NOTICE: This post references card features that have changed, expired, or are not currently available

Transferable points programs are awesome. If you find a great hotel or flight award but you don’t have enough (or any) of the needed points or miles, you can often transfer what you need from a program like Chase Ultimate Rewards, Amex Membership Rewards, etc.

I’ve pondered which bank program offers the best transfer partners before, but that was before Citi added compelling hotel transfer options, and that was also limited to bank programs. Other options worth considering are Brex and Bilt. Bilt (a rewards program targeted at those who pay rent) is particularly interesting since it is the only program to offer 1 to 1 transfers to American Airlines, and it is the only program to offer 1 to 1 transfers to more than one of the big three U.S. airlines now that Bilt also supports transfers to United.

For a full list of transfer partners for each program, see our Transfer Partner Master List.

Can Citi or Bilt dethrone Chase & Amex?

In my previous post on this topic, I picked Chase and Amex as having the best transfer partners. But that was before Citi added hotel programs, and I didn’t consider Bilt because its not a bank program. In this post, I’ll take another look to see which I like best.

In this post, I judge the quality of transfer partnerships across three big buckets: Airline Fundamentals, Hotels, and Sweet Spot Awards. In the next sections, I’ll look at how well each of the major transferable points programs cover these areas…

Airline Fundamentals

Are transfer partners available to book most flights when saver awards are available? Award pricing doesn’t need to be the cheapest anywhere, but pricing shouldn’t be over the top horrible either. The idea is that if you want to book an award made up of Star Alliance airlines, OneWorld airlines, or SkyTeam airlines, you should have a decent transfer partner option for doing so.

Star Alliance

All six programs offer decent Star Alliance award options. This is important because the Star Alliance is the biggest airline alliance and therefore usually the easiest with which to find international award availability. Star Alliance members Air Canada Aeroplan, Avianca LifeMiles, and United MileagePlus all offer the ability to book Star Alliance awards without paying fuel surcharges. Each program offers at least one of these three programs (they each offer other Star Alliance options too, but here I’m looking only at the transfer partners that don’t pass along fuel surcharges):

- Amex: Air Canada Aeroplan, Avianca LifeMiles

- Bilt: Air Canada Aeroplan, United MileagePlus

- Brex: Avianca LifeMiles

- Capital One: Air Canada Aeroplan, Avianca LifeMiles

- Chase: Air Canada Aeroplan, United MileagePlus

- Citi: Avianca LifeMiles

For the fundamentals of Star Alliance award bookings, I think that Bilt and Chase have the edge. United, which is unique to those two programs, is the only Star Alliance transfer partner that doesn’t charge award change fees. They don’t always have the best award pricing, but in general their award pricing isn’t horrible. For example, when I compared United to Air Canada I was surprised to find that in many cases United’s award pricing was better than Air Canada’s: United vs. Air Canada: Which is the better Chase transfer partner?

That said, I think that the combination of Air Canada and Avianca LifeMiles is good enough for most purposes, so Amex and Capital One come in close behind Bilt and Chase in this comparison. Brex and Citi trail the others because they only have one surcharge-free Star Alliance option whereas the others have two.

OneWorld Alliance

OneWorld is a much smaller alliance than the Star Alliance, but it offers many very useful airline carriers: American Airlines, Alaska Airlines, British Airways, Cathay Pacific, Japan Airlines, Qantas, Qatar, etc. The problem with the OneWorld Alliance is that you can’t entirely avoid paying surcharges on award tickets. British Airways is probably the worst offender in adding huge surcharges to their business class and first class awards and every single British Airways partner passes along these charges to the award booking customer when flying BA. So, given that none are perfect, let’s see which useful OneWorld programs each program supports:

- Amex: British Airways Avios, Cathay Pacific Asia Miles

- Bilt: American Airlines, Cathay Pacific Asia Miles

- Brex: Cathay Pacific Asia Miles

- Capital One: British Airways Avios, Cathay Pacific Asia Miles

- Chase: British Airways Avios

- Citi: Cathay Pacific Asia Miles

British Airways Avios is particularly good for short non-stop award flights whereas Cathay Pacific Asia Miles is best for very long distance mixed cabin awards (such as one segment in First class and other segments in Business class). Cathay Pacific Asia Miles also sometimes charges lower fuel surcharges than other programs when flying British Airways. American Airlines offers excellent international business class award prices.

