NOTICE: This post references card features that have changed, expired, or are not currently available

Chase often offers excellent bonuses on popular cards like the Sapphire Reserve card, Ink Business Cash and Ink Business Unlimited cards, so there is commonly interest in what awesome things can be done with the points earned from those bonuses. If you think that you can’t qualify for the Ink business cards because you don’t think you have a business, or maybe you don’t know how to go about signing up for a business card, I highly recommend reading “How to sign up for Chase Ink cards.” Also, if you’re unsure if you can qualify for a new Chase card because you’ve signed up for multiple cards in the past two years, see: “Chase 5/24 Rule: How to Count Your Status.”

Basic Info About Ultimate Rewards Cards & Points

| Card Type | Consumer | Business |

|---|---|---|

| Fee Free Cards | Freedom Flex: 5x rotating categories capped at $1,500 spend per quarter. 5x travel booked through Chase Travel℠. 3x dining & drugstore. 1x everywhere else. | Ink Business Cash: 5x at office supply stores and on internet, cable and phone services, up to $25K spend per account year. 2x gas and restaurants. 1x everywhere else. |

| Freedom Unlimited: 5x travel booked through Chase Travel. 3x dining & drugstore. 1.5x everywhere else. | Ink Business Unlimited: 1.5x everywhere. | |

| Premium Cards: $95 per year | Sapphire Preferred: 3x dining, select streaming services, and online grocery. 2x travel. 5x travel booked through Chase Travel. 1x everywhere else. This card also offers a 10% annual point bonus, so 3x becomes 3.1x, 2x becomes 2.1x, etc. | Ink Business Preferred: 3x travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year). 1x everywhere else. |

| Ultra Premium: $795 per year | Sapphire Reserve: 3x dining. 8x travel booked through Chase Travel. 4X flights and hotels booked direct |

If you have a lot of spend, you can rack up points quickly by using the above cards wisely. But that leaves the question of how best to use those points. Separately we published “Chase Ultimate Rewards sweet spots” which lists many ways to get great value from your points. That post is an awesome resource for those who already have the basics down. For everyone else, this post is intended to give you specific examples of great ways to use your points. This post is not intended to be a complete guide to all good uses for Chase points but rather an overview of a number of good uses so that you’ll know where to begin looking.

Here are some things you should know about Chase Ultimate Rewards points:

- Move points to a household member or business partner: You can freely move your points from one Chase account to another as long as the other account is owned by a household member or a business co-owner.

- Fee-free cards are advertised as “cash back” but really earn points: Chase Freedom cards, Ink Business Cash, and Ink Business Unlimited cards are all advertised as cash back cards. In practice, though, they earn Ultimate Rewards points. If you only have a fee-free card, then those points are usually worth only 1 cent each. However, if you move the points to a premium card, you can get much better value!

How NOT to use your points

Chase Ultimate Rewards points can always be cashed out at 1 cent per point. You should try to get better than 1 cent per point value, but never get worse.

- Don’t redeem points for merchandise or gift cards: Most point redemptions for merchandise and gift cards offer only 1 cent per point value. If you want to use your points this way it’s better instead to cash out your points to your bank account and then use your credit card to buy the things you want so that you’ll earn rewards for the purchase. Exception: sometimes Chase offers a discount on gift card redemptions. Even then, I don’t usually recommend this, but if you really need the gift cards and really want to spend points to get them, it’s not a terrible use of points.

- Don’t transfer points to IHG: IHG often has promotions where they sell their points for as little as half a cent each. This means that cashing out your Chase points and then using the cash to buy IHG points when on sale can result in getting up to twice as many points as transferring to IHG directly.

- Rarely transfer points to Marriott: Marriott points are usually worth less than 1 cent per point towards free nights. In most cases, you’d be better off booking your Marriott stay through Chase Ultimate Rewards and paying with points to get 1.25 to 1.5 cents per point value. Exception: In some rare cases, Marriott points can be worth much more than 1 cent each. When that’s the case, it can make sense to transfer your points.

