Time is winding down to secure your elite status requirements, snag your Companion Pass, and to make the most of your credit card “coupon book” perks. Here’s a checklist of points & miles related things that need to be done before its too late..

Earn elite status

Most loyalty programs have calendar year requirements for earning elite status. Airlines typically require spending a certain amount of money with the airline and some additionally require flying a certain number of miles or segments. Hotel programs usually require staying a set number of nights. In most cases, those requirements must be met in 2024 in order to have elite status in the 2024 elite year. One major exception: With American Airlines, you have until the end of February to reach your elite status goals.

Airline Elite Status

Here’s a selection of the top airline programs in the U.S., along with some hints for achieving status…

- American Airlines: You have until the end of February 2025 to achieve your 2025 elite goals. Keep in mind that credit card spend, portal rewards, Simply Miles rewards and more all deliver Loyalty Points towards status. Additional shortcuts:

- Barclays AAdvantage Aviator Silver: Earn up to 15K bonus Loyalty Points — 5K at $20K spend, 5K at $40K spend, and 5K at $50K spend during the status qualification period (e.g. March 1 through end of Feb)

- Citi® / AAdvantage® Executive: Earn 10K Loyalty Points when reaching 50K Loyalty Points during the status qualification period and another 10K when reaching 90K.

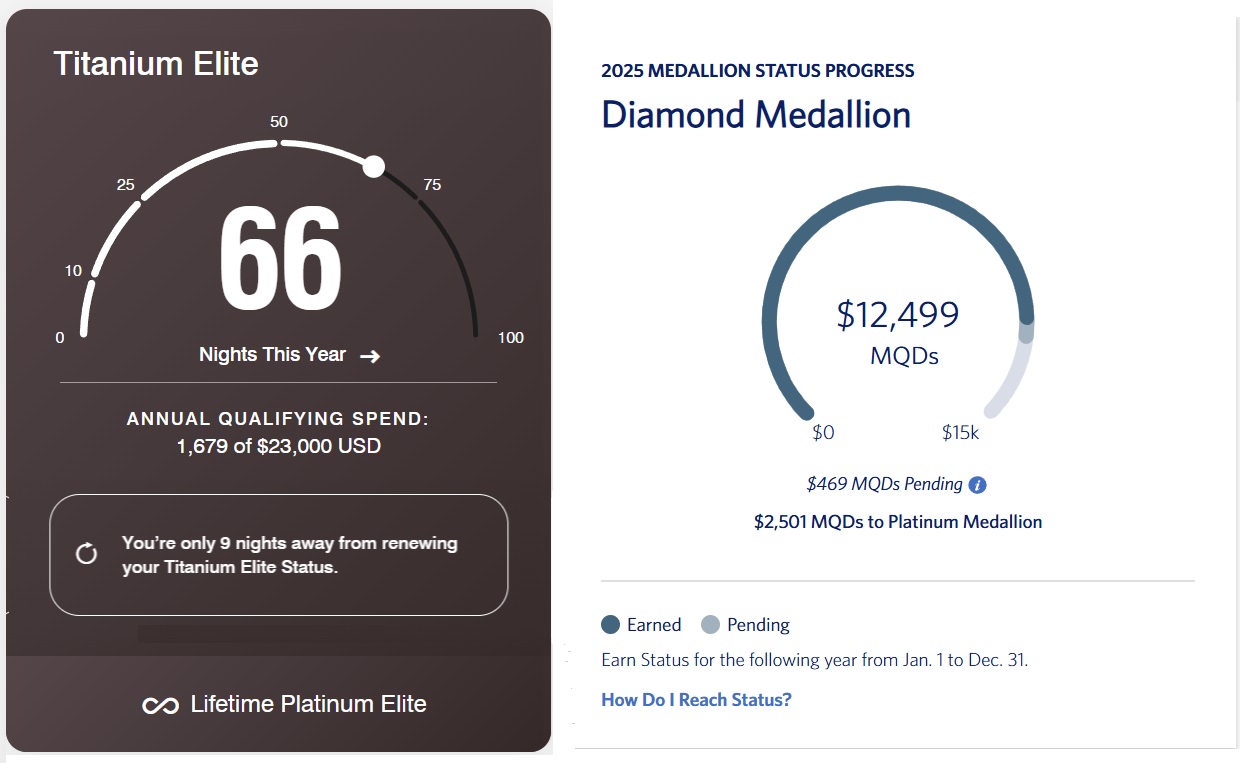

- Delta Airlines: Delta elite status is now earned entirely through Medallion Qualifying Dollars (MQDs).