In my opinion, Bilt has the best OneWorld coverage, but it is surprising and a bit disappointing that they don’t yet support British Airways Avios. Amex and Capital One are tied for second by offering both BA Avios and Cathay Pacific Asia Miles. Citi and Brex are a step down since they only support Cathay Pacific Asia Miles. And Chase pulls up at the rear with only British Airways Avios (and the more specialized Aer Lingus and Iberia Avios programs).

SkyTeam Alliance

The SkyTeam doesn’t have as many members as the Star Alliance and has fewer exciting-to-fly members than either the Star Alliance or OneWorld Alliance. SkyTeam is dominated by Delta in the Americas and Air France / KLM in Europe. And, unfortunately, there are no really great programs for booking SkyTeam awards. Delta charges far too many miles for most business class awards, and all programs pass along fuel surcharges at least in some cases. The best overall program for booking SkyTeam awards is probably Air France Flying Blue.

- Amex: Air France Flying Blue, Delta

- Bilt: Air France Flying Blue

- Brex: Air France Flying Blue

- Capital One: Air France Flying Blue

- Chase: Air France Flying Blue

- Citi: Air France Flying Blue

All six programs support 1 to 1 transfers to Air France Flying Blue. Amex gets the nod for best SkyTeam coverage, though, thanks to offering Delta as an option too. Delta often has decent economy award prices and they no longer charge change or cancellation fees on awards. Delta also doesn’t impose surcharges on awards departing from the U.S.

Airline Fundamentals: Ranking

With respect to the ability to book airline alliance awards with little fuss, Bilt and Chase arguably have a slight Star Alliance edge (thanks to supporting United) while Citi and Brex are at the bottom since they don’t offer transfers to Air Canada Aeroplan. All six programs are roughly equal with SkyTeam coverage since they all support transfers to Air France, but Amex has an edge thanks to also offering transfers to Delta. Bilt dominates OneWorld bookings thanks to their ability to transfer to AA, while Chase is the OneWorld loser with only Avios to turn to (no Cathay Pacific option).

I’d rank the programs as follows for airline fundamentals:

- Bilt

- Amex

- Capital One

- Chase

- Citi

- Brex

Please keep in mind that this ranking does not consider the ability to book paid flights with points at good point value. If we added that in, Chase would jump to the top thanks to the ability to book paid flights at 1.5 or 1.25 cents per point value (depending on which cards you have). It’s also important to understand that the difference between #1 and #6 for the above ranking is very small. All six programs cover the Alliance basics pretty well.

Hotels

Hotel coverage is an area where the six programs vary the most. Here are the hotel programs covered by each:

- Amex: Choice Privileges (1 to 1), Hilton (1 to 2), Marriott (1 to 1)

- Bilt: Hyatt (1 to 1), IHG (1 to 1)

- Brex: None

- Capital One: Accor (2 to 1), Choice Privileges (1 to 1), Wyndham (1 to 1)

- Chase: Hyatt (1 to 1), IHG (1 to 1), Marriott (1 to 1)

- Citi: Choice Privileges (1 to 2), Wyndham (1 to 1)

IHG points aren’t worth considering here. IHG points can be bought for less than a penny per point with the trick of booking and cancelling points+cash stays. I covered this trick with IHG here. When you can buy the same points at any time (as long as you have starter points) for less than a penny each, transfers offer very poor value.