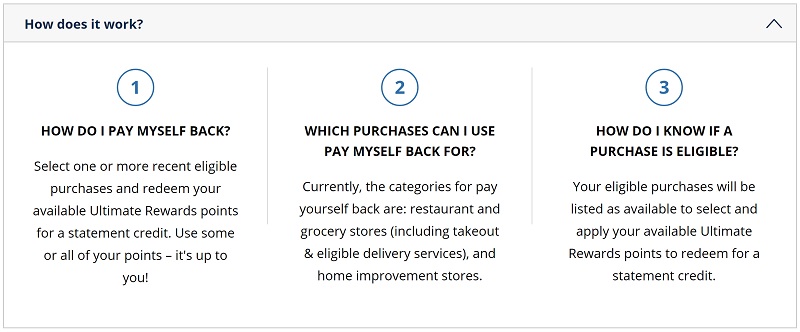

Do: Pay Yourself Back

Chase offers an innovative way to use your points: Pay Yourself Back. The idea is that you can use your card directly with certain merchants or merchant categories and then use points to erase those charges. The great thing about this is that you’ll still earn points for those charges that you erased! With the Sapphire Reserve card you’ll get 1.5 cents per point value, and with the Sapphire Preferred and Ink Business Preferred cards you’ll get 1.25 cents per point value.

For details and current categories available, see: Chase “Pay Yourself Back”.

Do (Sometimes): Book Travel through Chase Travel℠

When booking travel through Chase Travel℠, you’ll sometimes get better than 1 cent per point value with a premium card through PointsBoosts. Learn more about PointsBoosts in this post.

Chase lets you use points in this way to book flights, hotels, car rentals, “things to do”, vacation rentals, and cruises. To book, log into Chase here: ultimaterewardspoints.chase.com/travel/

Unfortunately, there are several downsides to booking travel this way:

- Airfare: If things go wrong, or you need to make changes, the airline will likely tell you that you have to go through your travel agent. This can make things much more complicated. Also, if you have to cancel a flight, any residual value may be held with Chase Travel℠ rather than directly with the airline and so you’ll have to go through Chase again to use that credit.

- Hotels: If the hotel you book has its own rewards program, you won’t earn points or elite recognition when booking through Chase. You also cannot apply discounts that are available when booking directly such as AAA, AARP, member rates, government rates, etc.

- Car Rentals: You cannot apply discounts that are available when booking directly. Plus, you won’t earn car rental rewards for these bookings. Further, if you have elite status with the car rental company, your status may not be recognized.

Do: Transfer points to airline & hotel programs

This is the way to go!

Chase offers a number of airline programs to which you can transfer your points 1 to 1. For a complete list, see: Chase Transfer Partners. By transferring points wisely, it’s often possible to get fantastic value for your points.

Please keep in mind these tips:

- Always have at least 1 transferable account: Chase Ultimate Rewards cards with no annual fee (such as Freedom Flex, Freedom Unlimited, and Ink Cash) do not directly allow point transfers to partners. However, if you or a household member or business co-owner have at least one card that permits transfers, then you’re good to go. For example, points acquired through the Chase Freedom card can be moved to a Chase Sapphire Preferred account and then transferred to airline or hotel partners. Cards that allow point transfers include: Chase Sapphire Reserve, Sapphire Preferred, and Ink Business Preferred.

- Wait to transfer points: Don’t transfer points until high value awards are available and you are ready to book them. Transfers are one-way only. Chase Ultimate Rewards points are valuable for their flexibility. Once you transfer, you are locked into a single program that may or may not have awards available.

- Check Award Value Before Transferring: Just because an award exists doesn’t mean that it’s a good idea to book it. For example, you might find that a flight is available for 25,000 miles, but the cash rate for the same flight is only $200. If you were to transfer your Chase points to an airline for this purpose, you’d get only 0.8 cents per point value.

- Partners Sometimes Offer Better Value: When booking flights, you’ll sometimes find better value booking an award using miles from a partner airline rather than the one you want to fly. For example, Air Canada Aeroplan sometimes charges fewer miles to fly United than United charges its own members for the same flight.

Transfer points to Hyatt!