- MQD Shortcuts: MQDs are mostly earned based on the dollars or miles spent for flying Delta, however there are a number of other ways to earn MQDs quickly (including simply applying and getting approved for certain Delta credit cards). Full details can be found here: Shortcuts to Delta Elite Status.

- MQM Rollovers: This year only, if you had rollover MQMs from last year, you can select to convert them to additional years of status (100K MQMs per year of extended status), MQDs (10 to 1 ratio), redeemable miles (2 to 1 ratio), or some combination of these options. Make sure to make your selection before the end of this year! If you don’t pick, all MQMs will be converted to MQDs. Rollovers no longer exist going forward so it would be a shame to get more MQDs than you need for the status level you’re seeking.

- United Airlines: Don’t forget that you can earn 25 PQPs towards elite status with each $500 of spend (subject to caps) on the United Gateway, Explorer, Quest or Club Infinite card.

Hotel Elite Status

- Hilton Honors: With Hilton, there’s no reason to go out of your way to earn more elite nights. Gold status is free for those with any of the following cards: Amex Platinum Card, Hilton Honors American Express Surpass Card, and the Hilton Honors American Express Business Card. Additionally, you’ll get top tier Diamond status with the Hilton Honors American Express Aspire Card or with $40K spend on the Surpass or Business card.

- IHG One Rewards: It’s possible to earn Diamond status by completing $40K spend (plus one additional purchase) on either the IHG One Rewards Premier Credit Card or the IHG One Rewards Premier Business Credit Card. Also keep in mind that IHG offers Milestone Rewards with the choice of a confirmable suite upgrade at 20 nights (and even better rewards at 40 and 70 nights). So, if you’re close to 20 nights or 40 nights, consider booking last minute stays to make up the difference.

- Marriott Bonvoy: There are many shortcuts to Bonvoy elite status with the easiest being to simply open a Bonvoy Brilliant card which gives you Platinum Elite status outright. For more shortcuts, see this post: Shortcuts to Marriott Elite status.

- World of Hyatt: Globalist status, which requires 60 nights, is the only elite level worth hunting, but Hyatt also offers Milestone Rewards and there are some goodies to be had at 40 and 50 nights. Here are a few shortcuts to earning Hyatt elite nights:

- Chase World of Hyatt Credit Card: Get 5 elite nights each year automatically. Additionally, earn 2 elite nights for each $5K spend.

- Chase World of Hyatt Business Credit Card: Earn 5 elite nights with each $10K spend.

- Expiring free night awards: Don’t forget that all stays booked through Hyatt earn elite nights, including those booked with points or with free night certificates. So, if you have any free night certificates close to expiry, you might as well get something out of them by booking and completing a stay. Keep in mind that you have to complete the stay this year for the nights to count. Also, don’t forget that free night certificates can be gifted to others. If a friend or family member has an expiring free night certificate they can gift it to you and you can use it to earn an elite night.

- For more tricks, see: Shortcuts to Hyatt elite status and Milestone Rewards

Choose elite choice benefits

Some elite statuses come with an annual choice benefit where you can select from among a few key benefit options. Be sure to make your choice selections ASAP.

- Aeroplan Select Benefits: You have until December 31, 2024 to pick your Select Benefits. You can pick them even if you only have temporary elite status due to a status match or free status thanks to having Marriott Titanium status. For tips on what to pick and why, see: About that Air Canada Aeroplan status match… [An interview with Prince of Travel].

- Delta Choice Benefit: You have until January 31, 2025 to select your choice benefit if you achieved Delta status last year for the 2024 elite year. If you achieved Delta status this year, you have until January 31, 2026 to make your selection. For details and recommendations, see: Delta’s Choice Benefits for Platinum and Diamond Elites.