I would discount Choice points for the same reason as IHG (you can buy points for less than a penny each) but Citi’s ability to transfer 1 to 2 is very interesting. Last I checked, it was possible to indirectly buy Choice points for 0.90 cents each by booking and cancelling points + cash stays. That gives the Citi to Choice transfer a capped value of 1.8 cents per Citi point. That’s pretty good! Choice points can often be used towards good value for Choice hotels or even towards Preferred Hotels.

Hilton points are usually worth about 0.4 cents each, but can sometimes be worth significantly more. On the other hand, Hilton often sells points for a half cent each and so that caps my perceived value of this 1 to 2 Amex transfer option at 1 cent per Amex point. That said, at the moment when you need Hilton points there might not be a sale going on and so this is a useful option even if it’s not one I value highly. This option becomes more useful when Amex offers a 30% or higher transfer bonus to Hilton (which they do frequently).

The option to transfer to Marriott is similar. While Marriott points are usually worth only about 0.6 cents each, there are times when they are worth much more. I wouldn’t want to transfer a lot of points to Marriott, but having the option to top off my account for a valuable award is nice. Both Amex and Chase offer 1 to 1 transfers to Marriott, but only Amex frequently offers transfer bonuses.

Capital One’s 2 to 1 transfers to Accor are mildly interesting because Accor points are worth a flat 2 cents Euro each towards hotel stays. 2 cents Euro is currently worth 2.22 cents USD. So, this transfer is a way to get slightly more than 1 cent per “Capital One” mile towards hotel stays. That said, the advantage of transferring versus just erasing hotel charges with your Capital One miles is so slight that I don’t think I’d bother unless I had a very expensive hotel stay to cover.

Capital One’s and Citi’s 1 to 1 transfers to Wyndham are more interesting. Even though Wyndham often sells points for slightly under 1 cent each, they usually have strict and very low caps on how many points you can buy. There’s no such cap on transferring from Capital One or Citi. The primary reason this is exciting is the ability to book Vacasa Vacation Rentals with Wyndham points. I’ll cover this in the next section on Sweet Spot Awards.

Without any doubt in my mind, the best hotel transfer option is to Hyatt. Bilt and Chase allow 1 to 1 transfers to Hyatt, and Hyatt points are super valuable. When used to book regular hotel stays, I found an average of over 1.6 cents per point in value without even trying to find the most valuable awards. That’s pretty good by itself, but it’s often possible to get far more value than that. Plus, Hyatt offers additional ways to get incredible value such as using points to book or upgrade to premium suites. Hyatt doesn’t have nearly as many properties as Marriott or IHG, but they’ve been rapidly adding more. Plus, their partnership with SLH (Small Luxury Hotels of the World) has opened up quite a few excellent options.

Hotels: Ranking

With hotel programs, the difference between programs is huge Bilt and Chase are the only programs that support a widely useful and valuable transfer option: Hyatt. After Bilt and Chase, I like Citi for its 1 to 2 transfers to choice and 1 to 1 transfers to Wyndham. Here’s how I rank them all:

- Chase

- Bilt

- Citi

- Amex

- Capital One

Brex didn’t even compete in this one.

Sweet Spot Awards

Some airline and hotel programs offer specific awards that are so much cheaper than any other options that we consider these to be great sweet spot awards. You can find our series of sweet spot award posts, here: Sweet Spot Spotlight.

Fly ANA First Class to Japan for 60K points or less one-way

ANA’s first class is reportedly fantastic. The trick to booking this cheaply (after confirming award space) is to transfer points to Virgin Atlantic and then call Virgin Atlantic to book ANA first class awards. Here are Virgin Atlantic’s award prices for flying ANA first class:

- Fly between Japan and Western U.S., Canada, or Australia: 55K points one-way.

- Fly between Japan and Central or Eastern U.S., or Europe: 60K points one-way.

If you can find first class award space (that’s the tricky part!), these prices are amazing. You can find more sweet spots using Virgin Atlantic points here: Best uses for Virgin Atlantic points.

