There are two fantastic 2X Everywhere cards available in the US. No, I’m not talking about Jennifer Garner’s Capital One Venture card. That’s a good card, and it does earn 2 Capital One “miles” per dollar, but if you want to convert those “miles” to airline miles, you usually end up with only 1.5 airline miles per dollar or less. Capital One “miles” transfer to airline miles at a rate of 1,000 to 750 (2 to 1.5) or 1,000 to 500 (2 to 1), depending upon the type of miles you want.

Great 2X Everywhere Card Options

The great 2X Everywhere cards that are the focus of this article are the Citi Double Cash and the Amex Blue Business Plus. Both cards have no annual fee. Both cards earn the equivalent of 2 points per dollar for all spend. Both cards offer rewards that are transferable one to one to many different airline programs. Both rewards programs offer occasional transfer bonuses such that transfer ratios are even better than one to one.

Citi Double Cash

The no-annual-fee Double Cash card is a 2% cash back card at heart. That’s pretty good, but the thing that makes it exciting is the ability to convert cash back rewards into ThankYou Rewards points. This then gives you the ability to convert those rewards to airline miles as long as you or a friend has either the Citi Premier or Citi Prestige card as well. For more, please see: Citi Double Cash Complete Guide.

There are a couple of disadvantages to this card that are worth noting:

- Citi charges foreign transaction fees

- You cannot transfer points to airline miles unless you or a friend has a card which does have an annual fee (either the Citi Premier or Citi Prestige)

Amex Blue Business Plus

The no-annual-fee Amex Blue Business Plus card offers 2 points per dollar for all spend for the first $50K of spend per calendar year. The card earns valuable Membership Rewards points which are directly transferable to a large number of airline programs, and a few hotel programs too. Unlike the Citi Double Cash, you don’t need a card with an annual fee to unlock the full power of the Membership Rewards program for transferring points to miles.

There are a few disadvantages to this card that are worth noting:

- Amex charges foreign transaction fees

- 2X earnings are capped at $50K spend per calendar year (then 1X)

- This is an American Express card, so it is not as widely accepted as the Citi Double Cash (which is a Mastercard)

The best “everywhere else” cards

Using our Reasonable Redemption Values (RRVs) to estimate how much each point is worth, we are able to use our credit card database to display the cards that offer the best value for “base” spend. Base spend is any spend that does not qualify for a category bonus. Here are the top 5:

| Card Info Name and Earning Rate (no offer) |

|---|

Earning rate: 2X Membership Rewards points on all purchases, up to $50K spend per calendar year (then 1X thereafter). Terms apply. (Rates & Fees) Base: 2X (3.1%) |

Earning rate: 1.5 miles per dollar for all spend. All Miles are doubled at the end of your first card membership year. Base: 3% |

Earning rate: 2% cash back everywhere (1% cash back for each purchase + 1% when paying your credit card bill for that purchase). ✦ For a limited time: Earn 5% total cash back on hotel, car rentals, and attractions booked on Citi Travel portal through 12/31/24. Base: 2X (2.9%) |

Earning rate: 2X Miles everywhere ✦ Earn 5X miles on hotel and rental car bookings through Capital One Travel Base: 2X (2.9%) |

Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5x on flights booked via Capital One travel. ✦ 2X everywhere else. |

Earning rate: 10X miles on hotels and rental cars booked via Capital One Travel ✦ 5x miles on flights booked via Capital One travel. ✦ 2X miles everywhere else. |

Earning rate: 2X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel |

Earning rate: With Platinum Honors status with Bank of America's Business Advantage Relationship Rewards program, this card earns: 2.625X points for all spend (and 5.25X for travel purchased through BOA's travel center) Base: 2.625X (2.63%) |

Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, earn: 3.5X travel and dining ✦ 2.625X everywhere else |

Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status Base: 2.625X (2.63%) |

Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status Base: 2.625X (2.63%) |

Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, this card earns: 2.625X points for all spend (and 5.25X for travel purchased through BOA's travel center) Base: 2.625X (2.63%) |

Earning rate: ✦ 3X Amtrak ✦ 2X qualifying travel, dining, transit, and rideshare ✦ 1X elsewhere |

Earning rate: 2X Amtrak ✦ 2X dining ✦ 1X elsewhere |

Earning rate: Tier One Rewards (which now requires $1,000 in an Alliant high-yield checking account and 2 electronic transactions per month) offers 2.5% cash back everywhere on up to $10K per billing cycle, then unlimited 1.5% cash back beyond $10K in purchases in a billing cycle. (Note that some purchases, like those from GiftCards.com, are not eligible for cash back) Base: 2.5% |

Earning rate: Earn 50% more points: Use your Card 30 or more times on purchases in a billing period and get 50% more points on those purchases less returns and credits. With 30 or more purchases, earn: 4.5x points at US supermarkets on up to $6,000 per year in purchases (then 1.5x) ✦ 3x points at US gas stations ✦ 1.5x points on other purchases. |

Earning rate: 1.5% cash back everywhere in the form of Go Far Rewards ✦ 1.8% back on Google Pay or Apple Pay purchases for the first 12 months Base: 1.5X (2.25%) |

Earning rate: 1.5X on all purchases ✦ 5X Lyft through through March 2025 |

Earning rate: 5x travel booked through Chase Travel℠ ✦ 5X Lyft through March 2025 ✦ 3x dining ✦ 3x drugstores ✦ 1.5X everywhere else |

Earning rate: Collect 1 $110 stamp for every night you stay at any eligible property booked on Hotels.com and collect 1 stamp each time you spend $500 on purchases with your card. Collect 10 stamps, get 1 reward night. Base: 0.002X (2.2%) |

Earning rate: 1.5X miles everywhere ✦ Earn 5X miles on hotel and rental car bookings through Capital One Travel Base: 1.5X (2.18%) |

Earning rate: ✦ 2X in the top 3 spend categories each calendar quarter through 12/31/24 (then the top 2 categories after that). Eligible categories include dining; airline tickets purchased directly with the airline; car rental agencies; local transit and commuting; gas stations; internet, cable and phone services; social media and search engine advertising; and shipping ✦ 4X Hyatt |

Earning rate: ✦ 2X restaurants / cafes / coffee shops, airlines, local transit, fitness clubs and gym memberships ✦ 4X Hyatt |

Base: 2X (2%) |

Earning rate: 6x prepaid hotel & car rental through Altitude Rewards Center ✦ 2.5X mobile wallet payments (on up to $5,000 spend per quarter) |

Earning rate: X1 offers "Boosts" of additional point earnings for various categories of spend, for specific merchants, and for certain thresholds of spend. You must enroll in these boosts to earn more points. Additionally, earn 3x for all spend between $1000 and $7,500 each calendar month Base: 2X (2%) |

Earning rate: 2X Miles on all purchases Base: 2X (2%) |

Earning rate: 2X Miles on all purchases Base: 2X (2%) |

Earning rate: Earn 2% cash back on your first $100,000 in eligible purchases each year then 1% Base: 2% |

Earning rate: 3% cash back when you check out with PayPal ✦ 2% cash back everywhere else Base: 2% Brand: 3% |

Earning rate: 3% cash back when you check out with PayPal ✦ 2% cash back everywhere else Base: 2% Brand: 3% |

Earning rate: 2.5% cash back on purchases of $5,000 or more ✦ 5% back on travel purchased through Chase Travel(SM) ✦ 2% cash back on all other spend Base: 2% Other: 5% |

Earning rate: 2% everywhere ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 2% |

Earning rate: 2% cash back as a statement credit on all purchases, up to $50K spend per calendar year (then 1% thereafter). Terms apply. Base: 2% |

Earning rate: ✦ 2X United ✦ 1.5X everywhere else |

Earning rate: 3X on Air France, KLM, and SkyTeam purchases ✦ 1.5X everywhere else |