- Marriott choice benefit: Annual Choice Benefit selection must be made by by 11:59 p.m. ET on January 7, 2025. Make your selection here. See: Marriott choice benefit valuations: Which to pick? for help deciding which to choose. Note: It’s a good idea to wait until January to make your 75 night selection. In the past, the 40K free night award has been given an extra year of validity when chosen in January rather than December.

Begin your pursuit of a Southwest Companion Pass

It’s getting late in the game, but there’s still time to set the wheels in motion towards your Southwest Companion Pass. The end of the calendar year is the ideal time to sign up for Southwest credit cards or to refer friends in order to earn huge numbers of qualifying points quickly and at the start of 2025. If you earn the Companion Pass early enough in the calendar year, it will be good for almost 2 full years: the rest of the year in which it is earned and all of the next.

For details, see these posts:

- Southwest Companion Pass Complete Guide

- 2 Southwest Companion Passes and a boatload of points with just 3 cards

Use free night certificates

Don’t let your free nights expire! Log into your account to see what certs you have and when they expire. I use AwardWallet to alert me when free nights are close to expiry.

- Hilton: Hilton seems to have a flexible policy lately regarding extending free night certificates. If you need some more time to use your free night, it can’t hurt to call and ask! See: Got an expiring Hilton free night certificate? Maybe it can be extended (YMMV).

- Hyatt: If you can’t find a good use for your Hyatt free night, you may be able to get some points for the cert by inquiring about it after the cert expires. This seems to be true only with certs provided by Hyatt, though. If your free night cert comes from Chase, you probably won’t get any points for it. And, as far as I know, the only way to find out where the cert came from is to ask Hyatt. See also: Best Hyatt Category 1-4 Hotels & Resorts.

- Marriott: Marriott no longer extends the validity of free night certificates. Use them or lose them!

Holiday gifting: If you have free night certificates that you can’t use for yourself, consider gifting them to someone else. You didn’t know what to get for that special someone anyway, so how about a night or two in a mid-tier hotel? Hyatt allows gifting free nights directly; IHG doesn’t technically allow it but people have reported success calling IHG to book a free night for someone else. More here: Gift hotel points, free night certificates, and award nights booked with points: Rules by program.

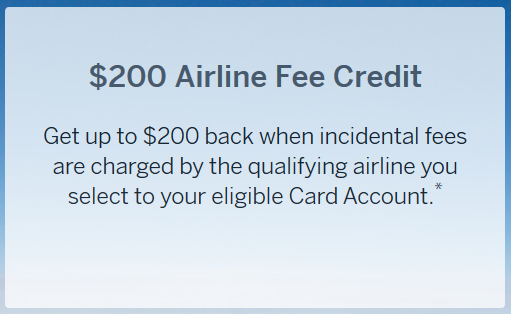

Use airline incidental credits

- Amex airline incidental credits, like those that come with the various flavors of Platinum cards are offered by the calendar year. These credits post based on the date that the charge is made on your card; even if you make a charge on 12/31 and the charge doesn’t post to your statement until a few days into 2024, it’ll count against your 2024 cap as long as the charge date shows December 31st or sooner — though beware that charges you make on 12/31 could show up on your account as 1/1/25. Don’t leave it until the very last minute. Also make sure you know which airline you’ve chosen (or you might be able to get a chat rep to change your chosen airline, but YMMV). See: Amex airline fee reimbursements. What still works?

- Chase Ritz-Carlton incidental credits are also based on calendar year and the date that the charge hits your statement. Be sure to charge any incidentals by December 31st and you should be able to apply your 2024 credit even if the charges don’t settle for a few days into 2025.

- Bank of America Premium Rewards and Premium Rewards Elite incidental credits work like Amex and Chase above in that the credit runs from January 1st to December 31st. Be sure to place qualifying charges by December 31st. As a data point, deposits to a United Travel Bank have worked in the past (same has been true with Amex cards that offer airline fee credits).

- Citi Prestige $250 travel rebate also works based on calendar year spend (this is a change from pre-2020 when they based the spend on December to December statement close dates).

Cardmember Year credits…

The following travel credits are based on cardmember year rather than calendar year. So, with these, the deadline depends upon when you initially signed up for each card:

- Capital One Venture X and Venture X Business: Get up to $300 off annually for bookings made through Capital One Travel.