All programs except Brex support transfers to Virgin Atlantic. Note that Capital One transfers to Virgin Red which then transfers 1 to 1 to Virgin Atlantic.

Fly Iberia business class to Europe for as few as 34K points one-way

Iberia offers some incredible award prices for their own flights. In particular, lie-flat business class flights from New York, Boston, Chicago, or DC to Madrid, Spain, are very cheap: 34K during off-peak dates or 50K during peak dates.

You can directly transfer Amex or Chase points to Iberia. With Capital One, you can indirectly transfer points to Iberia by first transferring to British Airways and from there to Iberia. Bilt, Brex, and Citi do not support transfers to Iberia or to British Airways.

Fly Delta One business class to Europe for 50K points one-way

Delta will often charge hundreds of thousands of miles for a one-way business class flight to or from Europe. Their partner Virgin Atlantic, though, charges only 50,000 miles one-way for non-stop business class Delta One flights. This price doesn’t include flights to/from the U.K., but all other direct Delta flights will work if you can find award availability. In my experience, award availability comes and goes over time so it’s worth checking regularly.

All programs except Brex support 1 to 1 transfers to Virgin Atlantic. Note that Capital One transfers to Virgin Red which then transfers 1 to 1 to Virgin Atlantic.

See also: How to book Delta flights with Virgin Atlantic miles

Fly Lufthansa First Class to Europe

Avianca LifeMiles offers awards on Star Alliance carriers with no fuel surcharges. If you’re willing to book relatively last-minute, one of the most luxurious ways to fly to/from Europe is on Lufthansa First Class. Lufthansa only opens awards to partners like Avianca within 2 to 4 weeks of travel.

In addition to offering an excellent first-class experience in the air (think caviar, top shelf champagne, complimentary slippers and pajamas, and comfortable bedding), Lufthansa offers terrific ground services, especially in Germany. During non-pandemic times, first class passengers transiting through Frankfurt or Munich get escorted to and from their exclusive first-class lounges, passport control is often handled within the lounge itself, fantastic food and drinks are provided for free, etc. Lufthansa’s ground services, in my opinion, are what make flying Lufthansa first class so desirable.

Avianca LifeMiles charges only 87,000 miles for a one-way first class award between the U.S. and Europe. That’s already excellent, but you can do better. By tacking on a Star Alliance flight in economy or business class to the end and/or start of your trip, the cost for the whole trip will go down. For example, Newark to Frankfurt alone in first class would cost 87,000 miles, but if you fly Newark to Frankfurt in first class and then Frankfurt to Istanbul in business class, the price for the entire trip goes down to about 81,000 miles. The longer the segments flown in economy and/or business class, the more the price of the trip will come down. You could reduce the total award price a lot more by booking relatively long flights on both sides. For example, fly Los Angeles to Newark on United economy, followed by Lufthansa First Class to Frankfurt, followed by Lufthansa economy to Istanbul. Full details can be found here: Avianca LifeMiles’ awesome mixed-cabin award pricing. First Class for less.

Amex, Brex, Capital One, and Citi support transfers to Avianca LifeMiles. Bilt and Chase do not.

Fly JetBlue Mint from New York to London

JetBlue’s “Mint” class is widely considered to be one of the best business class experiences available. Using Emirates Skywards miles, you can book JetBlue Mint between New York and London for only 64,000 miles one-way.

All six programs support 1 to 1 transfers to Emirates Skywards.

