓘ $296 1st Yr Value EstimateClick to learn about first year value estimates $200 cash back* ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn $200 (*awarded as 20,000 points) after spending $500 in the first 3 monthsNo Annual Fee Alternate Offer: Rakuten is offering bonus cashback or bonus points for this card This card is likely subject to Chase's 5/24 rule (click here for details). Recent better offer: Unlimited Double Cash Back for 12 month (expired 1/11/24) FM Mini Review: Great for 3x categories and 1.5X everywhere else. Excellent companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Click here for our complete card review Earning rate: 5x travel booked through Chase Travel℠ ✦ 3x dining ✦ 3x drugstores ✦ 2% cash back total on qualifying Lyft products and services purchased through the Lyft mobile application through 09/30/2027 ✦ 1.5X everywhere else Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ $10 quarterly credit for non-restaurant DoorDash orders See also: Chase Ultimate Rewards Complete Guide |

ⓘ $0 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer availableNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Great for 5X categories. Good companion card to Sapphire Reserve, Sapphire Preferred, or Ink Business Preferred. Earning rate: 5X Lyft through September 2027; 5X in rotating categories on up to $1,500 spend per quarter Base: 1X (1.5%) Card Info: Visa Signature or Platinum issued by Chase. This card imposes foreign transaction fees. Noteworthy perks: Free DoorDash DashPass for 6 months upon activation ✦ $10 quarterly Instacart credit ✦ 3 months free Instacart+ See also: Chase Ultimate Rewards Complete Guide |

ⓘ $985 1st Yr Value Estimate$50 prepaid hotel credit valued at $35 Click to learn about first year value estimates 75K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn 75,000 bonus points after spending $5,000 within the first three months from account opening.$95 Annual Fee Recent better offer: Expired 5/14/25: 100K after $5K spend FM Mini Review: Great welcome offer. Unlocks ability to transfer points to hotel & airline partners. Solid option to pair with no annual fee Ultimate Rewards cards such as the Freedom cards, Ink Business Cash, and Ink Business Unlimited. Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 5X Lyft through 9/30/27 ✦3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 10% annual point bonus Base: 1X (1.5%) Travel: 2X (3%) Flights: 2X (3%) Portal Flights: 5X (7.5%) Hotels: 2X (3%) Portal Hotels: 5X (7.5%) Dine: 3X (4.5%) Card Info: Visa Signature issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: Primary auto rental collision damage waiver ✦ Free DoorDash DashPass (min. one year, must activate by 12/31/27)✦ $10 off each month on one non-restaurant orders from DoorDash ✦ Transfer points to airline & hotel partners ✦ $50 back for hotel stays booked through Chase per cardmember year in the form of a statement credit ✦ Each account anniversary earn bonus points equal to 10% of total purchases made the previous year. |

ⓘ $1544 1st Yr Value Estimate$300 travel credit valued at $285, $300 StubHub credit ($150 Jan-Jun and again Jul-Dec) valued at $75, $500 Chase The Edit credit (2x per calendar year) valued at $125, $300 Chase Dining credit for dining at Sapphire Reserve Tables restaurants ($150 Jan-Jun and again Jul-Dec) valued at $75 Click to learn about first year value estimates 125K Points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 125K after $6K spend in the first 3 months. $795 Annual Fee FM Mini Review: Good all-around card for frequent traveler. Best when paired with no annual fee Chase Freedom Flex, Freedom Unlimited & Chase Ink Cash cards. Click here for our complete card review Earning rate: 8X Chase Travel℠ ✦ 4X flights and hotels booked direct ✦ 3X Dining ✦ 5X Lyft (through September 2027) Base: 1X (1.5%) Flights: 4X (6%) Portal Flights: 8X (12%) Hotels: 4X (6%) Portal Hotels: 8X (12%) Dine: 3X (4.5%) Card Info: Visa Infinite issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: After spending $75,000 each calendar year, get the following benefits: IHG One Rewards Diamond Elite Status ✦ Southwest Airlines A-List Status ✦ $500 Southwest Airlines credit when booked through Chase Travel ✦ $250 credit to The Shops at Chase Noteworthy perks: $300 Annual Travel Credit ✦ Transfer points to airline & hotel partners ✦ Up to $500 The Edit credit annually ($250 twice per calendar year) ✦ Up to $300 Dining credit through Sapphire Reserve Exclusive Tables ($150 January to June and again July to December) ✦ Complimentary AppleTV+ and Apple Music through 6/22/27 ✦ Up to $300 in StubHub credits ($150 January to June and again July to December) ✦ Points worth up to 2 cents each towards qualified bookings through Chase Travel ✦ Primary auto rental coverage ✦ Priority Pass Select lounge access ✦ Access Sapphire Lounges for yourself and 2 guests for free ✦ Access select Air Canada Maple Leaf lounges when flying Star Alliance ✦ Up to $120 Global Entry or TSA PreCheck® or NEXUS Application Fee Statement Credit ✦ Free DoorDash DashPass through 2027 ✦ Two promos of $10 off each month on non-restaurant orders from DoorDash ✦ $5 off restaurant order each month from DoorDash ✦ $10 monthly Lyft credit See also: Chase Ultimate Rewards Complete Guide |

FYI, your article says “You can redeem Ultimate Rewards points for… experiences through the Chase portal.“ However, it looks like this may no longer be a benefit for the CSP.