While Amex points and Citi points are best used with airlines, my favorite use of Chase Ultimate Rewards points is to transfer points to Hyatt. Hyatt has a generous award chart with standard award prices starting at only 5,000 points per night and maxing out at 40,000 points per night.

One awesome thing about using Hyatt points is that you don’t have to try hard to get excellent value. In my most recent analysis, I found that I averaged over 1.6 cents per point value without trying to find good value awards (see: What are Hyatt points worth?). With many properties, you can easily get much more value. Plus, when using points to book award stays, you never have to pay resort fees!

Stay in Amazing Luxury Hotels

Hyatt owns a number of luxury brands such as Alila, Andaz, Miraval, Park Hyatt, Thompson, and the Unbound Collection. In most cases (Miraval is an exception), award prices for standard rooms top out at 45,000 points per night. So, when booking a luxury hotel that otherwise sells for $900 per night, you’ll easily get 2 cents per point value (and often much more) even before accounting for savings due to taxes and resort fees on paid rates.

One of my favorite Hyatt stays ever was at the Alila Ventana Big Sur (pictured above). Ventana’s rooms normally start at over $1,500 per night, but they can alternatively be booked for 35,000 to 45,000 points per night. This is the type of place I’d never even consider booking if it wasn’t for the great value available through Hyatt points!

Other luxury Hyatt hotels I’ve stayed at and loved include:

- Andaz Papagayo in Costa Rica

- Park Hyatt Vendome in Paris

- Park Hyatt Zurich

Worth a mention is the Grand Hyatt Kauai. I haven’t yet stayed there, but Nick has and he loved it. See: Grand Hyatt Kauai: a great guest of honor stay and great redemption.

Use Hyatt Points to Stay in Amazing Suites

Unlike most other hotel award programs, Hyatt makes it easy to use points to book both standard and premium suites. You can book a suite entirely with points or you can book a hotel at a standard upgradeable rate and use points to upgrade to a suite. In many cases this makes it possible to stay in incredibly expensive suites at a very low cost.

See these posts for details:

- Finding extreme luxury in Hyatt Premium Suites

- Most exciting Hyatt premium suites bookable with points in the US

- The most Incredible Hyatt suites bookable with points worldwide

- How best to book Hyatt luxury suites

Transfer points to airline partners

Transferring Chase points to airline miles can be a great way to get great value. This is especially true for international business or first class flights. Below you’ll find examples of some of the best awards bookable with Chase partners…

Fly First Class to Japan for 60K points or less one-way

ANA’s first class is reportedly fantastic. This is an amazing use of points! The trick is to transfer Chase points to Virgin Atlantic and then call Virgin Atlantic to book ANA first class awards. Here are Virgin Atlantic’s award prices for flying ANA first class:

- Fly between Japan and Western U.S., Canada, or Australia: 55K points one-way.

- Fly between Japan and Central or Eastern U.S., or Europe: 60K points one-way.

If you can find first class award space (that’s the tricky part!), these prices are amazing. See also: Best uses for Virgin Atlantic points.

Fly Delta One business class to Europe for 50K points one-way

Delta will often charge hundreds of thousands of miles for a one-way business class flight to or from Europe. Their partner Virgin Atlantic, though, charges only 50,000 miles one-way for non-stop business class Delta One flights. This price doesn’t include flights to/from the U.K., but all other direct Delta flights will work if you can find award availability. In my experience, award availability comes and goes over time so it’s worth checking regularly.

See also: How to book Delta flights with Virgin Atlantic miles

Fly Iberia business class to Europe for as few as 34K points one-way

Iberia offers some incredible award prices for their own flights. In particular, lie-flat business class flights from New York, Boston, Chicago, or DC to Madrid, Spain, are very cheap: 34K during off-peak dates or 50K during peak dates.

Fly Anywhere with Air Canada’s Aeroplan

Air Canada’s Aeroplan miles can be used to book flights on any Star Alliance airline plus any one of their many other partners. The Star Alliance is the biggest of the 3 airline alliances and so that already makes Aeroplan a good choice. Then, add the fact that they have more additional partners that can be booked with miles than any other program and now you’ve really got something great. The more airlines that are available, the better chance there is of finding award flights that meet your needs. The route shown above is one that Nick booked and flew using Aeroplan miles for our 3 Cards, 3 Continents Challenge (read his recap here). Aeroplan additionally offers the ability to add a stop-over to any one-way award for only 5,000 additional points. This makes Aeroplan a great choice for almost any long distance international journey.