Fly Business Class Around the World

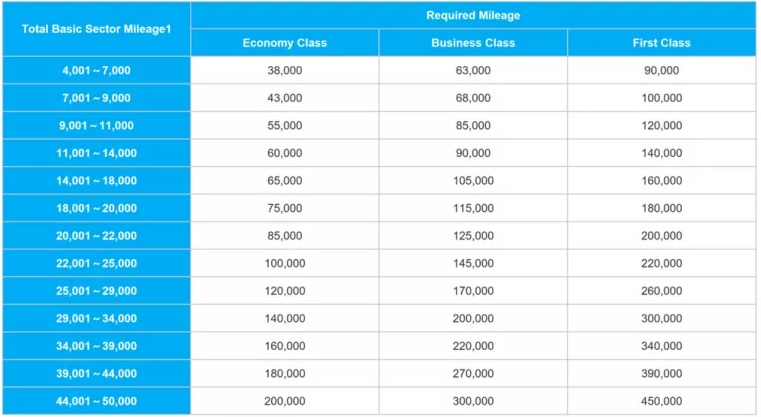

ANA has an incredible award chart for flying Star Alliance business class around the world:

It’s possible to fly around the world in business class for as few as 115,000 miles! Most itineraries will take you a bit farther and so you’ll pay 125,000 or 145,000 miles, but still, that’s an amazing value! You can stop in up to 8 different places along the way and build the trip of a lifetime. To learn more, see these posts:

ANA also offers some incredible values for round-trip awards that don’t circle the world. Some examples include:

- U.S. to Japan, flying ANA: 75,000-90,000 miles round-trip

- U.S. to Australia, flying ANA: 105,000-120,000 miles round-trip

- U.S. to Europe, flying Star Alliance partners: 88,000 miles round-trip

- U.S. to Africa, flying Star Alliance partners: 104,000 miles round-trip

Only Amex supports transfers to ANA.

Fly International First and Business Class via AA Sweet-spots

There are some great options for using AA miles:

- Fly first class on Japan Airlines or Cathay Pacific from the U.S. to Japan or Korea for 80K miles one-way.

- Fly first class on Etihad, Japan Airlines, or Cathay Pacific from the U.S. to the South Pacific for 110K miles one-way.

- Fly business class on partners like Japan Airlines and Cathay Pacific from the U.S. to the following destinations:

- Asia: 60K to 70K miles

- South Pacific: 80K miles

- Fly business class on partners like Qatar or Etihad from the U.S. to the following destinations:

- Middle East or India: 70K miles

- Africa: 75K miles

Avoid booking awards flying British Airways or Iberia since they’re known to impose very high surcharges on business and first class awards.

Bilt is the only program that offers standard 1 to 1 transfers to American Airlines (Citi offered this option briefly in 2021 as a limited time deal).

Fly to Hawaii for 7.5K One-way!

This is probably THE most amazing sweet-spot award. It’s possible to fly United Airlines to Hawaii from anywhere else in the United States for only 7.5K Turkish miles for one-way economy or 12.5K miles for business class!

Unfortunately, it is notoriously difficult to actually book these awards. First, you have to find United saver award space. Next, the really hard part kicks in: you have to find a Turkish agent capable and willing to book the award for you. This post might help: How to book United flights with Turkish Miles & Smiles. See also: Turkish Miles & Smiles Complete Guide.

Only Bilt, Capital One, and Citi offer transfers to Turkish Miles & Smiles. That said, many won’t want to deal with the complexities of booking Star Alliance awards with Turkish miles anyway. If that’s you, another good option is to transfer points to Singapore Airlines from any of the programs except Bilt. Singapore charges 17,500 miles each way in economy or 34,500 in business for United Airlines flights to or from Hawaii.

Use Hyatt Points to Stay in Amazing Suites

Unlike most other hotel award programs, Hyatt makes it easy to use points to book both standard and premium suites. You can book a suite entirely with points or you can book a hotel at a standard upgradeable rate and use points to upgrade to a suite. In many cases this makes it possible to stay in incredibly expensive suites at a very low cost.

See these posts for details:

- Finding extreme luxury in Hyatt Premium Suites

- Most exciting Hyatt premium suites bookable with points in the US

- The most Incredible Hyatt suites bookable with points worldwide

- How best to book Hyatt luxury suites

Bilt and Chase are the only programs that support transfers to Hyatt.