Earning rate: 3X Virgin Atlantic ✦ 1.5X everywhere else |

Earning rate: 10X IHG ✦ 5X travel, gas stations, restaurants and dining, social media and search engine advertising, office supply stores ✦ 3X on all other purchases |

Earning rate: 10X IHG ✦ 5X travel, dining, and gas stations ✦ 3X on all other purchases |

Earning rate: Make 20 or more purchases in a billing period and get 20% more points, less returns and credits ✦ With 20% more points, earn: 2.4X points at US supermarkets, on up to $6,000 per year in purchases (then 1.2x) ✦ 1.2X on other purchases |

Earning rate: 1.25X miles everywhere ✦ 5X miles on hotels and rental cars booked via Capital One Travel |

Earning rate: 1.8% back everywhere Base: 1.8% Dine: 1.8% Gas: 1.8% Other: 1.8% |

Earning rate: With Platinum Honors status with Bank of America's Business Advantage Relationship Rewards program, this card earns: 3.5% on dining plus 5.25% on 1 choice from: gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services (for the first $50,000 in combined choice/dining purchases each calendar year, 1.75% thereafter) and 1.75% everywhere else. Base: 1.75% Travel: 5.25% Dine: 3.5% Gas: 5.25% Phone: 5.25% Office: 5.25% Biz: 5.25% |

Earning rate: With Platinum Honors status with Bank of America's Preferred Rewards program, earn: 3.5% at grocery stores and wholesale clubs and 5.25% on gas up to the first $2,500 in combined purchases each quarter Base: 1.75% Travel: 5.25% Dine: 5.25% Gas: 5.25% Grocery: 3.5% Shop: 5.25% Other: 5.25% |

Earning rate: 6X Marriott ✦ 4X dining, internet, cable and phone service ✦ 4X gas stations and shipping ✦ 2X everywhere else. |

Earning rate: ✦ 6X Marriott Bonvoy ✦ 3X gas stations, grocery stores, and dining on up to $6K in combined purchases each year ✦ 2X everywhere else |

Earning rate: ✦ 6X Ritz & Marriott.✦ 3X airline tickets purchased directly with the airline, at car rental agencies and at restaurants ✦ 2X everywhere else |

Earning rate: 6X Marriott.✦ 4X restaurants & grocery on up to $15K spend per year ✦ 2X everywhere else |

Earning rate: 6X Marriott.✦ 4X restaurants & U.S. Supermarkets on up to $15K spend per year ✦ 2X on all other eligible purchases |

Earning rate: 6x at Marriott Bonvoy properties ✦ 4x at restaurants worldwide, U.S. gas stations, wireless telephone services purchased from U.S. suppliers and on U.S. purchases for shipping ✦ 2x on all other eligible purchases. Terms Apply. (Rates & Fees) |

Earning rate: 3X airfare -on flights booked directly with airlines; 3X restaurants worldwide, 6X Marriott; 2X on all other eligible purchases |

Earning rate: 6X Marriott ✦ 2X on all other eligible purchases |

Earning rate: Must use your card for 5 purchases per month, then: 3x Dining ✦ 3x Lyft ✦ 2x Travel ✦ 1x rent (one payment per month, up to 100,000 points per year) ✦ 1x on other purchases |

Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel |

Earning rate: ✦ 2X U.S. Restaurants ✦ 2X select U.S. Department Stores ✦ 2X Car Rentals Purchased Directly from Select Car Rental Companies ✦ 2X Airfare Purchased Directly from Airlines |

Earning rate: ✦ 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X prepaid hotels booked with American Express Travel |

Earning rate: ✦ 3x points at US supermarkets on up to $6,000 per year in purchases (then 1x) ✦ 2x points at US gas stations ✦ 1x points on other purchases. |

Earning rate: ✦ 2x points at US supermarkets, on up to $6,000 per year in purchases (then 1x) ✦ 1x on other purchases |

Earning rate: Earn 3X on one of your choice, 2X on rest. [3X choices: ✦ Airfare purchased directly from airlines ✦ U.S. purchases for advertising in select media ✦ U.S. purchases at gas stations ✦ U.S. purchases for shipping ✦ U.S. computer hardware, software, and cloud computing purchases made directly from select providers. 3X and 2X apply to first $100,000 in purchases in each of the 5 categories per year, 1X point per dollar thereafter. |

Earning rate: Earn 4X in combined eligible purchases in the two categories where your business spends the most each billing cycle (capped at $150K spend per calendar year, then 1x): Electronic goods retailers or software and cloud system providers in the U.S. ✦U.S. purchases at restaurants ✦Monthly wireless telephone service charges made directly from a wireless telephone service provider in the U.S. ✦ U.S. purchases for advertising in select media ✦ U.S. purchases at gas stations ✦ Transit purchases including trains, taxicabs, rideshare services, ferries, tolls, parking, buses, and subways. ✦ 3x on eligible purchases through AmexTravel.com ✦ 1x on all other purchases. Terms apply. |

Earning rate: ✦ 2X at AmexTravel.com ✦ 1X points on other purchases. Terms apply. |

Earning rate: ✦ 3X on travel & transit (including flights, hotels, taxis, and rideshares) ✦ 3X dining ✦ 1X points on other purchases. Terms apply. See |

Earning rate: 3X points for flights booked with airlines or on amextravel.com ✦ 4x points at US Supermarkets (up to $25K in purchases, then 1x) ✦ 4x at restaurants worldwide ✦ 1X points on other purchases. Terms apply. (Rates & Fees) |

Earning rate: 5X points for flights booked directly with airlines or with American Express Travel ✦ 5X points for prepaid hotels booked through American Express Travel |

Earning rate: 5X flights and prepaid hotels at AmexTravel.com ✦ 1.5X points per dollar on eligible purchases of $5000 or more (on up to $2 million of those purchases per year) ✦ 1.5x on US construction/hardware stores, US electronic goods, and US shipping ✦ 1X elsewhere ✦ Terms apply. |

Earning rate: 3X flights, hotels, homestays, car rentals, dining, gas, rideshares, transit, and streaming services |

Earning rate: 5x prepaid hotel & car rental through Altitude Rewards Center ✦ 3X travel and mobile wallet payments |

Earning rate: 3x for air travel and hotel stays, 2x for eligible business expenses (office supplies, business cable/internet, shipping, business phone and advertising), 1X everywhere else |

Base: 1X (1.5%) |

Earning rate: 3x for commercial air travel, 2x for gas and groceries, and 1X everywhere else |

Base: 1X (1.5%) |

Earning rate: ✦ 5X office supplies, 5X cellular/landline/cable ✦ 2X gas and hotels ✦ 5X Lyft through March 2025 |

Earning rate: 3X travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year) ✦ 5X Lyft through March 2025 |

Earning rate: 5X office supplies and cellular/landline/cable (on up to $25,000 in total purchases in 5x categories annually) ✦ 2X on the first $25K in combined purchases at gas stations and restaurants each cardmember year ✦ 5X Lyft through March 2025 |

Earning rate: 5x travel booked through Chase Travel℠ ✦ 5X Lyft through March 2025 ✦ 3x dining ✦ 3x drugstores ✦ 5X in rotating categories on up to $1,500 spend per quarter (Q2 2024: Amazon, Hotels & Restaurants) |

Earning rate: 5X Lyft through March 2025; 5X in rotating categories on up to $1,500 spend per quarter (Q4 2023: PayPal, wholesale clubs, and select charities). |

Earning rate: 5X Travel booked through Chase Travel℠ (2X all other travel) ✦ 3X Dining ✦ 3X Select streaming services ✦ 3X Online grocery ✦ 5X Lyft (through March 2025) ✦ 10% annual point bonus |

Earning rate: 10X hotels & car rentals booked through Chase Travel℠ ✦ 10X Chase Dining ✦ 5X flights booked through Chase ✦ 3X Travel and Dining ✦ 10X Lyft (through March 2025) |

Earning rate: 1.5% cash back for all spend. Base: 1.5X (1.5%) |

Earning rate: 1.5X everywhere; 3X for travel booked through BOA's travel center |

Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status. Note that you'll need Preferred Rewards on the business side ("Preferred Rewards for Business") to earn a greater return. Base: 1.5X (1.5%) |

Earning rate: 1.5% everywhere; Earn up to 2.625% back everywhere with Bank of America Platinum Honors status Base: 1.5X (1.5%) |

Earning rate: 1.5X everywhere; 3X for travel booked through BOA's travel center |

Earning rate: 1.5% cash back everywhere if you choose the cash back program (note that you must opt in to the cash back program at account opening to get the signup bonus and 1.5% everywhere. If you choose points, this card earns 1x everywhere and a bonus 1,000 points in any statement period that you spend $1,000 or more. Base: 1.5% |

Earning rate: 6x on first $1,500 in purchases each quarter with two retailers you choose ✦ 3x on first $1,500 in purchases per quarter on one everyday category (like wholesale clubs, gas and EV charging stations, bills and utilities) Base: 1.5% Gas: 2% Other: 6% |

Earning rate: 2.5%, 5%, or 10% back at select retailers ✦ 1.5% everywhere else ✦ Note a monthly limit of $200 in earned rewards. Base: 1.5% |

Earning rate: 2.5% for groceries, drugstores, sporting goods, fitness, and athletic apparel ✦ 1.5% everywhere else. Earn double (5% or 3%) each week when you meet fitness goals. Base: 1.5% Grocery: 2.5% Shop: 2.5% Other: 2.5% |

Earning rate: 1.5 miles per dollar for all spend. Base: 1.5% |

Earning rate: 1.5% everywhere ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 1.5% |

Earning rate: 1.5% everywhere ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 1.5% Other: 5% |

Earning rate: ✦ 2X travel and dining ✦ 1.5X everywhere else Base: 1.5% Travel: 2% Dine: 2% |

Earning rate: ✦ 2X travel and dining ✦ 1.5X everywhere else Base: 1.5% Travel: 2% Dine: 2% |

Earning rate: Unlimited 1.5% cash back on eligible charges when you pay within 10 days of your statement closing date. Pay your Minimum Payment Due by your Payment Due Date and the discount is applied to your next statement Base: 1.5% |

Earning rate: 5x on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1x thereafter. Eligible categories: Restaurants, Gas Stations, Grocery Stores, Select Travel, Select Transit, Select Streaming Services, Drugstores, Home Improvement Stores, Fitness Clubs and Live Entertainment. ✦ 1x on all other purchases |

Earning rate: ✦ 3 points per $1 at gas stations ✦ 2 points per $1 oat grocery stores ✦ 1 point per $1 on all other purchases |

Earning rate: ✦ 2 points per $1 on products and services that are purchased directly from AT&T ✦ 2 points per $1 on all purchases at online retail and travel sites ✦ 1 point per $1 on all other purchases |

Earning rate: ✦ 3 points per $1 on products and services that are purchased directly from AT&T ✦ 3 points per $1 on all purchases at online retail and travel sites ✦ 1 point per $1 on all other purchases |

Earning rate: 2X at supermarkets and gas stations on up to $6,000 per year ✦ Round up to nearest 10 TY points on all purchases |

Earning rate: 5x on travel booked through Citi Travel℠ Portal through June 30 2024 (excludes air travel) ✦ 2X at supermarkets and gas stations on up to $6,000 per year ✦ Round up to nearest 10 TY points on all purchases |

Earning rate: 2X dining and entertainment |

Earning rate: 3X grocery ✦ 3X dining ✦ 3X gas stations ✦ 3X flights, hotels, travel agencies |

Earning rate: 5X airfare, dining, and travel agencies ✦ 3X hotels and cruise line ✦ 1X everywhere else |

Earning rate: 3x travel ✦ office supply ✦ professional services |

Earning rate: ✦ 7X Hilton spend ✦ 5X US restaurants, US Supermarkets, and US gas stations ✦ 3X on all other eligible purchases |

Earning rate: ✦ 12X Hilton spend ✦ 5X on other eligible purchases (on the first $100K in purchases per calendar year, 3X thereafter). ✦ For eligible purchases made from March 28, 2024 through June 30, 2024: 6X on Select Business & Travel Purchases (flights booked directly with airlines or Amex Travel; car rentals booked directly from select car rental companies; US restaurants; US gas stations; wireless telephone services purchased directly from US service provider; US shipping purchases) |

Earning rate: ✦ 12X Hilton spend ✦ 6X U.S. restaurants, US Supermarkets, and US gas stations ✦ 4X U.S. Online Retail Purchases ✦ 3X on all other eligible purchases |

Earning rate: ✦ 14X Hilton spend ✦ 7X US restaurants, flights booked directly with airlines or amextravel.com, select car rental companies ✦ 3X on all other eligible purchases ✦ Terms & Limitations Apply. |

Earning rate: 5X hotels ✦ 4X airlines ✦ 3X restaurants & other travel ✦ 1X everywhere else |

Earning rate: 3X travel & transit, gas, phone plans (wireless and landline) and streaming services |

Earning rate: 8x Rideshare ✦ 5x Brex Travel ✦ 4x Restaurants ✦ 3x on recurring software like Salesforce, Zendesk, Twilio, and more ✦ 1x everywhere else |

Earning rate: 3X Southwest ✦ 2X Rapid Rewards(R) hotel and car partners ✦ 2X local transit and rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 1X on all other purchases. |

Earning rate: 3X Southwest ✦ 2X Rapid Rewards(R) hotel and car partners ✦ 2X local transit and rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 1X on all other purchases. |

Earning rate: 4X Southwest ✦ 3X Rapid Rewards(R) hotel and car partners ✦ 2X rideshare ✦ 2X social media and search engine advertising, internet, cable, and phone services ✦ 1X on all other purchases. |

Earning rate: 3X Southwest ✦ 2X Rapid Rewards(R) hotel and car partners ✦ 2X rideshare ✦ 1X on all other purchases. |

Earning rate: 2X local transit and commuting, including rideshare ✦ 2X internet, cable, phone services, and select streaming ✦ 2X Southwest |

Earning rate: ✦ 2X restaurants and grocery ✦ 3X JetBlue ✦ 1X everywhere else✦ |

Earning rate: ✦ 2X restaurants and office supply stores ✦ 6X JetBlue ✦ 1X everywhere else |

Earning rate: 2X restaurants and grocery ✦ 6X JetBlue ✦ 1X everywhere else |

Earning rate: 2X miles on Korean Air, Gas Stations, Dining |

Earning rate: 3X miles on Korean Air, 2x on Other Airlines, Car Rental, Hotels and Dining |

Earning rate: 2x on Korean Air, Hotels and Dining |

Earning rate: 2X Aeroplan miles per dollar spent on Air Canada purchases |

Base: 1X (1.3%) |

Earning rate: 4X AA ✦ 10X hotels booked through AA.com/Hotels ✦ 10X car rentals booked through AA.com/Cars ✦ 1X everywhere else |

Earning rate: ✦ 2X AA ✦ 2X certain telecommunications merchants ✦ 2X car rental merchants ✦ 2X gas |

Earning rate: 2X grocery ✦ 2X AA ✦ 1X everywhere else |

Earning rate: 2X restaurants ✦ 2X gas ✦ 2X AA |

Earning rate: 3X Air Canada ✦ 3X grocery stores ✦ 3X dining ✦ 500 bonus points with each $2K calendar month spend, up to $6K spend per month (1,500 points max) ✦ 1X everywhere else |

Earning rate: 2X United ✦ 2X gas stations ✦ 2X local transit and commuting |

Earning rate: 3X United ✦ 2X restaurants including eligible delivery services ✦ 2X on all other travel ✦ 2X select streaming |

