Membership Rewards is American Express’ transferable points currency. Points can be earned via credit card spend, new account welcome offers, credit card referrals and in many other ways. Once earned, these points can then be transferred to airline or hotel partners, used to pay for travel or merchandise and, in one specific case, even converted to cash back.

If you’re at all interested in free and/or luxury travel with points & miles, then you need to understand the basics of Amex Membership Rewards. Here, you’ll find everything you need to know.

How to earn Amex Membership Rewards Points

Credit Card Welcome Offers

The easiest and quickest way to earn Membership Rewards points is through Amex credit card welcome offers.

Usually, Amex stipulates that you can only earn points from a welcome offer if you’ve never had that card before (or in some cases, other cards within the same family). This is known as Amex’s “once in a Lifetime Language.” That said, targeted offers sometimes become available that do not have that language. These are known as “no lifetime language (NLL) offers and, if approved for one, you can get the bonus even if you’ve had the card before.

Below are the Amex Membership Rewards cards best current welcome offers.

| Card Offer |

|---|

Amex Credit Card Application Tips

- Safe to Apply: Amex is usually the safest bank for trying your luck at earning a new welcome offer. Most of the time, they won’t issue a hard pull when denying your application or when approving you if you already have at least one Amex card. Plus, they’ll warn you during the application process if you’re not eligible for the bonus.

- Once in a Lifetime Rule: If you've ever had a card before, you are most likely prohibited from earning a welcome offer for that same card if you apply now. Fortunately you'll be warned during the application process if this is the case. Amex is known to "forget" that you've had a card after about 5-7 years. Note that there are frequently offers with no lifetime language (NLL) that aren't bound by this restriction.

- "Family" Rules: In addition to the "once in a lifetime" rule, Amex now applies additional "family" rules to several groups of consumer cards. These rules don't apply to business cards.

- Platinum/Gold/Green: You may not be able to get a welcome offer on the Green, Gold, Platinum, Charles Schwab Platinum or Morgan Stanley Platinum if you've previously had any of the Platinum cards previously.

- Cash back cards: You may not be able to get a welcome offer on the Blue Cash Everyday card if you've previously had the Cash Magnet, Blue Cash Preferred or Morgan Stanley Blue Cash Preferred cards. You're not eligible for a welcome offer on the Blue Cash Preferred card if you've previously had the Morgan Stanley Blue Cash Preferred card.

- Delta cards: You can get a welcome offer on any of the Delta cards provided you've never had a more expensive Delta card than the one you are applying for. So, for example, you're eligible for a welcome offer on the Delta Reserve if you've had the Delta Gold, but you may not be eligible for a welcome offer on the Delta Gold if you've previously had the Reserve.

- 1 per 5 days: You can get at most one credit cards within every 5 days. This rule does not apply to Pay Over Time (charge) cards.

- 2 per 90 days: You can get at most two credit cards within 90 days. This rule usually does not apply to Pay Over Time (charge) cards.

- 1 of same product per 90 days: Amex will only approve you for the same card once every 90 days; this primarily comes into play when applying for "no-lifetime-language" (NLL) links.

- It seems that Amex considers the Marriott Bevy and Brilliant cards as the same product, which means that you would have to wait 90 days after applying for the Bevy before being able to be approved for the Brilliant.

- Marriott cards: Approval for any Marriott card is governed by a labyrinthine set of unintuitive rules. You can see the full eligibility chart here.

- Card Limits: Amex normally only allows customers to have five credit cards and ten Pay Over Time (charge) cards at one time. Both personal and business cards count towards the respective five and ten card limits. There are some instances where certain customers have been allowed to go above those limits.

- Application Status: Call (877) 239-3491 to check your application status or use this link.

- Reconsideration: If denied, you can call (800) 567-1083 and ask for your application to be reconsidered.

Credit Card Upgrade Offers

Amex frequently offers bonus points for upgrading from one card to another. For example, we’ve seen 140,000 point offers for upgrading from the Business Gold Rewards card to the Business Platinum card. Even better, these upgrade offers usually do not have the once per lifetime language mentioned above. This means that, if you are targeted for an upgrade offer, you should be able to earn the bonus points even if you currently have the card or if you’ve had the card before.