Use Wyndham Points for Valuable Vacation Rental Stays

Thanks to Wyndham’s relationship with Vacasa Vacation Rentals, it is possible to book one bedroom rental properties for only 15,000 Wyndham points per night (or 13,500 points per night for those with a Wyndham Earner card). Amazingly, some of the properties that are listed as 1 bedroom are huge and include not just a bedroom but also a separate loft space with one or more beds and multiple bathrooms. Nick wrote about his stay at such a property here: The Greenbrier Pigeon Forge Vacasa rental via Wyndham Rewards. Bottom line review.

Citi and Capital One support 1 to 1 transfers to Wyndham.

See also: Wyndham Vacasa: Great Value is Real!

Use Choice Points for Ascend, Nordic Choice, or Preferred Hotels

Choice points often offer excellent value (greater than 1 cent per point) towards Nordic Choice Hotels, and select Ascend Collection Hotels. You can also get good value at some of the best hotels in the world thanks to Choice’s partnership with Preferred Hotels.

For details about getting great value from Choice points, see:

- Nordic Choice Sweet-Spots: Great Value w/ Choice Points

- Choice’s Ascend Collection Gems (Great Value with Citi Points!)

- Preferred Hotels & Resorts via Choice: Value unlocked. Frustration assured.

While Amex and Capital One offer 1 to 1 transfers to Choice, Citi is a much better option since Citi offers 1 to 2 transfers for those with a Citi Premier or Prestige card. For example, if you transfer 15,000 Citi points you’ll get 30,000 Choice points.

Sweet Spot Summary and Rankings

The Sweet Spots described above, and which transferable points programs support them, is summarized in the following table:

| Amex | Bilt | Brex | Capital One | Chase | Citi | |

|---|---|---|---|---|---|---|

| ANA first class with Virgin Atlantic miles | ✔ | ✔ | ✔ | ✔ | ||

| Iberia Biz Class to Europe | ✔ | ✔ | ✔ | |||

| Delta Biz Class to Europe with Virgin Atlantic miles | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Lufthansa First Class with Avianca miles | ✔ | ✔ | ✔ | ✔ | ||

| JetBlue Mint | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Round the World with ANA | ✔ | |||||

| AA Sweet Spot Awards | ✔ | |||||

| Hawaii for 7.5K with Turkish miles | ✔ | ✔ | ✔ | |||

| Hyatt Awards | ✔ | ✔ | ||||

| Vacasa Vacation Rentals | ✔ | ✔ | ||||

| Choice Gems | ✔ |

The table above shows that each program offers access to different sweet spot awards. So, in order to rank the programs from best to worst with respect to sweet spot coverage, it’s important to understand which sweet spots are most important to you. How likely are you to take advantage of the sweet spot and how often?

Here’s my personal rankings:

- Hyatt Awards. I’ve transferred points to Hyatt countless times for valuable awards and I expect to continue doing so far into the future.

- Choice Gems. Since Citi introduced 1 to 2 transfers to Choice, I’ve used approximately half a million Choice points, most of which were transferred from Citi. My stays so far were at Preferred Hotels, but I have my eye on some Ascend on Nordic Choice properties as well.

- Vacasa Vacation rentals. I haven’t yet booked a Vacasa award stay, but I value the option to do so.

- Delta Biz Class to Europe with Virgin Atlantic miles. Since my local airport is a Delta hub (DTW), I have easy access to non-stop Delta flights to Europe. The ability to book these flights in Delta One Business Class for only 50,000 points each way is phenomenal.

- ANA first class with Virgin Atlantic miles. I haven’t had a chance to take advantage of this sweet spot yet, but I definitely want to! I’d love to fly ANA first class and the ability to do so at such low award prices is amazing.

- AA Sweet Spot Awards. AA offers a great combination of low cost international business class awards with the ability to change and cancel awards for free. I’ve booked a number of Qatar Q-Suites awards just in case my travel lined up to fly them, but so far I’ve had to cancel each one.