Earning rate: 2X United ✦ 2X restaurants ✦ 2X on hotel stays |

Earning rate: ✦ 4X United ✦ 2X dining & travel |

Earning rate: 2X at restaurants including eligible delivery services , gas stations, and office supply stores ✦ 2X United ✦ 2X on local transit and commuting, including taxicabs, mass transit, tolls, and ride share services |

Earning rate: ✦ 2X gas and grocery ✦ 3X Asiana. |

Earning rate: ✦ 3X Virgin Atlantic ✦ 1X elsewhere |

Earning rate: 3X Alaska Airlines ✦ 2x gas, EV charging, shipping and local transit ✦ 1X elsewhere |

Earning rate: 3X Alaska Airlines ✦ 2x gas, EV charging, local transit, rideshare, cable, and select streaming services purchases ✦ 1X elsewhere |

Earning rate: 3X Emirates ✦ 2X airfare, hotel, and car rentals ✦ 1X everywhere else |

Earning rate: 3X Emirates ✦ 2X airfare, hotel, and car rentals ✦ 1X everywhere else |

Earning rate: 2X Miles & More |

Earning rate: ✦ 2X AA, office supply, telecommunications services, and at car rental agencies ✦ 1X everywhere else |

Earning rate: 2X AA ✦ 1X everywhere else |

Earning rate: ✦ 3X AA ✦ 2X hotel and car rentals ✦ 1X everywhere else |

Earning rate: 2X restaurants worldwide ✦ 2X Delta ✦ 1X on all other eligible purchases |

Earning rate: 2X Delta ✦ 2x restaurants worldwide ✦ 2x US supermarkets |

Earning rate: 2X Delta ✦ 2X U.S. purchases for advertising in select media and U.S. shipping purchases (capped at $50k per year starting 1/1/24) |

Earning rate: 3X Delta ✦ 1.5X on eligible transit, U.S. shipping & office supply store purchases |

Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 2X restaurants ✦ 2X US Supermarkets |

Earning rate: 3X Delta ✦ 3X purchases made directly with hotels ✦ 1.5X on transit, eligible U.S. shipping, and purchases of $5K or more (up to $100K per year) |

Earning rate: 5x Gas and EV Charging ✦ 3X supermarkets, restaurants, and TV, radio, cable, streaming services ✦ 1X everywhere else. |

Earning rate: 4X Travel for PenFed Honors Advantage Members ✦ 3X travel otherwise ✦ 1.5X everywhere else. Advantage membership is available to anyone who opens an Access America Checking account, or to military members. |

Earning rate: ✦ 5X IHG ✦ 3x dining, gas stations utilities, cable, Internet, phone, and select streaming services ✦ 2X everywhere else |

Earning rate: Earn 1.529% back on your purchases when your Upromise Program account is linked to an eligible College Savings Plan or 1.25% if it is not ✦ Up to $250 cashback rewards per calendar year on gift card purchases at MyGiftCardsPlus Base: 1.25% |

Earning rate: 3x TAP Air Portugal purchases ✦ 3x hotels, car rentals, & rideshare ✦ 1x everywhere else |

Earning rate: 3X Spirit ✦ 2X dining & grocery ✦ 1X everywhere else |

Earning rate: ✦ 3X airline, hotel, taxi, limousine, rental car, train bus, restaurant, fast food and takeout food and dining purchases ✦ 1X everywhere else |

Earning rate: ✦ 2X Cathay Pacific ✦ 1.5X dining ✦ 1.5X purchases outside of the US ✦ 1X everywhere else |

Earning rate: 3X British Airways. Iberia, Aer Lingus, and LEVEL ✦ 2X hotel accommodations booked directly with the hotel ✦ 1X elsewhere |

Earning rate: 3X British Airways. Iberia, Aer Lingus, and LEVEL ✦ 2X hotel accommodations booked directly with the hotel ✦ 1X elsewhere |

Earning rate: 3X British Airways. Iberia, Aer Lingus, and LEVEL ✦ 2X hotel accommodations booked directly with the hotel ✦ 1X elsewhere |

Earning rate: 10X at Best Western properties ✦ 2X elsewhere |

Earning rate: 5x hotels and car rentals when booked through US Bank Portal ✦ 4X travel, gas stations and EV charging ✦ 2x take out, food delivery (including apps like GrubHub, UberEATS, etc), dining and streaming services |

Earning rate: 4X travel and gas stations ✦ 2x take out, food delivery (including apps like GrubHub, UberEATS, etc), dining, grocery (including meal kit delivery) and streaming services |

Earning rate: 4X take out, food delivery (including apps like GrubHub, UberEATS, etc), and dining ✦ 2X grocery (including meal kit delivery), gas stations, and streaming services |

Earning rate: ✦ 3X restaurants ✦ 2X gas stations and airlines |

Earning rate: 3X travel & dining |

Earning rate: Earn Verizon Dollars: 4% grocery & gas ✦ 3% dining ✦ 2% Verizon (including monthly wireless bill) ✦ 1% everywhere else |

Earning rate: 4X gas stations ✦ 3X dining ✦ 2X grocery stores (up to $8,000 spend per cardmember year across all three categories combined) |

Earning rate: 3x travel (includes airlines, hotels, and car rentals) ✦ 2x dining |

Earning rate: 2x travel (includes airlines, hotels, and car rentals) |

Earning rate: 3X MGM ✦ 2X Gas and Grocery ✦ 1X everywhere else |

Earning rate: ✦ 3X Travel, Dining and Gas ✦ 1X everywhere else |

Earning rate: 5X in rotating categories, up to $1500 spend per quarter (Q4 2023: Amazon.com and Target) |

Earning rate: 5X in rotating categories, up to $1500 spend per quarter (Q1 2024: Gas Stations & Electric Vehicle Charging Stations, Home Improvement Stores & Public Transit) |

Earning rate: 5X gas ✦ 3X grocery and dining ✦ 2X Sears and KMart |

Earning rate: 3x Allegiant ✦ 2x dining |

Earning rate: 2x Royal Caribbean, Celebrity Cruises, and Azamara |

Earning rate: 2x Royal Caribbean, Celebrity Cruises, and Azamara |

Earning rate: 3x Norwegian cruise line purchases ✦ 2x air and hotel |

Earning rate: Choose one of ten categories for 3x and one for 2x each quarter, then 1x everywhere else. Must choose 3x and 2x categories before each quarter starts or all purchases will default to 1x. You may select your categories as early as the first day of the preceeding quarter. Bonus categories are not capped. Base: 1X (1%) |

Earning rate: ✦ 2X Miles for travel and dining ✦ 1X everywhere else |

Earning rate: 3% cash back on eligible purchases at gas stations and EV charging stations, office supply stores, cell phone service providers and restaurants ✦ 1% back everywhere else ✦ Note: purchases of gaoline greater than $200 will not be deemed to be a purchase of automotive gasoline and will therefore earn only 1%. Base: 1% Dine: 3% Gas: 3% Phone: 3% Office: 3% |

Earning rate: 3% back at gas stations, office supply stores, and cell phone/service providers ✦ 1% back everywhere else ✦ Note: purchases of gaoline greater than $200 will not be deemed to be a purchase of automotive gasoline and will therefore earn only 1%. Base: 1% Gas: 3% Phone: 3% Office: 3% |

Earning rate: Each quarter, choose two 5% cash back categories (capped at $2K spend per quarter combined) and one 2% category (uncapped). 1% cash back everywhere else. 5% Categories: Home Utilities ✦ Ground Transportation ✦ Select Clothing Stores ✦ Cell Phone Providers ✦ Electronic Stores ✦ TV, Internet & Streaming Services ✦ Gyms/Fitness Centers ✦ Fast Food ✦ Sporting Goods Stores ✦ Department Stores ✦ Furniture Stores ✦ Movie Theaters. 2% Categories: Gas Stations ✦ Restaurants ✦ Grocery Stores Base: 1% Travel: 5% Dine: 2% Gas: 2% Grocery: 2% Shop: 5% Phone: 5% Other: 5% |

Earning rate: 2x on top two categories where you spend the most each month. Base: 1% Other: 2% |