Note that it’s best to accept these offers only after you have earned a welcome offer for the card that you’re upgrading to. Accepting an upgrade offer for a given card will make you ineligible to receive a new cardmember welcome bonus for that card if it contains Amex’s “once in a lifetime” language.

Shopping Portals

It is possible to earn Membership Rewards points by starting your shopping with the Rakuten Shopping Portal. An option within the portal lets you choose whether you want to be paid via cash back or in Membership Rewards points.

In addition to earning points by clicking through to stores from the portal, you can also register your credit cards with the portal to earn additional points at select stores and restaurants.

Credit Card Category Bonuses

Another great way to earn Membership Rewards points is by using the best card for different spending categories. If you spend a lot personally or through your business on any of the below categories, you can do very well. Particularly noteworthy is the no-annual-fee Blue Business Plus Credit Card which offers 2 points per dollar for all spend, up to $50K spend per calendar year (then 1X thereafter). That’s fantastic.

| Spend Category | Best Options |

| US Supermarkets |

American Express Gold 4X (up to $25K per year, then 1X) EveryDay Preferred Up to 4.5X* (max $6K per year) |

| US Gas Stations |

Business Gold Up to 4X** EveryDay Preferred Up to 3X* |

| Restaurants | American Express Gold 4X (up to $50K per year, then 1X) American Express Green 3X Business Gold Up to 4X**, US only |

| Travel (Broadly Defined) |

American Express Green 3X |

| Flights |

Platinum consumer cards 5X Business Platinum (via Amex Travel) 5X Business Gold Up to 4X** American Express Green 3X |

| Prepaid Hotels |

Platinum cards (via Amex Travel) 5X American Express Green 3X |

| Select Car Rental Companies | American Express Green 3X |

| US Advertising in select media | Business Gold Rewards Up to 4X** |

| US Computer related purchases |

Business Gold Rewards Up to 4X** |

| US Construction/Hardware Stores | Business Platinum 2X |

| Everywhere else | Blue Business Plus 2X (eligible purchases, up to $50K annually) EveryDay Preferred 1.5X* |

* The Amex EveryDay Preferred is currently not available to new applicants. The card earns a 50% bonus every billing period in which the card was used for 30 or more transactions. Before the 50% bonus, the card has the following bonus categories: 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x); 2x points at US gas stations; 1x points on other purchases. After the 50% bonus, it offers: 4.5x points at US supermarkets on up to $6,000 per year in purchases (then 1.5x); 3x points at US gas stations; 1.5x points on other purchases.

** The Business Gold Card offers 4X on the two categories where your business spends the most each billing cycle from the following categories ($150K spend per calendar year, then 1x): Electronic goods retailers or software and cloud system providers in the U.S., U.S. purchases at restaurants, Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S., U.S. purchases for advertising in select media, U.S. purchases at gas stations, Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways.

Credit Card Referrals

Yet another way to earn Membership Rewards points is by referring friends and relatives to an Amex credit or charge card. In some cases these referral bonuses can be quite substantial and Amex can offer as much as 40,000 points for referring someone to another Amex card. However, if you want to keep your friends, then make sure that the offer they get is as good as the best available public offer (by comparing your referral offer to our Best Offers page).