- Chase Sapphire Preferred: Earn up to $50 in statement credits annually for hotel stays booked through Chase.

- Chase Sapphire Reserve: Earn up to $300 in statement credits annually for all travel spend.

- US Bank Altitude Reserve: Earn up to $325 in statement credits annual for all travel and dining spend.

Use other annual / monthly credits

This is not a complete list of credits, but some that are top of mind are shown below.

- American Express Business Platinum:

- Dell $200: Use the semi-annual $200 Dell credit by December 31st. Be sure to enroll online for this benefit if you have not already done so. Note: Dell won’t charge your card until the item ships. If ordering near the end of the year, make sure to only buy items that ship immediately.

- Wireless $10: Get up to $10 per month back when you use your card to pay for wireless telephone service. Make sure to visit the benefit page to enroll.

- American Express Platinum:

- Prepaid Hotels $200 Credit: Use your $200 calendar year credit towards prepaid Fine Hotels & Resorts or The Hotel Collection hotels. Note that you can book now for a stay that takes place anytime in the future. See: Searching for deals through Fine Hotels & Resorts, Find your own Fine Hotels & Resorts deals, and The Hotel Collection Mini Guide: Prepaid rates earn hotel points/perks, and more surprising finds. No need to enroll.

- Saks $50: Use the $50 semi-annual Sak’s Fifth Ave credit. Don’t forget to enroll in this benefit!

- Uber / Uber Eats $35: Use the monthly Uber / Uber Eats credit. Remember that December’s Uber credit is $35 rather than the usual $15. Enroll simply by adding your Amex card to your Uber wallet.

- Digital Entertainment $20: Earn up to $20 per month in credits for subscriptions to Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and/or The Wall Street Journal . Enroll here and then setup the service to charge your Platinum card monthly. Note that the maximum rebate is $20 altogether — you do not get up to $20 per service.

- American Express Gold

- $50 semi-annual Resy credit: Get up to $50 back when you use your card at a restaurant listed on Resy from January through June, and again from July through December. You do not have to use Resy at all to get this credit other than to find out which restaurants are listed there. Make sure to enroll!

- Misc $10 Dining: Use monthly $10 credit valid at Goldbelly, Wine.com, Five Guys, Seamless/Grubhub, or The Cheesecake Factory. Make sure to enroll!

- Uber / Uber Eats $10: Use the monthly $10 Uber / Uber Eats credit. Enroll simply by adding your Amex card to your Uber wallet.

- $7 Monthly Dunkin credit: Easiest option here is to load $7 onto the Dunkin app each month. Make sure to enroll!

- American Express Business Gold Card

- $20 FedEx, Grubhub, office supply: You can use your $20 per month credit by buying gift cards at an office supply store or online at Staples.com. Or, simply place a Grubhub order (enrollment required).

- American Express Bonvoy Brilliant

- $25 monthly dining credit. Use your card at any restaurant, coffee shop, etc. to get up to $25 back each month.

- American Express Hilton Aspire

- Up to $400 Hilton Resort Credit per calendar year ($200 semi-annually): Don’t let this expire unused! There are multiple creative ways to use this even if you don’t have a stay planned before the end of the year. See this post for one option.

- $50 quarterly flight credit. Use your card to pay directly to an airline for airfare or other airline fees to get up to $50 back per quarter.

- American Express Hilton Surpass

- $50 quarterly Hilton hotel credit: Get up to $50 back each quarter by using your card at any Hilton hotel.

- American Express Hilton Business

- $60 quarterly Hilton hotel credit: Get up to $60 back each quarter by using your card at any Hilton hotel.

- Citi AAdvantage Executive World Elite MasterCard

- $120 per calendar year rental car credit: Earn up to $120 back on eligible Avis or Budget car rental purchases, up to $120 every calendar year. Going forward it looks like this will be limited to prepaid rentals.