Earning rate: 3% phone, internet and cable services ✦ 2% dining and gas stations Base: 1% Dine: 2% Gas: 2% Phone: 3% |

Earning rate: 3% on your eligible top spend category ✦ 2% on your second top category ✦ 1% everywhere else ✦ Eligible cateories include Dining & Nightlift, Travel, Bills & Utilities, Health & Beauty, Grocery, Gas, Transportation, Entertainment Base: 1% |

Earning rate: 4x Dining, takeout, & delivery ✦ 2x grocery stores, grocery delivery, gas station, and streaming services ✦ 1x everywhere else Base: 1% Dine: 4% Gas: 2% Grocery: 2% |

Earning rate: 3% cash back on up to $2K in spend in the category you choose each quarter: gas stations, travel & entertainment, restaurants, discount & warehouse stores, grocery stores, utilities & office supply stores, electronics and computer and camera stores, department and apparel and sporting good stores, auto parts & service, and home improvement stores Base: 1% Travel: 3% Dine: 3% Gas: 3% Grocery: 3% Shop: 3% Office: 3% Biz: 3% Other: 3% |

Earning rate: 2X Gas ✦ 2X Grocery ✦ 2X Travel ✦ 1X elsewhere Base: 1% Travel: 2% Gas: 2% Grocery: 2% Brand: 2% |

Earning rate: 5% back at at every store at every Simon Mall, Mills, or Premium Outlet in the U.S. Use your card 5 times each statement period to earn Rewards. ✦ 1% back on all other purchases. Base: 1% Shop: 5% Brand: 5% |

Earning rate: 4x gas ✦ 4x bars, restaurants, and select food delivery services ✦ 4x on Pelicans tickets ✦ 10% statement credit for concessions purchases at Smoothie King Center and at the in-venue and online Pelicans team store Base: 1% Dine: 4% Gas: 4% Brand: 4% Other: 4% |

Earning rate: 5x on Marlins tickets ✦ 5% back on retail & concessions at IoanDepot Park ✦ 3x on dining, food delivery, gas and drugstores ✦ 1x on everything else Base: 1% Dine: 3% Brand: 5% Other: 3% |

Earning rate: 5x points on Liverpool FC merchandise at the Official Liverpool FC Store and on Liverpool FC ticket purchases, select rideshare and streaming services ✦ 3x at bars, restaurants, and select delivery services ✦ 1x everywhere else Base: 1% Dine: 3% Brand: 5% Other: 5% |

Earning rate: 5x rideshare and streaming services ✦ 5x bars and restaurants on match days ✦ 1x everywhere else Base: 1% Dine: 5% Other: 5% |

Earning rate: 5x Cavs season tickets and streaming services ✦ 3x other Cavs tickets, dining, grocery, and delivery ✦ 1x everywhere else Base: 1% Dine: 3% Grocery: 3% Brand: 5% |

Earning rate: 5X on rotating categories each quarter. 5% limited to $6K spend per year. Base: 1% Grocery: 5% Other: 5% |

Earning rate: ✦ 4% gas & EV charging (up to $7K spend / year) ✦ 3% restaurant & travel ✦ 2% Costco ✦ 1% everywhere else Base: 1% Travel: 3% Dine: 3% Gas: 4% Brand: 2% |

Earning rate: ✦ 4% gas and EV charging (up to $7K spend / year) ✦ 3% restaurant & travel; 2% Costco ✦ 1% everywhere else Base: 1% Travel: 3% Dine: 3% Gas: 4% |

Earning rate: 2X grocery stores, restaurants, gas stations, and most Disney locations ✦ 1X everywhere else Base: 1% Dine: 2% Gas: 2% Grocery: 2% Brand: 2% |

Earning rate: This card only earns 1% back in the form of "Disney Dream Dollars" on most purchases (and 2% in bonus categories) and the meet & greet is also available on the Disney debit card. However, the current signup bonus makes it worth a look. Base: 1% |

Earning rate: 3% in Amazon rewards on US purchases at Amazon.com and Amazon physical stores ✦ 3% back at Whole Foods ✦ 3% back on Chase Travel purchases ✦ 2% Back in Amazon rewards at US restaurants, local transit and commuting (including rideshare), US gas stations, and drugstores ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Grocery: 3% Shop: 3% Brand: 3% Other: 2% |

Earning rate: Prime Members: 5% in Amazon rewards on US purchases at Amazon.com and Amazon physical stores ✦ 5% back at Whole Foods ✦ 5% back on Chase Travel purchases ✦ 2% Back in Amazon rewards at US restaurants, local transit and commuting (including rideshare), US gas stations, and drugstores ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Grocery: 5% Shop: 5% Brand: 5% Other: 2% |

Earning rate: 4% cash back on dining, entertainment, and popular streaming services ✦ 3% at grocery stores ✦ 1% everywhere else ✦ 8% cash back on Capital One Entertainment purchases ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 1% Dine: 4% Grocery: 3% Other: 4% |

Earning rate: 3% on dining, entertainment, select streaming services, and purchases at grocery stores (excluding superstores like Walmart® and Target®) ✦ 8% cash back on Capital One Entertainment purchases ✦ 5% on hotels and rental cars booked via Capital One Travel (terms apply) ✦ 1% everywhere else Base: 1% Dine: 3% Grocery: 3% Other: 3% |

Earning rate: 3% travel & AAA ✦ 2% gas, grocery store, wholesale club and drugstore purchases ✦ 1% back everywhere else Base: 1% Travel: 3% Gas: 2% Grocery: 2% Shop: 2% Brand: 3% Other: 2% |

Earning rate: 2% on dining plus 3% on 1 choice from: gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services (for the first $50,000 in combined choice/dining purchases each calendar year, 1% thereafter) and 1% everywhere else. Base: 1% Travel: 3% Dine: 2% Gas: 3% Phone: 3% Office: 3% Biz: 3% |

Earning rate: 2% at grocery stores and wholesale clubs and 3% on one category of your choice between gas, online shopping, dining, travel, drug stores, or home improvement/furnishings (can choose a new category monthly) up to the first $2,500 in combined 2% and 3% category purchases each quarter, then 1%. Base: 1% Travel: 3% Dine: 3% Gas: 3% Grocery: 2% Shop: 3% Other: 3% |

Earning rate: 3% back on your choice of the following: gas and EV chargng, online shopping, cable, streaming, internet & phone plans, dining, travel, drugstores, home improvement & furnishings (can choose a new category monthly). ✦ 2% back at grocery stores & wholesale clubs ✦ 1% back everywhere else. 2% and 3% rewards are capped at $2500 in combined purchases per quarter Base: 1% Travel: 3% Dine: 3% Gas: 3% Grocery: 2% Shop: 3% Phone: 3% Other: 3% |

Earning rate: 3% airfare, hotel stays, and car rentals ✦ 2% restaurants ✦ 1% everywhere else Base: 1% Travel: 3% Dine: 2% |

Earning rate: 3% drugstores and gas stations ✦ 2% medical expenses ✦ 1% everywhere else Base: 1% Gas: 3% Other: 3% |

Earning rate: 5X on Breeze Airways Nicer and Nicest Bundles & Trip Add-ons ✦ 2X on Breeze Airlines Nice Bundles ✦ 2X grocery ✦ 2X restaurants ✦ 1X everywhere else (including Breeze flights) Base: 1% Dine: 2% Grocery: 2% |

Earning rate: Earn 5x on eligible Priceline.com purchases. Earn 2x on gas and restaurants. Base: 1% Dine: 2% Gas: 2% Brand: 5% |

Earning rate: ✦ 5% US office supply stores and US wireless phone services ✦ 3% your choice from list of categories (e.g. airfare, hotels, car rentals, gas stations, restaurants, select media buys, shipping,computer) ✦ 1% other purchases. 3% and 5% rebates are capped at $50,000 per rebate year and then earn 1% thereafter. Terms Apply. Base: 1% Travel: 3% Gas: 3% Phone: 5% Office: 5% Biz: 3% |