Fly Business Class to Two Africa Destinations for 168K Round-Trip

United Airlines has an interesting award option called an “Excursionist Perk”. The idea is that when booking a round-trip award, you can add a free flight within your destination region. While there are many ways to take advantage of this type of award, a simple approach is to design a trip with two destinations that are in the same region (United has their own definition of regions — details here).

In the example shown above, I priced out round-trip business class awards to South Africa. For the dates I looked at, United priced business class awards to South Africa at 168,000 miles round-trip. By doing an Advanced Search and changing the route to go from the U.S. to South Africa, then to the Seychelles, and then back to the U.S., the award price remained the same: 168,000 miles. That’s because the middle flight from Johannesburg South Africa to the Seychelles was free (except for about $40 in taxes).

Learn more about Excursionist Perk flights in these posts:

- Saving thousands of miles with United Excursionist Perk

- Maximizing (and understanding) United Excursionist Perks

- United Excursionist Perk Maps. Visualize regions to optimize awards.

Fly to Hawaii for 13K to 19.5K one-way

Several Chase transfer partners offer very good deals for flights from/to Hawaii:

- Air France: Fly Delta Airlines between the continental U.S. and Hawaii for 17,500 miles one-way in economy or 30,000 one-way in business class (unfortunately Delta rarely opens business class awards to Hawaii to their partners)

- British Airways: Fly American Airlines or Alaska Airlines economy class between the U.S. west coast and Hawaii for as few as 13,000 Avios points one-way.

- Singapore Airlines: Fly Alaska Airlines economy class between the U.S. west or mid-west and Hawaii for 13,500 to 14,000 miles one-way.

- Singapore Airlines: Fly United Airlines between the continental U.S. and Hawaii for 19,500 miles one-way in economy or 39,000 one-way in business class (unfortunately United rarely opens business class awards to Hawaii to their partners)

- Southwest: Southwest often has very cheap fares to Hawaii and since they base their award prices on their cash fares, the awards can be cheap too.

Conclusion

There are many exciting ways to use Chase points. This post was intended to give you a taste of some of them. I have no doubt that many readers will be eager to point out great value options that I left out (please do!). This post is not intended to show you how to accomplish these things though. For example, finding award space so that you can fly business or first class can be a very difficult trick on its own. The solution, though, usually varies by circumstance. If a type of award listed above sounds particularly appealing to you, I recommend searching for additional posts on the topic (e.g. search for “how to find Japan Airlines first class award availability”). Hopefully this post will at least help you decide next steps…

See also:

My latest use of UR was transfers to Hyatt and United. Both transfers were small to top off each account to book awards. For less than 44K of UR we reserved 4 nights in Osaka Hyatt in a suite and 2 United seats to return from Osaka to the US in PE. I like using stranded miles and points in this way.

Looks like it is 19,500 miles now in economy for US – Hawaii on United using Singapore miles.

Do you still have to call in to transfer points to a spouse?

The first time you do it, you need to call to connect accounts. After that you should be able to do it online

Thanks, wish they’d fix that so I didn’t have to call in like before.

Just a note that Hyatt Regency ABQ is no more. It is now “The Clyde.” Ugh. (Had a reservations for the suite in your photo half way down. Cancelled during covid after they reflagged.)

Bummer!

Right, that was awesome for 5k points and upgrade to a suite as a globalist!

great article!! This is my go-to site when I tell people who are interested in this hobby. Yes, it does take some time but it is sooo well worth it!

I’ve recently product changed my Preferred (acquired 09/20) to the Freedom Flex. Looking to add to my pile of points. Can I get the Reserve?

Thanks

You will be eligible for the Sapphire Reserve bonus once 48 months have passed since the bonus for the Sapphire Preferred posted to your account. And, of course, you will need to be below 5/24 at the time of application.

Thanks for the info. Guess I’ll go with an Ink then…