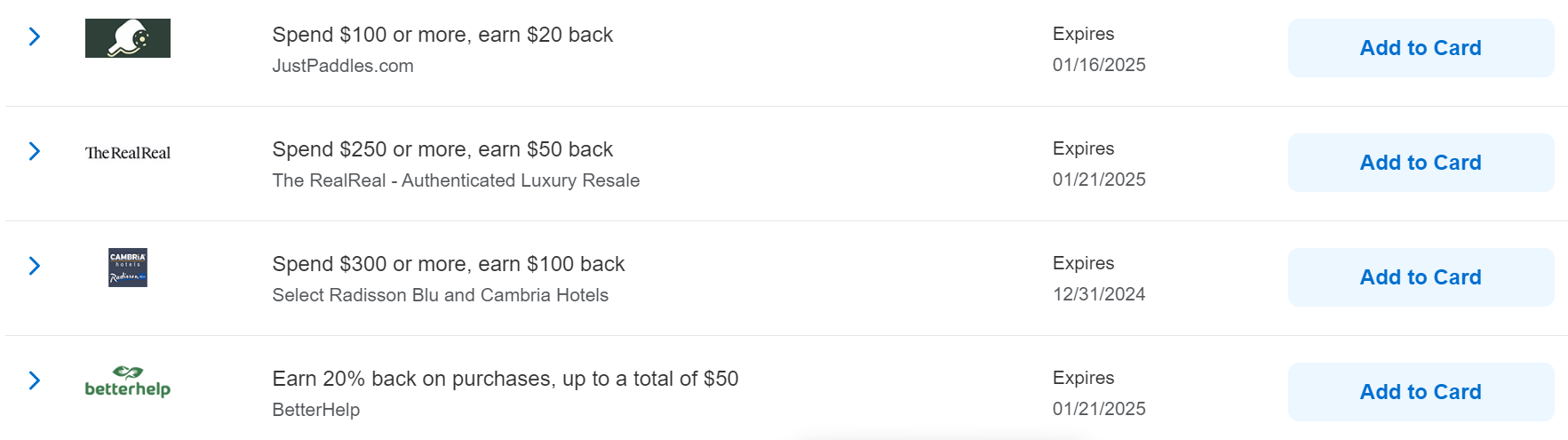

Amex Offers

Amex Offers are a great option for saving cash, but they can also provide terrific opportunities for point-earning as well. Amex Offers can also act like an additional category bonus in which you can get extra Membership Rewards points per dollar spent at selected merchants.

Log into your account and check the section titled “Amex Offers and Benefits” to look for offers like these.

Additional options for Earning Amex Membership Rewards Points

Enroll in Pay Over Time

Once you sign up for an American Express charge card, you will start getting emails and letters inviting you to sign up for Pay Over Time. This option essentially turns your charge card, which has to be paid off monthly, into a credit card that can carry a balance. Don’t do it. That is, don’t sign up until the offer includes a bonus of 10,000 to 30,000 Membership Rewards points. In our experience, these bonus offers usually appear towards the end of your first year of card membership (as long as you haven’t enrolled already).

Once you get an offer like the one shown above, go ahead and sign up. As long as you keep paying your card’s complete balance each month, there is no downside to enabling this feature.

International Payments

Amex offers businesses the ability to earn 1 Membership Rewards point per $30 of foreign wire payments (max 4,000 points per transaction). Even better, you may receive a welcome bonus offer like the one shown above (keep an eye out for this in your mailbox or email!).

How to Use Membership Rewards Points

In general, Membership Rewards points are worth up to 1 cent each. Fortunately, there are three ways in which it is possible to get more value: redeem points for flights, transfer points to hotel or airline partners, or invest with rewards.

Travel

Those folks with American Express Platinum Cards® automatically get 1 cent per point value when redeeming points for travel. That’s not particularly good, but it’s much better than what you can get without a Platinum card. Currently, the only way to get better than 1 cent per point value when redeeming points for travel is with the Business Platinum Card.

The Business Platinum Card offers a 35% Airline Bonus: Get 35% of your points back when you redeem points through Amex Travel for any flights with your selected airline.

After you receive the 35% rebate, the value works out to 1.54 cents per point. Additionally, when you use points this way, you will almost always earn the same miles for the ticket as if you had paid with cash. That’s very good, but it does require owning this ultra-premium card and paying the annual fee.

Transfer Points to Partners

The optimal use of Membership Rewards points, in our opinion, is to transfer them to airline and hotel partners in order to book high value awards. Your best bet is usually to wait until you find a great award before transferring points. One exception: Amex often offers 30% or higher transfer bonuses to certain programs. If you’re confident that you’ll use the points for good value, it may make sense to transfer points when those bonuses are in effect.

Points can be transferred to the loyalty accounts of the primary cardholder or to any authorized user or employee on the account.

Amex Membership Rewards Transfer Partners

It’s free to transfer Membership Rewards points to foreign airlines. For transfers to US airlines, however, Amex charges an “excise tax offset fee” of $0.0006 per point (with a maximum fee of $99). Airlines subject to this fee are noted below.