Earning rate: Prime Members: 5% in Amazon rewards on US purchases at Amazon Business, AWS, Amazon.com, Whole Foods on up to $120K in purchases per calendar year, then 1% ✦ 2% Back in Amazon rewards at US restaurants, US gas stations, and on US wireless telephone services ✦ 1% back on all other purchases Base: 1% Dine: 2% Gas: 2% Grocery: 5% Shop: 5% Phone: 2% Brand: 5% Other: 2% |

Earning rate: ✦ Up to 5% Cash Back as a statement credit at U.S. supermarkets, U.S. gas stations & select U.S. drugstores (Everyday Purchases) ✦ Up to 1% Cash Back as a statement credit on other purchases. ✦ For your first $6,500 in purchases in a reward year, you will earn 1% on Everyday Purchases (5% thereafter), and 0.5% on other purchases (then 1%) ✦ Terms Apply. Base: 1% Grocery: 5% Other: 5% |

Earning rate: ✦ 3% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 3% cash back as a statement credit at US gas stations on up to $6,000 per year, then 1%. ✦ 3% cash back as a statement credit on U.S. online retail purchases on up to $6,000 per year, then 1% ✦ 1% cash back as a statement credit on other purchases ✦ Terms apply. Base: 1% Gas: 3% Grocery: 3% Shop: 3% |

Earning rate: ✦ 6% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 6% Cash Back as a statement credit on select U.S. streaming subscriptions. ✦ 3% Cash Back as a statement credit on transit (includes taxis/rideshare, parking, tolls, trains, buses and more). 3% cash back as a statement credit US gas stations ✦ 1% cash back as a statement credit on other purchases ✦ $7 monthly statement credit on Disney Bundle subcription of $12.99 or more. Enrollment required. ✦ Terms apply. Base: 1% Travel: 3% Gas: 3% Grocery: 6% Shop: 3% Other: 6% |

Earning rate: ✦ 6% cash back as a statement credit at US supermarkets up to $6,000 per year in purchases (then 1%) ✦ 6% Cash Back as a statement credit on select U.S. streaming subscriptions. ✦ 3% Cash Back as a statement credit on transit (includes taxis/rideshare, parking, tolls, trains, buses and more). 3% cash back US gas stations ✦ 1% cash back on other purchases ✦ Terms apply. Base: 1% Travel: 3% Gas: 3% Grocery: 6% Shop: 3% Other: 6% |

Earning rate: 5% back at all bookstores, including Amazon (note: this is capped at $1000 in purchases per month) ✦ 2% back at restaurants, gas stations, supermarkets, Netflix, Spotify, Uber and Lyft. Base: 1% Dine: 2% Gas: 2% Grocery: 2% Other: 5% |

Earning rate: 5X at FlyFrontier.com ✦ 3X restaurants |

Earning rate: 8X Wyndham & gas ✦ 5X marketing, advertising, and utilities (telecommunications, cable, satellite, electric, gas, heating oil and water) ✦ 1X everywhere else |

Earning rate: 6X Wyndham & gas ✦ 4X restaurants & grocery ✦ 1X everywhere else |

Earning rate: ✦ 5X Wyndham & gas ✦ 2X restaurants & grocery ✦ 1X everywhere else |

Earning rate: ✦ 3X Wyndham ✦ 2X gas, utility & grocery ✦ 1X everywhere else |

Earning rate: ✦ 5X Wyndham ✦ 2X gas, utility, & grocery ✦ 1X everywhere else |

Earning rate: ✦ 3X Marriott Bonvoy ✦ 2X travel ✦ 1X everywhere else |

Earning rate: ✦ 2X airline, car rental, & restaurants ✦ 5X Marriott. |

Earning rate: 2X airfare, car rental and dining ✦ 3X Sonesta |

Earning rate: 3X Hawaiian Airlines ✦ 2x gas, dining, and grocery stores ✦ 1x everywhere else |

Earning rate: 3X Hawaiian Airlines ✦ 2x gas, dining, and office supply stores ✦ 1x everywhere else |

Earning rate: 2X charity and then 2X in one of the following: cell phone providers, gas, grocery, or airline purchases (whichever category you spend most on each month). |

Earning rate: ✦ 2X cell phone ✦ 2X charity ✦ 2X gas, office supply, or airline purchases (whichever is most each month). |

Earning rate: 3X Expedia purchases |

Earning rate: 4X Expedia purchases ✦ 2x restaurants & entertainment |

Earning rate: 10X at Choice Hotels ✦ 5X at gas stations, grocery stores, home improvement stores, and phone plans ✦ 1X everywhere else |

Earning rate: 5X at Choice Hotels ✦ 3X at gas stations, grocery stores, home improvement stores, and phone plans ✦ 1X everywhere else |

Earning rate: ✦ 5X IHG ✦ 2X gas, grocery, and restaurants |

Earning rate: 2X on spending with LAN & TAM |

Earning rate: This card does not earn ongoing rewards beyond the welcome bonus. Base: 0% |

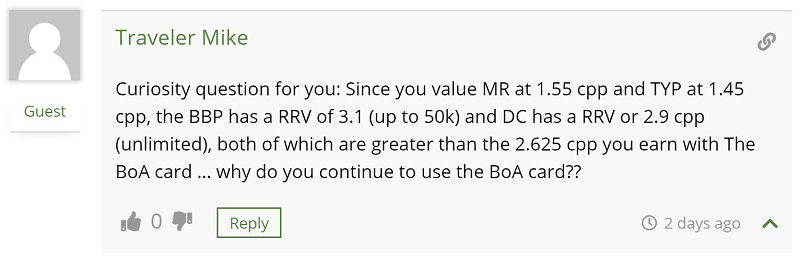

At the time of this writing, the Amex Blue Business Plus offers the best “everywhere else” value (3.1%); next is the first year of the Discover It Miles card (which offers the equivalent of 3%), and the Citi Double Cash comes in third (2.9%). The only reason that the Blue Business Plus and Double Cash cards aren’t tied is that we somewhat arbitrarily set the value of Amex Membership Rewards points a little higher than Citi ThankYou points. If you’re interested in the full background on this, please see: A big change to Frequent Miler’s point values.

Premium Rewards with Platinum Honors

Another card that shows up in the top 5 list (at the time of this writing) is the Bank of America Premium Rewards card with Platinum Honors Preferred Rewards. This card offers only 1.5% cash back for base spend, but with Platinum Honors Preferred Rewards status, cardholders get a 75% bonus on rewards earned. This combination turns the card into a 2.62% everywhere powerhouse. For details, see: Bank of America cards: awesome if you’ve got $100K lying around.

I’ve posted elsewhere that this is my “everywhere else” card (see: What’s in Greg’s Wallet?). And readers have asked why. Why use a card that offers 2.62% returns when I could average 2.9% with the Citi Double Cash or 3.1% with the Amex Blue Business Plus?

2x Everywhere Cards and Diminishing returns

The 2X Everywhere cards from Amex and Citi offer better than 2.62% rewards when using our Reasonable Redemption Values (RRVs) to estimate point values. Let’s consider what that means. RRVs are estimates of the value at which it is reasonably easy to get that much value or more. When transferring points to airline miles and booking awards, it’s reasonable to assume that you can get equal or better than 1.45 cents per point value with ThankYou points and equal or better than 1.55 cents per point value with Amex Membership Rewards.

The problem with blindly using the above numbers is that there’s a diminishing return to earning more points once you already have many. If you already have enough points to cover trips you are likely to take in the foreseeable future, then any additional points you accumulate become less likely to be used towards good value, or at all.

This concept may be easier to understand if we take a very specific points currency as an example. Consider Amtrak points. Amtrak points are worth up to 2.56 cents each on Acela trains and up to 2.9 cents each on other routes. So, a card that earns only 1 Amtrak point per dollar, actually offers a decent rate of return towards Amtrak trips. In fact, at the time of this writing, Amtrak credit cards made it into our top 10 list of the best cards for everyday spend.