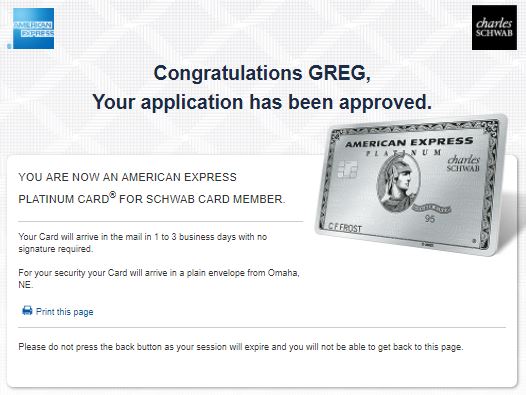

Apply for Amex cards

December is the ideal time to apply for American Express cards that come with annual credits. That is because those credits are based on calendar year. It is therefore possible to open a card with incidental credits now and potentially use that incidental credit for 2024 by December 31st and then receive a new incidental credit starting on January 1st, 2025. Since your next annual fee would not be scheduled to post until December 2025 or January 2026, it would be possible to use your annual credit again in January 2026 and cancel the card within 30 days of the annual fee charge if you decide that you no longer wanted to keep it.

Transfer / pool points

Some programs limit how many points you can transfer between members within a calendar year. If you’re looking to pool points for a valuable award, consider making a transfer before December 31st so that you’ll have more capacity to transfer beginning next month.

- Citi ThankYou points: You can transfer up to 100,000 Citi ThankYou points per year and/or receive up to 100,000 Citi ThankYou points per calendar year. Keep in mind that points received through a transfer from another cardholder expire after 90 days. Only transfer points with an immediate use in mind. That said, if your chosen award will require sending over more than 100K points, you should be able to transfer up to 100K by December 31st and then a fresh 100K beginning on January 1st.

- Marriott Bonvoy Rewards: You can transfer up to 100,000 points per calendar year to another member and you can receive up to 500,000 transferred points per calendar year. That will reset on January 1st, so make any necessary transfers now if you think you might need to move more points than those caps.

- Hilton Honors: Each account can receive up to 2,000,000 Hilton Honors points in a calendar year and you are limited to six Hilton points pooling transactions per calendar year.

- Wyndham / Caesars: One way to prevent Wyndham points from expiring after 4 years is to transfer points back and forth from Wyndham to Caesars. One problem (besides the general slowness and bugginess of the process) is that Caesars has an annual limit on how many points can be moved to Wyndham. At the time of this writing, my account shows a 30K limit, but this seems to change at times. Anyway, if you’re trying to move more than the limited amount, you can move the maximum now before the end of 2024 and move the rest next year. For details see: How to prevent Wyndham points from expiring.

Redeem points or miles for annual rebates

If you have the Citi Rewards+, remember that you’ll get back 10% of the points you use (up to 10,000 points back) per year. This means that if you have your points pooled with a Premier or Prestige card and you transferred 100,000 points to an airline or hotel program, you’d get 10,000 ThankYou points back. This rebate is based on the date your statement closes in December. Make sure to redeem a total of 100,000 points before your statement closes. Details for how to do this are in Travel with Grant’s post: Max Out 10% Citi ThankYou Points Rebate on Citi Rewards+ Credit Card (10K Annual Limit).

Make sure you’ve completed spend bonuses

Whether the quarterly category bonus on a card like the Chase Freedom Flex card or a big spend bonus that’s based on calendar year, you’ll want to run the numbers to be sure you’ve made it over the hump. For example, it would be a shame to end up just under the $15,000 spend required for a Hilton or Hyatt free night certificate.

Bottom line

The end of the year can be a stressful time for everyone. This list is intended to help a little bit by providing a checklist of things to get done before its too late. That said, my advice is to try not to sweat it too much. If you’re feeling stressed, give yourself permission to forget about some of the smaller stuff. Didn’t take advantage of this or that deal? That’s OK!

I suspect that Nick strategy for getting more free cruises is problematic.

No experience with Bailiy’s but when I tried match Ceasar status on January to another program, I was rejected as Caesar’s expiration is 1/31.

On my Marriott account it says that I must make my Annual Choice Benefit selections by December 31st. The terms still say Jan 7th. Does it say Dec 31st every year, I can’t remember? I’m afraid to wait until January in case I lose the 40k certificate.

Now mine says to select by February 1st. So I guess that answers the questions.

What about extending IHG free night certs?