| Rewards Program | Amex Transfer Ratio | Best Uses |

|---|---|---|

| Aer Lingus Avios | 1 to 1 | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| AeroMexico ClubPremier | 1 to 1.6 | AeroMexico is a SkyTeam partner. Club Premier points can be used to book flights on AeroMexico, SkyTeam alliance members (such as Delta or Korean Air), or on select partner airlines. Unfortunately many have reported that awards are extremely difficult to book through AeroMexico so we do not recommend transferring points to this program. If you want to fly AeroMexico, look to transfer points to another SkyTeam partner (such as Air France) and then book AeroMexico with that program. |

| Air Canada Aeroplan | 1 to 1 | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. |

| Air France KLM Flying Blue | 1 to 1 | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. |

| ANA Mileage Club | 1 to 1 | Redeem for Star Alliance flights. Multiple stopovers allowed. ANA offers many great sweet-spot awards, including flying around the world in business class for as few as 115K miles! See also: ANA - a terrific Membership Rewards gem. |

| Avianca LifeMiles | 1 to 1 | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. |

| British Airways Avios | 1 to 1 | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| Cathay Pacific Asia Miles | 1 to 1 | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. |

| Choice | 1 to 1 | Choice Privileges points seem to be randomly valuable within the US, but dependably valuable internationally in expensive locations such as Scandinavia and Japan. Points can sometimes offer great value when used towards participating Preferred Hotels of the World. |

| Delta SkyMiles | 1 to 1 plus excise tax | Delta no longer charges change or cancellation fees on awards originating in North America. Flash award sales and flights to/from locations other than the U.S. or Canada can offer great value. See: Best uses for Delta miles. |

| Emirates Skywards | 1000 to 800 | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. |

| Etihad Guest | 1 to 1 | Etihad offers a distance based award chart for flying Etihad and another for its partners. Points may offer good value for expensive but short-distance flights. |

| Finnair Plus+ | 1 to 1 via BA | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. |

| Hilton | 1 to 2 | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. Note that Hilton points often go on sale for half a cent each and so its rare for point transfers to Hilton to be a good value. |

| Iberia Avios | 1 to 1 | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. |

| JetBlue | 250 to 200 plus excise tax | JetBlue points offer the most value when cheap ticket prices are available and when award taxes are high relative to the overall cost of the ticket (more details can be found here). The JetBlue Plus Card and the JetBlue Business Card offer a 10% rebate on awards, so you can get more value by holding one of these cards. |

| Marriott Bonvoy | 1 to 1 | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. |

| Qantas Frequent Flyer | 1 to 1 | Best use is probably for flights on El Al with no fuel surcharges. Also useful for short AA flights. Qantas offers distance based award charts similar to Cathay Pacific. Both are OneWorld Alliance members. I recommend comparing award prices across both programs before transferring to either. Qantas offers round the world business class awards for only 280,000 points (but with many restrictions) |

| Qatar Privilege Club Avios | 1 to 1 | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. |

| Singapore Airlines KrisFlyer | 1 to 1 | Use to book Singapore Airlines First Class awards (generally reserved for their own members), Alaska Airlines economy awards, or for Star Alliance awards (including United Airlines). |

| Virgin Atlantic Flying Club | 1 to 1 | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). |

Current Membership Rewards Transfer Bonuses

Here are the currently available transfer bonuses from Amex Membership Rewards (this table will update automatically when new offers are found):

| Transfer Bonus Details | Start Date | End Date |

|---|---|---|

| 40% transfer bonus from Amex Membership Rewards to Virgin Atlantic Flying Club [Targeted] | 11/21/25 | 12/31/25 |

Cash back (invest with rewards)

The best way to get cash back is to add the American Express Platinum Card for Schwab to your credit card portfolio. This card offers a benefit called “Invest with Rewards,” which allows the cardholder to deposit Membership Rewards points into a Schwab account at a value of 1.1 cents per point. For example, 50,000 points becomes $550.

Considering the fact that there are so many ways to earn lots of Membership Rewards points, the ability to cash out at 1.1 cents per point isn’t too bad, however this benefit is limited to a maximum of 1,000,000 points per year. After that, the rate goes down to an unappealing 0.8 cents per point.

Note that the Morgan Stanley Platinum card also offers Invest with Rewards, but only at a value of 1 cent per point.

Amex Business Checking is another way to cash out Membership Rewards, but there is a bit of a catch. The standard rate is only 0.8 cents per point, which is something no one should consider doing. There is an increased rate of 1 cent per point possible, but in order to get it, you must also hold a Business Platinum card (and the $895 annual fee that comes with it). Also, like the Schwab Invest with Rewards option, that improved rate is limited to a maximum of 1,000,000 points redeemed per year while the standard rate of 0.8 cents per point is unlimited.