With that background, imagine now that you’re planning an Amtrak trip that will offer 2.9 cents per point value. The more concrete your plans, the more sensible it would be to earn points through Amtrak credit card spend. But, suppose too that this is a “one and done” trip. You don’t expect to ride Amtrak again afterwards. In that case, it makes sense to use an Amtrak credit card to earn the required points, but it makes no sense at all to continue using the card once you’ve earned enough for this trip. Advanced players may note that Amtrak points have another good potential use (converting points 1 to 3 to Choice points), but that complicates my story so pretend that’s not a factor for this discussion. Or, see this post to understand why Choice is not as good of a deal as you thought.

Deciding how many transferable points you want or need is not nearly as straightforward as with Amtrak points, but the general concept is similar. It makes sense to keep earning until you get to the point where you’re less likely to use extra points. I can’t tell you how many you need to feel like you’re there. In my case, I have enough in either program (Amex Membership Rewards or Citi ThankYou Rewards) for several international first class trips or even more business class trips. Plus, I have many points in specific loyalty programs (AA, Alaska, ANA, Avianca, BA, Delta, United, Virgin Atlantic, …) such that I don’t even need to dip into transferable points for a very long time. So, I’m there. I’m at the point where acquiring new transferable points is no longer a priority. I’ll happily take them when they’re easy pickings, but I won’t pay a lot for them…

Buying points, inadvertently

I’ve written about this concept many times in the past, so I’ll just touch on it quickly here. When you have both a points-earning credit card and a cash back credit card and you opt to use the points-earning credit card, the result is functionally equivalent to buying points. For Nick’s coverage of this topic, see: How much do you pay for your miles and points?

In my case, I can choose to earn 2 Amex or Citi points per dollar or I can earn 2.62% cash back. If I choose to earn points, that’s functionally equivalent to buying points for 1.31 cents each. When comparing to most airline mile sales, that’s a great deal. But, if I don’t need additional points (as I explained in the above section), it’s suddenly a bad deal. It simply doesn’t make sense for me to invest in acquiring more points.

The exception is when I have the opportunity to buy points for less than the cash-out value. Since I have the Schwab Platinum card, I can cash out Amex points for 1.25 cents each. And since I have the Citi Prestige card, I can cash out Citi points for 1 cent each. If I had the opportunity to buy Amex points for less than 1.25 cents each or Citi points for less than 1 cent each, I’d do it because it would be a money making deal. Put another way, if I didn’t have a cash back card that offered 2.5% back or better, I’d use the Blue Business Plus card. And if I didn’t have that Amex card and didn’t have a better than 2% cash back card, I’d use the Citi Double Cash.

Other factors

It’s not the focus of this post, but it’s worth pointing out that points have two major disadvantages over cash:

- Cash can be invested. Points can’t.

- Points devalue more dramatically than cash. Cash devalues with inflation, but you can partially offset that problem by investing it. If your investment results outpace inflation, then you win. Points devalue when airline programs increase award rates. Holding onto transferable points rather than specific airline miles helps alleviate devaluations because they support many programs and some devalue less often or less harshly than others. And sometimes an airline program introduces new options that make the miles more valuable. With transferable points, there’s a reasonable chance that such a program is a transfer partner. But, still, the general trend over time is toward less value rather than more.

Conclusion

Point programs, and especially transferable points programs, have the ability to offer outsized value. Our Reasonable Redemption Values (RRVs) give you a mid-point idea of what value you should be able to expect. With the best transferable points programs and a bit of research, you should be able to get much more value than the RRV. That’s why I love these transferable points programs.

On the other hand, there are diminishing returns to earning more and more points. Once you have all of the points that you are likely to use towards good value, any additional points may be used for worse value or never used at all. Once you have a comfortable pile of points, my advice is to focus elsewhere on other valuable points. Once you have a comfortable pile of each of the transferable points currencies, it makes sense to focus instead on cash back. That’s where I’m at. And that’s why my Bank of America Premium Rewards card with Platinum Honors is the “everywhere else” card in my wallet.

[…] Greg has written before about how the Bank of America credit cards can be pretty awesome with their Preferred Rewards program, particularly the highest-level Platinum Honors. Greg recently wrote about how having that level of rewards with Bank of America means that his Premium Rewards card earns 2.62% cash back everywhere — and about how that makes it a great “everywhere else” card that prevents him from using his 2x-everywhere cards. See: Why there are no 2X everywhere cards in my wallet. […]

Funny thing for me is, once I THINK I have enough URs then Chase offers Pay Yourself Back for a sweet, sweet cash premium right back into my bank account & poof, 400,000 are gone! Or Chase offers an addtl discount on their travel portal so I book with them instead.

All my upfront spend earns 1.5, 3, or 5x (10x temp with streaming services) as well (so 2.25, 4.5, 7.5, & 15x once redeemed on the portal or pay myself back). I personally cannot make (or be tempted to spend!) as much with any other point system. And if worse ever comes to worse, I can always quickly cash out at 1 cent/UR. Best of (most) worlds the other point systems/cash fall short.

You could save the majority of us who don’t have either too many points or 100k at our disposal the 8-10 minutes of reading the article by stating that somewhere at the top (a subtitle perhaps?) instead of near the bottom.

Greg, the Amtrak analogy really brings the your argument together. I think it’s worth highlighting again that you don’t need $100k “lying around” because investments, retirement accounts and checking/saving all count towards the total. Also, for people without the Schwab Plat that wants a cash back anywhere card, at the Platinum level ($50k), you would still be getting a 50% bonus which translate to a 2.25 cent/$ return which would still be one of the best rates out there.

Where your argument falls apart for me is the following:

I believe Travel Rewards card points can be only redeemed for statement credit towards travel purchases? I don’t think you can redeem it as cash or redeposit it into your savings account like you can with the Premium Rewards card. So points on your Travel Rewards card is not “as good as money.” Given the travel category restriction, RRV of TY and MR should be factored into this comparison which puts them on more even grounds.

The Premium Rewards card has a $95 annual fee while the 2 other cards don’t. You would need to charge more than $14k on your Premium Rewards compared to the no annual fee Double Cash to break even. The card does have TSA Pre and airline credit but those can’t be considered at face value considering how prevalent they are on other cards. If you can redeem MR at 1.25 cents through Schwab, you’d need to spend more than $63k to break even (Although I’m not factoring in the Plat annual fee here). Also, you need to make use of this every year. If you ever need to switch to earning points again, the annual fee would quickly eat away any gains you made.

Thanks re the Amtrak analogy

Travel Rewards: I don’t think I said anywhere in this post that the points were as good as money, did I? I agree that those points are not as good as money unless you also have the Premium Rewards card (you can move points from one to the other and then cash out)

Premium Rewards: Yes it has a $95 annual fee, but I recoup $100 each year thanks to its annual $100 airline fee credit, so for me it is basically free.

Sorry, didn’t mean to imply that you said that the points were as good as money, I was just using the quotations to make a point that Travel Rewards points are not equal to Premium Rewards points. So if Premium Rewards points are valued at 1cent/point, Travel Reward points should be valued to something less than that.

I was looking for a reason where if you had $100k you wouldn’t immediately go the BoA route and honestly I don’t think there is one. Merrill’s platform works pretty well for anyone other than day traders, with Platinum Honors you also get free stock trades, and no ATM fees. Factor in the ~$300 sign-up bonus for moving money to Merrill, the $500 SUB for the Premium Rewards card, and the earning bonus and there is quite a lot of upside.

I thought you can move Travel Reward points to Premium Rewards points and then cash out.

Yep, you can

Got it. Thanks for clarifying!

does Citi allow you to transfer your TY points to cash back at a $.01 rate?

If you have the Prestige card, yes. Without the Prestige card you can still get 1 cent per point by exchanging points for a check intended to pay mortgage or student loans.