When I look at the benefits for the CSP from the app, it lists access to book experiences as a benefit, but when I navigate to that page it says my card is “not eligible” to book any experiences and no experiences display to browse through or select.

When I sent Chase a SM, they replied: “Jim, regrettably, experiences booking is not included to the earnings on the Chase Sapphire Preferred card.“ and listed the benefits and they did not include experiences. I’m not sure this is a huge deal but it’s irritating when banks do this kind of thing. What other benefits are they doing this with?

Auto Rental Coverage has new details: · Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to $60,000 for theft and collision damage for most rental vehicles with an MSRP of $125,000 or less.

In my notes, I also added: Rentals for 31 days or less. Cardmember must be listed as primary renter.

Thanks for all your great work!!

For CSP you may wish to update the 5X on Lyft date to 2027

Is there a way to find the exact date a previous Sapphire bonus posted? I know the date I previously opened the card, and when the spend was due, but I don’t have a record of when the 48 month clock actually began.

I secure messaged Chase and they told me the date (it was my statement date that month/year). Hope this helps. I was also able to go back into my statements and find it myself if you don’t feel like waiting for Chase to reply.

I currently have the Sapphire Reserve (sign up bonus received 8 years ago) so what are the mechanics I should follow to take advantage of this sign up bonus?

Is it simply product change my Sapphire Reserve to something else like the Freedom Unlimited and then apply for the Sapphire Preferred? If so, is there any amount of time I need to wait after product changing before applying?

Conventional wisdom is that you should wait about a week after product changing before trying to apply. It might work sooner, but it does take the system some amount of time to recognize that you’re no longer a cardholder.

I’m not quite 48 months removed from my last sapphire bonus…. Does anyone know how long the 100k bonus offer will last? Or have any data points on how long Chase limited-time offers last in general?

We rarely know in advance when an intro bonus offer will end (and when we do, it usually isn’t far in advance). Some offers last weeks, others months. It’s hard to know for sure.

For the 48 month rule, do I have to wait 48 months after being approved or 48 months after having received the SUB?

My referral link is showing 100k for Sapphire Preferred

Is the $1025 first year valuation still right without the $300 travel credit that expired? I think the valuation didn’t adjust.

Pretty sure the 90k Sapphire Preferred has expired in Sept. I went into a branch today and there was an elevated offer of 70k for the Sapphire Preferred to apply there.

Hi, I am new here. This link worked yesterday morning for the 80k bonus; then when I went to sign up at 2:00pm, it no longer works. It still says “This offer is no longer available”. Does this happen often? Do the offer links on your website start working again after they are taken down like this? Thanks for your help!

It seems like the offer has gone back down to 60k SUB. I tried sending my wife a referral link and it said 60k. I tried just going to chase’s site to sign up for the card and it was also 60k

For me it says there is an outage, but I can go to their page or link off other sites and it works fine. This offer must be expired.

I applied (via your link) for Chase Sapphire Preferred. After filling out all info, it spun and spun, said it would time-out if I don’t click to continue. This happened several times, it finally timed out for good.I have never seen this behavior before. Should I re-apply and start over? Could it be related to using DuckDuckGo?

Strange. I haven’t seen that happen. Yes, I’d recommend starting over, and just in case, use a browser that doesn’t have DuckDuckGo running.

Success today! I applied online using Chrome, got the “we will let you know” message. Called reconsideration line and in about 2 minutes was approved. Just needed to move some of the credit limit from a Freedom card to the Preferred.

Congratulations!

How long after you applied did you call the reconsideration line and get them to approve your app? I applied two days ago and when I call the reconsideration line the automated message says my application is still pending.

Is the in-branch offer with $50 groceries and $0 AF also up to 100K points?

Will Chase match to this if you are still in the process of meeting the SUB spend for that offer?

I don’t know what the current in-branch offer is.

No: most likely Chase will not match (but it can’t hurt to call and ask)

[…] good to go. For example, points acquired through the Chase Freedom card can be moved to a Chase Sapphire Preferred account and then transferred to airline or hotel […]

[…] Sign up for the fee-free Chase Sapphire Preferred card. This offers both a great welcome bonus and the ability to redeem points at better than 1 cent […]