Other ways to redeem Membership Rewards Points

You can also redeem points for gift cards or merchandise. At most, with this approach you’ll get 1 cent per point value, but usually you’ll get quite a bit less.

You can also use points to pay some merchants directly (Amazon.com, for example). Don’t do this. These options offer very poor value. Further, they may compromise the security of your account (i.e. if someone hacks into your Amazon account, they might spend your Membership Rewards points – causing you a headache in getting your points reinstated).

Amex Membership Rewards Travel Sweet Spots

Our post, Amex Membership Rewards sweet spots, details the best value uses of Amex Membership Rewards. Either click here or click below to jump to a section of the post:

- Domestic US Flights

- Hawaii

- Europe

- Asia

- Caribbean / Latin America

- Africa

- Australia / New Zealand / Oceania

- Round the world ticket

- Hotel Partners

Managing Membership Rewards

Combine Points Across Cards

Amex automatically pools all of your points together. When you earn points with different cards, the point total shown when viewing either card is the total across cards.

Share Points Across Cardholders

Unlike Chase and Citibank, Amex doesn’t allow members to move points from one person’s account to another. That said, it is possible to transfer one person’s points to another person’s loyalty program account. The key is that the person who receives the points must be an authorized user or employee on the other person’s account. For example, your spouse can transfer Membership Rewards points to your Virgin Atlantic account as long as you’re an authorized user (or employee) on any of their Membership Rewards-earning cards.

In order to use this method to share points, the authorized user card must be active for 90 days before it will unlock the ability to transfer your points to the authorized user’s loyalty program account.

How to Preserve a Deceased Person’s Points

If a person with Amex Membership Rewards points dies, the executor of the estate or an authorized account manager can request to transfer their Membership Rewards points to another person or to redeem points in any other way (e.g. transfer to loyalty program, redeem for gift cards, etc.). Full details can be found here.

How to Keep Points Alive

Thankfully, it is very easy to keep Amex Membership Rewards points alive. Simply keep any Membership Rewards card open. For example, if you are about to close your one and only Membership Rewards card, then open another Membership Rewards card account first in order to preserve your points. Amex offers some no-fee Membership Rewards cards, such as the Blue Business Plus and the Amex Everyday, so this shouldn’t be much of a burden.

More information

Amex’s official Membership Rewards page can be found here.

I have a rewards checking account with over 500k reward points in it from previous credit cards that were closed a few months ago. Just opened an amex platinum, but my points do not show up on my plat cc “page” of the website when looking at my rewards. My accounts are linked and both accounts show up when I log onto Amex’s website. Can I transfer my points from my rewards checking to my cc ?

I’m surprised that the points didn’t automatically show up. Maybe it takes a while before that happens. Anyway, it would make sense to call Amex to ask

Back in December Frequentmiler.com had a 250k bonus offer for the business platinum. I’ve had the personal platinum, but never an Amex business card or any type. After putting $25k on the card, they stiffed me in the bonus! I canceled the card, but got the Dell credit and $135 of Delta fees. The bonus was too good to be true.

What did they say when you asked them why they weren’t awarding the bonus? It wasn’t too good to be true…lots and lots of readers got it. So did I. This is the first we’ve heard of anyone having a problem with it.

Did you get a pop-up when applying telling you that you wouldn’t get the bonus if you applied? Have you had the Business Platinum card before?

‘

I’ll also tack on another question: when did you complete the $25K spending requirement? In recent weeks, a lot of Amex stuff has been posting slowly. I’m wondering how much time passed after you completed the requirement?

The $20k spend to qualify for the 250k bonus points was satisfied in the first billing cycle; some was paying estimated taxes, some holiday purchases.

When I applied using the referral link through frequentmiler.com, there was no disqualify pop-up. But some fine print disclaimers on the left side did mention bonus points might not be rewarded if I previously had the business platinum and other typical items.

The bonus didn’t appear after the first billing cycle. I called and the representative said he’d make a note on the account and to check again. After the second billing cycle, still nothing and I called again. Was handed off to some higher level representative that wouldn’t budge at all and gave a lengthy sales pitch to downgrade.

I later applied for the business gold through another site and scored 175k bonus points (unfortunately frequentmiler.com’s 200k bonus link was dead).