If only I had that 100k just lying around 🙁

IRAs (incl rollovers from old 401ks) count.

Just a heads up for the future that in the email version the list of other credit cards didn’t stop at five – not sure if it rendered all 254 but it was an extraordinarily long list.

Thanks, I’m aware of that issue but I don’t know any way to fix it. I’m glad that our newsletters now state this at the top: “The posts in this newsletter are best viewed online”

Greg

You left out 2 other great cash cards with no fees

– the Fidelity Rewards Visa 2% cash back

https://www.fidelityrewards.com/credit/welcome.do

– and the Amex business cash

https://www.americanexpress.com/en-us/business/credit-cards/blue-business-cash/57460?linknav=US-Acq-GCP-BusinessCards-ViewAllCards-CardTitle-BlueBusinessCash

BofA is good only if you have 100k lying around

Yep, there are lots of good 2% cards. This post was explicitly about why I use my 2.62% card instead of my 2X transferable points cards.

I think this post is written a bit from the perspective of a person who does manufactured spending. You probably already use up your $25 to $50k in office supply 5x to buy MOs indirectly. But for those of us that don’t do that the easiest card to use for everyday spend is a visa gift card purchased from staples.com for a fee of 3 percent. My wife and I have $50k in office store capacity and even without using all the various fee free promos and just getting the $300 cards delivered straight to the house, we are effectively buying UR points for about .58 cents. Given their current good as cash value of 1.5 percent, this is somewhere around 4.5 percent return on the $309 cards. I find the cards especially easy to use for non bonus spend on things like utilities and medical expenses. For little uneven amounts left on the cards I just reload Amazon if there are no current bonus spending opportunities otherwise left on Amazon.

No, the post wasn’t from the perspective of manufactured spending. The idea is simply that I want to have a card in my wallet to defer to for great rewards when I don’t have one that offers good bonus categories. Buying Visa gift cards for that purpose is a good way to go, but I find that too painful because it requires keeping track of lots of gift cards and sometimes you can’t split big purchases across cards.

Ahh, I see. I didn’t really mean that it was written from the perspective of MSers but more that I think many people who do not MS often do not use up their entire allotment of office spending on the ink cards, which is a bit inefficient if they are paying the annual fee but also a missed opportunity for everyday spend. Splitting the tender is a pain but I find it worth it for the return over the double cash or the amex blue business (or the chase 1.5x everywhere card).

Your method makes sense and is particularly good if it works for you.

Like Greg, I find it painful to keep track of many gift cards with differing balances. Splitting tender in-store can be doable, but splitting tender online is not possible at most stores. Sure, there is the possibility of maybe buying merchant gift cards with some of the Visa gift cards, etc etc. I’m sure there must be others, but Dell is the only retailer that comes to mind where I know you can split tender via multiple CCs online. Again, that’s not to take away from your method — it’s smart, it’s just more work than some will be willing to put into it. Thankfully, the Ink Cash card (which would be the more common 5x card now that the Ink Plus has been unavailable for a few years) has no annual fee, so most likely aren’t paying an annual fee on their 5x office supply stores these days. But even in that case, you’re right that it’s a missed opportunity to ignore your strategy — it’s just a question of how feasible and convenient it is for you.

All excellent points, Nick. Right – no annual fee! Even better. Just for the sake of completeness in case others might want to use my same strategy — I don’t use them on the little stuff or when I’m out and about charging $10 here or $15 there. It’s actually pretty rare these days that on my day to day every day spend that I don’t have some card with a good multiplier to use anyway – gas, groceries, food – that would beat 2.65 cents cash back. On the few things that aren’t I do use double cash instead of charging uneven amounts and having to track visa gift cards even if the return is less efficient. I use the 5x visas for stuff that I’m doing online or that I can call in to pay. Utilities are really easy for me. I can pay electric or city online with no fee and you just type on how much you want to pay. So, I just buy a stack of $300 visas from staples, activate them all at the same time in one sitting, and then it is pretty easy to use them. If the bill is $200 I pay it with the top card on the stack and then write down that I have $100 left on it on a post-it. Then when the electric is due (say it’s $300) I pay $100 to use up the card, and then pay $200 with the next card on the stack, etc. Property taxes is the same – I do those all at once with 7 or 8 cards, takes 10 minutes. When you don’t MS it’s actually really easy to keep track of visa gift cards when you’re just repeatedly using them regularly because at any given time you only have one active one with a balance less than the purchase face amount. If I had lots and lots little nonbonus spending throughout the typical day then, yeah, I would not want to use the visa gift cards. Edit– Insurance is the other biggie. Pay however much I want online.

Nick, as an FYI you can split-tender for online purchases at Sam’s Club. It makes those occasional Amex offers for $10 back for $30 in spend (or similar) more appealing when my AUs also have the same offer.

Nick or Greg eat al,

Why wouldn’t Larry just use a US Bank credit card and get 5% for all his utilities bills rather than 4.5% via his Visa gift card liquidation strategy? (I am assuming he doesn’t have more than 2k a quarter in utilities bills). I understand the logic behind liquidating Visa gift cards as MOs but why use these for purchases when other credit cards offer a higher return via their bonus categories?

My apologies if I’m missing something but I’ve read his comment several times and can’t figure out the utilities piece? (Taxes makes sense except for the 2 card/limit per provider) Thank you in advance.

I can’t speak for Larry, but my guess is that he doesn’t have a card that offers a good bonus for utility payments.

Well written post, although some of us may not have $100k lying around. However, given Chase’s new pay me back feature, I have been spending points into pseudo cash back given your same mentality. In this case, 3x on dining, travel etc is worth more on the Reserve card. As well as the other 5x+ categories Chase has with other cards. I hope it sticks around. Although the $550 (~$250) annual fee should be considered within the math. BofA definitely does have an advantage with lower annual fees. Do you think your cost of parking $100k with BofA is worth it considering the other options you have to invest that money? Given the bonus perks BofA is offering, it wouldn’t surprise me if they have higher maintenance/investing/etc fees compared to some of the competition. No idea tho and maybe DoC has already covered some of this. I really do need to research more into investing.

Actually, you don’t need any money stored with BOA. If you have $100K in investments, you can move management of the investments over to Merrill Edge and as long as you have a BOA checking account, you’ll now qualify for the 75% bonus. For example, I simply changed the management of $100K of my 401K savings (which were previously at Vanguard) over to Merrill and boom, I was done. This didn’t change anything about my 401K investments — there were no additional fees, I didn’t have to sell and rebuy stocks, etc. As a plus, I’ve found Merrill great to work with in general. As a double plus, Merrill often has good bonuses for moving money to them and so you may be able to pick up $300 or so by doing this. I recommend calling a Merrill agent for info since they often have access to investment bonuses that you won’t find online.

Is the account at Merrill a solo 401k or is it a rollover IRA? For non self employed people or those who move IRAs around or move money from an employer sponsored plan into a rollover IRA there are potential consequences that can cost you money in the long run or keep you from taking advantage of tax friendly strategies that even you are not doing right now you might want to do in the future. I am not a CPA and this is not tax advice. But for those who are not eligible to make Roth retirement contributions it is worth learning about backdoor roth conversions each year and understanding how money in a retirement IRA outside an employer sponsored plan can create problems for the backdoor roth. This is one of this areas where the intersection of the points and miles game and investment strategy can lead to unintended consequences. Even for those young points and miles enthusiasts not focused much on retirement stuff yet these are important considerations because the truth is the difference in various points and miles strategies can pale in comparison to the long term benefits of tax advantaged retirement compounding.

Yeah, always good to do the necessary thorough research or hire someone knowledgeable before changing large amounts of money.

Thanks for the reply. That makes it seem more manageable rather than 100k “lying around”. (I probably would have titled that “100k of investments“ instead 😉 constructive feedback). I’m glad Merrill has been good to work with too. Thanks for sharing your personal experience.