- Lufthansa First Class with Avianca miles. Lufthansa flies out of my local airport (DTW). Usually they only offer economy and business class, but every now and then they offer first class too. When that’s available, I highly value this option!

- Iberia Biz Class to Europe. This would rank higher if Iberia flew from my local airport.

- Round the World with ANA. I’ve ranked this one low only because it takes a huge time commitment to use this award effectively. I absolutely love this one in theory, but it’s hard to fit it into a busy schedule. If my wife and I were retired, though, I could see this one being near the top of my list.

- Hawaii for 7.5K with Turkish miles. How can I rank the best sweet spot last? I don’t have the patience to jump the hoops necessary to book these awards. Turkish has made the award booking process hard enough to ensure that only those ready to put in the work can book these awards.

After compiling the above sweet spot rankings (again: the above rankings are particular to me. I’d expect readers to have very different rankings), I can now rank the transferable points programs based on their coverage of sweet spot awards:

- Bilt: Hyatt is so important to me that Bilt takes the top spot even though it doesn’t support my next two favorite options (neither 1 to 2 to Choice, nor 1 to 1 to Wyndham is supported). I also love that Bilt supports transfers to AA.

- Chase: Again, thanks to my love for transfers to Hyatt, Chase takes second place even though it is relatively weak on sweet-spot coverage otherwise.

- Citi: Citi has very good sweet-spot coverage, including the awesome ability to transfer to Choice 1 to 2.

- Amex: Amex doesn’t support any of my favorite hotel sweet-spots, but they do arguably offer the best airline sweet-spot coverage.

- Capital One: Capital One’s transfer partner list checks a lot of boxes, but just falls a tiny bit short of other programs since they don’t support Hyatt, ANA, or Choice 1 to 2 (they do support Choice 1 to 1). They’re really close though!

- Brex: Brex isn’t even close. Brex doesn’t currently offer any hotel transfer partners, nor do they have any partners that are unique.

Summary

Here is how each program ranked in each of the three areas I examined:

Airline Fundamentals:

- Bilt

- Amex

- Capital One

- Chase

- Citi

- Brex

Hotels:

- Chase

- Bilt

- Citi

- Amex

- Capital One

Sweet Spot Awards:

Note: This ranking is highly dependent upon the sweet-spots that are important to me. I expect many/most readers would rank these differently…

- Bilt

- Chase

- Citi

- Amex

- Capital One

- Brex

Overall “Best”: Bilt

Bilt took first place in two categories and second place in a third!

Conclusion

Bilt has come out of nowhere to arguably now offer the single best set of transfer partners. That does not mean that it is the best rewards program, though! The other programs offer many more ways to earn points quickly: big welcome bonuses, refer-a-friend bonuses, better category bonuses, etc. If I could only have one rewards program, I wouldn’t pick Bilt because it’s too hard to earn points in great numbers. Luckily, no one has to settle on a single rewards program!

Well the major problem or drawback with Bilt is actually getting the card, as it is invite only at this point

Sponsored post?? Come on… This is points guy worthy, not frequent miler worthy!!!

Nope we don’t do sponsored posts.

I respectfully disagree that Bilt is the overall best rewards points program. While I get that they have some nice transfer partners I don’t see how you can rank them #1 when you can’t actually get a card without joining a waitlist, there is no SUB, and the bonus categories are average at best. It’s hard to use those great categories when you can’t earn enough points for a nice redemption.

If you pay rent, you earn buckets of points.

Sure you can earn some points on rent but there’s a limited number of people who can benefit from that. My point is that Bilt shouldn’t be in the discussion of the best points when the program is not well-rounded. Yes, Bilt has nice transfer partners but the card is only available on a waitlist, there’s no SUB, and no real benefits to people who don’t pay rent.

Totally agree. Even with paying rent the earnings are relatively minimal.