Having said all that, Amex points are valuable. In the past year we had 2x J on Qatar to Johannesburg and 2 F on Cathay to Jakarta.

Hello there, does the point sharing also applicable to Amex Biz Plat? Specifically, can points be transferred to an employee [P2] airline’s FFnumber? Thank so much.

Yes, but they still need to be an AU (or an “employee card” on a biz card) for 90 days before you can transfer to their accounts.

P2 opened her first Amex card and we’re trying to set up autopay from my checking account because that’s what we use for all our credit cards. However, we noticed Amex’s payment page says the following.

“Please note: You must use a checking or savings account. Money Market, line of credit, credit, and investment accounts as well as balance transfer checks are not accepted. You must be the bank account holder or an authorized signer on the bank account provided. If applicable, the Account Manager assigned to a specific Account will be allowed to make payments for that Account using the bank account(s) assigned to that Account.”

So are we not allowed to use a checking account under my name to pay for P2’s Amex? We are married and have the same address but don’t have the same last name if that matters… How are you guys handling P2’s Amex payments? Has anyone tried paying from another person’s checking account?

I’ve never had any issues with paying P2s Amex from accounts in my name only. We do have the same last name, but I haven’t heard of folks with different last names having problems, either.

I am about to close my BRG. I also have a Rewards Checking account (personal, not biz). Can anyone confirm that having the checking account will keep my MR alive? Thanks.

Pulled the trigger on closing the BRG and I can now confirm my MR points are alive and well via my checking account.

This is interesting. Are the points still transferable with only the checking account?

I just checked and I do appear to be able to transfer, but it says this:

“If American Express® Rewards Checking and/or American Express® Business Checking are your only Membership Rewards® Products, your points transfer options will be limited to a selection of participating hotel and travel partners.”

I have 12 partners available:

Air Canada Aeroplan

British Airways Executive Club

Cathay Pacific

Choice Privileges

Delta SkyMiles

Etihad Guest

Hilton Honors

Iberia Plus

Marriott Bonvoy

Qatar Airways Privilege Club

Singapore Airlines | KrisFlyer

Virgin Atlantic Flying Club

Related topic: Theres currently an Amex offer for Amex Gift cards on amexgiftcards.com (I see $50 back on $750 spend, up to 2x on one card, a smaller offer on another).

I know the recommendation is that Amex hasnt counted many gift card purchases toward minimum spend for welcome offers, but has anyone tried doing it on amexgiftcard.com?

TYPO?

“you earn points from a welcome offer if you’ve ever had that card before”

*NEVER ?

Play erase this comment after u fix it

Did I read that if I pay my wireless phone bill here in the U.S, I will get 4X?

Why did you exclude the Blue Cash Preferred card and the 6% return on groceries from the best uses at US Supermarkets? I was looking at this card and maybe you just saved me from making a mistake.

It doesn’t earn Membership Rewards points, just cash back. Because of that, it’s not part of that table (or the post, in general).

thank you for letting me know. I thought this card when paired with a qualifying Amex cards would allow you to combine the cash back with rewards points. Like Capital One Venture and Capital One Savor. Seeing this article was very timely

Hello,

To confirm/clarify, we can transfer to frequent flyer program of AU but not to his/hers membership rewards program

Yes that’s right

This post needs to be updated in Cash Back section – Schwab now offers 1.1 cents per point.

Thanks. Fixed.

Do you need to have a ‘premier’ card (gold, platinum) in order to use MR points for transfer partners (akin to Chase requiring a Sapphire card, etc)?

Nope. All newly available Membership Rewards cards have this ability. This includes the fee-free Everyday and the fee-free Blue Business Plus.

Are you saying that I can transfer from ANY Amex card to partners except for the Marriott and Delta cards? I can cancel all my other Amex cards that earn MR points and keep just the Everyday free card and I can transfer? That is news to me.

Yes that’s correct. Amex hasn’t offered non-transfer-able membership rewards cards in many years.

Thanks, Greg. Where have I been lately? Nowhere. But I have been collecting points and points.

Time to travel again

[…] Credit Card Referrals […]

[…] get it: The 60K offer is a great one and is a good pick for anyone interested in accumulating Amex Membership Rewards points. The refer-a-friend Three For All is also a fantastic offer that you should take advantage of if […]

[…] Read all about Membership Rewards points here: Amex Membership Rewards Complete Guide. […]