I never wrote that Bilt was the best rewards program. I wrote that it has the best transfer partners. That’s different. In fact, in the conclusion paragraph I wrote the following in bold: “ That does not mean that it is the best rewards program, though! ”

I saw that after I re-read the article but wasn’t able to update my comment. Thanks for clarifying…I can totally see how you could say they have great transfer partners. That I can agree on! I still don’t think the program is great, but that’s a comment for another post, I guess.

I plan to separately update my transferable points scorecard that looks at a lot of factors but wanted to deep dive here into transfer partners since there’s a lot of ground to cover on this one topic

Thanks and I always appreciate the deep dives and analysis you do!

Thanks for the excellent summary. Clearly, I need to take the time to change a United award booking, rather than redeposit immediately!

The ability to earn buckets of points should be another separate category here. I would rank Amex by a mile for SUB’s, Chase for MS (carefully) and Citi for regular spend. Bilt would be last.

Yes I addressed that in the conclusion

I’m surprised you didn’t mention ANA under the Star Alliance section. While they do pass on fuel surcharges, their mileage rates are so great that it can sometimes be worth paying a few hundred in fuel surcharges (depending on the airline) to pay 50-75% of the mileage rate you would pay for other Star Alliance programs. The fuel surcharges, ability to only book RT awards, and routing limitations do limit their flexibility compared to United, Avianca, and Aeroplan but I would say the combination of ANA/Avianca/Aeroplan puts Amex slightly ahead of Chase and Bilt in this category unless you really value United.

I gave props to ANA in the section about sweet-spot awards.

So United has no fees on award changes, but does charge for redeposit?

i’ve found this confusing over the last year in that I was charged for redeposit, and a friend ( with no elite status) was charged nothing.

United doesn’t charge for redeposit as long as the flight is more than 30 days in the future. Hint: no charge to change award to a later date.

Such a great collection of insights! Might be worth mentioning transfers to Delta cost $…not quite as painful as some fuel surcharges out there, but still a sting.

True

How do you rank Citi’s hotel partners higher than Amex? Citi only has Choice and Wyndham, Amex has Hilton, Marriott and Choice.

Did you actually read the post? Yes, AMEX has more transfer partners but at ratios that you would virtually never actually want to transfer at.

Bilt may have the best overall group of transfer partners but they just have a debit card right now which is currently only available by invitation. If they came out with a credit card that was openly available they would probably be #1 for sure.

BILT is a credit card. The pay rent feature is done via ACH, which is like a debit card. But, everything else is standard credit card charge.

As Reno Joe said, Bilt is a credit card. But regardless, this post was only comparing the transfer partners not other aspects. In my opinion, Bilt falls far short of Amex and Chase with regards to the ability to earn lots of points quickly. But that’s only relevant if you were somehow forced to pick only one program. I think Bilt is a great supplement to the others thanks to its great transfer partners and the ability to earn points paying rent.

Bilt is a great program and you can tell it was designed by people who really know what will appeal to miles and points collectors. Unfortunately, that’s a double-edged sword since those program designers are also aware of all the pitfalls of making a program generous but unprofitable. I’d switch to Bilt myself (even though I own and don’t rent) except that I’m used to earning 3, 5, 10, or 15 points from all spend.

For AA flyers, one can think of Bilt as a card with a rewards structure somewhat similar to the Barclays Silver . . . without the annual fee . . . with the choice to transfer to other partners if one wanted. Of course, no EQM / LP bonus on spend but you get the idea. I think Bilt cracking the domestic airline transfer monopolies will open the door to others. Citi should be quaking in its boots.

It might be worth mentioning that Citi transfers to Qatar . . . and Qatar will use Avios . . . which will be transferable to BA, Iberia, and Aer Lingus. This would allow Citi to indirectly give one access to the Iberia to Europe in business class opportunity . . . and a range of other One World opportunities.

Great idea. I’ll try to remember to update this with that info once we learn for sure that Qatar Avios transfer to BA Avios (I assume that to be the case, but who knows)